DNY59

“Traders face not one however two main dangers: the chance of dropping cash and the chance of lacking alternatives”. – Howard Marks

Halloween represents a scary time and that concern entered the investing panorama as October got here to a shut. There isn’t a have to go over the entire “points” that elevate the concern quotient, each investor can recite the listing. Fairness pullbacks are by no means snug, however it is very important put them in perspective. The S&P 500 usually experiences three to 4 5% declines a year-one of which is normally 10% or more- so the current pullback is just not uncommon. What’s uncommon is the short flip of occasions which may as soon as once more be ushering in a change in pattern. Enter a mini-rally that when once more has many market observers confused.

Nonetheless, as we’ve got lined for months on finish it’s the long-term view that ought to put a scare into everybody. Whether or not this seems to be one frightful second within the near-term story or seems to be Half One in an ongoing collection of scary motion pictures is but to be decided. When the fairness market soared to 4588 in July and retreated shortly, I instantly famous that it might have represented an intermediate TOP. As time went on and equities struggled after which tumbled to present ranges, that notion began to get cemented in place. The next peaks to the “MACRO” view, which stays stuffed with scary scenes.

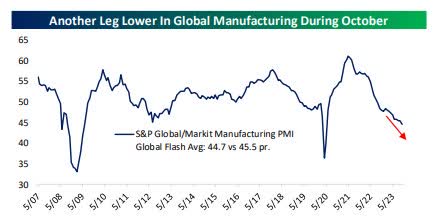

Beginning with the World view, the notion that PMIs had been “bottoming” took successful with final month’s experiences. On the international stage, Manufacturing information has been steadily deteriorating for over two years, and October’s studying slid additional into contraction territory at 44.7. Exercise within the Companies sector hasn’t been as weak, however momentum is to the draw back with October’s studying falling to 48.3 from 49.8.

World Manufacturing (www.bespokepremium.com)

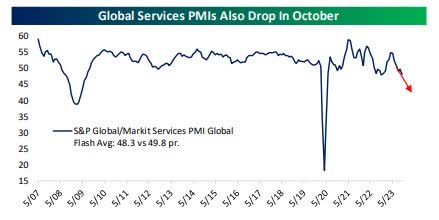

Exercise within the Companies sector hasn’t been as weak, however momentum is to the draw back with October’s studying falling to 48.3 from 49.8.

World Companies (www.bespokepremium.com)

Maybe the scariest MACRO challenge of all is one which was lined in late August. Regardless of the rhetoric that the US budget is being cut, the stats (details) present the finances deficit for fiscal 2023 was $1.7 trillion. A fast refresher on this matter. Projected finances deficits for the following ten years by no means get smaller and inside 5 years are anticipated to exceed $2.5 trillion. Consequently, the Treasury will add $20 trillion to excellent debt within the subsequent decade. Debt in relation to GDP will climb to a file excessive stage. As the quantity of debt excellent climbs, the curiosity expense will improve commensurately.

The SILENT KILLER

It’s this “curiosity expense” that was highlighted earlier within the 12 months as THE challenge that can trigger probably the most hurt to the economic system and might spiral your entire US financial state of affairs uncontrolled. But there’s solely a minority faction in D.C that’s speaking about it Curiosity on the general public debt has risen from 1.5% of GDP earlier than 2008 to 2.5% right now and based on a current Congressional Budget Office forecast, curiosity expense on the debt is anticipated to develop to three.7% of GDP by 2033, exceeding discretionary spending on protection (2.8%) and nondefense packages (3.2%). It has by no means been larger. Right this moment “curiosity” represents 15% of all tax income. The remaining 85% of tax income can be utilized for spending on every part else. However by 2033 the CBO estimates that curiosity might be 20% of tax income. That signifies that the spending on every part else will drop to 80%, and naturally every year it can worsen.

Once I have a look at the urgent points I’ve a very completely different take from what’s being mentioned right now. It’s completely different from what the mainstream media, the speaking heads, and the alarmists have latched onto. There’s a purpose why I’ve criticized and scoffed on the alarmists who say the U.S. MUST have EVs as major transportation. The notion that the nation’s greatest drawback right now might be changing to various power platforms and EVs by the mid-2030s can be an astonishing dismissal of the REAL issues at hand. The ONE challenge that’s going to alter existence on this nation goes to be the economic system. PERIOD.

