- MicroStrategy plans to purchase $42B BTC within the subsequent 3 years.

- An analyst projected that MSTR will grow to be extra like a US spot BTC ETF.

Michael Saylor’s agency, MicroStrategy, introduced plans to accumulate $42 billion of Bitcoin [BTC] within the subsequent three years, simply earlier than the 2028 halving cycle.

“Right this moment, we’re asserting a strategic aim of elevating $42 billion of capital over the subsequent 3 years, comprised of $21 billion of fairness and $21 billion of fastened revenue securities, which we seek advice from as our “21/21 Plan.”

This has bolstered Saylor’s uber-bullish stance on BTC, as he expects the asset to achieve $3 million-$49 million within the subsequent 20 years. He has additionally supported Trump’s pro-crypto stance, with the newest push for eradicating the capital positive factors tax on BTC.

Is MSTR altering to BTC ETF?

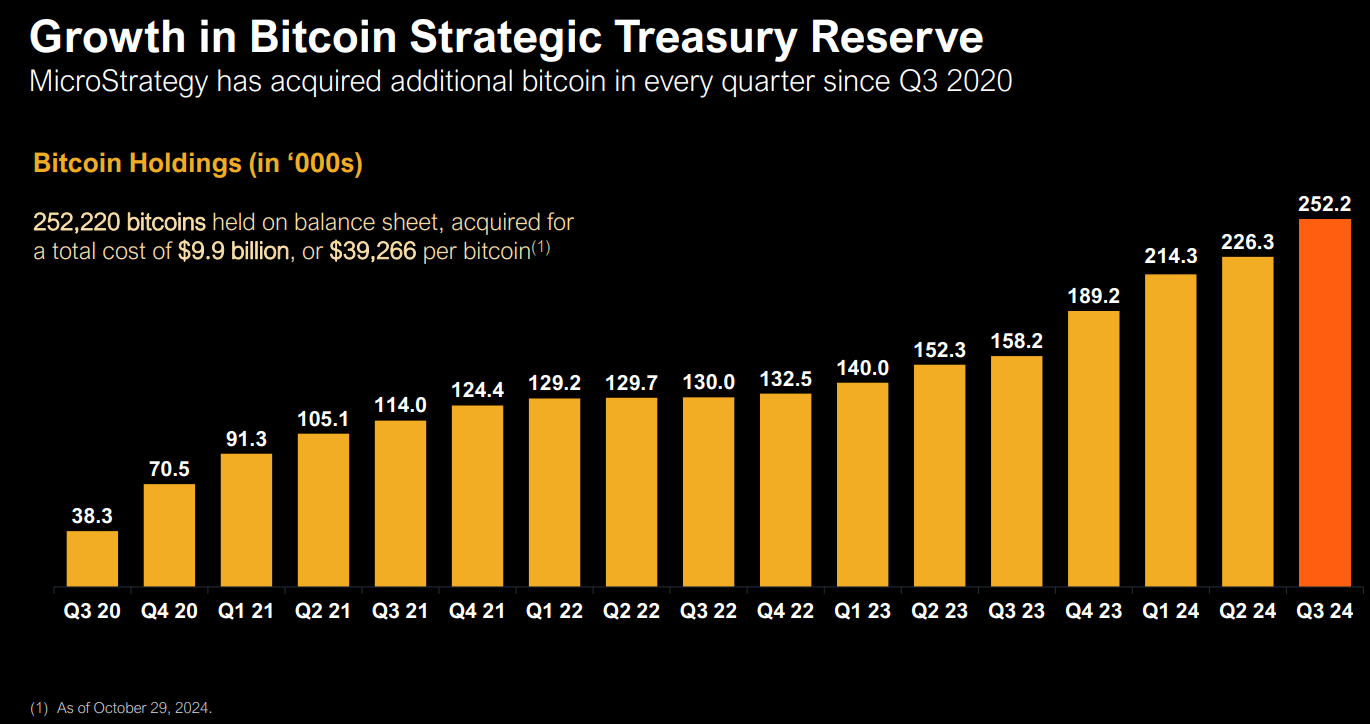

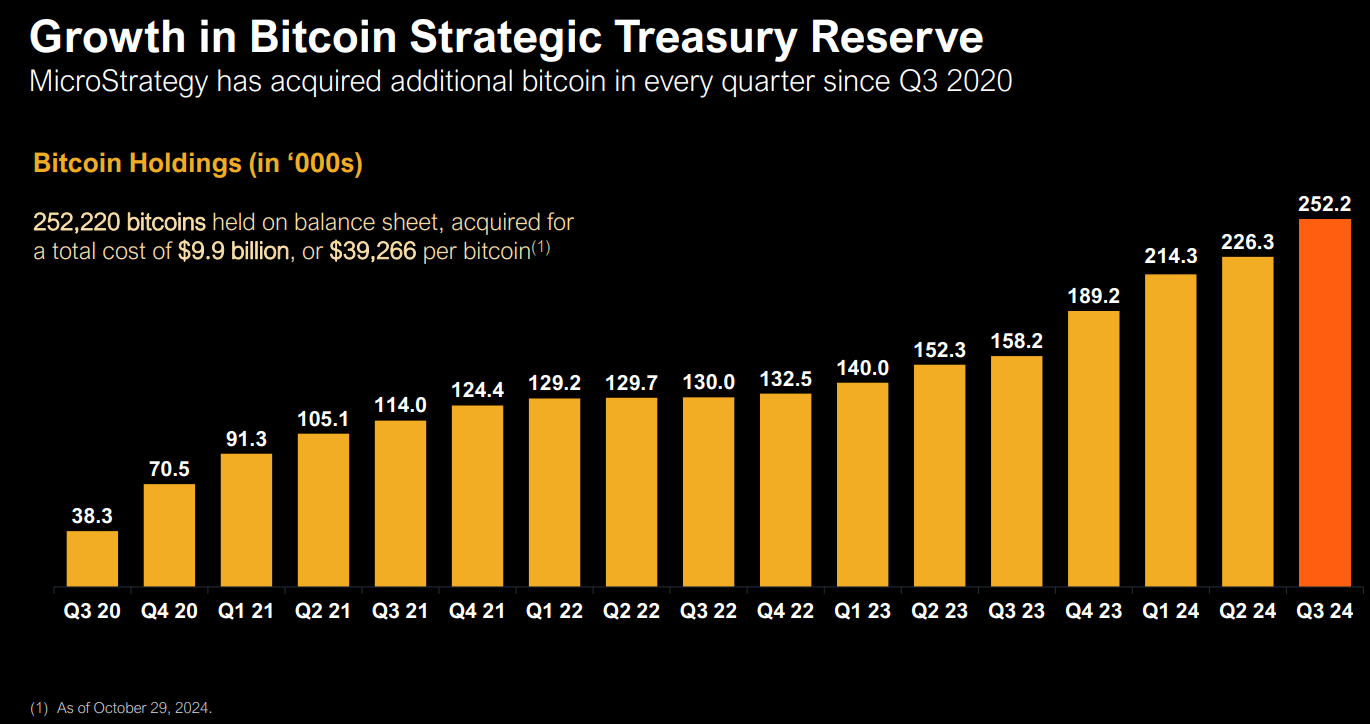

As of October 2024, MicroStrategy held 252, 220 BTC, acquired for $9.9 billion. The agency’s BTC stash was now value over $18.15 billion at present costs, translating to $8 billion in unrealized positive factors.

Supply: MicroStrategy

Nevertheless, a part of the agency’s $42 BTC acquisition plan will probably be executed by means of a $21 billion ATM (at-the-market) inventory issuance program, which some analysts consider would flip its inventory’s MSTR right into a BTC ETF.

One of many analysts, Quinn Thompson, founding father of macro-focused crypto hedge fund Lekker Capital, said,

“By ripping the bandaid off and asserting a large ATM shelf like this, they’re turning $MSTR right into a de-facto ETF.”

