Andy Feng

Article Thesis

NIO Inc. (NYSE:NIO) is an organization with a really unstable share worth. Just lately, information about an fairness providing brought about market worries that made NIO’s inventory droop nearer to the 52-week low — within the meantime, underlying enterprise development has lastly picked up once more. Whereas there are query marks on the subject of NIO’s future, the valuation is not excessive for an electrical automobile inventory.

What Occurred?

NIO, one of many bigger Chinese language electrical automobile pure-play firms, has been within the information currently as a consequence of a capital elevate and hypothesis that extra fairness issuance would possibly occur.

NIO’s Convertible Bond Providing

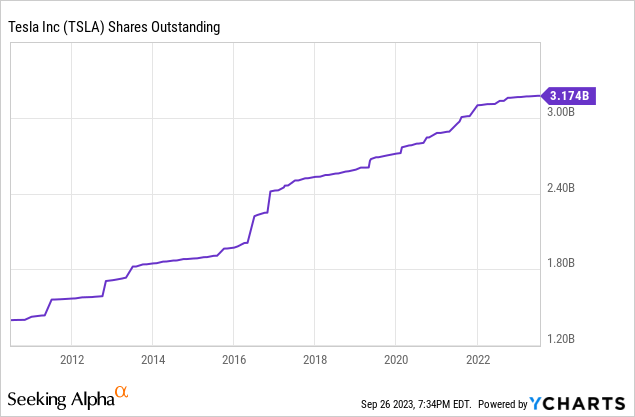

The primary information merchandise is a convertible bond providing that did occur. NIO issued $1 billion value of convertible bonds, cut up evenly between bonds maturing in 2029 and bonds maturing in 2030 — $500 million every. NIO is a fast-growing EV participant that should make investments closely with a view to construct out manufacturing capability, its retail footprint, and so forth. On the similar time, NIO is, like many different EV pure-plays, not worthwhile but, which signifies that these investments aren’t financed through working money flows, however, as an alternative, through money on the stability sheet. When that begins to run decrease, including new capital through a bond providing, fairness providing, or a “combine” between the 2 — a convertible bond providing — is sensible. Different development firms, together with present EV king Tesla (TSLA), have operated in an analogous manner, as we will clearly see after we check out Tesla’s share rely through the years:

Since Tesla went public, its share rely has simply greater than doubled. This was partially as a consequence of shares and choices being issued to Elon Musk and Tesla’s staff, however secondary choices additionally performed a serious function. It has not harm Tesla’s share worth, as underlying enterprise development was quick sufficient to greater than offset the headwinds of a rising share rely.

Ideally, the identical will occur at NIO, too: If the share rely climbs at a sure development price yearly, however the income development price is considerably increased than the share rely development price, then income per share will rise, it doesn’t matter what. After all, there isn’t a assure that NIO’s underlying enterprise development shall be interesting, however in latest months, development has accelerated — extra on that later.

Whereas capital raises are kind of regular for fast-growing, not-yet-profitable firms reminiscent of NIO, the market nonetheless did not just like the convertible observe providing. Shares continued to say no in a pattern that started in early August when shares peaked round $15 — they’re now buying and selling at simply above $8.

NIO used a number of the proceeds to purchase again convertible bonds it had issued earlier, ones with maturity dates in 2026 and 2027. The bonds that NIO purchased again had a face worth of $500 million, that means NIO nonetheless had substantial leftover money so as to add to its stability sheet to fund future development.

Worries About Further Capital Elevate

Whereas the market did not like the truth that the convertible bond providing did occur, the market additionally anxious about a further capital elevate that has, at the very least to this point, not occurred.

There have been some stories and rumors about NIO probably in search of to boost one other $3 billion value of capital from buyers. For an organization that’s valued at round $15 billion proper now, that may make for a fairly substantial share rely enhance (assuming that NIO would concern fairness, not debt). It could not be shocking to see shares expertise promoting stress if NIO really issued this a lot fairness, however the firm did not try this. Actually, the corporate denied even planning a further capital elevate proper now. That is the corporate’s assertion on the topic (see hyperlink above; highlights by creator):

The Firm has been made conscious of sure media speculations claiming that the Firm is contemplating elevating sure capital from buyers, which have been extensively circulated at this time. In mild of the bizarre market exercise within the Firm’s American depositary shares at this time, the Firm wish to make clear that the Firm at the moment has no reportable capital elevating exercise, aside from the latest convertible notes providing that was accomplished on September 25, 2023.

Whereas the corporate doesn’t deny that it’s going to elevate capital sooner or later — denying that may make no sense, as the corporate would not learn about its long-term money wants but — it appears fairly clear that there won’t be a capital elevate anytime quickly.

