- Analysts reveal divergent views on the present miner profitability disaster.

- One camp deems the disaster as a ‘market prime’ whereas others time it as a ‘purchase sign’

After final week’s Fed resolution, Bitcoin [BTC] appears to be going through one other troubling issue influencing its worth—miners.

The biggest digital asset dropped beneath $70K after the Fed failed to chop rates of interest in June, opposite to what the market initially anticipated.

Quick-forward to the brand new week. As of press time, BTC struggled to carry above $65K as a consequence of what market analysts claimed could possibly be headwinds from Bitcoin miners.

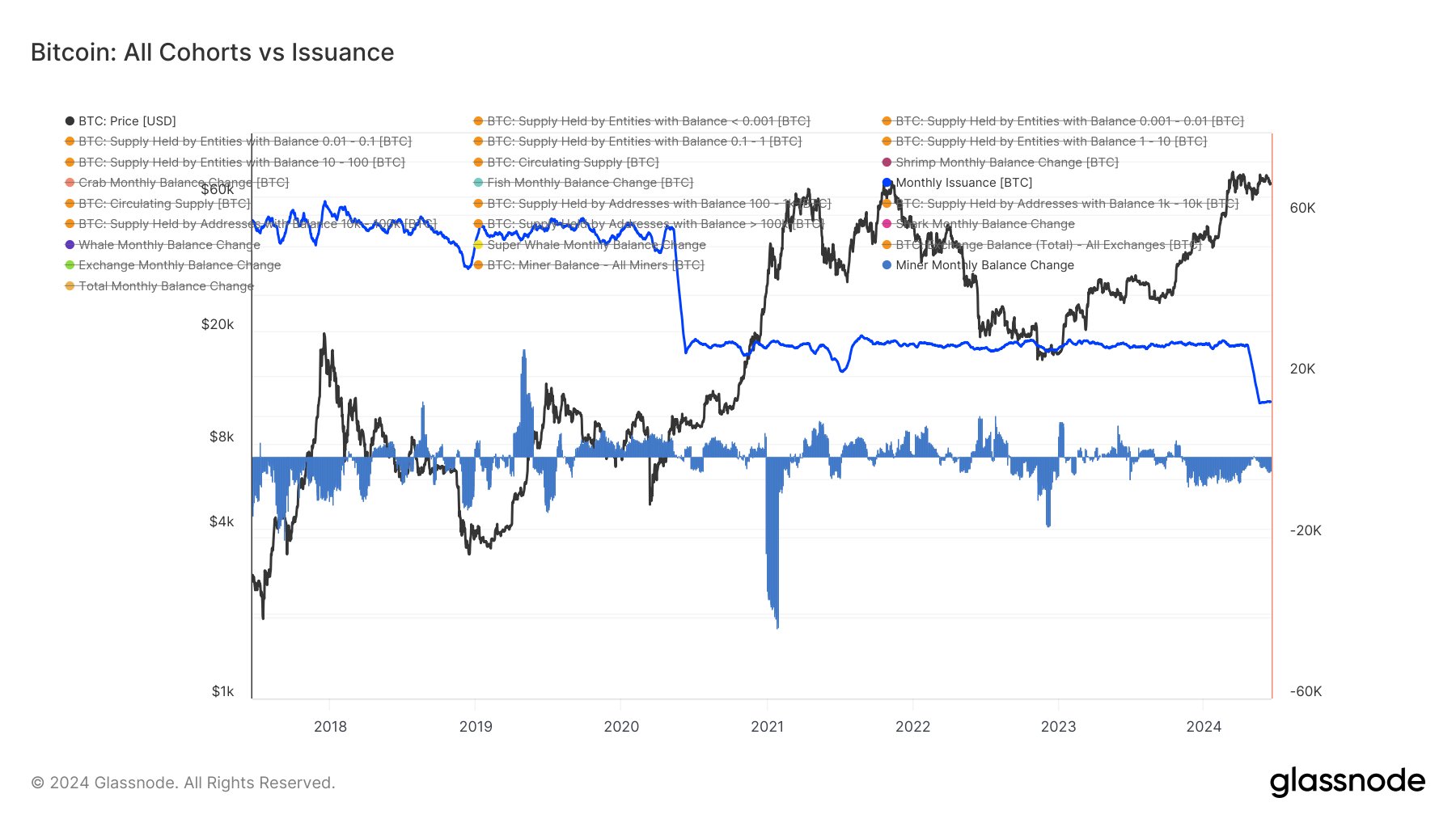

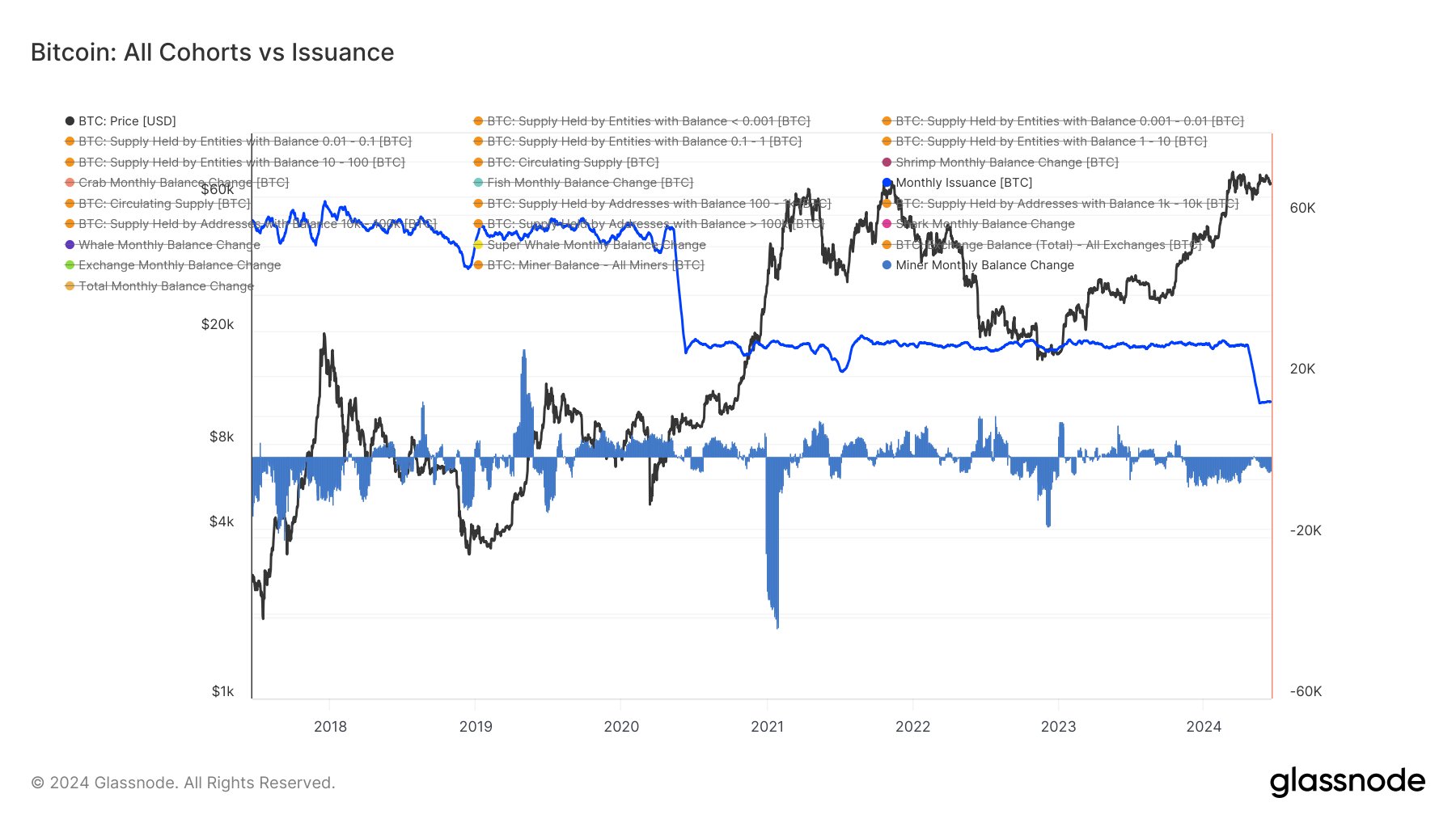

Based on James Van Straten, a famend on-chain analyst, BTC miners have offered over 30,000 BTC of their reserves since final October.

‘Miner addresses collectively maintain a considerable treasury of 700,000 BTC, however their stability has decreased by 30,000 BTC since October. This era marks the longest distribution section for miners since 2017, including to headwinds’

Supply: Glassnode

Put in a different way, miners, particularly ineffective ones after the April halving occasion, are promoting their holdings to cowl bills and probably exit the sector as a consequence of profitability points.

Must you promote or purchase BTC?

The profitability disaster of miners, referred to as miner capitulation, has been ongoing for the previous 33 days. Thus, the promoting stress from miners could possibly be one of many components weighing on the BTC worth in the meanwhile.

Some miners have diversified into AI computing to stay worthwhile after the halving occasion in April.

