- Bitcoin faces stress amidst Mt. Gox repayments, with consultants like Alex Thorn highlighting potential impacts on Bitcoin Money.

- Contrasting compensation methods by Mt. Gox, Gemini, and FTX raised questions on market stability and investor sentiment.

The yr 2024 was thought of one of many luckiest years for Bitcoin [BTC], particularly with the Bitcoin ETF launch, reaching a brand new all-time excessive of $73K, and the anticipated Bitcoin halving occasion.

Nonetheless, because the crypto neighborhood is getting ready for the complete and ultimate approval of the spot Ethereum [ETH] ETF in July, BTC appears to have taken a again seat.

In reality, on the time of writing, whereas ETH surged by 1.58% previously 24 hours, BTC was flashing pink candlesticks on its each day charts buying and selling at $61K.

What’s behind Bitcoin’s downfall?

Whereas many are blaming the Mt.Gox compensation plan as the rationale behind Bitcoin’s decline, Alex Thorn, Head of Firmwide Analysis at Galaxy Digital, provided a special perspective.

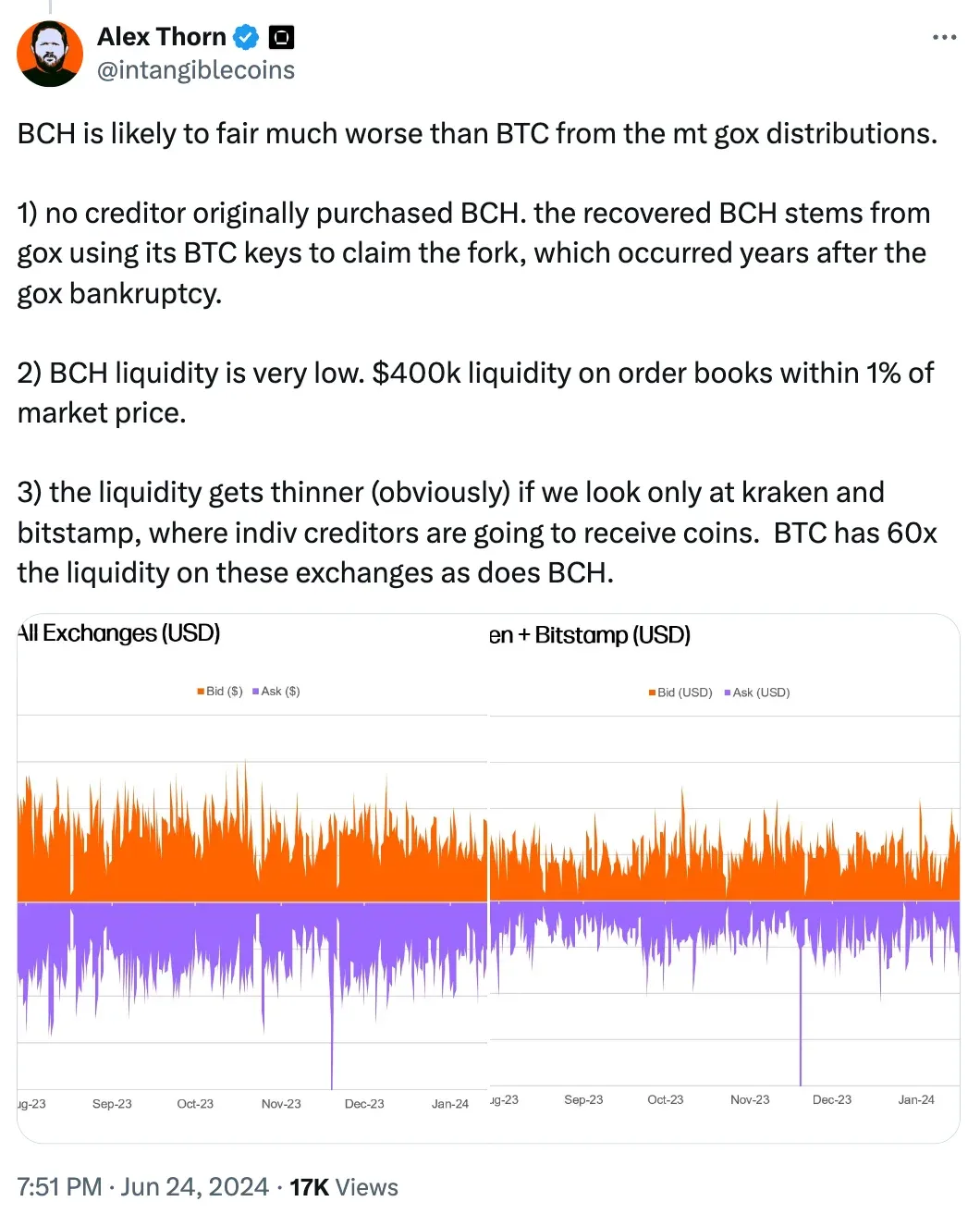

Per Thorn, Bitcoin Money [BCH] was affected extra. Increasing on his viewpoint, he took to X (previously Twitter) and stated,

Supply: Alex Thorn/X

Right here, Thorn is referring to an enormous hack that Mt. Gox suffered in 2014, ensuing within the lack of 740,000 BTC (value $15 billion immediately).

