zhengzaishuru

Pricey readers/followers,

My funding up to now in Neste (OTCPK:NTOIF) has not materialized in the way in which that I anticipated it to do throughout early 2023. If taking a look at what corporations have carried out considerably worse than I anticipated them to, Neste would definitely be on the prime of this listing for this yr up to now. That is regardless of already witnessing double-digit value drops for the corporate.

I proceed to view Neste in a good gentle – however the underlying fundamentals and what drives the corporate’s earnings and progress clearly require extra time given what unfavorable impacts we have seen over the previous 2 quarters.

On this article, I will be revisiting my Neste thesis, and have a look at what I count on from right here on out – and furthermore, why I am nonetheless investing in Neste, albeit at a comparatively sluggish tempo.

That is an replace on my already-existing thesis for Neste, final lined on this article.

Neste – I proceed to view the upside as vital.

I first began writing about Neste again in 2022. Whereas the corporate has seen a decline since then, so has the S&P500. Since my first article, the corporate is down round 18%. Not an excellent RoR, however then once more, underlying fundamentals and trade haven’t moved the way in which I, or different analysts, forecasted them to be. It is a part of the problem within the vitality sector.

Why do I like Neste a lot?

A number of causes. A part of it’s that the corporate is Finnish, instructions a €28B+ market cap, has markets across the complete world, and operates two giant refineries within the Nordics which account for virtually 20% of the Scandinavian manufacturing capability. The truth that it is a financially and essentially sound enterprise is definitely a part of it as properly. In a way, the corporate is the world’s main producer of renewable diesel.

As soon as a part of vitality large Fortum (OTCPK:FOJCF) and spun off round 17 years again, it is nonetheless state-owned to 40%. The Finnish, just like the Norwegian and in contrast to the Swedish state stays a serious investor in structurally necessary native companies. The corporate hasn’t utilized for credit standing scores from any company, and thus holds none -but Neste carries minimal debt, with vital borrowings in bonds at a median maturity of 3-4 years.

Not like most vitality corporations, a part of the corporate’s concern is dividend yield. It has a really low yield, regardless of its share value decline and sector, which normally lends itself properly to earnings investments.

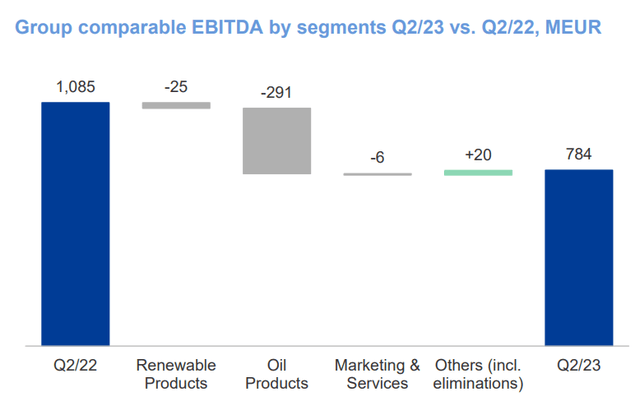

Nevertheless, the most recent set of outcomes doesn’t give encouraging developments when it comes to earnings. We’re seeing but extra declines in comparable EBITDA regardless of gross sales quantity will increase. The corporate does have vibrant spots in its report, together with good outcomes from advertising and marketing and providers – however on the similar, reported stock losses. (Supply: 2Q23 Neste)

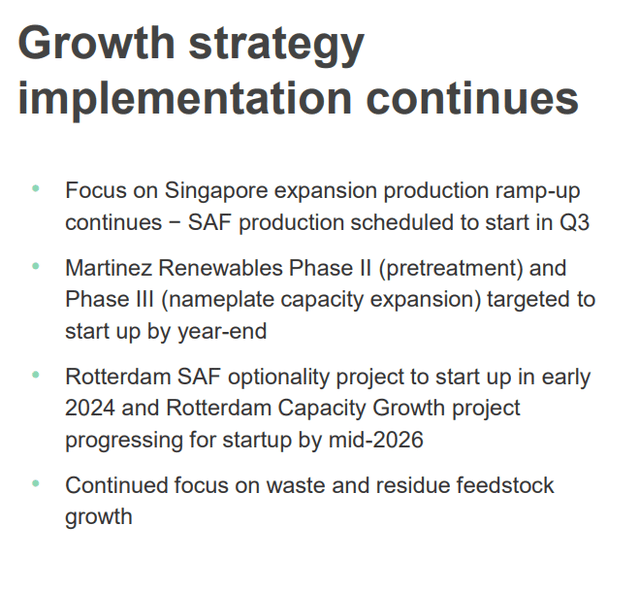

Development methods have been a part of Neste’s plan for years right here. The Singapore and Martinez capacities are issues I’ve been masking in each article on the corporate – however as with different corporations that start their earnings name by touting their security information and incident numbers, you normally can inform when the monetary a part of the outcomes is not as much as par. So was the case for 2Q23 (Supply: 2Q23 Neste).

