Warchi/E+ by way of Getty Photos

I price Nemetschek (OTC:NEMTF) as a maintain, because the inventory value already incorporates first rate income progress for the following few years. NEM has proved over a few years to be a German champion, delivering superb long-term compounding returns for traders who held their shares for a few years.

The structure, engineering, and building (AEC) trade, or, in different phrases, the development sector, is the least digitalized in comparison with others given its excessive diploma of fragmentation, its non-serial manufacturing processes, and its low profitability. However, digital transformation is seen as a key aggressive benefit by many gamers within the building sector, and corporations like NEM are known as to guide this strategy of transformation within the trade.

NEM affords not solely nice long-term tailwinds but additionally sturdy aggressive benefits that shield its enterprise mannequin from different opponents and future disruptions.

The corporate is within the course of of accelerating the participation of its subscription mannequin from its complete revenues, so it was comprehensible that there could be a slowdown in income progress for 2023 in comparison with 2022. It is a long-term profit for the corporate, making its enterprise mannequin much more resilient and predictable.

I’ll discover NEM’s enterprise mannequin and evaluate some key efficiency metrics with these of its most important competitor within the building sector. Lastly, I’ll calculate the intrinsic worth, assuming that I need to maintain the shares till 2030.

Enterprise Mannequin

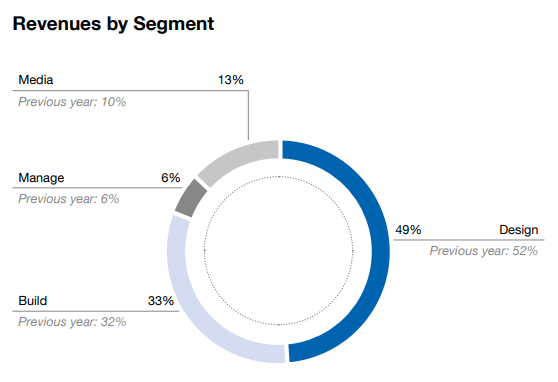

NEM affords software program that covers all the building cycle: planning, designing, constructing, and managing buildings by means of its 13 totally different manufacturers. The income breakdown as of 2022 by section is the next:

Annual Report

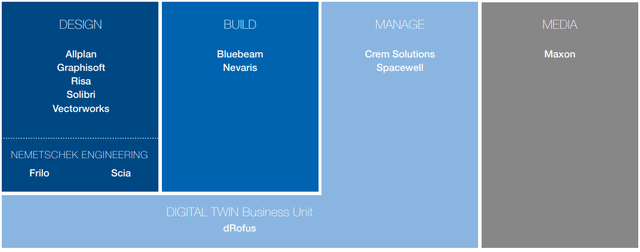

It is clear that the design section is a very powerful one, however the firm is taking steps to scale back that focus, pushing up different segments such because the construct and media segments, as may be seen within the chart above. The 13 totally different manufacturers are distributed throughout the totally different segments:

Annual Report

The Design section affords software program, by means of 5 totally different manufacturers, that’s principally utilized by architects, designers, engineers, house owners, and normal contractors to make planifications and designs for building tasks. NEM’s updates on this section are associated to enhancing the coordination of workflows, notably real-time workflows, among the many totally different customers of the identical mission to be extra environment friendly and to allow a extra sparing use of assets.

It’s extremely fascinating how these softwares have gotten key instruments for patrons as they should face excessive costs of uncooked supplies and the growing demand for sustainability and power effectivity in buildings. I can think about that even in exhausting macroeconomic headwinds, these softwares are much more obligatory to assist building corporations cut back prices whereas supporting them to be extra environment friendly of their capital allocation.

The Construct section, by means of the manufacturers Bluebeam and Nevaris, affords software program that’s built-in from the bidding and award part to invoicing, budgeting, scheduling, and value calculation. NEM was working on this section to develop cloud-based options; on this sense, this software program allows customers to work from wherever whereas utilizing any system.

The Handle section is extra targeted on digitalizing the administration of buildings, providing an revolutionary software program portfolio. The manufacturers Crem Options and Spacewell supply software program that meets the more and more urgent demand for extra environment friendly buildings in a sustainable and environmentally pleasant method whereas optimizing power consumption. As an example, Spacewell Power is a software program as a service ((SaaS)) that helps detect, monitor, and cut back power consumption in buildings by combining IoT sensors, real-time information, and synthetic intelligence.

