Sundry Pictures

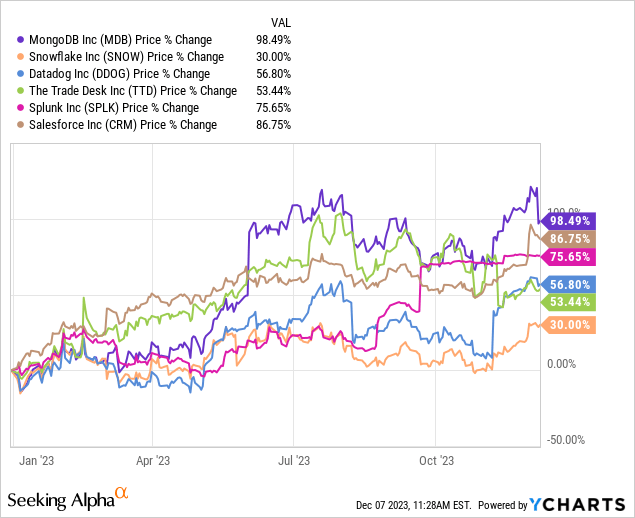

MongoDB (NASDAQ:MDB), an organization that runs a database below the identical identify, turned one of many extra thrilling cloud investments in 2023 as soon as buyers labored out that it may very well be a major beneficiary of firms’ growing improvement of generative Synthetic Intelligence (“AI”) functions, which require a safe, scalable database able to rapidly accessing unstructured information akin to phrases, photographs, movies, emails, sounds, and social media posts. The inventory is up almost 100% year-to-date, slam dunking over different well-liked cloud names like Salesforce (CRM), Splunk (SPLK), Datadog (DDOG), The Commerce Desk (TTD), and Snowflake (SNOW).

The corporate lately reported third-quarter earnings, which confirmed glorious income progress and better-than-expected profitability that beat analysts’ prime and bottom-line estimates. Nonetheless, the inventory dropped 11% the day after buyers perused the report. MongoDB’s present valuation assumes huge progress, and earlier than the corporate reported, the inventory was “priced for perfection.” A number of metrics in the report made some buyers query that valuation. Therefore, the explanation for the drop.

The market nonetheless expects scintillating progress over the following 5 to 10 years at its present valuation. But, buyers should be cautious about extremely valued, unprofitable early-stage firms like MongoDB as a result of the international economic system just isn’t but out of the woods. Inflation, wars, and persistently high-interest charges proceed to threaten international progress. This text will talk about MongoDB’s long-term progress drivers, excessive valuation, issues, and why buyers already proudly owning the inventory ought to proceed to carry it.

MongoDB’s long-term progress drivers

Investor Session at MongoDB.native NYC 2023 Presentation

Even earlier than generative AI appeared in late 2022, the necessity for firms to distinguish and develop a aggressive benefit by creating proprietary software program functions was already on the rise, which drove MongoDB’s progress. Anybody who has listened to sufficient of the corporate’s earnings calls and investor conferences has seemingly heard administration talk about this subject. At an Investor Convention held in New York Metropolis, the Chief Working Officer and Chief Monetary Officer (“CFO”) of MongoDB, Michael Gordon mentioned:

As I discussed, the kind of important side of aggressive benefit is folks need to innovate extra rapidly. You heard Dev talked about that within the keynote, that is one of many key drivers. And so, an increasing number of [software] functions shall be constructed and that can proceed to be a tailwind for us in our enterprise. Right here, you’ll be able to see the estimate from Microsoft, that extra functions are constructed within the subsequent 5 years than the final 40 years mixed simply to place one context or body of reference.

Supply: Investor Session at MongoDB.native NYC 2023

A number of many years in the past, on the planet of firms shopping for off-the-shelf software program to fulfill their wants, the C-suite inside massive tech giants guided a lot of the choices regarding software improvement, as solely a small pool of people and corporations held the technical experience to supply software program. One level of notice about MongoDB’s “Developer Energy” commentary on the above investor presentation is that builders gained that standing via the proliferation of cloud computing, the power to collaborate over lengthy distances, and the growing accessibility of improvement instruments and assets. Right this moment, armies of builders inside and out of doors massive enterprises have extra management over app improvement. Because the above investor slide factors out, builders right now are “the actual resolution makers in expertise,” the driving drive within the speedy enlargement of functions.