Firm ROACE has dropped from over 30% to 27.4%. That is nonetheless stellar in comparison with an organization goal of round 15% or above, however right here I say that the corporate is working with a far too low “bar”. The corporate’s leverage stays low – however once more, it was once round 10%. It is now 24.3%. So elementary and related KPIs on the monetary facet are slowly rising worse, and that is a part of what’s placing stress on the corporate’s share value.

As a renewable gas provider utilizing inputs akin to vegetable oil, waste, and residue, the pricing for such feedstock and their logistics prices are a serious a part of what’s driving developments right here. Neste’s fundamental feedstocks are soybeans, used cooking oil, animal fats and palm oil, with outputs akin to diesel, gasoline, and heavy gas oil.

The latter of those has been at a unfavorable margin on a versus-brent differential for over a yr, and the margins have been compressing for the opposite two since late 2022 – although maybe a greater phrase could be “normalizing”.

Nevertheless, it is my view that the margin for Neste’s 2Q23 was considerably weaker than within the sequential 1Q23, even when they had been above sure averages for the long term. We won’t count on margins for gas and oils to actually normalize to Pre-2021 ranges. At the very least not with out vital macro adjustments. However the reality is that Neste is just not realizing the potential many analysts noticed over a yr again.

Each revenues and earnings are down, with earnings as a lot as 50%, on a YoY foundation. This drop is coming from each of the most important segments of Renewable merchandise and Oil merchandise. The truth that Neste touts the efficiency of promoting/providers, a lower than 5% of income/EBITDA section, reveals you that issues actually aren’t that good right here – and {that a} 50%+ drop in working revenue really signifies that the corporate actually has held up fairly properly in comparison with how a lot it may drop.

The downside is refining margins. The estimate is that when the brand new capability in Singapore and Martinez are on-line, these will work to offset these negatives. From a margin perspective, the bigger impression got here most positively from the oil merchandise section. Renewable developments weren’t excellent, however they weren’t as dangerous.

Neste IR (Neste IR)

Positives? Do they exist right here?

In fact, they do. I do preserve a “BUY” ranking on this firm in spite of everything, and I’ve no plans to divest my shares. I’d not be as optimistic until there have been positives. In the long term, the corporate is definitely trying pretty respectable. On a half-year foundation, we’re seeing larger volumes and gross sales margins normalizing at a stage that may allow the corporate to be impressively worthwhile over time.

The primary impacts over the long term are associated to fixed-cost will increase. What’s extra, money move is bettering. Neste has all the time been an efficient supervisor of working capital, and it is displaying this right here. The corporate’s NWC is all the way down to 38.7 days from 56.4, and it is “softer” issues like these that I need to level to for Neste benefits right here – as a result of these softer targets are principally what we have now to go on right here.

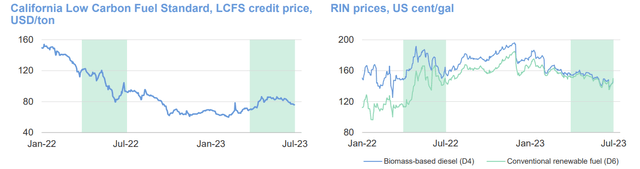

Neste is not in a straightforward spot. Whereas Renewable efficiency stays considerably okay from the bigger image when it comes to EBITDA and even margin, the oil section is taking a beating. The beforehand very excessive LCFS credit score costs for California, which have been driving firm margins and gross sales, have additionally not recovered to any main type of stage, and you may virtually retrace the corporate’s share value by following these market drivers for renewables.

Neste IR (Neste IR)

Oil…that is a unique story. Refining margins and comparable EBITDA are actually in a freefall, regardless of comparable gross sales quantity and 85%+ refinery utilization charges. The corporate is a really low-cost producer, with manufacturing value at round $6.3/bbl down from $6.8 YoY, however margins are nonetheless driving issues decrease right here because of fastened prices. New property beginning up will do some to normalize this on a company-wide foundation, however I do not count on any type of miracle on a ahead foundation. As an alternative, I’d say there’s nonetheless ample room for margins to pattern down additional.