The media section has been principally strengthened by acquisitions in the previous few years by means of the model Maxon. This section seems to be unrelated to the opposite segments, that are solely targeted on the development trade. However, I feel that this media section opens a number of future progress alternatives because of the very strategic acquisitions made by NEM.

Certainly, after the acquisitions of Redshift, which affords rendering options, and Red Giant, which affords options for movement design and visible results, NEM, by means of its model Maxon within the media section, acquired Pixologic in 2021, whose model ZBrush is taken into account the very best 3D digital sculpting software among the many consultants. Sculping software program may be very widespread amongst graphic designers and avid gamers since it may possibly handle particulars in a method that might be unattainable to do utilizing conventional 3D modeling strategies.

NEM has built-in all of the Maxon merchandise into one package deal underneath a subscription mannequin. As such, NEM has publicity to the rising 3D animation and the rising metaverse markets with an end-to-end software program portfolio alongside the digital content material creation worth chain.

Normally, the NEM’s technique with all its totally different manufacturers, notably these smaller manufacturers the corporate has been buying through the years, is to create worth by means of cross-selling. Certainly, a small model with a extra native presence is expanded internationally by means of NEM’s world community, collectively with different NEM’s software program.

Lengthy-term Tailwinds and Moat

There are sturdy causes to carry NEM for a number of years as the corporate enjoys clear long-term tailwinds:

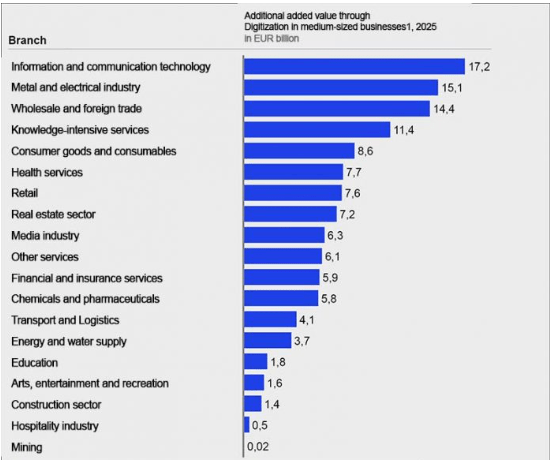

www.elearning-journal.com

Within the chart above, it is clear that the development sector is on the backside of the checklist for digitalization, as the development sector is without doubt one of the least digitalized industries. The opposite sector that has loads of room to digitize is the humanities, leisure, and recreation, so NEM was working to be uncovered to that sector by means of its media section, because it was talked about earlier than.

As such, the development sector provides loads of alternatives for gamers like NEM to supply extra added-value software program and to draw new shoppers. Additionally, rules about building information modeling (BIM) in a number of nations are serving to to make sure that BIM applied sciences change into more and more necessary within the building sector. BIM is a digital illustration of the bodily and purposeful traits of a facility.

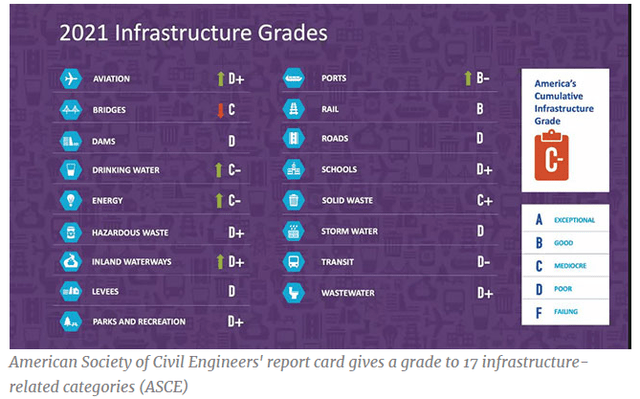

One other necessary issue is the insufficient infrastructure worldwide, notably in these nations the place NEM’s revenues are uncovered, like within the case of the US.

ASCE Report Card

The final report card made by the American Society of Civil Engineers (ASCE) was in 2021, assessing the infrastructure grade of C, which clearly signifies that the US infrastructure in a number of sectors requires upgrading. NEM has purchased a number of corporations within the US, akin to Pink Large, Bluebeam, and many others., with a purpose to reinforce its market place within the US, representing round 34% of that market’s complete revenues.