To pay the mounting curiosity invoice different classes of spending should be lowered. Satirically that can decelerate the “inexperienced agenda” and wasteful spending to stabilize the state of affairs. The one query – How a lot harm has already been completed? Right here is the actual stunning and disturbing a part of this story. There may be however a small minority that’s recognizing and talking to this challenge. That leaves the bulk in DC believing they’ve minimize the deficits, and of their minds leaves extra room for added spending. The underside line is that the finances deficit is spiraling uncontrolled and plenty of leaders in Washington are making no severe effort to rein in spending. If one does not acknowledge an issue then it is inconceivable to use a ‘repair”.

Right here is one other approach to take a look at the state of affairs in a approach that even Washington, D.C. can perceive. The Bureau of Labor Statistics tells us that customers right now spend 33% of their earnings on housing. Let’s suppose that customers go on a spending spree, borrow extensively, and curiosity funds on bank card payments characterize one other 33% of their earnings. Just one-third of that earnings might be accessible to pay for meals, gasoline, medical bills, insurance coverage, schooling, and holidays. Due to this fact, it ought to be apparent that customers can’t afford such a spending spree.

Satirically in the identical timeframe the place alarmists are predicting doom and gloom worrying about every part however the RIGHT factor, is when a possible dying spiral will hit the US economic system (assuming it hasn’t completed so earlier than then). In contrast to what we’ve got skilled because the Nice Monetary Disaster, rates of interest are not a benign issue and as soon as the curiosity funds have been made there won’t be sufficient cash left over for every part else.

MIGRATION

What makes this case worse is the self-inflicted ache that provides to the issues. The continued unlawful migration challenge was recognized some time in the past as one other large drawback that can have an effect on the US MACRO scene in some ways. Billions have already been spent and we are actually being reminded that the COST related to taking up this burden can flip into one other bottomless pit. The mayors of Chicago, Denver, Houston, Los Angeles, and New York are asking for federal help to the tune of $5 Billion to handle the surge of migrants. That is the BEGINNING, not the top of those requests that can go on for years. The argument is that prices like these are merely a drop within the bucket. Newsflash; the drops have changed into a waterfall and the bucket has been washed away.

I will finish this a part of the presentation with a sobering reality – The federal government has already been on a spending spree, and the “spiral” downward might be about to start.

The “Inexperienced” SPENDING SPREE and the Affect on the GLOBAL SCENE

The impact on the MACRO scene from poor coverage selections can be going to be felt on a world scale. The headlines are all over the place, but policymakers are dismissing them. The transition to “inexperienced” has slowly began to collapse. In the event you do not consider the headlines or this commentary then simply check out what the market is saying concerning the “renewable” and “EV” shares that characterize the “transition”.

There may be extra chaos with photo voltaic shares and rightfully so. Many of those corporations are nonetheless having fun with monumental “subsidies”, but they cannot produce outcomes. Enphase (ENPH) is one instance, reporting a miss on unit shipments of micro inverters whereas Q3 revenues had been 3% decrease than forecast. This autumn revenues had been guided a brutal 39% to 48% decrease than consensus.

Much like SolarEdge (SEDG) and their preliminary announcement final week, ENPH reported an enormous steerage minimize attributable to Europe. Administration famous the outlook has soured due to “excessive stock at our distribution companions together with a softening in demand in our key markets – the Netherlands, France, and Germany”.

Getting again to (SEDG), they reported an enormous earnings miss this week and minimize steerage by 50%. The basics have soured and the technical image is a catastrophe. Within the case of ENPH, the inventory dropped right into a BEAR pattern and is now down 66% in 8 months. SEDG is in the identical place and simply 6 months has declined 86%. Whereas analysts and speaking heads discuss Bubbles in different sectors of the market your entire “inexperienced” bubble that nobody spoke about has burst. If anybody believes I am cherry-picking to make a degree, then take into account the Photo voltaic ETF (TAN). This diversified ETF has “solely” misplaced 50% in that timeframe.

