- MicroStrategy provides 122 BTC to its holdings, now totaling 214,400 Bitcoins.

- Regardless of damaging broader Bitcoin metrics, there’s a attainable uptick on the horizon.

In a strategic addition to its cryptocurrency reserves, MicroStrategy, the software program big turned Bitcoin [BTC] advocate, has not too long ago expanded its portfolio.

On the thirtieth of April, the corporate, underneath the management of founder Michael Saylor, disclosed the acquisition of a further 122 Bitcoins, bought for about $7.8 million.

This newest transaction elevates MicroStrategy’s whole Bitcoin holdings to roughly 214,400 items.

This buy was a part of MicroStrategy’s ongoing dedication to Bitcoin, which has been a central facet of their enterprise mannequin in recent times.

Additionally, regardless of the volatility and up to date downtrends within the cryptocurrency market, MicroStrategy launched its first quarter financial report for 2024, detailing their holdings at a valuation of $7.54 billion.

This values their intensive Bitcoin stock at a mean worth of $35,180 per unit.

The agency has been persistently bullish on Bitcoin, accumulating 25,250 Bitcoins because the final quarter of 2023 at a mean worth of $65,232 per BTC.

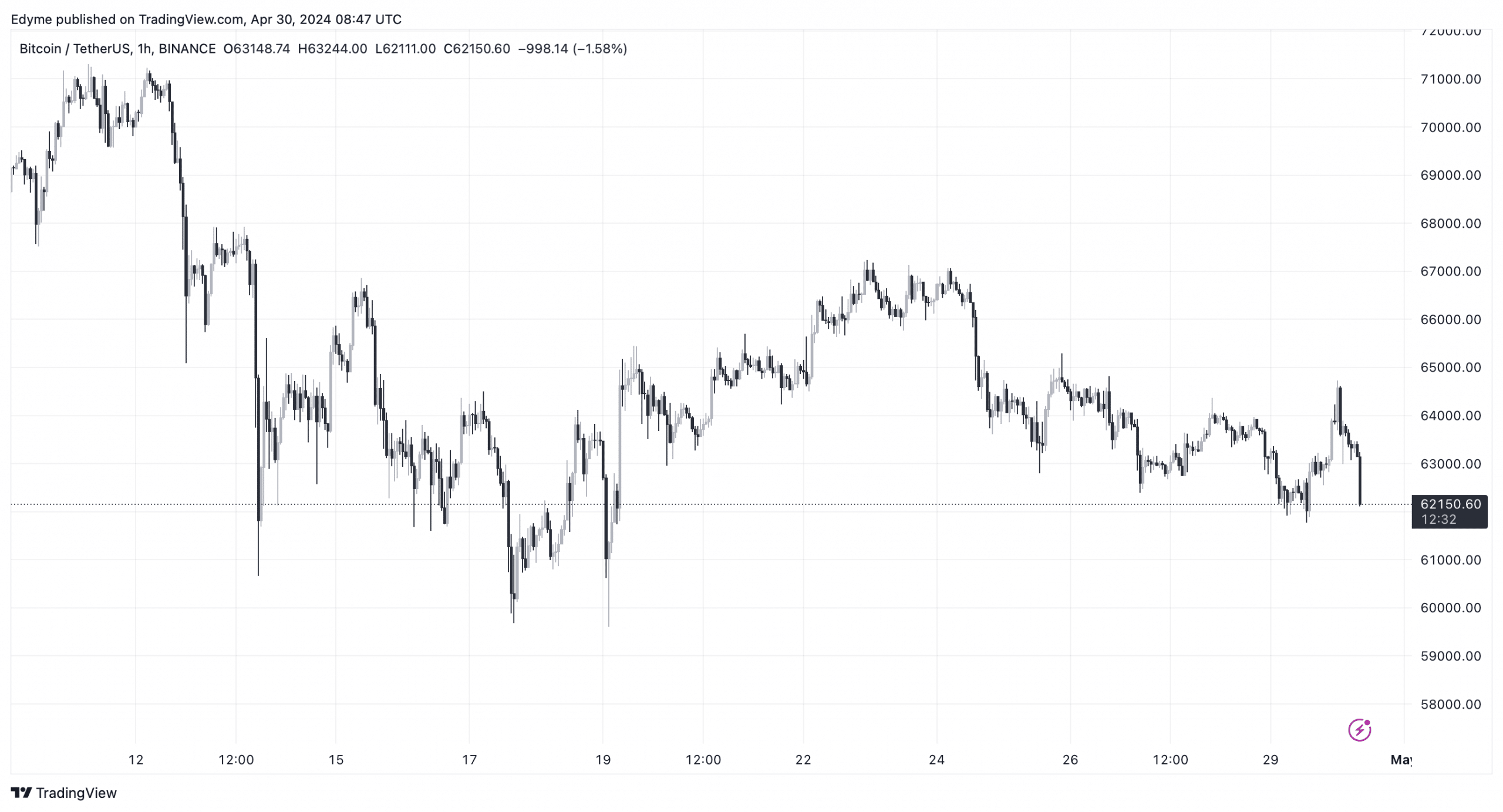

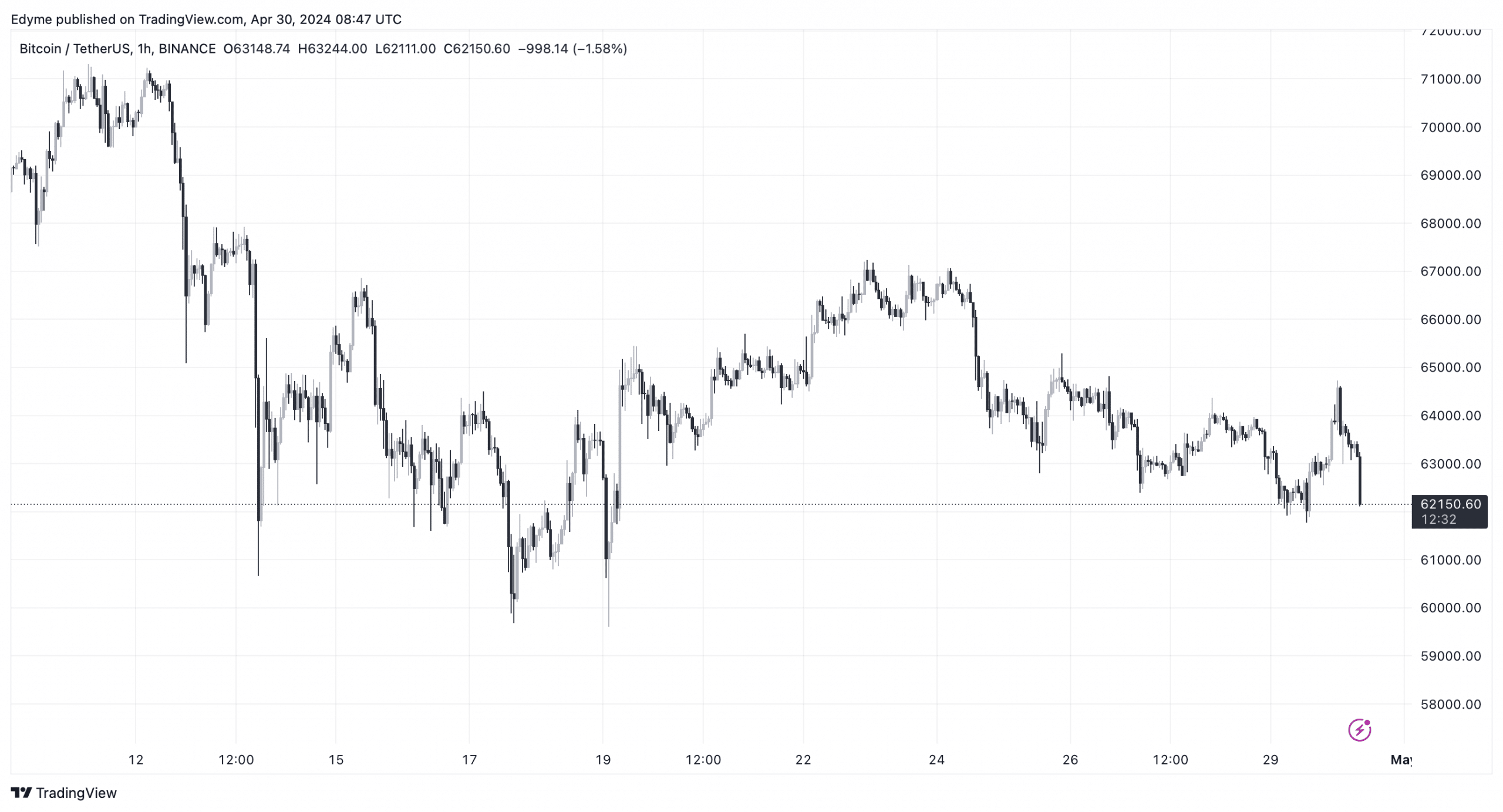

Bitcoin’s bumpy highway

Regardless of MicroStrategy’s optimistic accumulation, the broader market has continued to face challenges.