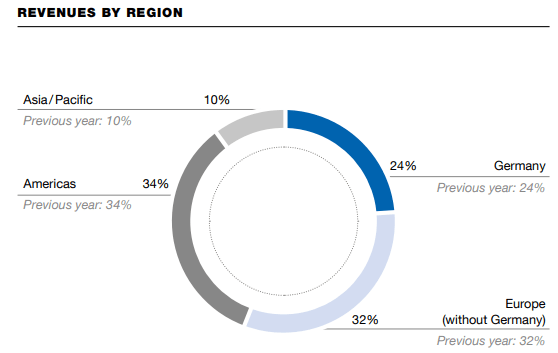

Annual Report 2022

It is anticipated that the share of revenues that come from the US is not going to change considerably in 2023.

With regard to Europe, in accordance with FitchSolution’s study:

Within the medium time period, between 2023 and 2027, we anticipate the Europe area to common annual actual progress of two.1% beneath the worldwide building trade’s common of three.2%% y-o-y over the identical interval.

The primary elements behind this efficiency are the macro headwinds and the excessive building materials prices. It is clear that if the US must improve its infrastructure, Europe would possibly want to take action too to maintain being aggressive.

Based on a study of the construction sector at a worldwide degree, it is anticipated that the constructing building market will develop at 9.8% CAGR and residential constructing building will develop at 5.4% CAGR in 2032.

Nemetschek’s moat

NEM has an fascinating moat, which relies on the truth that it is actually costly for any of its greater than 6 million customers globally to modify to different suppliers. These sorts of software program are realized in universities, schools, and institutes within the fields of engineering, structure, or design, and the educational curve to grasp them may be very gradual. This contributes to having a really fragmented market, which strengthens the limitations to entry for brand new gamers.

Additionally, NEM reinforces that stickiness of customers having a recurrent interplay with its customers, which allows it to develop new options that add worth to prospects. As an example, that is how NEM recognized years in the past that one of many most important obstacles to working with these softwares was the issues related to the collaboration amongst totally different professionals on the identical mission. Now, NEM affords the likelihood to have a method higher coordination of workflows amongst members of a piece staff in actual time about the identical mission, enabling the work staff to be extra environment friendly whereas utilizing its assets higher.

As such, the software program just isn’t simple to study, and the corporate makes you stick with the model whereas providing higher and higher enhancements that really add worth to your work. Nevertheless, there are different points that make NEM an organization to be on our radar: NEM doesn’t use stock-based compensations as many different SaaS corporations do, so there isn’t any dilution to shareholders.

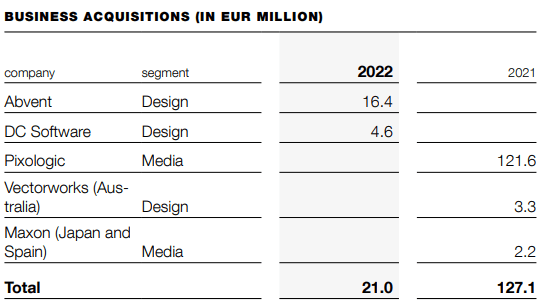

NEM has particular necessities to purchase potential subsidiaries, akin to measurement, profitability, tradition, imaginative and prescient, and many others. Thus, it is not a shock that NEM has enormously strengthened its enterprise mannequin with its superb acquisitions, as the corporate additionally lets these subsidiaries function independently as soon as they’re a part of the group. As well as, NEM buys most of those good subsidiaries at first rate costs; as an example, NEM purchased Abvent in 2022, paying 0.28x occasions gross sales, and DC Software in 2022 too, paying 1.31x occasions gross sales.

Annual Report 2022

I don’t like how a lot NEM paid for Pixologic in 2021, a complete of 121 million euros, which meant round 34x gross sales; nonetheless, I do perceive that this acquisition was important to bolster NEM’s media section for long-term progress, and the excessive value doesn’t have an effect on NEM’s monetary state of affairs, notably when the corporate has generated a FCF of round 200 million euros in every of the final 2 years.

Though the worth paid was excessive for that acquisition, NEM would possibly make the most of his world community to increase the operations of Pixologic to get the very best worth attainable, because it has performed in every of its different acquisitions. Additionally, I do know that it is not at all times attainable to search out superb potential acquisitions at first rate multiples, so NEM has strengthened its technique of investing in start-ups, which might allow it to get improvements sooner.

Outcomes Q3 2023 and Outlook 2025

NEM delivered a income progress of solely 5.53% and a drop in its EPS of -10.8% as of September 2023 YoY. Usually, NEM delivers double-digit income progress. The explanation behind this obvious not-so-good efficiency is the method during which the corporate is concerned in migrating all its revenues primarily based on licenses, that are primarily one-off funds, to subscriptions, that are recurrent. NEM is executing this transition very nicely, as a change like that might have decreased income and earnings progress, and most significantly, the free money move (FCF).

