Editor’s word: In search of Alpha is proud to welcome Yahor Zaikou as a brand new contributor. It is simple to grow to be a In search of Alpha contributor and earn cash in your finest funding concepts. Lively contributors additionally get free entry to SA Premium. Click on right here to seek out out extra »

onurdongel/iStock by way of Getty Pictures

Introduction

It’s not information that U.S. pure fuel costs (NG1:COM) are extremely unstable. Along with the standard cycles from overproduction to shortages in commodity markets, we’re coping with a commodity the place the stability of provide and demand is so delicate that it might change dramatically even in response to single, hard-to-predict technical elements, such because the Freeport explosion final yr. And, in fact, pure fuel value is extremely weather-dependent, which apparently provides it an simple status as a widow maker.

The evaluation of pure fuel provide and demand dynamics is moderately sophisticated and multifactorial additionally as a result of each provide and demand are multicomponent. There may be inner and exterior demand. Home demand is for energy technology, for heating and for numerous industries, and every of those elements ought to be analyzed individually. In flip, provide can also be extremely various. The price of manufacturing varies enormously from basin to basin and there’s additionally related pure fuel, which is obtained as a by-product of oil. And because the icing on the cake, there are literally many native fuel markets resulting from transportation constraints. After all, an actual evaluation to forecast the pure fuel market should embrace an evaluation of the dynamics of all these elements, however the uncertainty will probably be fairly massive because of the massive variety of variables and their probabilistic nature.

On this article, in contrast, we are going to take a holistic method and attempt to analyze the dependence of the worth of pure fuel on only one variable–how a lot fuel is in storage. We’ll see how this dependence has modified up to now and attempt to look into the long run.

Gasoline Costs And Gasoline In Storage: How It Used To Be

Under, you possibly can see graphs of pure fuel costs and storage surplus in comparison with the typical of the earlier 5 years. The very first thing I seen after I put these graphs collectively was that the phrases of pure fuel producers’ representatives that the present surplus will dissipate sounded much more convincing to me. This isn’t simply an abstractly rational assertion from the standpoint of market legal guidelines, pure fuel inventories have certainly all the time tended in the direction of their common worth, at the very least lately. On the identical time, in comparison with manufacturing volumes, the deficit and surplus have by no means appeared too massive.

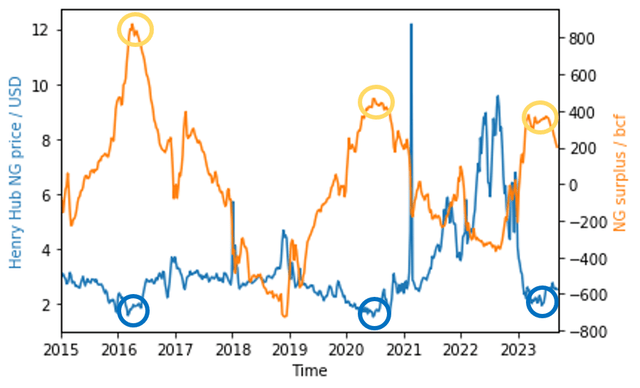

Pure fuel costs and surplus of pure fuel in storage in comparison with the typical stock of pure fuel in storage over the earlier 5 years (information by EIA)

The utmost surplus we see on the graph is produced in a couple of week, and the exports which have fallen resulting from an accident at only one LNG terminal in a number of months exceed the present surplus. The market is continually doing the fragile work of balancing itself.

As you may count on, if one compares graphs of pure fuel value and surplus, it’s straightforward to see that they’re associated. Worth minima have been reached in 2016, 2020 and 2023 nearly concurrently with the utmost surpluses. This yr’s value minimal was larger than within the earlier two circumstances, however the surplus was additionally barely decrease this yr, so this yr’s value minimal matches properly into the sequence of earlier value minimums.

On the identical time, we see that the average provide deficit in 2022 coincides with a lot larger costs in comparison with earlier years. To make sense of this, let’s check out the graph under, the place costs are proven as a perform of the pure fuel storage surplus. Whereas what we see is much from a wonderfully clean line, the graph clearly exhibits that lately costs have relied on the excess in certainly one of two patterns proven in several colours.

