anyaberkut/iStock through Getty Pictures

Novartis (NYSE:NVS) not too long ago accomplished the spin-off of Sandoz which reworked the corporate right into a pure-play biopharma firm with increased margins and a considerably improved development profile. The inventory can be down 12% since my earlier impartial/maintain article and the decrease valuation coupled with improved margins and development prospects put the corporate in a greater place to extend shareholder worth. Given the corporate’s dimension and development profile, I don’t anticipate miracles going ahead however do imagine the inventory can compound no less than within the excessive single digits over the medium and long run.

Sandoz spinoff

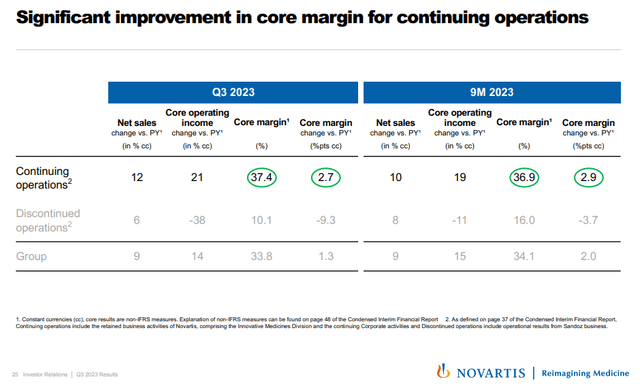

Novartis executed the spin-off of Sandoz in early October. Sandoz was a drag on margins and income development and its spinoff created a “clear” biopharma enterprise for Novartis. You possibly can see from the slide under how all of the metrics for the persevering with operations look loads higher than the Sandoz unit – increased income development, increased core margin, and enhancing margins versus worsening margins.

Novartis investor presentation

The spinoff may additionally result in considerably improved gross sales and earnings multiples within the medium to long run. It may occur within the close to time period as properly, however in all probability not till we see business sentiment enhance.

Pharma enterprise momentum

The biopharma enterprise is in fine condition with a number of present high-growth merchandise and several other pipeline merchandise and label growth alternatives for present merchandise.

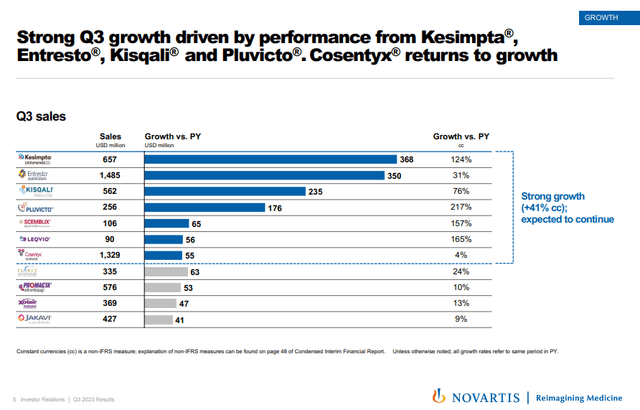

Kesimpta, Entresto, Kisqali, Pluvicto, and Leqvio are among the many key accepted merchandise which are exhibiting robust development.

Novartis investor presentation

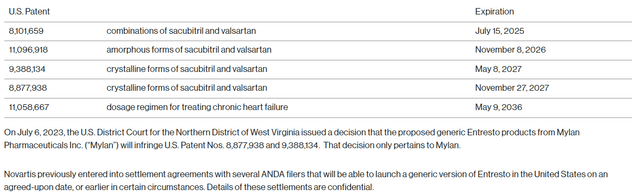

Entresto is the one product with an unsure future because of the potential generic competitors. Novartis has appealed to reverse the unfavorable US District Court docket determination on the mix patent protecting Entresto and different mixtures, which expires in July 2025 (together with pediatric exclusivity). Entresto continues to be Novartis’ largest product with world gross sales seemingly reaching $6 billion this 12 months, and the patent state of affairs and the related lawsuits are advanced and with an unknown final result. That is additionally not the one issued and legitimate patent on Entresto and others expire between 2026 and 2037.

Novartis press launch

Different main merchandise don’t have medium-term patent exclusivity points.

Kesimpta and Kisqali stay the opposite key development merchandise and have delivered 124% and 76% Y/Y development in Q3, respectively and the 2 merchandise mixed now have an annualized internet gross sales run charge of practically $5 billion.

Pluvicto, Scemblix, and Leqvio have continued to generate triple-digit Y/Y development within the third quarter, however have a a lot smaller income base than the opposite three merchandise.

