Brandon Bell

Shares of Nordstrom (NYSE:JWN) have been a poor performer over the previous 12 months, shedding about 30% of their worth as the corporate has battled by way of extra stock, stagnating client demand, and an exit from its Canadian operations. In the end, the corporate continues to be lagging behind its friends on stock enchancment, and so I see higher alternatives elsewhere.

Looking for Alpha

Within the firm’s third quarter, JWN earned $0.25, which beat consensus by $0.12, whilst income fell by 6.5% to $3.3 billion. Inventories had been down a good sharper 9% as the corporate has labored to right-size ranges given the weaker gross sales surroundings. This has enabled the corporate to be much less promotional, which is why earnings had been greater than final 12 months’s $0.22.

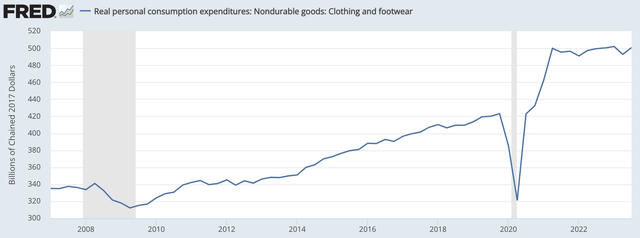

Gross margins had been up 180bp from final 12 months to 35%. It is a particular constructive. There is no such thing as a doubt that the firm is in a greater stock place than it was. Like many different retailers, JWN was overstocked in late 2021 and 2022. As you’ll be able to see under, attire consumption surged after COVID as shoppers spent down extra financial savings. As inflation rose and these financial savings shrank, gross sales have since stagnated. With inventories increase however gross sales flatlining, retailers like Nordstrom needed to resort to extreme discounting to maneuver merchandise.

St. Louis Federal Reserve

On the intense facet, as a result of gross sales have stagnated for thus lengthy, attire spending ranges now not look so stretched relative to tendencies. Attire spending has now risen 4% every year since 2019, which is above the ~3% pre-COVID pattern, however now not egregiously so. Absent a recession, I do count on that attire spending can return to actual progress subsequent 12 months.

The query for retail sector buyers must not simply be “have inventories fallen” however “have they fallen sufficient.” Sure, Nordstrom’s inventories are down 2% greater than gross sales, but when they had been greater than 2% overstocked, this relative decline wouldn’t be sufficient. I worry that’s the place Nordstrom sits. On the finish of Q3 2019, JWN carried $2.54 billion of inventories whereas gross sales had been $3.6 billion. Inventories are $2.63 billion at this time whereas gross sales are $3.3 billion. Inventories are 3.5% greater whilst gross sales are 8% decrease than pre-COVID. Sure, stock is extra productive than the horrible 2022 ranges, however that is nonetheless 11.5% degradation from pre-COVID relative stock ranges. By comparability, Macy’s has 17% decrease inventories at this time than in 2019.

To me, evidently Nordstrom is much less over-stocked, however that it’s nonetheless over-stocked. In a sector already going through secular strain from e-commerce and stuffed with firms buying and selling under 10x earnings, worth buyers have the power and necessity to be picky in what shares they purchase, utilizing stringent standards. Robust stock management is a type of, given the significance of maximizing margins in a world the place gross sales progress is sluggish.

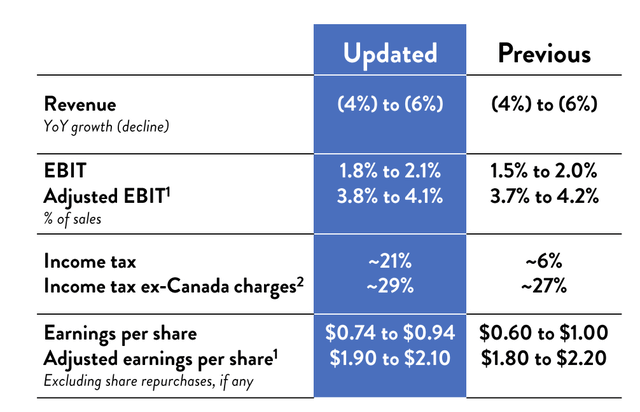

Given this degree of inventories relative to 2019, JWN goes to wish a really sturdy vacation season to maneuver adequate merchandise and keep away from having extra inventory after Christmas that it must mark down. I’m not sure that may happen, and administration’s up to date steering doesn’t appear to level to it both. If the corporate raised steering, that might suggest a stronger This autumn, which might probably justify stock ranges. As a substitute, it left income unchanged and easily narrowed adjusted EBIT margin and EPS ranges whereas leaving their midpoint unchanged. This doesn’t level to a brighter year-end.

Nordstrom

Furthermore, apparel-centric retailers like Nordstrom all the time add inventories by way of the primary 9 months of the 12 months as a result of Christmas is such a essential quarter. Gross sales rose about 20% sequentially from Q3 to This autumn last year. Nonetheless given inventories began the 12 months bloated and that administration has prioritized stock optimization this 12 months, I might count on inventories to have risen extra slowly. That has not occurred. Inventories are up $687 million to date this 12 months vs $550 million final 12 months. I merely don’t see the extent of stock self-discipline essential to make me assured JWN won’t must return to promotions and shed gross margins if this vacation season proves to be a bit softer.

Inside its two manufacturers, Nordstrom’s income was down 9%, or 4.9% adjusting for its exit from Canada. Rack was down 2%. Administration mentioned it’s seeing sequential enchancment in activewear, magnificence, and equipment. Given decrease revenue shoppers are going through extra strain, given inflation and exhausted extra financial savings, the underperformance of its foremost model to its off-label model is stunning and provides to my concern Nordstrom has misplaced relevance to its goal buyer, which can make it much more troublesome to take care of pricing and develop gross sales.

Elsewhere, SG&A spending was down by 7%, roughly in keeping with gross sales. Internet curiosity expense of $24 million was down from $32 million final 12 months as it’s incomes extra curiosity on its money balances, that are up by $82 million to $375 million. I might observe its share rely is up over 2% from final 12 months as a consequence of share-based compensation. Whereas JWN has $438 million of buyback capability, it’s specializing in its stability sheet, focusing on 2.5x debt to EBITDA leverage.

JWN carries $2.9 billion of debt; $250 million matures inside the subsequent 12 months. It has generated $749 million of EBITDA this 12 months, excluding the Canada winddown prices. Given a stronger This autumn seasonally, leverage can be about 2.6x this 12 months, so its stability sheet is getting nearer to acceptable ranges, assuming EBITDA doesn’t degrade in 2024, although refinancing maturities on this surroundings seemingly will improve curiosity prices.

I additionally would warning buyers about being too involved concerning the fact-free money circulate is -$269 million to date this 12 months. As famous, it builds stock within the first 9 months after which sells it down in This autumn, inflicting seasonal working capital strikes. Excluding working capital, free money circulate has been ~$175 million and may end the 12 months over $275 million. This does present scope to proceed paying a $0.19 dividend.

At about 7.5x earnings and 8-9x free money circulate, JWN isn’t an costly inventory. Nonetheless, with gross sales nonetheless declining and inventories elevated, it’s not clear this firm is but by way of with extra promotions. Shares could also be low-cost for a cause, in different phrases.

A number of the issues which have plagued shares for 2023 might proceed into 2024, additional pushing off potential, significant buybacks, and growing my concern that JWN proves to be a worth entice. With firms like Macy’s much better positioned on stock and extra prone to have seen their enterprise trough, I might make investments elsewhere and count on Nordstrom shares to proceed to underperform.