With the appearance of low-code/no-code platforms and AI-powered assistants, the day is quickly approaching when folks with out coding abilities can construct apps — a democratized software program improvement actuality. In such a world, MongoDB will profit considerably. Michael Gordon additionally mentioned on the New York investor session, “Along with builders and the necessity for all these functions to occur, there will be different technological developments, the place by an increasing number of functions shall be constructed to be a bit little bit of a democratization that can additional speed up the constructing of functions, all of which ought to profit us.” The corporate’s third-quarter earnings launch talked about tighter collaboration with cloud gamers like Amazon (AMZN) and Microsoft (MSFT). In particular, the discharge said:

MongoDB expanded its collaboration with cloud hyperscalers, together with a brand new integration between MongoDB Atlas and Amazon Bedrock, which makes it simpler for patrons to construct functions utilizing managed basis fashions with their proprietary information. As well as, MongoDB is now built-in with coding assistant instruments Amazon CodeWhisperer and Microsoft Copilot to assist streamline AI-powered improvement.

Supply: MongoDB Third Quarter FY 2024 Earnings Launch.

MongoDB Atlas is the corporate’s cloud-based database. Bedrock is an Amazon service builders can use to construct generative AI functions. Amazon CodeWhisperer helps builders write code, and Microsoft Copilot is an AI-powered assistant that assists customers with a number of merchandise throughout Microsoft’s cloud. As well as, the earnings launch briefly talked about a number of merchandise targeted on enhancing buyer’s talents to make use of generative AI, together with MongoDB Atlas Vector Search, which aids builders after they construct real-time generative AI functions, and MongoDB Atlas Search Nodes, that are devoted servers inside the Atlas platform particularly designed to deal with search inside workloads with as much as 60 % quicker question occasions (pace may be essential in generative AI functions). So, generative AI may drive MongoDB’s income progress potential considerably increased, one thing buyers found out earlier this yr — one cause they bid up the inventory to significantly increased valuations.

A superb earnings report on the floor

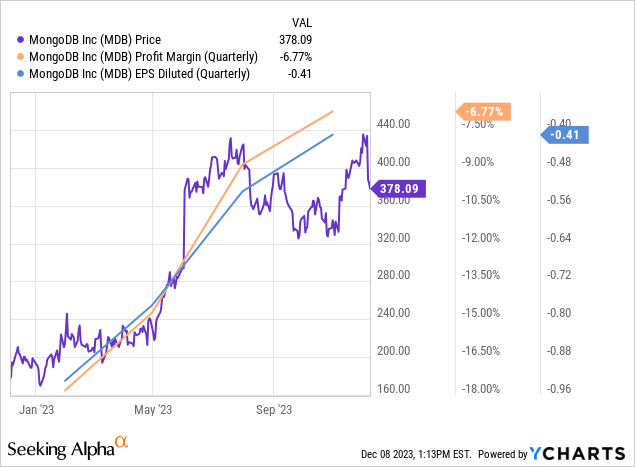

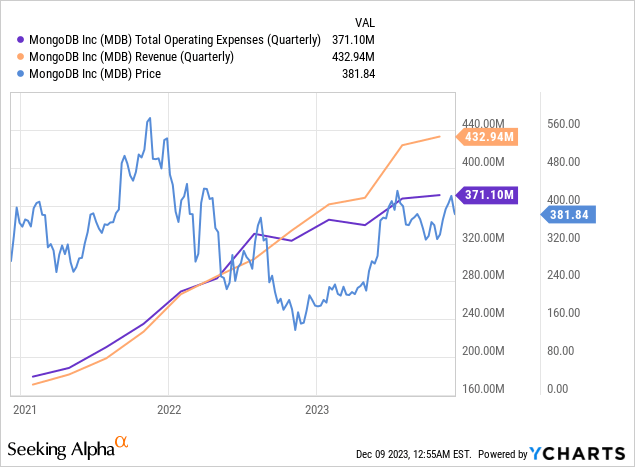

MongoDB turned in a superb efficiency on the highest and backside traces. Income rose 29.77% from the earlier yr’s comparable quarter to $432.9 million, 7.2% increased than consensus estimates. The corporate additionally recorded a GAAP (Usually Accepted Accounting Rules) web loss per share of $0.41, beating consensus analysts’ estimates by $0.62. The chart beneath exhibits a speedy enchancment in bottom-line profitability since final yr and the way the inventory worth has risen roughly in step with elevated profitability and income.

The corporate additionally raised its full-year fiscal 2024 steering for income, non-GAAP working earnings, and non-GAAP web earnings per share — a basic beat-and-raise quarter.

