- Mt. Gox’s latest switch has left it with a $3B BTC stability.

- BTC continued its sell-off forward of the U.S. July jobs report set for the 2nd of August.

The latest Mt. Gox switch of $3.1 billion Bitcoin [BTC] to BitGo has lowered the defunct change’s stability much more, signaling that its provide overhang might finish quickly.

In line with Arkham data, the BitGo switch, made on the thirtieth of July, has introduced the Trustee property’s stability to $3.06 billion.

“Final night time Mt. Gox addresses moved 33.96K BTC ($2.25B) to addresses we consider are more than likely BitGo:..After these transfers, Mt. Gox now holds 46.16K BTC ($3.06B), together with the brand new Mt. Gox handle.”

Mt. Gox provide stress is nearly over

The above appreciable discount within the trustee property holdings meant that, like German authorities stress, the Mt Gox perceived risk would finish quickly.

Curiously, the latest distribution from the defunct change didn’t exert stress in the marketplace as beforehand assumed.

In line with Glassnode data, there weren’t notable sell-side results amongst main exchanges, Kraken and Bitstamp, that the trustee property used for repayments.

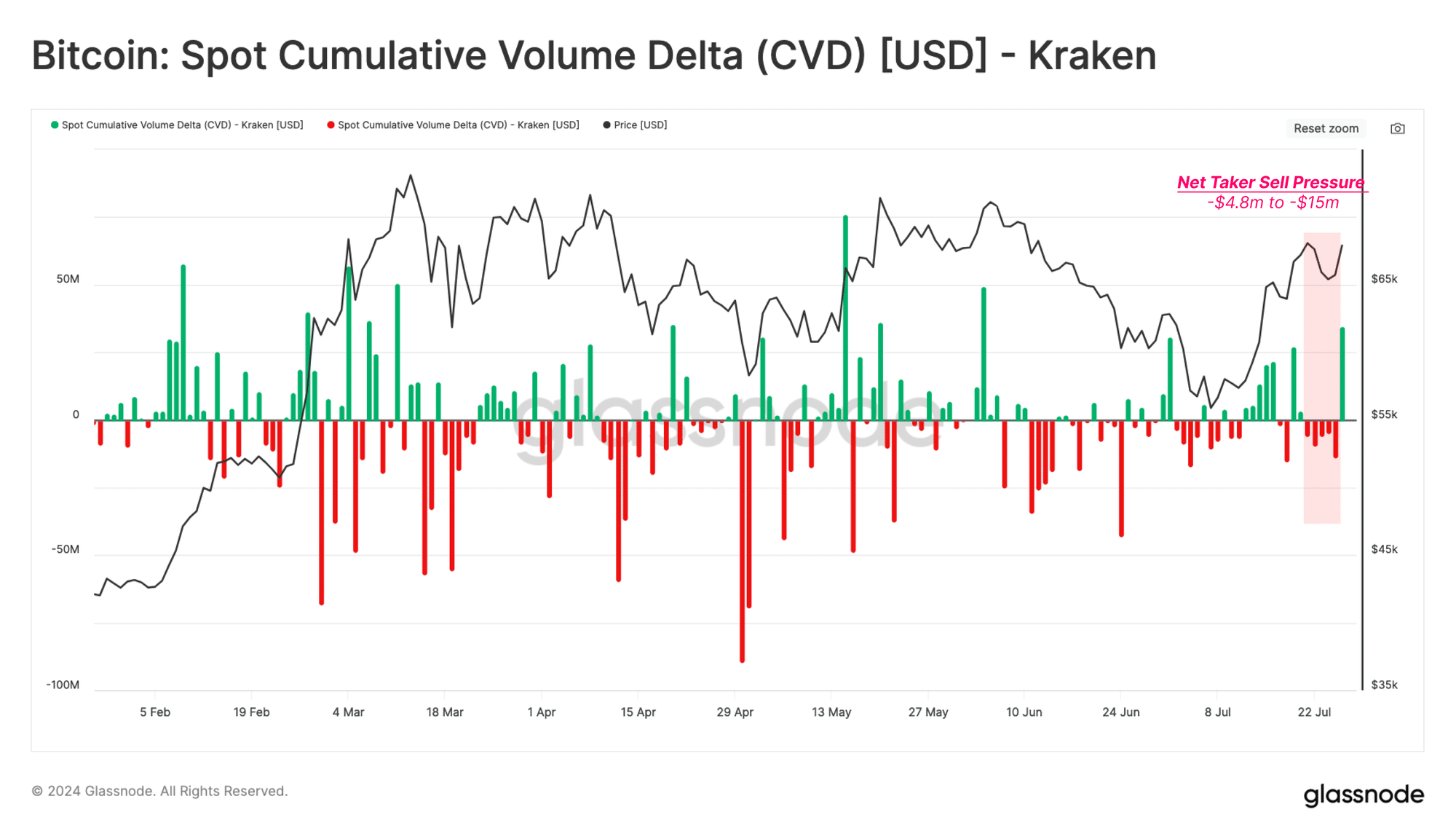

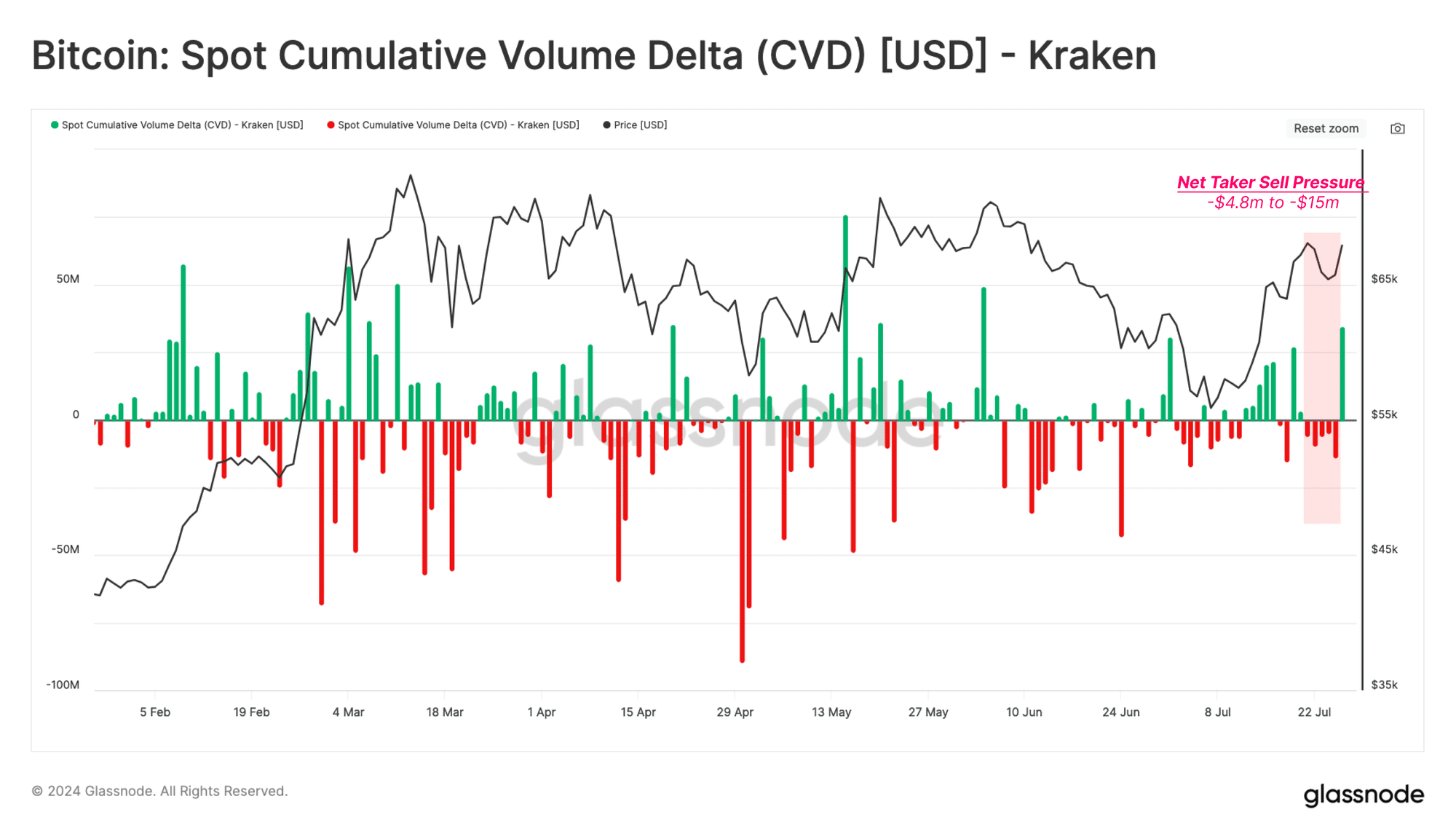

In truth, the Spot Cumulative Quantity Delta (CVD) metric on Kraken surged marginally after the distribution, denoting that there wasn’t any promoting stress after the change obtained the reimbursement.

