- Demand for XMR has spiked over the previous few days

- This occurred regardless of the proposed plan to close down LocalMonero

Monero’s native coin XMR seems poised to increase its seven-day rally, regardless of the adverse sentiments across the closure of LocalMonero, a peer-to-peer (P2P) buying and selling platform for the privateness coin.

On 7 Could, LocalMonero announced that it has disabled all new sign-ups and commercial postings for XMR on its platform. It added that on 14 Could, it will disable new XMR trades, and by 7 November, its web site can be taken down.

XMR appears to be like the opposite approach

At press time, the favored privateness coin was valued at $132.52, rallying by 8% within the final 7 days, in keeping with CoinMarketCap. This, although the broader market has remained largely circumspect over the previous.

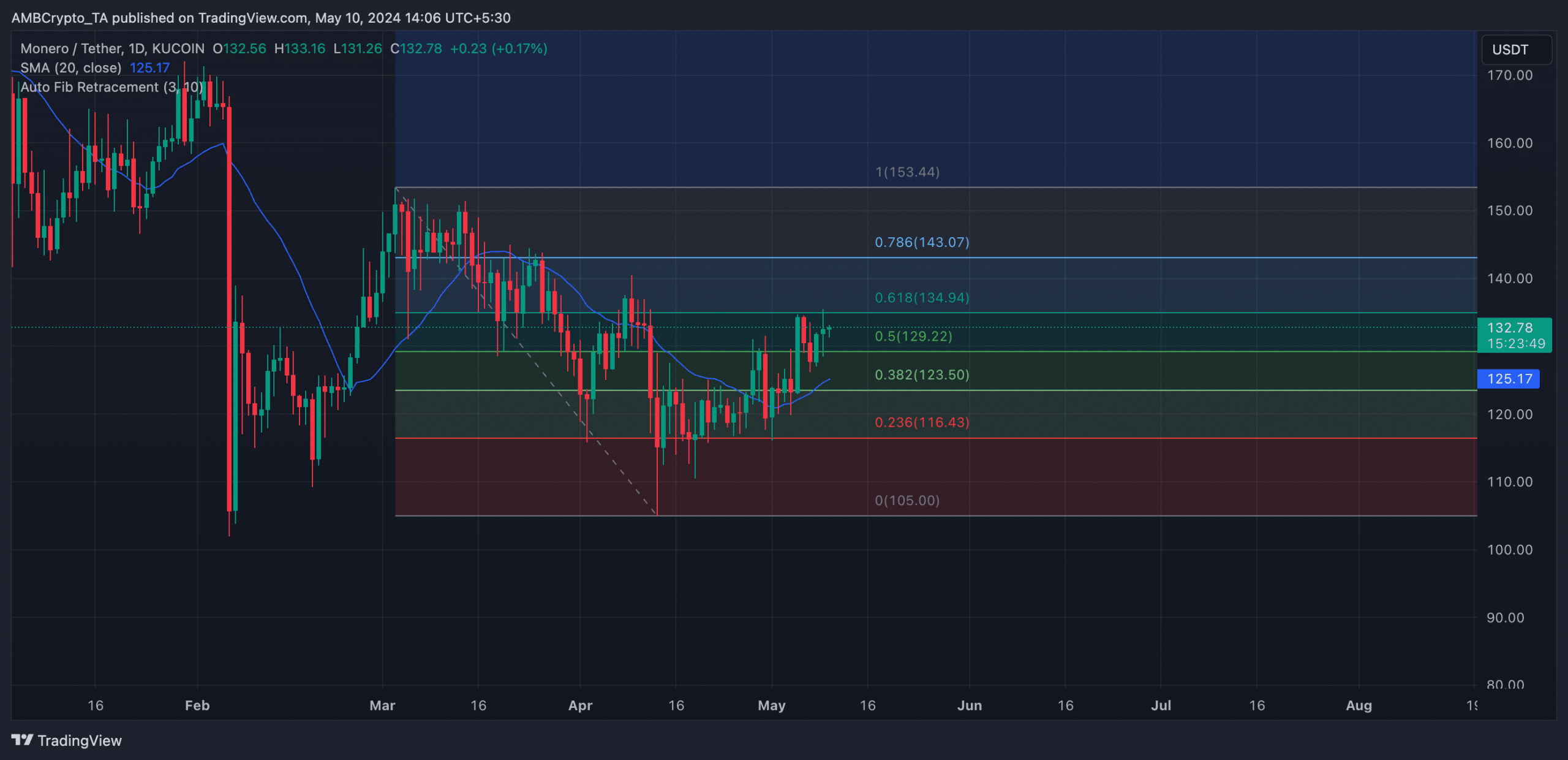

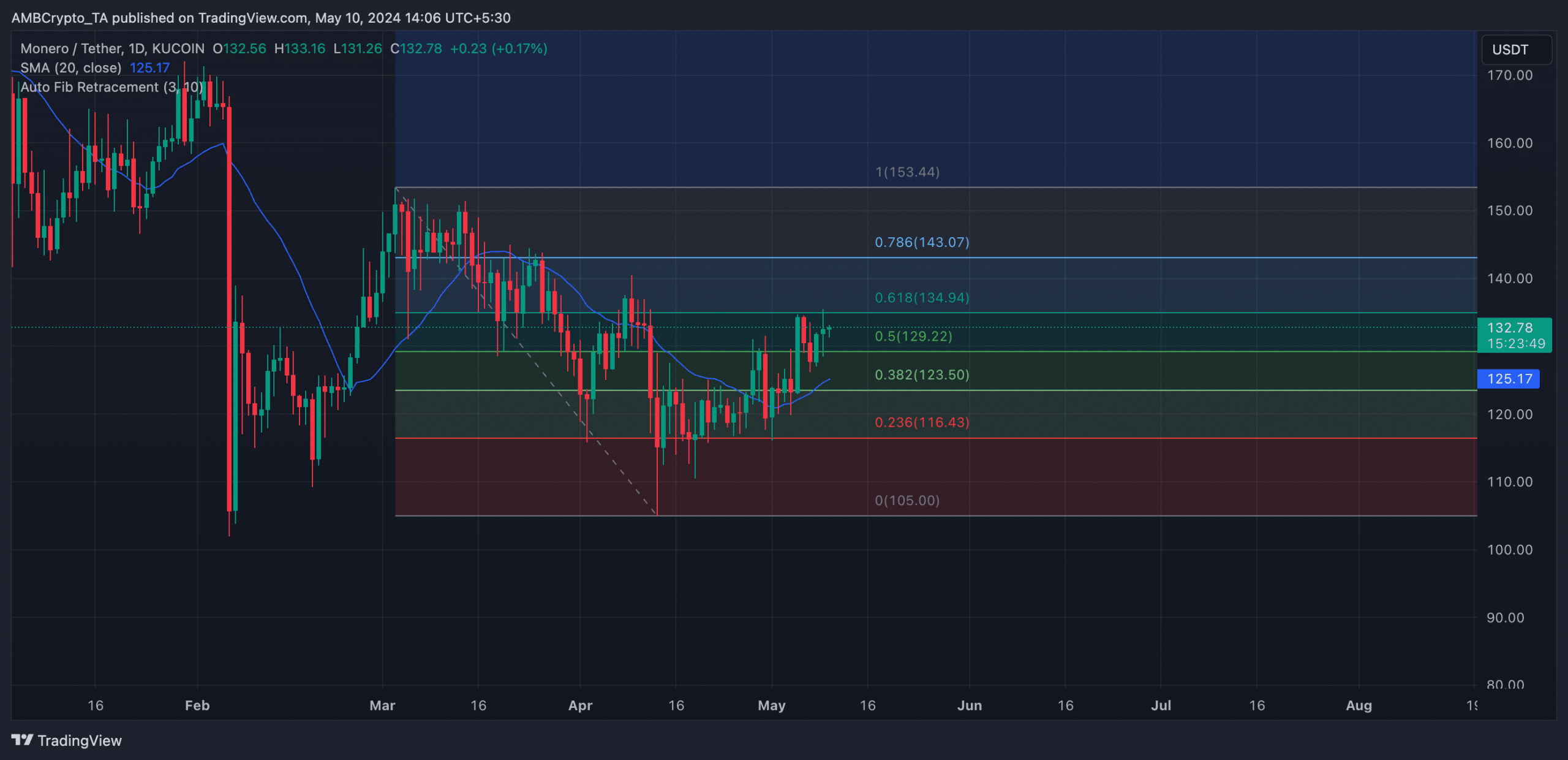

An evaluation of its value efficiency on the every day chart confirmed the potential of an prolonged rally within the brief time period. As an example, at press time, the altcoin’s value lay above its 20-day small shifting common (SMA). An asset’s 20-day SMA is a short-term shifting common that displays its common closing value over the previous 20 days.

When it’s positioned beneath an asset’s value, it means that the short-term pattern for the asset is upward. That is typically considered as an indication that consumers are accountable for the market and {that a} sustained rally is feasible.

An asset’s 20-day SMA is a short-term shifting common that reacts shortly to cost modifications. It displays the typical closing value of an asset over the previous 20 days.

Learn Monero’s [XMR] Worth Prediction 2024-25

Moreover, XMR’s rising momentum indicators signalled excessive shopping for momentum throughout the market. At press time, the coin’s Relative Power Index (RSI) was 57.13, whereas its Cash Circulate Index (MFI) was 71.69.

At these values, these indicators recommended that market members favoured XMR accumulation over its distribution.

Confirming an influx of liquidity into the XMR market, its Chaikin Cash Circulate (CMF) had a studying of 0.14, on the time of writing. This indicator measures the movement of cash into and out of an asset, with a constructive CMF considered as an indication of constructive market energy.

Relating to XMR’s subsequent value level, readings from its Fibonacci retracement revealed that if it efficiently breaches the $134-price stage, it will goal to change palms at $143 on the charts.

Supply: XMR/USDT on TradingView

Nevertheless, if that is invalidated and the bears exert stress available on the market, the altcoin’s value might fall beneath $125.