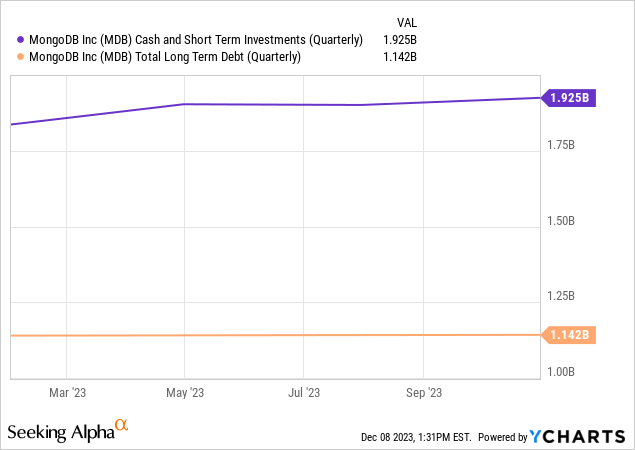

MongoDB ended the quarter with $1.9 billion in money and short-term investments on the stability sheet. It had $1.1 billion in long-term debt or almost $0.8 billion in web money. The corporate has a debt-to-equity ratio of 1.23, suggesting it has a comparatively low threat of defaulting on its money owed and has the monetary flexibility to pursue progress alternatives. It additionally has a quick ratio of 4.74, reflecting that the corporate has considerably extra extremely liquid property like money equivalents, marketable securities, and accounts receivable than present liabilities. So, buyers needn’t fear about MongoDB’s working into monetary difficulties within the quick time period.

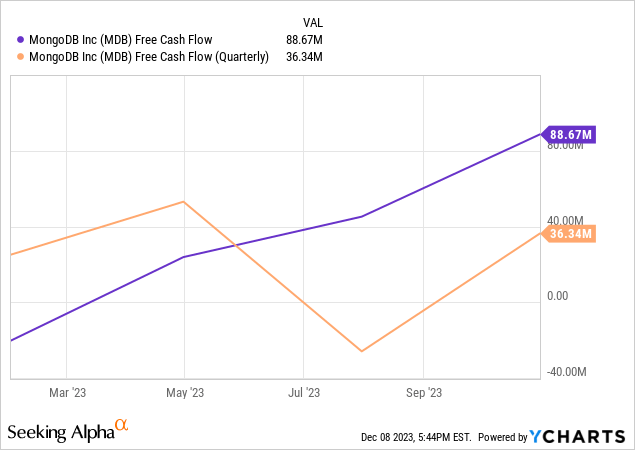

Final, the corporate produced almost $89 billion in trailing 12-month free money circulation (“FCF”). It appears to be like prefer it may finish fiscal 2024 with its first constructive FCF yr. Buyers have seemingly appeared favorably on the inventory this yr and pushed up its valuation as a result of it has achieved constructive FCF for the primary time, and the metric appears to be like like it’s trending increased.

Sometimes, a inventory goes up when an organization stories a beat-and-raise quarter. Nevertheless, MongoDB’s inventory sank. You may ask, “Why did the inventory drop?” So, let’s dig deeper into why some buyers learn the report and left dissatisfied.

Buyers apprehensive about its progress versus profitability

MongoDB’s third quarter calculated billings had been $385.5 million, 12.8% decrease than analysts’ estimates of $442.3 million. Billings is a method that analysts try to predict the longer term income progress of some firms. Billings are additionally listed as accounts receivable on the stability sheet and are very important to money circulation. Since MongoDB does not immediately disclose a billings metric, some analysts use calculated billings (income plus the quarter-over-quarter change in whole deferred income) metric instead. When the calculated billings quantity got here in below analysts’ estimates this quarter, it implied that MongoDB would develop slower sooner or later, which makes buyers nervous because the firm’s present valuation calls for superior income progress. Any top-line “disappointments” may make the inventory worth implode. So, whereas the third quarter’s income is above expectations, buyers are apprehensive about progress slowing in future quarters.

Nevertheless, calculated billings could be a flawed metric, and MongoDB administration does not condone folks utilizing it to foretell the corporate’s future income. CFO Michael Gordon mentioned on the corporate’s third-quarter earnings name:

As we have mentioned from the start. A few of these like calculated billings are deferred income metrics aren’t tremendous useful or do not present a ton of perception by way of how we run the enterprise. We have additionally talked about how during the last couple of years, one of many issues we have been making an attempt to do is cut back friction for the gross sales drive. A few of that features lowering the emphasis round upfront commitments. And in order that helps speed up lending new workloads and issues like that and that can circulation via or does circulation via the monetary statements as much less upfront deferred and issues like that. And so — however permits us to kind of synthetically cowl extra floor from a salesforce perspective.

Supply: MongoDB Third Quarter Fiscal Yr (“FY”) 2024 Earnings Name Transcript.