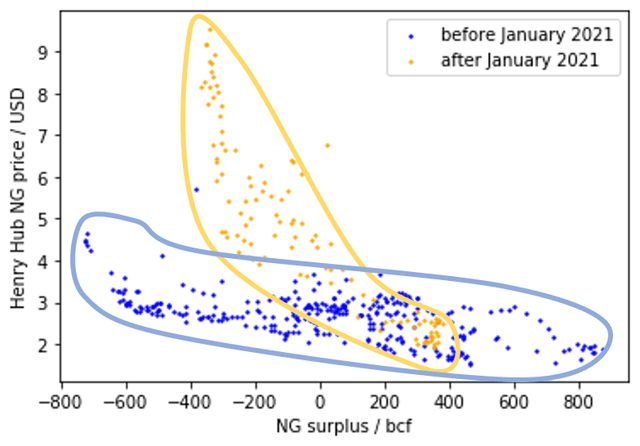

Pure fuel costs vs surplus of pure fuel in storage (information by EIA)

Till 2021, we’ve a flatter curve with a considerably stronger rise in costs to $4 on the very left aspect of the graph when the deficit is at its most. Between 2021 and 2022, we’ve a powerful value enhance to nearly $10 even with average deficits. The distinction between the 2 patterns is clearly seen simply when there’s a deficit of pure fuel in storage, whereas when there’s a surplus, costs are in the identical vary. Maybe the reason being that when there’s a surplus, the market pays extra consideration to the manufacturing price under which the pure fuel output will probably be drastically diminished, which is able to rapidly convey the excess to zero. The manufacturing price apparently has not modified radically lately, within the sense that it has modified lower than the statistical unfold of the values on the graph. Anyway, the market is now in surplus, and we won’t inform from this graph whether or not the later paradigm is constant or whether or not we’re again to the sooner pre-LNG paradigm. There may be one other technique to discover it out, we are going to come again to that later.

It is very important word that though the temporal boundary between the 2 patterns is unfair to some degree, with the intention to clearly separate the factors, the border needed to be drawn in 2021. In different phrases, nicely earlier than the start of issues with Russian fuel provides to Europe because of the conflict and thus the paradigm shift that led to the emergence of the later sample can hardly be defined solely by panic. Plainly between mid-2019, when the interval of pure fuel deficit available in the market ended, and early 2021 when the deficit returned to the market one thing occurred that modified the response of pure fuel costs to its deficit in an enormous manner, particularly, it led to a lot larger costs. What precisely occurred? I believe the proper reply is that in this time interval the quantity of LNG exported from the US doubled, growing by over 5 bcf/d. As you possibly can see within the graph under this was the interval of the quickest development in LNG exports in historical past and I’ve not discovered another occasions of such magnitude within the pure fuel market to place ahead an alternate speculation.

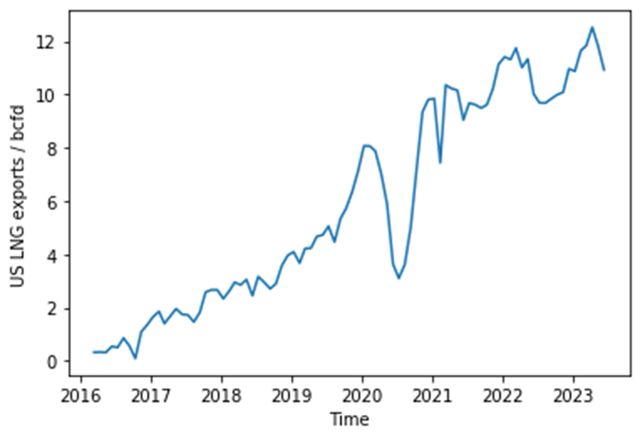

US LNG exports vs time (information by EIA)