Nonetheless, Quinn Thompson, CIO of crypto hedge fund Lekker Capital, considered the continued miner disaster as a ‘top indicator for crypto’ and worse than the miner disaster within the 2022 crypto winter.

“What’s a greater prime indicator for crypto than all BTC miners getting indiscriminately bid up on the coattails of AI and $NVDA?”

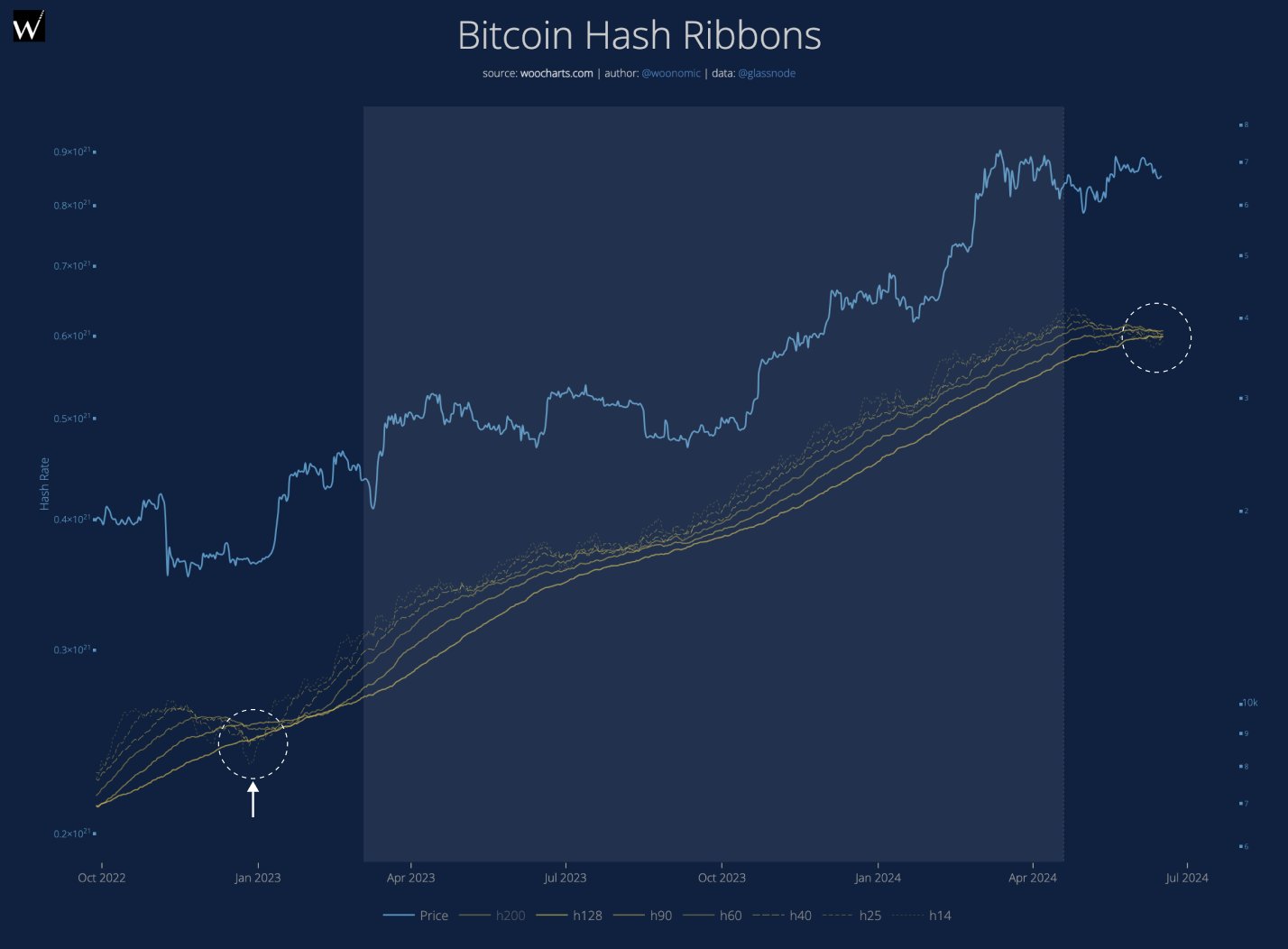

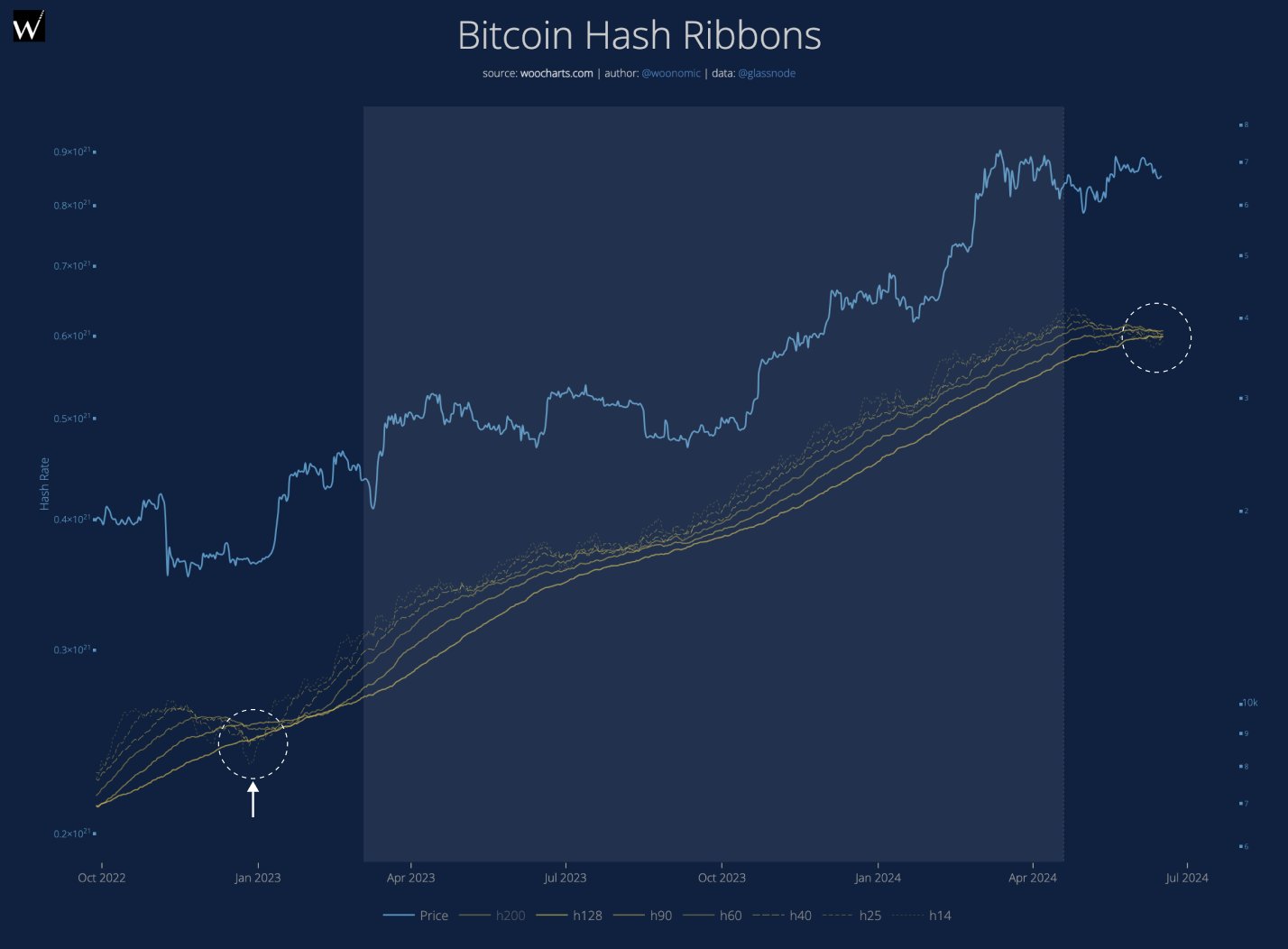

One other person and analyst, Willy Woo, acknowledged that the BTC worth could be “punished” till the hashrate improves.

“Bitcoin worth will proceed to be punished till the hash market picks up some quantity. That is why bankers used to name it drug cash.”

Supply: Willy Woo

Hashrate, the computing energy to mine a BTC, declined considerably after halving in April and later in Might, per Blockchain data.

Like Woo, one other analyst, Cole Garner, acknowledged {that a} BTC purchase sign was imminent if the hashrate recovered.

“When hashrate reverts, Hash Ribbons will print one of the traditionally dependable #bitcoin purchase indicators ever seen. And we’re near that sign.”

Hash Ribbons are shifting averages that observe hashrate downtrends and sometimes sign purchase indicators.

That mentioned, whereas Thompson deemed the miner disaster a “market prime indicator,” others timed it as a possible purchase sign.

In addition to, BTC’s worth has sometimes stayed close to its common mining price, which hit $86K, and will push the king coin to hit the goal quickly sufficient.