The above assertion, in plain English, says that the corporate has targeted on making it simpler for its gross sales groups to shut offers by requiring much less upfront dedication from prospects, leading to much less deferred income, which makes metrics like calculated billings look dangerous. Nevertheless, in the long run, this technique permits the salespeople to shut extra offers and onboard new shoppers quicker. Within the grand scheme, a decrease calculated billing may not be one thing buyers ought to fear about.

One other concern was that regardless of having an finish market administration described as “massive and rising,” it reported 46,400 prospects on the finish of the quarter, a rise of 1,400 sequentially, lacking analysts’ estimates of 46,870. Since buyer progress is one issue driving income progress for a subscription-based enterprise like MongoDB, a slowdown in buyer acquisition might imply the corporate can not maintain its present income progress trajectory.

The chart beneath exhibits that MongoDB’s working bills briefly outpaced its income in mid-2022, suggesting the corporate wanted to get extra bang for the bucks it was spending. As well as, buyers reacted poorly to the ensuing lack of profitability whereas the Federal Reserve raised rates of interest. The inventory dropped from over $360 in Could 2022 to beneath $140 by the top of November 2022.

MongoDB responded by drastically slowing hiring. In the course of the firm’s fourth quarter FY 2023 earnings name, Chief Govt Officer Dev Ittycheria mentioned:

We are going to considerably decelerate our general headcount progress in fiscal [2024]. We grew headcount by 30% [in FY 2023]. We count on this quantity to be within the single digits in FY 2024.

Supply: MongoDB fourth Quarter FY 2023 Earnings Name.

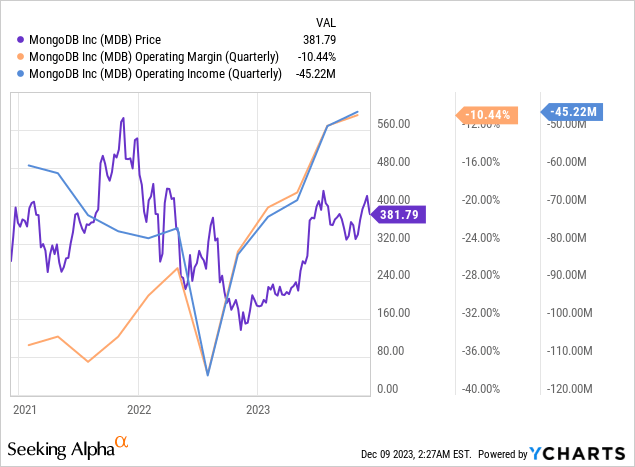

Dev Ittycheria additionally indicated that the corporate supposed to grow to be extra environment friendly throughout the board in Gross sales and Advertising (S&M), Analysis and Improvement (R&D), and Common and Administrative. After the corporate lowered its working bills in relation to income progress, the working margin quickly improved, and the working loss shrank, as seen within the chart beneath.

Buyers drove the inventory worth up, believing the corporate had operating leverage. Michael Gordon talked in regards to the substantial margin enchancment throughout the yr within the third quarter fiscal yr (“FY”) 2024 earnings name:

Our vital margin enchancment this yr is primarily pushed by our income outperformance and the truth that we did not improve our tempo of funding because the income outlook improved till comparatively late within the yr. In consequence, we achieved higher margin enlargement this yr than we expect is fascinating within the quick time period given the long-term market alternative forward of us.

Supply: Third Quarter FY 2024 Earnings Name Transcript

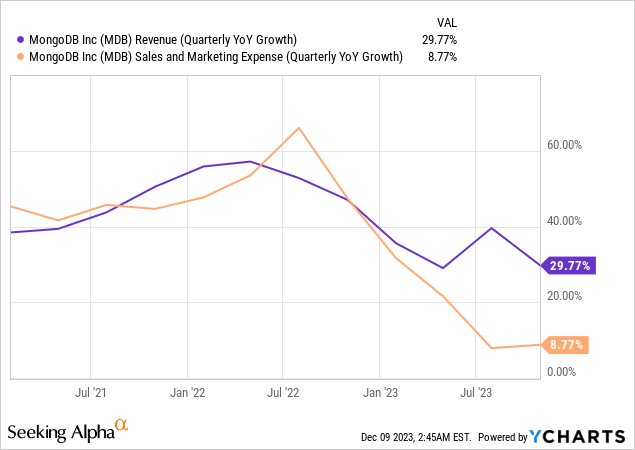

The language above means that in response to the cyclical cloud downturn and the poor macroeconomy, MongoDB administration might have in the reduction of on working bills far an excessive amount of in FY 2024, leading to sub-optimal buyer and income progress. The next chart exhibits how a lot the corporate slammed the brakes on S&M spending. The corporate seemingly wants to boost S&M spending at a a lot increased charge than 8.77% to attain acceptable buyer progress charges. The query is, how a lot ought to they improve S&M?