The repayments, beginning in July 2024, might be made in Bitcoin and BCH. This might enhance promoting stress on these cryptocurrencies, as collectors will obtain and probably unload their newly acquired belongings.

The doable resolution

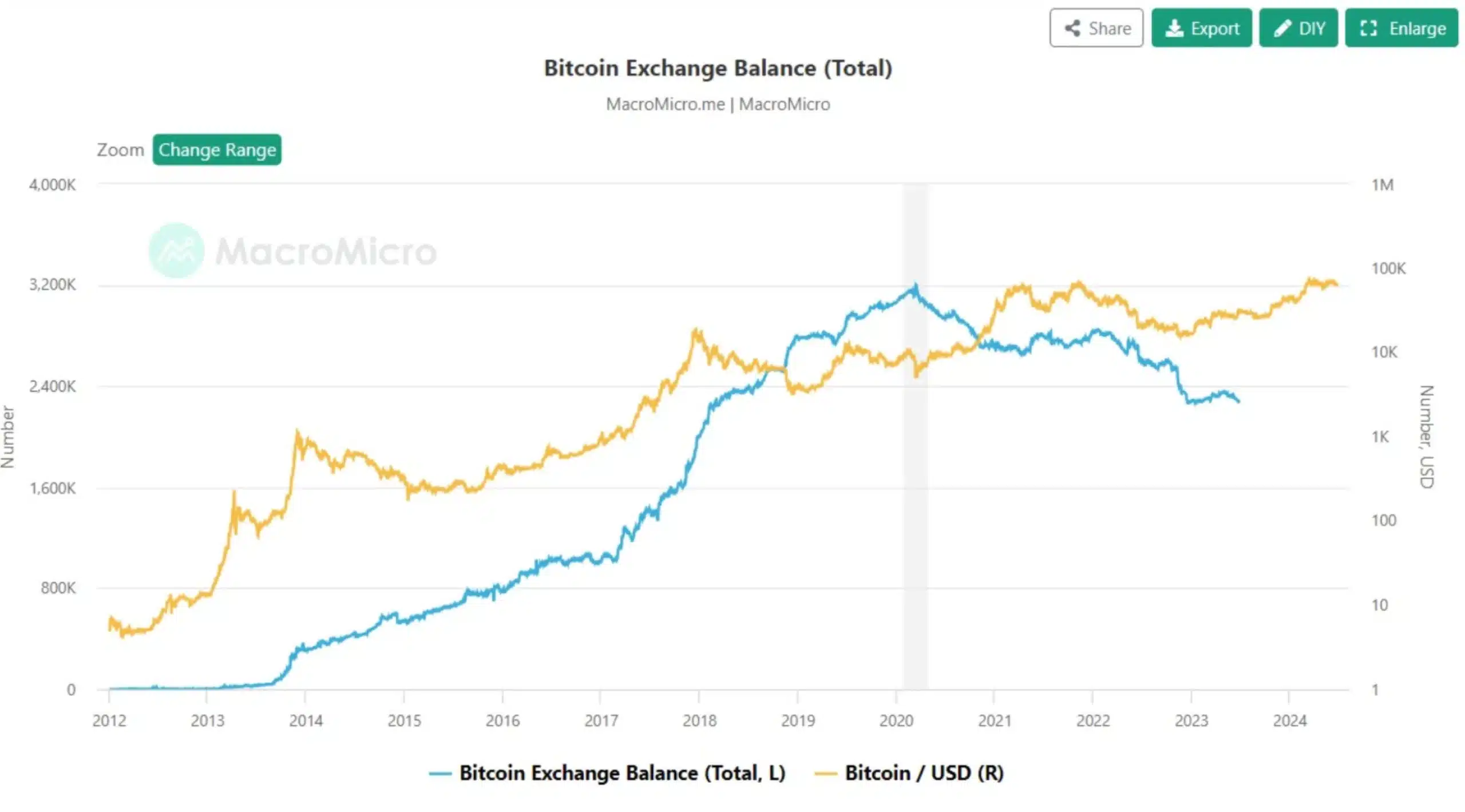

To keep watch over this case, many execs advised counting on Bitcoin alternate balances as a dependable indicator of Bitcoin’s worth power.