Cosentyx grew solely 4% Y/Y within the third quarter however may get a brand new wind at its again whether it is accepted for the therapy of hidradenitis suppurativa this quarter. Humira continues to be the one accepted therapy possibility and whereas its gross sales aren’t damaged down by indication, I’ve seen estimates from numerous corporations growing potential remedies for the situation of Humira doing no less than $2 billion and as much as $3 billion a 12 months. It was accepted within the EU for the therapy of HS within the second quarter and internet gross sales grew 15% Y/Y versus a 3% decline in america. The U.S. approval may put Cosentyx again to double-digit development in 2024 and past.

There are different photographs on aim for Cosentyx in addition to lively late-stage trials in large cell arteritis, polymyalgia rheumatica, and rotator cuff tendinopathy, that would additional enhance its development charges within the second half of the last decade.

And the way forward for Novartis’ cardiovascular franchise nonetheless seems good. I used to be impressed by the progress of Leqvio in the previous couple of quarters. International gross sales have reached $90 million in Q3 regardless of the dearth of scientific information from a cardiovascular outcomes trial and people aren’t anticipated till no less than 2026. I now anticipate Leqvio to grow to be a blockbuster product earlier than the outcomes trial readout and a multi-billion product by the tip of the last decade, assuming the outcomes from that trial are optimistic.

One cardiovascular candidate that I imagine is underappreciated is pelacarsen, in improvement for the therapy of sufferers with elevated lipoprotein A, or LP[a]. I wrote about LP[a] as a drug goal in my November 2022 article on Arrowhead Prescribed drugs (ARWR) and can borrow a number of sentences (and will add that Arrowhead has since monetized its royalty stream on olpasiran whereas retaining the fitting to obtain the remaining milestones from associate Amgen).

Lp[a] is a genetically validated goal – a recent analysis from the UK Biobank with a various pattern of 460,000 people confirmed that the danger of atherosclerotic heart problems (‘ASCVD’) related to Lp[a] ranges was log-linear for ranges above the median, with growing danger for increased Lp[a] ranges. The standardized danger for ASCVD was “11% increased for every increment of fifty nmol/L, unbiased of adjustment for conventional danger elements, and with comparable impact estimates in all race and ethnicity teams.”

Whereas this sounds promising for Lp[a] as a therapeutic goal, it isn’t a certainty that danger discount might be achieved pharmacologically with medicine like pelacarsen or olpasiran and because of this these corporations are conducting massive cardiovascular outcomes trials.

Pelacarsen has a substantial head begin over olpasiran and outcomes from the cardiovascular outcomes trial are anticipated within the first half of 2025. If the outcomes are optimistic, this may very well be one of many largest breakthroughs for heart problems medicine because the invention of statins, and I’d anticipate pelacarsen to grow to be a multi-billion product for Novartis by the beginning of the subsequent decade, if not sooner.

And final, however not least, among the many potential development merchandise is iptacopan, in improvement for the therapy of paroxysmal nocturnal hemoglobinuria (‘PNH’) and different complement-mediated ailments. I already wrote about iptacopan final 12 months and will add that it met the first endpoint on the interim evaluation within the section 3 trial in IgA nephropathy sufferers. Extra readouts in C3 glomerulopathy and aHUS sufferers are anticipated this quarter and in 2025, respectively.

Two pipeline candidates that I assumed had first rate potential and that I discussed in my earlier article are now not a part of Novartis’ pipeline. The corporate determined to finish the collaboration with BeiGene (BGNE) which lined BeiGene’s PD-1 antibody tislelizumab and TIGIT antibody ociperlimab.

There are additionally different product candidates within the pipeline that I can’t go over on this article which are additionally anticipated to drive extra development within the following years, and we must always anticipate the corporate to proceed so as to add extra property by means of enterprise improvement.

General, I imagine the present product portfolio and pipeline, together with extra property that come by means of enterprise improvement efforts can ship no less than mid-single-digit income development charges and doubtlessly excessive single-digit development charges within the medium and long run. This isn’t thrilling development, however must be ample for Novartis to keep up a double-digit P/E ratio that would attain excessive double-digit in expansionary intervals and I imagine Novartis can ship a long-term share worth development charge of no less than 8% and as much as 11-12%, however the increased finish would want some bigger pipeline wins, resembling pelacarsen reporting strong therapy impact in sufferers with elevated LP[a].

Conclusion

The correction within the share worth and the profitable spin-off of Sandoz have introduced Novartis to decently enticing ranges. The corporate has a great assortment of accepted development merchandise and some promising ones in late-stage improvement, and I’d anticipate to see the portfolio broaden by means of M&A within the following months and years.