Individuals may quickly uncover precisely how a lot working leverage MongoDB has as soon as it begins upping its spending on S&M. If it seems that the one means the corporate can produce acceptable buyer and income progress charges is by spending extreme quantities on S&M, suggesting decrease working leverage than initially thought, buyers may begin discounting the inventory’s valuation for that infraction. However, if it seems that administration can improve S&M sufficient to attain acceptable progress charges whereas nonetheless making progress on reaching working profitability, it suggests the corporate has a ample diploma of working leverage. In that case, buyers might proceed to award the inventory a premium progress valuation.

MongoDB just isn’t rising its enterprise in a vacuum. It has vital competitors that features NoSQL, Amazon Dynamo DB, Apache Cassandra, and HBase within the NoSQL database category, providing related options and performance. NoSQL databases retailer info in paperwork as a substitute of columns and rows utilized by SQL databases. MongoDB describes the quite a few variations between NoSQL and SQL in this article. Though MongoDB administration believes that NoSQL is superior to SQL, the top four databases are the next SQL databases: Oracle (ORCL), MySQL, Microsoft SQL Server, and PostgreSQL. Though right now it has a lead on its rivals, for it to proceed to achieve market share, MongoDB might must spend considerably on S&M and R&D. Subsequently, buyers on this firm face the chance that competitors may cut back profitability margins beneath acceptable ranges.

Is it a purchase, promote, or maintain?

MongoDB’s valuation appears to be like poor based mostly on many conventional valuation ratios. It sells at a price-to-sales (P/S) ratio of 17x. Though the corporate’s third quarter 2023 year-over-year progress charge of 30% may justify its present valuation, MongoDB has but to attain GAAP profitability, and solely this yr did it report its first quarter of constructive FCF. The uncertainty of when it could possibly produce sustained GAAP profitability might justify a decrease P/S ratio.

The corporate’s non-GAAP ahead price-to-earnings (P/E) ratio for the fiscal interval ending January 2025 is 120.26 in comparison with an estimated non-GAAP earnings-per-share (“EPS”) year-over-year progress charge of 8.52%. The consensus ahead P/E is way increased than the EPS progress charge out to 2026, in line with In search of Alpha. Since its EPS progress charge is comparatively low in comparison with its excessive P/E ratio, that means the market could also be overvaluing MongoDB’s future progress potential.

The next exhibits a reverse discounted money circulation mannequin with a trailing 12-month FCF of $88.67, a terminal progress charge of three%, and a reduction charge of 10%. On December 8, 2023, the closing worth of $381.79 implies FCF rising at a charge of 45.6% over the following ten years to achieve $3.9 billion, which is a extremely aggressive assumption when MongoDB remains to be proving its enterprise mannequin can constantly produce constructive money circulation and income. The market doubtlessly overvalues the inventory.

MongoDB Reverse DCF

|

Third quarter FY 2024 reported Free Money Circulate TTM (Trailing 12 months in hundreds of thousands) |

$88.67 |

| Terminal progress charge | 3% |

| Low cost Fee | 10% |

| Years 1 -10 progress charge | 45.6% |

| Present Inventory worth | $381.79 |

| Terminal FCF worth | $3.925 billion |

MongoDB’s intrinsic inventory worth is $215.35 after I assume FCF will develop at 37%. I used a 37% progress charge as analysts count on non-GAAP EPS to develop from $2.93 at a CAGR (Compound Annual Progress Fee) of 36.54% to $48.34 in 2033, and I assume FCF will roughly develop in step with its EPS progress charge.

MongoDB DCF

|

Third quarter FY 2024 reported Free Money Circulate TTM (Trailing 12 months in hundreds of thousands) |

$88.67 |

| Terminal progress charge | 3% |

| Low cost Fee | 10% |

| Years 1 -10 progress charge | 37% |

| Present Inventory worth | $381.79 |

| Terminal FCF worth | $2.135 billion |

| Intrinsic Worth | $215.35 |

In response to the above calculations, at $215.35, MongoDB is 44% overvalued. If you’re risk-averse or a price investor, it could be greatest to keep away from this inventory. Even aggressive progress buyers ought to be cautious about shopping for at present costs. There could also be higher factors to purchase the corporate over the following yr. Nevertheless, in the event you already personal shares, the potential upside from generative AI is value persevering with to carry the inventory for the long run. I charge the inventory a Maintain.