Nonetheless, in a current submit on X, standard commentator Matthew Hyland criticized the importance of reducing alternate provide by calling it “overrated.” He elaborated,

“The availability facet IMO is overrated. BTC on exchanges dropped throughout your complete bear market but, BTC worth continued down with it. Long run it issues however inside multi-years, it has proven it doesn’t.”

Supply: Matthew Hyland/X

Effectively, it’s essential to notice that it’s not the primary time Mt. Gox has performed such a factor.

Supply: Pat/X

Mt.Gox, not the one one!

Apart from Mt. Gox, Gemini, too, introduced its plans to reimburse customers impacted by their discontinued Gemini Earn program.

The founders took to X (previously Twitter) and highlighted that on the twenty ninth of Could, Earn customers acquired $2.18 billion in digital belongings.

Furthermore, FTX, a crypto-exchange that underwent chapter proceedings final yr, additionally unveiled its plan to settle its money owed.

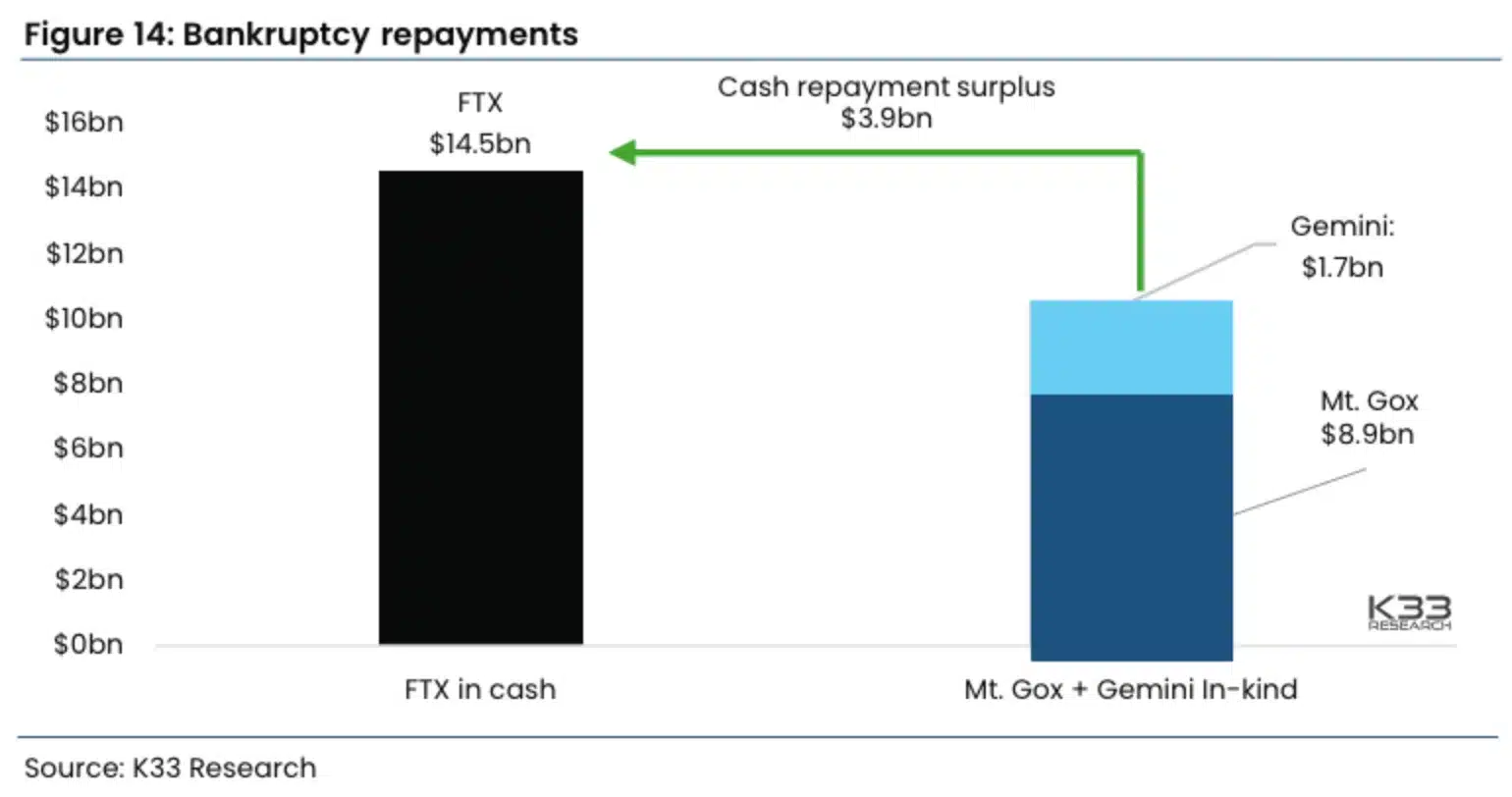

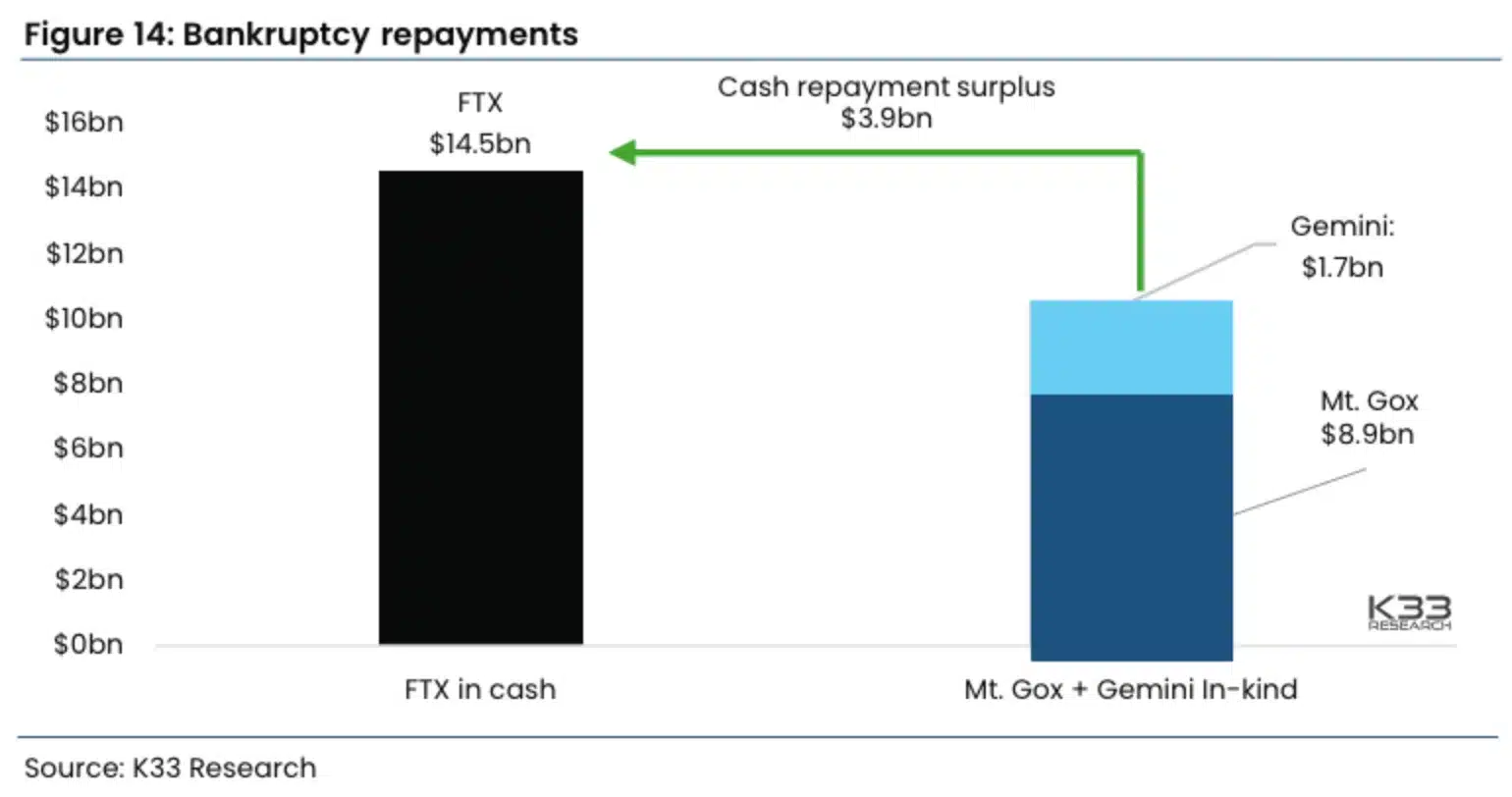

Nonetheless, in line with analysts from K33 Research, the affect of those repayments on market sentiment might differ from different creditor settlements.

In contrast to entities like Mt. Gox and Gemini, which plan to repay collectors with cryptocurrencies, FTX intends to execute cash-based repayments.

Supply: K33 Analysis

This divergence in compensation strategies might affect investor views and market stability in numerous methods.