Additionally, from 2021 onwards, there was a interval of excessive costs in world LNG markets and there’s a nice temptation to attribute the excessive US pure fuel costs to the affect of exterior costs because of the globalization of the pure fuel market. In follow, it isn’t that easy. A quite common and affordable counterargument is that if LNG terminals are working at full capability for the U.S. pure fuel market, it does not matter how a lot pure fuel prices in Europe or Asia- it will not be attainable to extend exports. However initially, though I am not an knowledgeable, I will enable myself to take a position on the next matter. From my observations of export volumes, I can assume that LNG terminals have some freedom in how a lot fuel to ship at a given moment— a bit extra or a bit much less. The month-to-month export excessive as seen within the graph above was reached in April of this yr at 12,6 bcf/d. That is fairly considerably larger than in lots of the latest months when Freeport was both already working or nonetheless working, i.e. nominal liquefaction capability was the identical as it’s now. And all this time it was thought that export capability was absolutely utilized. The market could imagine that larger costs on world markets can result in a 1 bcf/d enhance in provide (a price that appears affordable primarily based on the chart under), which isn’t a negligible quantity. Such a rise in exports alone would convey all the present surplus to zero in about 7 months. Second, whether or not or not the worldwide market’s affect on the U.S. is justified, it’s undoubtedly there, and has been for a variety of years. Will it all of a sudden come to an finish, given the truth that within the coming years we are going to see a rise in LNG exports and, as a consequence, a transfer in the direction of the already simple globalization of the pure fuel market? I doubt it.

What Futures Inform Us

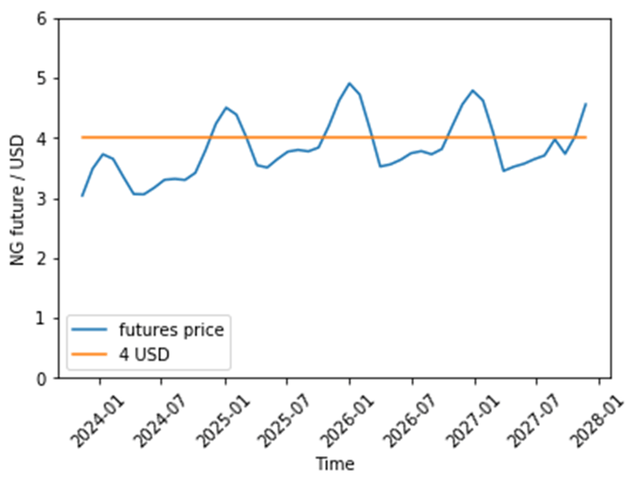

Importantly, the futures market additionally appears to imagine that costs will proceed to observe the trajectory from the later sample, and thus we proceed to be in it. As proven within the graph under, beginning in 2025 the futures market predicts common annual costs simply above $4. It is smart that the futures market assumes that there will probably be a zero deficit on common for every of those years, as a result of the market is successfully looking for stability.

In that case, then futures costs are in line with the later sample. The value-vs-surplus graph exhibits that pure fuel costs close to zero surplus are clustered round $4 for the second sample, whereas the corresponding costs for the primary are round $3.

Knowledge by barchart.com

Conclusion

The principle conclusion of this text is that in the course of the subsequent interval of pure fuel deficit, costs are more likely to rise rather more than the market presently expects. How far we’re from that period– relies on many elements, these are described within the introduction. The principle one is the climate. As well as, such a forecast itself implies a rise in value volatility, not a lower. Subsequently, shopping for decaying monetary devices like UNG and BOIL doesn’t seem to be a good suggestion to me, regardless of my bullish place on pure fuel.

I believe it’s higher to purchase shares of pure fuel producers. Nevertheless, the eye ought to be paid to their monetary power and their low manufacturing prices, which may be sure that the corporate will safely survive the interval of low costs, if it lasts for a while. I additionally assume you will need to take note of how an organization hedges pure fuel costs. The much less hedges, the extra upside in my view. Because of this, if I might solely personal shares of 1 pure fuel producer, I’d select Antero Sources (AR). However that could be a fairly dangerous method. Do your personal due diligence.