This could ease buyers’ issues, as a consequence of two causes:

- First, with no extra capital elevate deliberate proper now, shareholders needn’t fear about dilution an excessive amount of.

- Second, NIO seemingly is pleased with its money stability now, which signifies that deliberate capital spending is aligned with the assets the corporate has entry to proper now. If no capital elevate is deliberate within the foreseeable future, then one might argue that overspending is not a serious concern at NIO.

Operational Progress And Valuation

The electrical automobile market continues to develop throughout totally different geographic markets, together with within the US and China. As a Chinese language EV participant, NIO naturally is most uncovered to Chinese language EV demand.

Whereas NIO’s development price was fairly interesting during the last couple of years, development declined throughout the first half of the present 12 months — despite the fact that others, reminiscent of BYD (OTCPK:BYDDY)(OTCPK:BYDDF) continued to ship excellent quantity development.

That was disappointing, as EV buyers naturally wish to see the businesses they put money into producing robust enterprise development. Nevertheless, NIO appears to have overcome headwinds reminiscent of provide chain points now, as development has improved markedly in latest months. New product introductions that match nicely with what customers in China are searching for additionally helped in bettering NIO’s enterprise development price.

In August, NIO delivered greater than 19,000 automobiles, which made for a development price of 81% in comparison with the identical month one 12 months earlier. That development price may be very compelling, each in absolute phrases and likewise in comparison with the rather more meager development NIO has been attaining throughout the first half of the present 12 months.

This development was partially pushed by NIO’s latest new mannequin introductions, such because the ES6 sensible SUV which has been well-received by customers in its residence market. Whereas not as a lot of a quantity mannequin, the brand new ET7 sedan additionally has performed a task in bettering enterprise development at NIO, and as a consequence of its above-average gross sales worth it ought to have a optimistic impression on revenues and margins going ahead, all else equal.

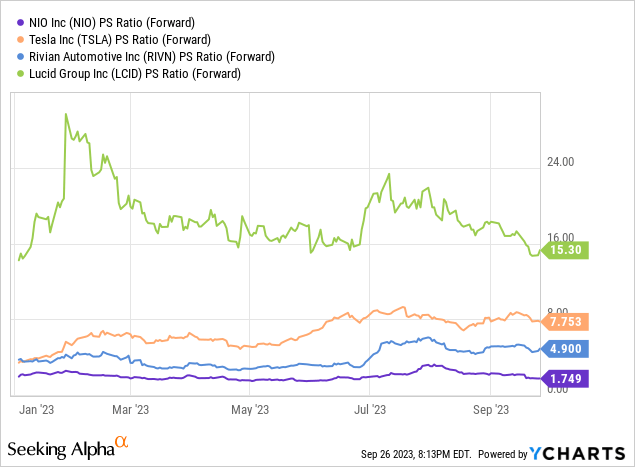

NIO is not worthwhile but, thus we won’t worth the corporate primarily based on the earnings it generates, which might be one of the crucial frequent approaches to valuing an organization’s shares. We are able to, nevertheless, have a look at the revenues that NIO generates:

Immediately, NIO trades at 1.7x ahead (this 12 months’s) gross sales, primarily based on present analyst estimates. That is the next valuation in comparison with most legacy car firms, however removed from costly in comparison with different EV pure-plays. Tesla is valued at a 4.5x increased gross sales a number of, whereas Rivian Automotive (RIVN) and Lucid Group (LCID) are buying and selling at huge premiums in comparison with NIO as nicely. Tesla is worthwhile, not like the opposite three, thus one can argue {that a} premium valuation is justified. However LCID and RIVN are fairly removed from being worthwhile, they promote manner fewer automobiles in comparison with NIO, and but, they commerce at excessive valuation premiums. Whereas NIO being a Chinese language firm could be seen as a macro threat issue, one may also argue that this is a bonus for NIO, as China’s EV market is crucial one on the planet, and NIO is advantaged there, in comparison with American opponents.

Takeaway

Whereas an funding in an unprofitable development firm undoubtedly comes with main uncertainties and dangers, the violent selloff NIO has skilled during the last couple of weeks appears considerably overdone.

NIO’s development has improved, and the valuation is not excessive — at the very least in comparison with different EV pure-play shares. If NIO can sustain its quantity development price, gross sales and margins ought to enhance significantly going ahead. Following the latest capital elevate, the corporate additionally ought to have ample liquidity for some time, thus stability sheet worries have eased. With the valuation having come down so much during the last couple of weeks, NIO is now a a lot better deal once more than it was with shares buying and selling within the mid-teens.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.