The alarming drop in photo voltaic firm fundamentals is only one instance of the whole rout that has been seen throughout your entire clear power spectrum. The preliminary rally out of the COVID Crash was a boon for these names as everybody was being informed it was clear power or nothing. There could be no room on this planet for fossil fuels. The First Belief World Wind ETF (FAN) is 45% off its excessive set in early ’21 and has now given again all of its positive aspects since 2020.

It is easy, corporations are discovering that regardless of large tax incentives and subsidies, most initiatives aren’t financially possible. Danish wind energy developer Orsted just lately canceled two WIND projects off the East Coast of the U.S. In doing so the corporate would slightly write off 5+ Billion and stroll away from $1 Billion in tax incentives from this “journey” slightly than proceed with a dropping proposition.

The inventory market’s message is proven within the graphic under, and it is telling the REAL story. All-encompassing ETFs just like the World Clear Vitality ETF (ICLN) have been destroyed dropping 60% because the 2020 increase.

Clear Vitality shares (www.bespokepremium.com )

This transition has now come to grips with actuality. Free market forces have taken over and will gradual the amount of cash being tossed at these initiatives. For the sake of the worldwide economies, one can solely hope these true financial forces have acknowledged what is happening and can finally regain management of the state of affairs. There isn’t a room for “EMOTION” in financial and coverage selections, and we now see the outcomes of speeding into an ‘agenda’. They are not fairly, or acceptable.

Sadly, this debacle does not finish there;

Now we’re experiencing an ongoing EV fiasco unfolding right here within the U.S. that can impression EVERYONE.

I’ve made my stance very clear on the transition to “electrical” because the latter half of 2021, and now these warnings that this might be a COSTLY failed experiment are coming to go. FREE MARKET forces ought to all the time be allowed to play out. POLICY selections can then observe. The cart was put earlier than this horse from the outset and the prices are actually seen as one more self-inflicted wound. DEMANDING that one thing has to “work”, does not guarantee success.

The MACRO economic system has been severely impacted by pointless prices, with little return. Governments across the globe, particularly right here within the US have handed out subsidies with no return on funding. Likewise, companies and customers will bear the brunt of those coverage selections within the type of larger prices throughout the board for EVERYONE. Extra on that later.

As with all transition that’s void of a plan there might be casualties, and the smaller corporations might be among the many first. Electric vehicle component maker Proterra has filed for chapter together with EV manufacturer Lordstown Motors. HUGE sums of cash have already been misplaced and this is perhaps the start of a nasty ending for corporations which have tied their horse to the EV wagon.

Hertz World simply reported earnings and there have been some notable discussions on EVs;

- The corporate will decelerate the tempo by which it provides battery electrical autos to its fleet for a wide range of causes.

- The rental automobile firm additionally cited Tesla’s value cuts negatively impacting the resale worth of its EVs, and better than anticipated restore prices for EVs as one more reason to gradual its tempo of electrification.

Ford reported earnings and on the convention name, mentioned it can now defer and probably cancel 12 billion in EV expenditures. We have already heard the foremost automakers announce they’re dropping tens of millions on EV manufacturing. For instance, Ford introduced it lost a staggering $36,000 on every EV it sold last quarter. If I hadn’t seen this headline from EV maker Lucid Motors, I would not have believed it.

Lucid Motors Loses $338,000 Per Automotive

These are headlines that hardly ever make the sunshine of day as a result of when one states these details, it’s instantly dismissed as heresy. This is not about preventing the “clear” agenda that is concerning the actuality of the state of affairs affecting companies and economies across the globe. The one vivid spot is that the Lucid debacle will not have a big impression on the US economic system as a result of it’s funded by the Saudis. Nonetheless, we should not ignore that it’s the poster little one for a plan gone awry.

Rivian Automotive, Inc. reported a loss of $1.37 billion in its third quarter. The corporate “solely loses” $32,500 per automobile. Whereas that could be a vital enchancment for them, one has to surprise if the demand might be sturdy sufficient for the corporate to keep away from the identical chapter destiny as Lordstown Motors.

Many noticed the handwriting on the wall and warned what was about to happen, but policymakers solid forward utilizing an “emotion-filled agenda” as their playbook. Maybe the sunshine has lastly come on. As an alternative of absurd directives, “Free market” situations are actually calling the photographs and forcing corporations concerned within the “Inexperienced Transition” to rethink their plans. We now hear that GM has determined to alter its course on a “transition” that’s struggling.