Neste focus is on its progress ambitions.

Neste IR (Neste IR)

The outlook continues to dictate a fancy forecast. 3Q23 volumes are anticipated to be decrease, and glued prices are anticipated to extend, with a 4-week upkeep shutdown in Rotterdam in 4Q23, margins are anticipated to be decrease right here as properly.

The corporate’s liquidity profile stays good – however once we begin taking a look at valuation right here, it turns into clear a minimum of to me, that enchancment within the firm will take extra time. There’s an upside, but it surely’s in 2024 on the earliest, not this yr.

Neste – Constructive valuation developments proceed

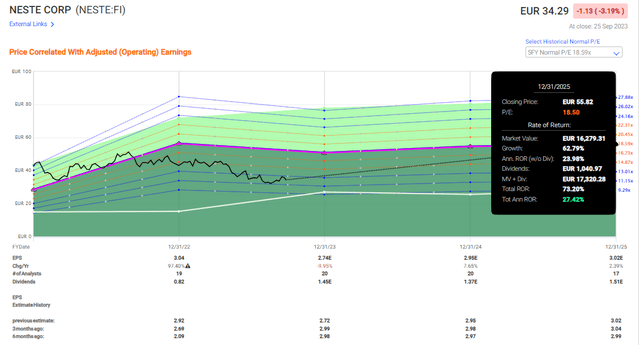

Some analysts are calling for Neste to be a “HOLD” right here. I’d say that is too conservative/too unfavorable on the corporate’s elementary valuation and developments – however on the similar time, the potential for a near-double-digit drop in 2023E EPS is excessive.

With the corporate not even yielding 3% presently, this isn’t a high-yielding vitality firm – and discovering a ten% upside that features a 5-8% yield on this sector is just not particularly onerous on this market that we’re seeing at present.

Neste has just a few issues going for it. It is premiumization is a type of issues. Neste usually trades at 18.5x, at the moment at 12x. With a 3% EPS progress charge, it is not obscure why traders will not be so eager on the enterprise. At a conservative 13-15x P/E vary, we’re seeing an upside right here beginning at 10.8% per yr, as much as round 15.6% to 15x P/E on a ahead foundation with an implied share value of €44/share in 2025E. That is still the muse of my optimistic thesis on Neste. The corporate is just too low cost for what it provides traders and even a a number of 3-4x beneath the premiumized one nonetheless leads to a double-digit upside.

That is the upside to a normalization of 18.5x

Neste Upside (F.A.S.T Graphs)

So you’ll be able to see, that you’d must basically count on Neste to actually underperform for a protracted, lengthy time to see a long-term unfavorable RoR right here. That is why I proceed to be optimistic about Neste as an funding. The upside, primarily based each on forecasts, on historic valuations, and if we have a look at friends, all of it reveals potential upside.

Neste has 20 analysts following the corporate. Most of these – 15 – are both at “BUY” or comparable “outperform” scores. The common PT goes from €30/share to €60/share. My very own PT was €47 in my final article – and I am not shifting it right here. The analyst common is €46.5, implying an upside of 36.4% because the inventory trades on the time of writing this text.

I see the positives outweighing the negatives right here. I proceed to be optimistic on Neste each because of fundamentals in addition to because of long-term progress prospects, in addition to comparability to friends. I consider this, regardless of the decrease yield, to be one of many higher oil/vitality investments that may be made right here.

Thesis

My thesis for Neste is now as follows:

- Neste is maybe probably the most attention-grabbing oil/vitality corporations in Europe. They’ve discovered their area of interest, and so they’ve pivoted at what I view as precisely the appropriate time to serve a market that is going to wish their merchandise for the subsequent few many years on the very least.

- Neste has robust financials and really robust potential. Even when the yield at present is not that spectacular, future returns may simply go into excessive double or low triple digits.

- Neste inventory is a “BUY” with a value goal of €47 right here, and I am sticking to this value as of Could of 2023, with the latest drop within the firm’s valuation – even with the latest biofuel mandate.

- Regardless of extra drops in valuation throughout 2H23, I proceed to view it as a optimistic funding, and I’m shopping for extra right here.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

- If the corporate goes properly past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is essentially secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at the moment low cost.

- This firm has a practical upside primarily based on earnings progress or a number of growth/reversion.

The corporate now fulfills all of my standards for investing in a enterprise.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.