Kelly Liu/iStock through Getty Photos

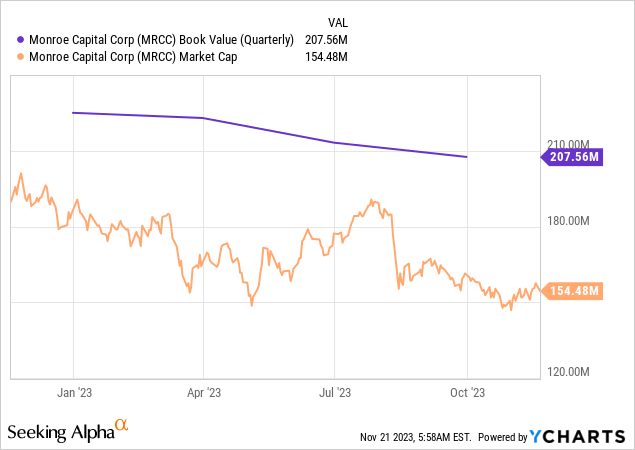

There are dozens of publicly traded enterprise growth corporations providing buyers compelling yields and Monroe Capital (NASDAQ:MRCC) is not any totally different. Whether or not or to not chase the yield relies on a number of elements together with the web asset worth, credit score underwriting high quality, and the outlook for funding revenue progress towards broader concerns for the route of the US economic system over the following calendar 12 months 2024 and past. I final lined MRCC in the summertime stating that the quarterly distributions have been secure however that continued NAV headwinds prevented the BDC from being a purchase. Following the NAV is vital to understanding why a BDC trades at a premium or low cost with MRCC’s fiscal 2023 third quarter NAV coming in at $207.6 million, round $9.58 per share.

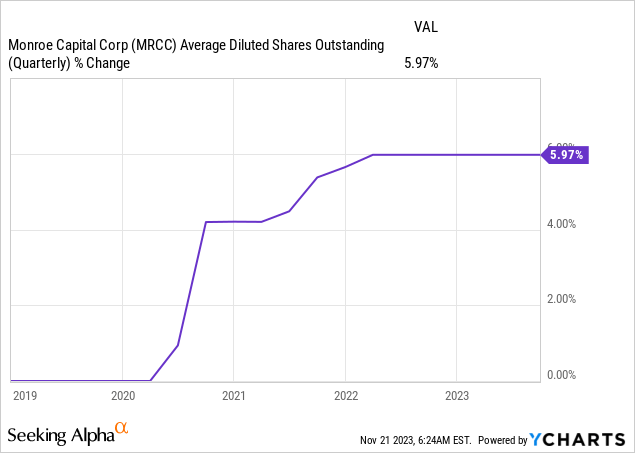

BRCC at present trades for $7.08 per share, a 26% low cost to NAV. This low cost has been persistent year-to-date, placing MRCC at odds with a broader macro setting the place a Fed funds price at 5.25% to five.50% has pushed vital NAV features for credit score portfolios out-earning their dividends. BRCC’s 8% NAV decline per share over the past 12 months has not been pushed by an growth of its share rely because the BDC has primarily stored this frozen at 21.7 million for the final 2 years and with progress of simply 6% over the past half-decade. The core headwinds come from an especially tight protection ratio, loans on non-accrual standing, and rising payment-in-kind revenue. The BDC final paid out a $0.25 per share quarterly dividend, sequentially unchanged and for a 14% annualized dividend yield.

Cost-In-Sort Revenue, Dividend Protection, And Flagging Development

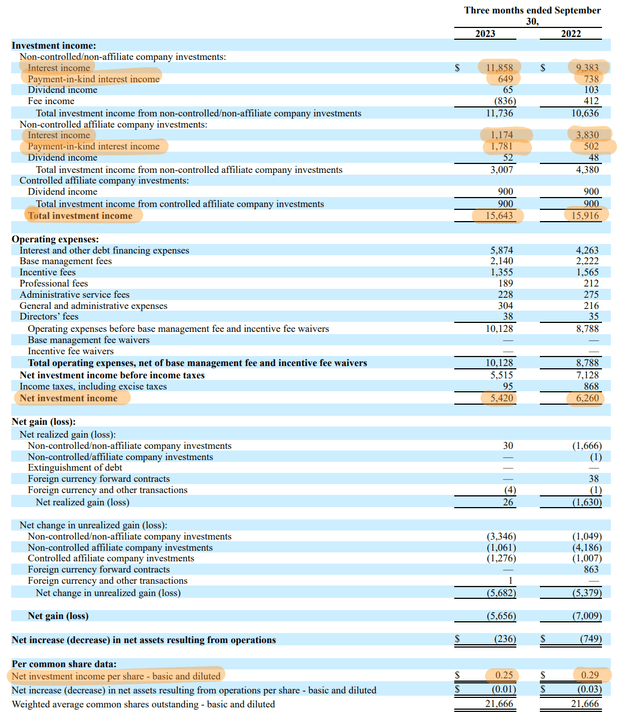

MRCC recorded a complete funding revenue of $15.64 million, down 1.8% over its year-ago comp and a miss by $540,000 on consensus estimates. Web funding revenue of $5.4 million, round $0.25 per share dipped by 4 cents per share from its year-ago comp. It means the BDC is at present paying out 100% of its dividend to frequent shareholders. The dip in NII got here with no new investments being positioned on non-accrual standing throughout the quarter. MRCC at present has 4 investments valued at $6.2 million marked as non-accrual; Arcstor Midco, Forman Mills, Training Company of America, and NECB Collections. This was round 1.2% of the BDC’s portfolio honest market worth.