Whereas this “nightmare” was being bought, the US Energy Information Administration assembled a report with the next projections;

Even beneath a state of affairs with excessive oil costs, electrical autos will account for less than a third of car and truck sales through 2050.

It is nonetheless early but when we have a look at how the EV inventory levels have exploded due to lack of gross sales, their prophecy might come to go. Extra importantly, it doesn’t matter what your stance is on the “carbon warnings”, no business or economic system can survive when a product is produced at a loss to realize a outcome that to this present day can’t be decided.

This presentation is concerning the impression of spending – Spending that’s uncontrolled and can have an effect on international economies. Tossing billions into these agendas will proceed to have a SEVERE impression on any debt-ridden economic system. Between the EV mistake and the current labor package deal that provides extra prices to every automobile, the U.S. auto business is BROKEN. From an funding perspective, your entire group stays in a BEAR market pattern. There isn’t a purpose to advise being concerned in any of those shares. The one factor that might be worse; this failed experiment would require a authorities bailout to cease the bleeding from the losses which can be being racked up right now.

This is not about denying local weather change or the necessity for clear power. It’s all about actuality. Coverage selections and extreme spending have penalties. Right here within the US free market forces are actually taking up and slowing down a transition that’s failing, and which will lastly decelerate the wasteful spending with this experiment. The issue although is not a failed plan it’s a failed plan that’s going to price EVERYONE. As time goes by increasingly more FACTS are revealed, and the FACTS are telling us EVs are NOT cost effective.

Given their price, EVs are nothing greater than socialism for the wealthy: a switch of prices from larger net-worth people to middle- and lower-income taxpayers. WHY? Each taxpayer will bear the price of the subsidies to supply the automobile after which proceed to pay to subsidize the EV proprietor for his or her charging prices. Taxpayers that may least afford it. When these spending sprees impression economies negatively, change is so as. Till we see that change going down the harm will proceed.

Nothing is solid in stone, and that applies to this evaluate as nicely. Many issues can come alongside to dramatically change the state of affairs. Nonetheless, the amount of cash that has been flushed away is staggering. Moreover, “wishing” and “hoping” that issues will change or (worse but) wanting spending to proceed on the “initiatives”, is just not a method that debt-ridden economies can embrace right now. It’s now being proven that this transition merely provides to debt throughout the board, from the federal authorities to the companies concerned, to EVERY shopper.

The MACRO state of affairs will dictate market outcomes over the long run. I am open to all outcomes with possibilities assigned to every. Within the meantime, I will take care of what’s instantly in entrance of me and proceed accordingly.

The Week On Wall Avenue

The prior week’s 5.82% acquire for the S&P 500 was the very best week of the 12 months and the very best week for the foremost US benchmark because the week ending November eleventh from final 12 months. You could not fault an investor for pondering that it could be a great time to loosen up and sit issues out for a bit till issues cool off and among the uncertainty recedes.

That’s precisely what occurred as buying and selling started on Monday, however on the finish of the day each the S&P and NASDAQ posted modest positive aspects. The mini melt-up continued because the successful streaks had been prolonged as soon as once more. Tuesday’s motion noticed the S&P make it seven straight days of positive aspects whereas the NASDAQ prolonged its positive aspects to eight in a row, its longest every day win streak since November ’21.

Resilience was the phrase on Wednesday, at the very least for the S&P and NASDAQ. Modest positive aspects prolonged their streaks by one other day. The longest-winning skein in two years. Nonetheless, this bifurcated market scene noticed the DJIA pull again and the Russell lengthen its dropping streak to three days. The small caps bumped into resistance and within the dropping stretch have already given again half of their positive aspects throughout final week’s rally.

It was a turnaround Thursday as the entire successful streaks got here to an finish. On a closing foundation, the S&P racked up a 6.4% acquire through the rally. The curler coaster buying and selling within the small caps continued because the (IWM) rally (7.4%) ended, after which proceeded to provide again 4% till the index stabilized on Friday.

The entire indices aside from the Russell 2000 (IWM) closed the week with positive aspects on the again of a robust rally in Know-how and on Friday.