CVD tracks the web promote or purchase quantity on the change, with a constructive worth indicating extra purchase quantity on market orders aspect.

Supply: Glassnode

Glassnode established an identical state of affairs on Bitstamp. Therefore, the reimbursement didn’t drag the market just like the German authorities’s sell-off. In brief, the remaining $3 billion BTC could possibly be moved with out affecting the market.

Nevertheless, the important thing promote stress in the mean time was the U.S. authorities. It at present has about $13 billion BTC after shifting $2 billion BTC final week and spooking the market.

Since June, the German and US sell-off fears have provided bears extra edge out there.

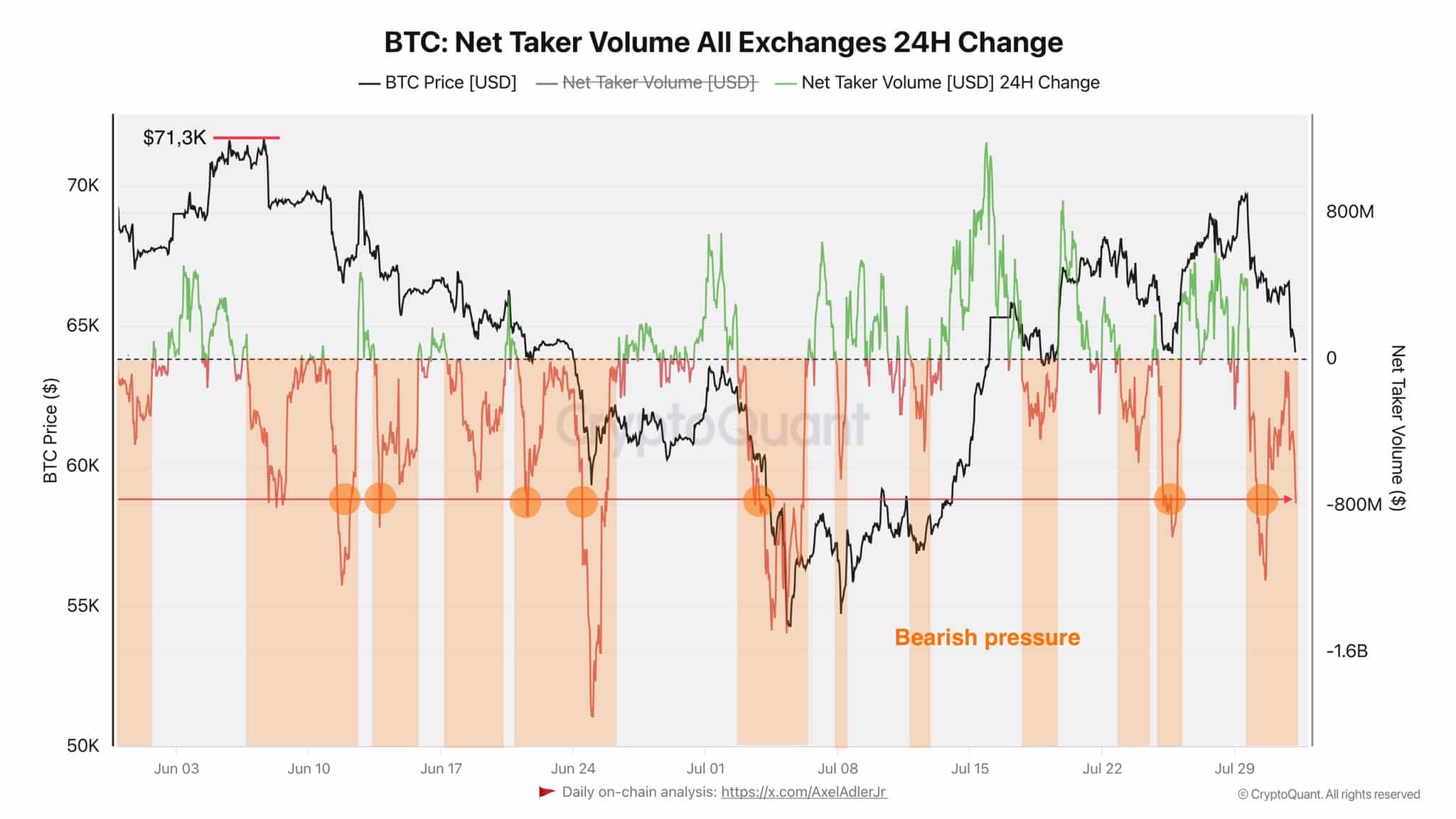

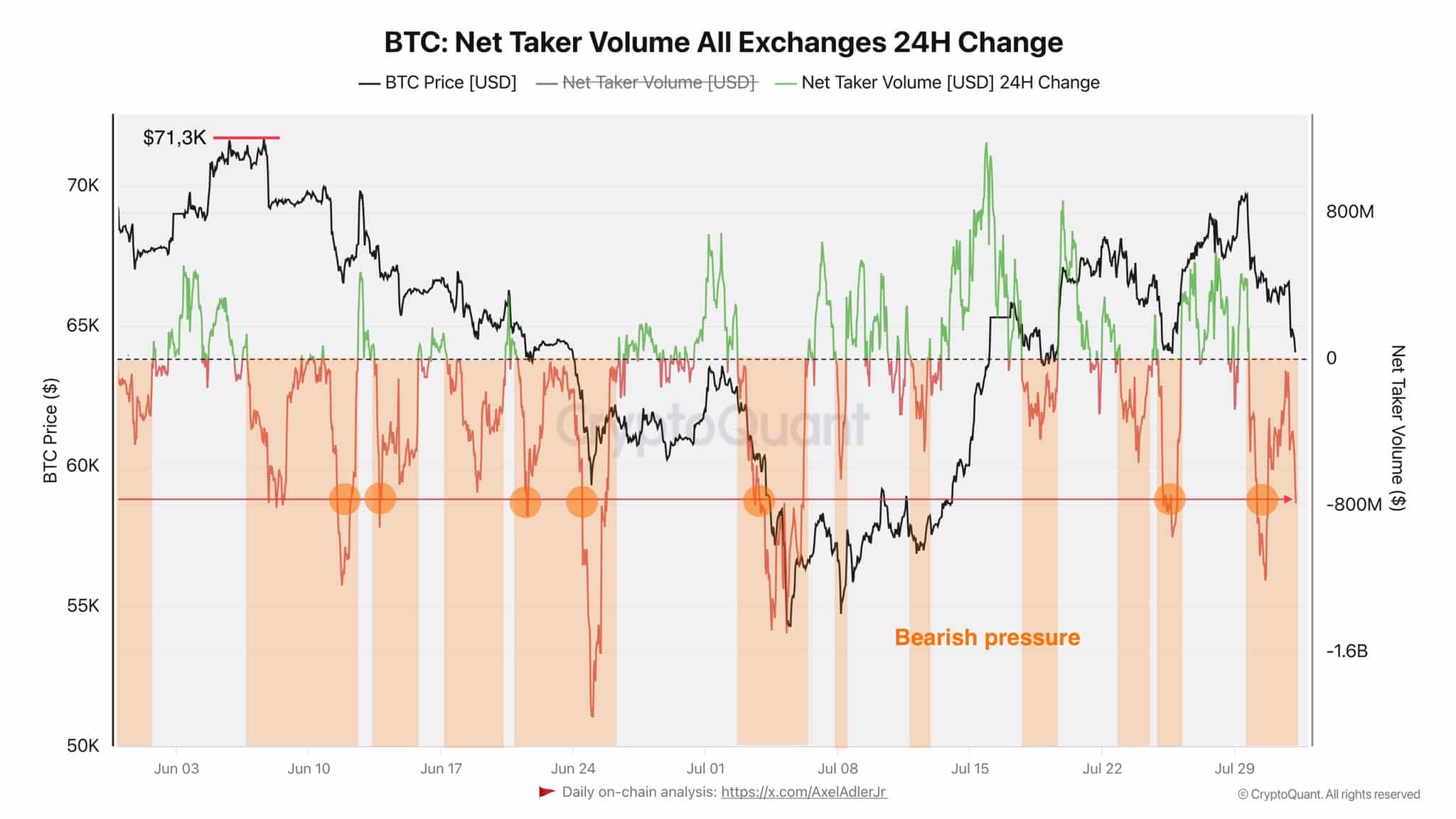

In line with CryptoQuant analyst Axel Adler, the promoting stress has emboldened bears all through the summer time, as proven by the Web Taker Quantity.

“It should be acknowledged that the bears’ stress because the starting of summer time has been spectacular. Till the metric turns into larger than zero, the bulls should fear.”

Supply: CryptoQuant

The unfavourable Web Taker Quantity meant the market had been predominantly promoting, as purchase volumes outweighed the purchase aspect.

As of press time, BTC had hit $63.0k and threatened to weaken additional forward of the U.S. July Jobs reviews, that are set to be launched on the 2nd of August.

It stays to be seen whether or not the roles report will ease the accelerated sell-off regardless of the dovish FOMC assembly.