- Dell Applied sciences didn’t add BTC to its holdings in Q2

- Then again, AI was the most important driver of the agency’s earnings

Michael Dell, CEO of tech {hardware} large Dell Applied sciences, left the Bitcoin group disillusioned after it was revealed that the agency didn’t undertake a BTC technique in Q2. The crypto group anticipated a declaration of BTC holdings through the Q2 earnings report on 29 August. This, as a result of the CEO has been publicly in help of the world’s largest cryptocurrency throughout X (previously Twitter).

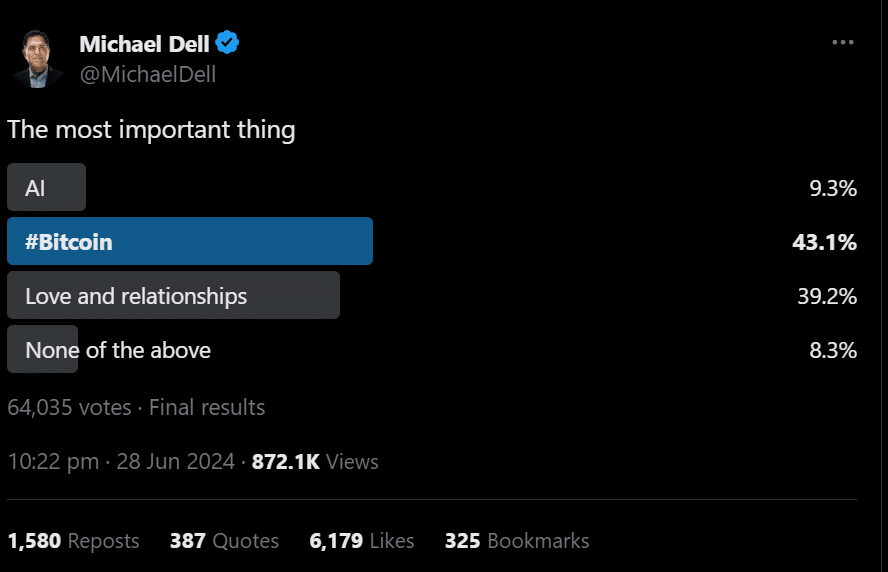

Dell’s ‘public help’ for BTC

In June, Dell conducted an X ballot to find out ‘crucial factor’ between AI, BTC, and love/relationships. The ballot outcomes ranked BTC larger than the remainder of the objects and attracted optimistic reactions from a few of the high BTC bulls like Michael Saylor.

Supply: X

Per week earlier than conducting the aforementioned ballot, Dell Applied sciences’ Chief posted a cryptic message – ‘Scarcity creates value,’ which is often related to BTC due to its capped provide of 21 million cash.

These posts created the impression that the exec was leaning in direction of the crypto asset. By extension, many additionally believed Dell would undertake the well-known BTC technique that Michael Saylor and MicroStrategy pioneered.

Nevertheless, BTC wasn’t talked about within the agency’s Q2 earnings report. Most market watchers couldn’t cover their disappointment after their BTC hopes have been dashed.

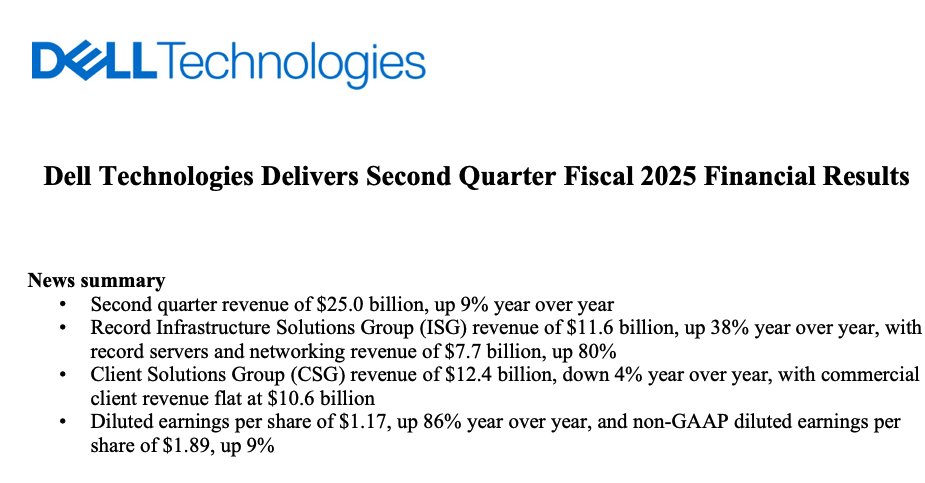

Supply: Dell Applied sciences

Curiously, regardless of Bitcoin rating larger than AI within the ballot on X, AI was the main driver of the agency’s Q2 earnings. Reacting to the agency’s Q2 efficiency, Dell Applied sciences’ Vice Chairman Jeff Clarke stated,

“Our AI momentum accelerated in Q2, and we’ve seen a rise within the variety of enterprise prospects shopping for AI options every quarter.”

Right here, it’s price noting that MicroStrategy’s Bitcoin technique, which entails maintaining BTC as a part of the treasury, has been adopted by the likes of Semler Scientific and Metaplanet.

MicroStrategy, at press time, held 226.5K BTC, price over $13B. The technique’s foremost purpose is to spice up the underlying inventory’s worth, particularly amid rising institutional adoption by BTC ETFs. This was not too long ago famous by Eric Semler, Chairman of Semler Scientific. He said,

“We’re inspired by the rising institutional adoption of bitcoin. It was not too long ago reported that for the primary time, establishments personal greater than 20% of bitcoin ETF belongings underneath administration. We consider this rising institutionalization will drive worth for each Bitcoin costs and for our stockholders.”