THE ECONOMY

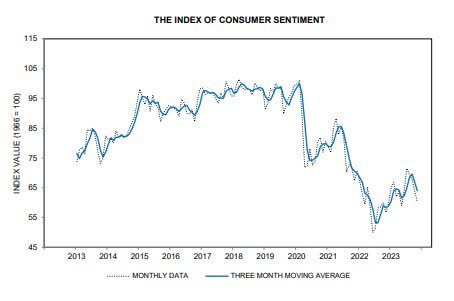

Michigan Consumer sentiment continues to stay nicely under pre-pandemic ranges rolling in at 60.4 down from final month’s studying of 63.8. Given the entire points within the economic system right here within the US, none of it is a shock.

Michigan Sentiment (www.sca.isr.umich.edu/charts.html)

Merely acknowledged there’s nothing constructive about any of the patron sentiment information factors, regardless of analysts attempting to place lipstick on these charts.

THE FED

In ready remarks on the Worldwide Financial Fund, Federal Reserve Chair Jerome Powell acknowledged;

“U.S. inflation has come down over the previous 12 months however stays nicely above our 2 p.c goal.1 My colleagues and I are gratified by this progress however count on that the method of getting inflation sustainably right down to 2 p.c has a protracted strategy to go. The labor market stays tight, though enhancements in labor provide and a gradual easing in demand proceed to maneuver it into higher stability. Gross home product progress within the third quarter was fairly sturdy, however, like most forecasters, we count on progress to average in coming quarters. In fact, that is still to be seen, and we’re attentive to the chance that stronger progress might undermine additional progress in restoring stability to the labor market and in bringing inflation down, which might warrant a response from financial coverage.

The Federal Open Market Committee is dedicated to attaining a stance of financial coverage that’s sufficiently restrictive to convey inflation right down to 2 p.c over time; we aren’t assured that we’ve got achieved such a stance. We all know that ongoing progress towards our 2 p.c purpose is just not assured: Inflation has given us just a few head fakes. If it turns into applicable to tighten coverage additional, we won’t hesitate to take action. We’ll proceed to maneuver rigorously, nevertheless, permitting us to handle each the chance of being misled by just a few good months of information, and the chance of overtightening. We’re making selections assembly by assembly, based mostly on the totality of the incoming information and their implications for the outlook for financial exercise and inflation, in addition to the stability of dangers, figuring out the extent of extra coverage firming which may be applicable to return inflation to 2 p.c over time. We’ll preserve at it till the job is completed.”

After an eight-day rally, the inventory market did not want a lot to reverse the mini uptrend and take some income but when buyers bought on these remarks they do not perceive what’s going on. There was nothing new in that assertion.

The World Financial system

EUROZONE

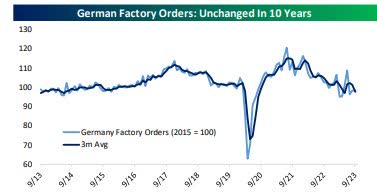

Whereas order volumes from German producers beat estimates and had been little modified, the very fact stays they’re presently trending across the similar stage they had been at in 2016.

German Manufacturing unit Orders (www.bespokepremium.com)

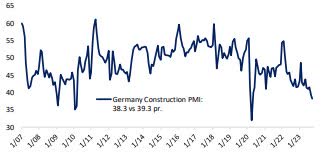

Germany: Development exercise as measured by the S&P World/Markit Development PMI in Germany confirmed the weakest exercise ranges since 2010 (apart from the COVID shock) this month.

Germany Const. PMI (www.bespokepremium.com)

However development volumes have outperformed manufacturing and utility output, which reveals simply how weak the German economic system is correct now.

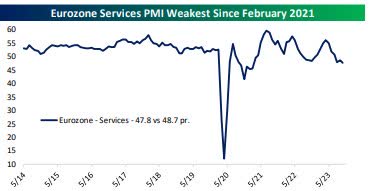

As for the Euro Companies sector, S&P World/Markit information on Companies PMI confirmed the weakest studying because the winter of 2021.

Euro Companies PMI (www.bespokepremium.com)

EARNINGS

Every week I replace my listing of corporations that report “Triple Play” EPS experiences the place they beat on each the highest and backside strains and lift ahead steerage. These corporations are telling buyers that their enterprise is nice.

Apart from CORE holdings, I’ve restricted ALL of my publicity to those and ONLY these corporations.