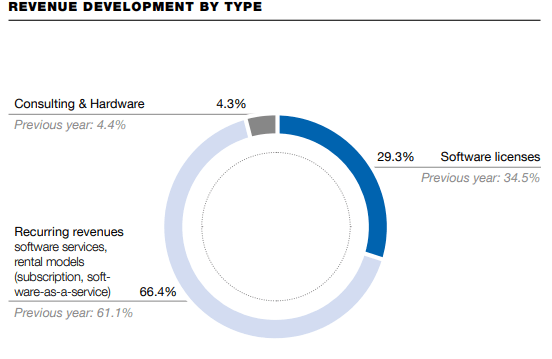

Annual Report 2022

Within the chart above, I see that recurring revenues elevated from 61.1% in 2021 to 66.4% in 2022. These recurrent revenues are anticipated to achieve 75% in 2023 as a part of this course of. It is actually fascinating that even underneath these circumstances the place the FCF is pushed down as a subscription mannequin implies, initially, much less money from license funds, NEM managed to ship a better FCF, reaching 171 million euros, which represented a progress of 9.5% as of September 2023 YoY.

The next proportion of subscriptions from the full revenues helps the corporate in establishing extra correct steering whereas serving to it to make its enterprise mannequin extra predictable. This additionally contributes to delivering a extra steady FCF and revenues, making the corporate’s enterprise mannequin extra resilient in troublesome eventualities.

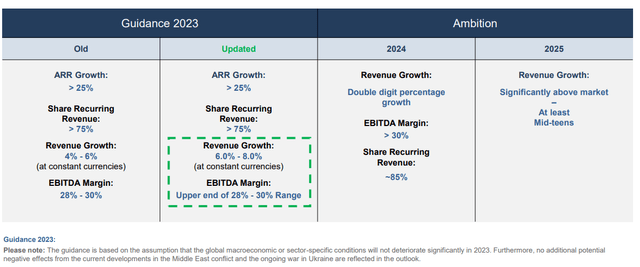

Nemetschek Presentation Q3 2023

Based on the steering, NEM has given a income progress expectation of 4% to six% for 2023 initially of the 12 months as a consequence of the migration to a subscription mannequin from the license mannequin. However, NEM raised these income progress expectations to six%–8%, which was taken very positively by the market. Additionally, the share of recurrent revenues is anticipated to achieve at the very least 75% in FY2023, which signifies that the migration course of is being executed as anticipated.

As well as, NEM has set different bold targets for 2024 and 2025, as the corporate expects double-digit income progress with a strong EBITDA margin and a share of recurrent revenues reaching 85% in 2024. I estimate {that a} conservative assumption may be a income progress of 10–11% for 2024. For 2025, NEM expects income progress of at the very least 15%, which signifies that the corporate has completed its migration course of with larger recurrent revenues and much more alternatives to ship new subscription-based companies to present shoppers and new ones.

I’ll incorporate these estimations in our calculation of the intrinsic worth.

Nemetschek’s Closest Competitor: Autodesk

I’ve discovered that Autodesk (NASDAQ: ADSK) is NEM’s closest competitor, even when each corporations are principally uncovered to totally different areas. Most of Autodesk’s revenues come from the US, and NEM has related publicity within the US however is usually uncovered to Europe.

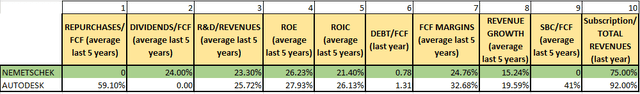

Creator, Annual Reviews

Wanting into the desk above, I may even see that each corporations have had superb returns on capital, low ranges of debt, excessive FCF margins, and double-digit income progress in the previous few years. Each corporations spend related ratios of R&D over revenues, which signifies that each are constantly investing of their respective companies to take care of their market place.

Nevertheless, I like extra how NEM manages its enterprise, as the corporate doesn’t use stock-based compensations to draw expertise, even when NEM is ready to rent gifted professionals who’re drawn to its good title within the trade. Then again, I like that NEM makes use of most of its FCF to be reinvested in its personal enterprise, growing extra worthwhile improvements to additional reinforce the stickiness of its software program.