Bitcoin’s worth has been on a downward trajectory, with a major 4.5% drop over the previous week.

Latest information from CoinGecko highlighted a 24-hour low of $61,890 for Bitcoin, although there was a minor restoration of 1.5%, bringing the worth as much as $63,226 on the time of writing.

Supply: TradingView

The continued challenges will not be restricted to instant worth fluctuations. A broader perspective revealed vital declines in a number of of Bitcoin’s core metrics, akin to hash worth, significantly following the cryptocurrency’s fourth halving occasion on the twentieth of April.

Notably, the decline in Bitcoin’s worth seems to be mirrored by a lower in its hash worth, which not too long ago hit all-time lows.

It fell under $50 per PH/s per day for the primary time ever, signaling a tricky interval for miners, whose profitability is now severely squeezed.

Supply: Hashrate Index

This decline has not solely affected the profitability of mining operations however has sparked considerations over the long-term viability of mining, contributing to damaging investor sentiment.

Nevertheless, amidst the prevailing bearish traits, some analysts stay bullish about Bitcoin’s future prospects.

AMBCrypto, for example, steered that whereas the near-term outlook might even see Bitcoin testing help ranges round $61k, a successful rebound from this level might set off a brand new bull rally.

Such a rally might probably push costs to reclaim $66k, and presumably even escalate to $71k within the lead-up to attaining new file highs.