The “selective” BULL market continues beneath the floor

The Each day chart of the S&P 500 (SPY)

This week turned out to be a consolidation of the prior week’s positive aspects. On Friday, the S&P 500 posted its highest shut since September twenty first.

S&P 500 (www.tc2000.com)

The index has taken step one in breaking the downtrend that has been in place because the July highs. With nearly each analyst and establishment singing the identical This autumn rally tune, this has all of the earmarks of a self-fulfilling prophecy.

INVESTMENT BACKDROP

It positive regarded like all was nicely in July, however this final pullback is a delicate reminder of the uncertainty that exists. After shares had sunk over the previous two weeks with virtually no signal of any actual shopping for, the precise reverse was seen final week when there have been virtually no pullbacks of word, as the foremost indices blew by way of any resistance standing in the best way. The sharp “V” formed restoration represents the automated buying and selling setting that exists. Computerized programmed buying and selling can exacerbate a fundamental transfer in both path and normally steps up when indices are buying and selling in and round short-term inflection factors. So it isn’t all that shocking that we have seen fast, giant swings just lately. The back-and-forth whipsaw nature of the market over the previous few weeks has been troublesome and irritating. It is one thing that buyers must be taught to reside with.

The dearth of a robust Major pattern leaves market individuals with out numerous conviction. This short-term scene will both play out as an oversold bounce or the beginning of the This autumn rally. In actuality, nothing has been resolved simply but. It looks as if we’ve got been on this place for a lot of the 12 months. It is a backdrop that could be very troublesome to get used to and one that’s onerous to generate income. Sadly, additionally it is “typical” throughout BEAR markets.

Contemplating the consensus view is that 2023 was the beginning of a brand new BULL market, that could be a minority stance.

FINAL THOUGHTS

The opening quotes describe what has been mentioned right here just lately. Understanding after which making use of Mr. Marks’s assertion requires an investor to separate the short-term market setup from the longer-term MACRO view. That’s extra vital than ever within the setting we discover ourselves in This autumn. In fact that applies to the extra “energetic” investor that trades round their CORE holdings making the most of “alternatives” as they’re introduced.

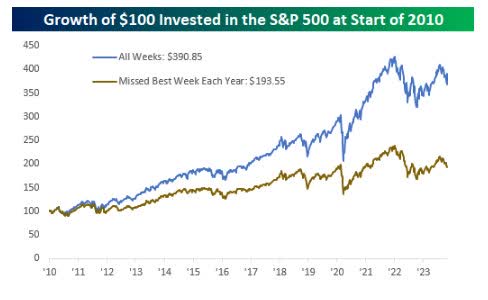

Nearly all of true LONG-TERM buyers have to comprehend that “TIMING” the market is all the time troublesome to tug off and that’s the reason they need to all the time have the majority of their investments IN the market always. The chart under reveals the expansion of $100 invested within the S&P 500 initially of 2010 (dividends not included) on each a buy-and-hold technique in addition to if an investor missed out on the very best week of every calendar 12 months. The hole is big. Whereas the unique $100 is now price $390.85, had you missed out on the very best week of every 12 months, you’ll have lower than half of that quantity at $193.55

Timing (www.bespokepremium.com)

In different phrases, nicely over half of the positive aspects since 2010 will be attributed to these 14 weeks. Admittedly, you might make the counterargument that a lot of the losses throughout this era have additionally occurred in a small variety of weeks, however attempting to efficiently anticipate when these good weeks or down weeks will happen is IMPOSSIBLE.

That’s the benefit the true long-termers have over the inhabitants of buyers that will not have TIME on their facet. That makes for a really numerous algorithm and steerage, and that’s the reason detailed recommendation is reserved for members of my service.

THANKS to the entire readers that contribute to this discussion board to make these articles a greater expertise for everybody.

These FREE articles assist assist the SA platform. They supply info that speaks to Each the MACRO and the short-term state of affairs. With a various viewers, there isn’t a approach for any creator to get particular until they’re merely highlighting ONE inventory, ETF, and so forth.

The knowledge offered right here is verified by SA and the vast majority of the time, third-party hyperlinks are offered as assist. If anybody can level out a remark in any article I put forth and show that it’s factually INCORRECT I’ll REMOVE it.

Better of Luck to Everybody!