Conversely, Autodesk has used greater than 50% of its FCF within the final 5 years to make repurchases, so the corporate has much less cash to bolster its enterprise. As well as, a part of the repurchases’ impact is compensated by the dilution of the stock-based compensations granted to its workers.

In column 10, I discover that the subscriptions symbolize 92% of Autodesk’s complete revenues, whereas NEM remains to be within the course of of accelerating its income by means of subscriptions, leaving the corporate with extra progress prospects as it would enhance much more that proportion of subscriptions within the subsequent few years. Autodesk made this transition within the years 2016–2019, which was not simple for the corporate as its revenues, internet earnings, and FCF declined considerably, delivering detrimental ROE and ROIC as its fairness was accumulating the detrimental earnings and it didn’t cut back its share buybacks, that are thought of detrimental throughout the fairness in accounting phrases.

In fact, Autodesk is a extra strong firm now exhibiting good efficiency since then, however the best way these transitions are managed provides us a way of the administration’s execution, and NEM is taking extra gradual steps emigrate to a totally subscription mannequin with out affecting its monetary efficiency materially, giving extra confidence to its shareholders within the course of.

Valuation

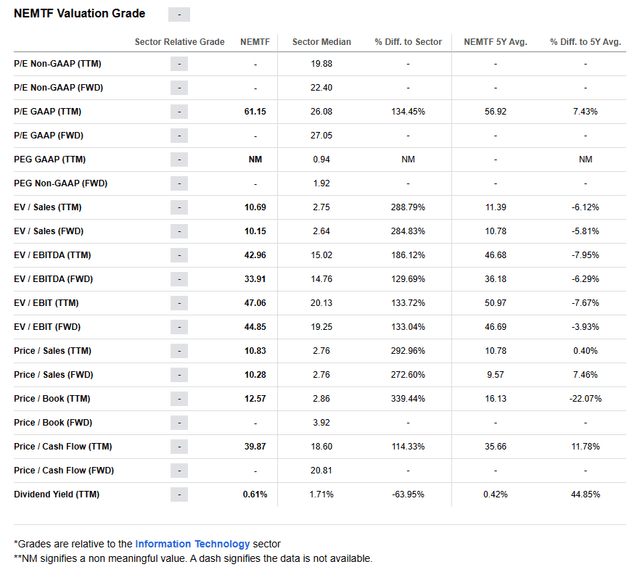

Based on SA, all of the multiples for valuation point out that NEM is pricey in comparison with its friends:

SA

I do know that NEM is a high-quality enterprise, so most of those multiples assume that each firm has the identical high quality, which isn’t true. So, I’ll calculate an approximate intrinsic worth primarily based solely on NEM’s personal deserves.

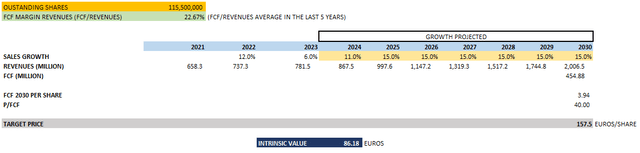

First, I might want to make sure assumptions:

- Excellent shares: 115,500,000 (as of September 2023)

- FCF Margins: 22.67% (common of the final 5 years)

- I assume that NEM is held till the 12 months 2030.

- Income progress for 2023: 6%–8%, in accordance with management’s guidance

- Income progress for 2024 and 2025: in accordance with administration’s steering

- Income progress past 2025: I assume 15% annual as I estimate that its migration course of to a full-subscription mannequin is accomplished.

- P/FCF 2030: 40x (common of the final 8 years)

- Discounted price: 9%

Creator

Based mostly on our assumptions, I make a projection of income progress of 6% for 2023, 11% for 2024, and eventually 15% for 2025 and past. So, I take the revenues projected for 2030, after which I multiply these revenues by the FCF margins of twenty-two.67%. NEM has been very constant within the final 10 years, in order that FCF margins could possibly be even larger for 2030; then, consequently, I get an approximate FCF of 454.8 million euros for 2030.

Now, I take that FCF of 454.8 million to be divided by the excellent variety of shares of 115.5 million shares to get a FCF per share for 2030, getting 3.94. On this sense, I take the FCF per share of three.94 and multiply it by 40, which is the NEM’s common P/FCF of the final 8 years. Then, I get a goal value of 157.5 euros per share in 2030, so I calculate the current worth to deliver it again to 2024, contemplating that 2023 is sort of completed.