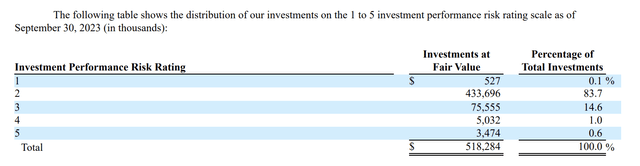

Monroe Capital Fiscal 2023 Third Quarter Kind 10-Q

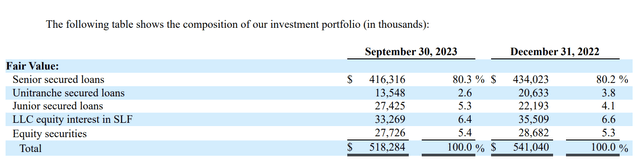

Cost-in-kind revenue is spiking and at $2.4 million for the third quarter accounted for 15.5% of complete funding revenue. This was up from 7.8% within the year-ago comp. Rising PIK revenue infers the specter of a better portion of loans being positioned on non-accrual standing in future quarters. Critically, MRCC recording a decline in funding revenue while working in extraordinarily optimum macroeconomic circumstances for BDCs highlights why the low cost to NAV has stayed so fixed. The BDC’s 99 firm funding portfolio had a good worth of $518 million on the finish of the third quarter, down from $541 million on the finish of December 2022.

Monroe Capital Fiscal 2023 Third Quarter Kind 10-Q

Critically, MRCC solely made a $2 million funding in a single new portfolio firm throughout the third quarter. There was additionally $10.7 million of delayed draw fundings and add-ons to current portfolio corporations towards $6.7 million in repayments. The BDC’s progress is slowing down on the broad discount of its credit score portfolio, a deceleration that might change into extra acute as soon as rates of interest begin to peel again within the second half of subsequent 12 months.

Credit score Underwriting, Leverage, And 2024 Outlook

MRCC has positioned 83.7% of its portfolio at a grade 2 threat score, the second lowest on its threat scale. This describes investments exhibiting an appropriate degree of threat that’s much like the chance on the time of origination with the issuer additionally usually performing as anticipated. Therefore, round 16.2% of the portfolio corporations with a score of grade 3 to grade 5 have seen a deterioration versus origination. This was a sequential enchancment from 17.6% within the second quarter.

Monroe Capital Fiscal 2023 Third Quarter Kind 10-Q

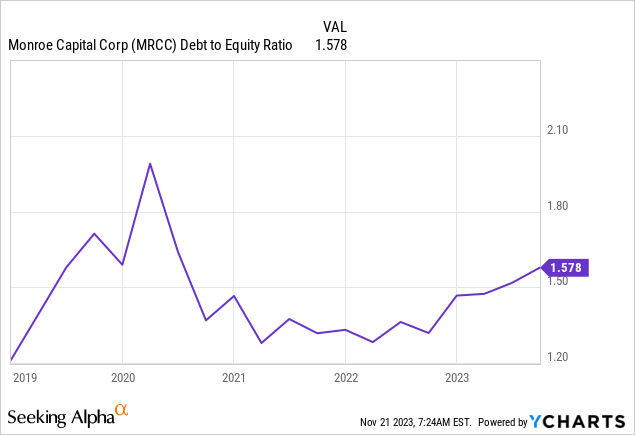

It is onerous to advocate the ticker as a purchase on the again of damaging funding revenue progress, NAV weak point, and a decent dividend protection ratio. Credit score underwriting seems to be secure however the BDC will likely be extra uncovered to the potential downward drift impression on yield as soon as the Fed funds price begins being minimize. It will come because the BDC’s debt-to-equity ratio is rising and at 1.6x on the finish of the third quarter was amongst the very best debt ratios within the BDC area.

Future complete returns are probably set to be damaging because the lengthy elusive dovish Fed pivot is realized. The Fed’s 25 foundation factors hike in July is now more likely to be the ultimate of the present tightening cycle with 30-Day Fed Funds futures pricing in a 100% chance charges stay unchanged on the upcoming December and January Federal Open Market Committee conferences. In mild of the extra dovish macroeconomic setting and the extraordinarily tight dividend protection, MRCC is being rated as a promote.