DNY59

For readers who’ve adopted our pure gasoline (NG1:COM, UNG) articles this yr, you’ll know that we have been bearish. We stay bearish regardless of the steep decline in worth on account of 3 fundamental elements:

- Extraordinarily robust Decrease 48 gasoline manufacturing averaging ~105 Bcf/d.

- Very bearish climate to start out the winter heating demand season.

- Elevated storage going into withdrawal season making the market closely depending on a bullish winter.

The one means for us to vary our opinion of the pure gasoline market is that if the next 3 issues occur:

- Decrease 48 gasoline manufacturing drops again to ~102 Bcf/d.

- ECMWF-EPS forecast reveals an especially chilly climate setup in January.

- Storage estimates present the top of withdrawal again down under the 5-year common.

At this second in time, 2 out of the three issues we listed have a really low likelihood of hitting. our storage projections, we’ve storage ending March over ~2 Tcf.

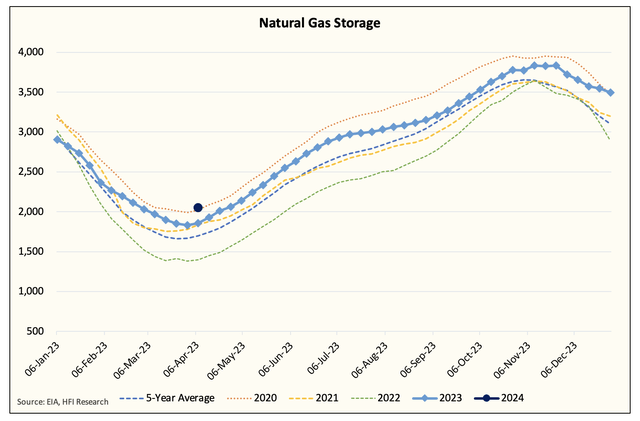

EIA, HFIR

Over the following 5 storage reviews, we’re forecasting a surplus of 206 Bcf relative to the 5-year common. In contrast to final yr, once we noticed an especially chilly occasion in H2 December, we’re seeing the precise reverse with this December displaying file low HDDs.

EIA, HFIR

In essence, essentially talking, we want a ~3 Bcf/d drop in manufacturing and a ~400 Bcf revision in storage. We would wish to see 1) a chronic chilly occasion in January and February and a couple of) extreme declines in manufacturing.

HFIR

Sadly, this seems extraordinarily unlikely. Manufacturing has been nothing however stellar this yr ensuing within the dire worth drop we’re seeing now. And until these two issues materialize, I do not assume pure gasoline costs in 2024 will see the $3 deal with.

However it might worsen…

I believe that is the true downside with the pure gasoline market. Whereas it seems that is about as dangerous as dangerous will get, the problem is that this might not be the worst-case situation. Following a record-warm December, we might have bearish winter climate in January, which might open the potential of sub $2 gasoline. For the second, ECMWF-EPS long-range is displaying large chilly potential in mid-January, and for the pure gasoline bulls’ sake, we hope that is true.

CommodityWx

This can be a very traditional bullish winter climate sample, and if this materializes, we might see storage attracts over 250 Bcf. However once more, it is a large if, so we must look forward to the top of December climate forecasts to see if this materializes.

Not all hope is misplaced…

Because the title of this text suggests, that is about as dangerous as dangerous will get. With pure gasoline costs now falling to the purpose of eliminating the potential of any chilly threat shock, the market could get jolted if bullish climate is on the horizon.

HFIRweather.com

In the meanwhile, we do not see any bullish climate surprises within the 15-day outlook, so pure gasoline bulls must wait. However for these of you affected person sufficient, there might be a buying and selling alternative right here given the severity of the selloff we have seen.

We suggest that if there may be certainly the potential of a bullish climate shock, we might provoke a short-term (lower than per week) place in names like Antero Assets Company (AR) to reap the benefits of the sentiment. We’d not maintain these positions lengthy as we stay bearish on pure gasoline, however it’s a tradable occasion.

For now although, we urge you to remain on the sidelines. Nothing bullish is materializing and should not occur for some time longer.