Thus, discovering the intrinsic worth:

Intrinsic worth = 157.5/(1+discounted price)^7

Lastly, I get an approximate intrinsic worth of 86.18 euros per share. The present inventory value is round 77 euros per share, however there’s not sufficient margin of security. If an investor is drawn to the corporate, he would possibly purchase now however must be prepared to purchase extra shares because the inventory value declines. A sensitivity evaluation may assist us to know a extra approximate vary of intrinsic values, altering our most important assumptions:

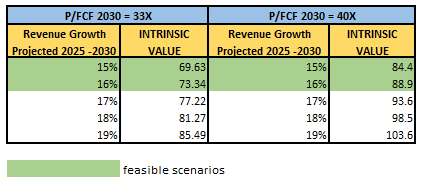

Creator

I observed {that a} P/FCF of round 33x is what the market is keen to pay in exhausting eventualities for this high-quality firm; that is what I noticed within the final quarter of 2022 when there was a lot uncertainty in regards to the results of the quick rate of interest hikes by the FED within the world building sector. Then again, a P/FCF of 40x is a median a number of, so I construct two eventualities, as is seen within the desk above.

As well as, NEM’s administration acknowledged that from 2025 on, they anticipate at the very least 15% income progress. Due to this fact, in a conservative method, I can set a variety of intrinsic worth, trying on the numbers shaded inexperienced, between 69.63 and 88.9 euros per share, roughly. I amassed shares at a value of 60 euros per share to assemble a margin of security.

In fact, NEM is ready to ship a income progress of greater than 15%, or the market may be keen to pay a better a number of P/FCF than 40x in 2030, which might enhance the intrinsic worth to ranges larger than 93 euros per share, however I must be conservative in our projections to construct up a margin of security.

Dangers

NEM operates in a really cyclical trade like the development sector, so when the financial system reveals weak spot with excessive rates of interest, the development sector would possibly undergo, and all of the gamers which can be a part of that sector would possibly undergo too.

However, NEM has a well-diversified pool of consumers throughout 142 countries, so diversification considerably reduces this threat, as recessions don’t have an effect on each financial system on the planet with the identical depth. As well as, NEM’s software program has change into a necessary device for engineers, architects, and designers to be extra environment friendly in the usage of their assets in eventualities with excessive prices of uncooked supplies, amongst different uncertainties.

Competitors may be one other issue that might decelerate NEM’s income progress, as there are formidable gamers akin to Autodesk, Bentley Programs (NASDAQ: BSY), and even Ansys (NASDAQ: ANSS). Nevertheless, this can be a very fragmented market with a number of progress alternatives for each participant, given the large long-term tailwinds of the development sector, which seems to be one of many least digitalized industries on the planet.

Then again, NEM has demonstrated strong execution in its natural and inorganic progress over the previous many years. Additionally, NEM has strengthened its moat by means of its steady funding in strengthening engagement with its customers and growing new revolutionary releases that become very worthwhile for patrons. All of those could possibly be seen by means of its excessive returns on capital of greater than 20% persistently through the years, low debt ranges, constant income progress, excessive FCF margins of greater than 20% persistently, and many others.

Possibly what may symbolize one other threat for some traders is the excessive inventory volatility. Some traders who’re extra targeted on the brief time period or center time period would possibly discover this inventory unappealing, because the inventory can transfer strongly, typically going up or down with none information. However, this inventory works very nicely for long-term holders, as each huge drop may be harnessed to purchase extra shares whereas having fun with the long-term compounding good thing about an organization that really is aware of easy methods to surf the macro headwinds because it was based in 1963.

Remaining Ideas

Generally, a brief report on corporations like NEM doesn’t give us sufficient data to understand how good they really are. On this article, I needed to point out that NEM may be a kind of few European gems that really deserves to be included in any portfolio with a long-term horizon.

The corporate is a money cow machine that is ready to ship double-digit income progress persistently. As soon as its migration mission reaches a full subscription mannequin, NEM may have an much more resilient enterprise mannequin that can open up extra alternatives to supply new subscription companies whereas receiving extra cash flows as a part of its present software program companies.

It isn’t shocking that the market is keen to pay excessive multiples for this firm, provided that NEM combines strong income progress and FCF margins. There are many progress shares on the market, however most of them are comparatively new with lower than 15 years of operations. Conversely, NEM is an organization based within the Nineteen Sixties that was capable of adapt itself to all of the megatrends skilled since then and is now engaged on the present megatrends: the event of cloud options throughout its totally different manufacturers and varied synthetic intelligence initiatives.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.