This could permit the agency to difficulty shares within the secondary market at any time to fund its BTC acquisition, nearly just like how US spot BTC ETFs function. In keeping with Thomspon, this might enhance MSTR much more.

The fairness program, alongside the intention to difficulty convertible notes (debt) to purchase BTC, sums up the agency’s long-term imaginative and prescient of turning into a ‘Bitcoin financial institution,’ as revealed in mid-October.

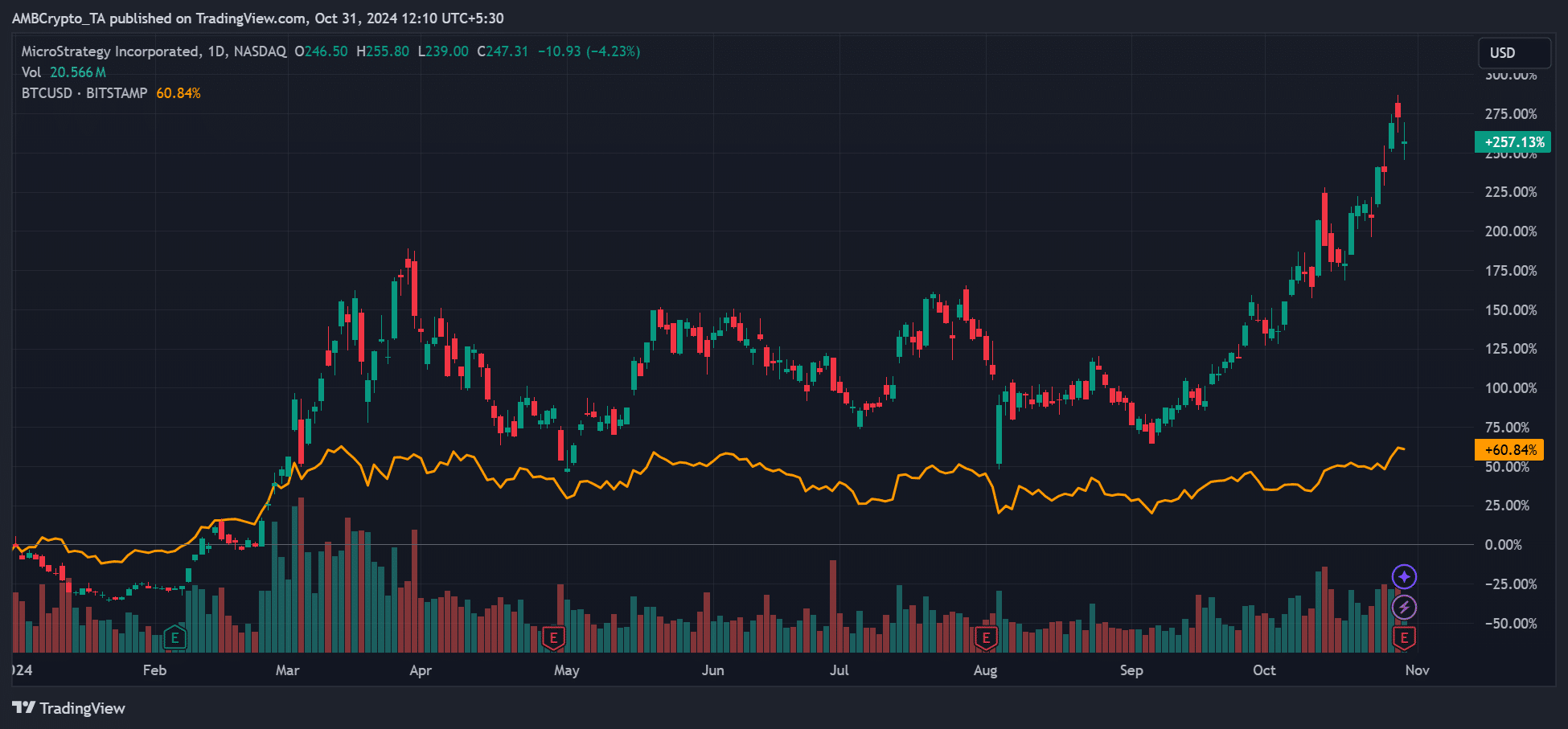

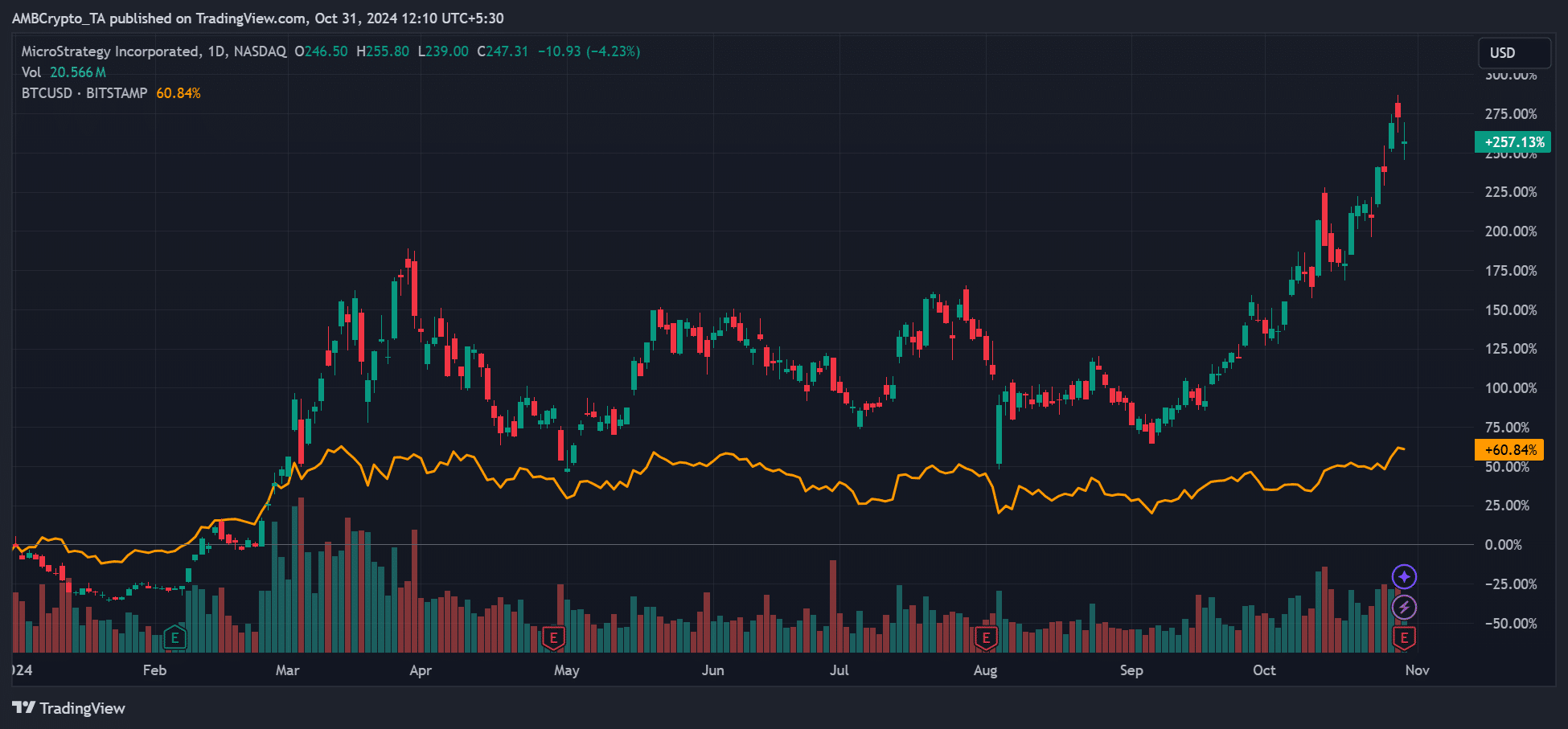

That stated, MSTR holders appeared to be the actual beneficiaries of the newest replace. MSTR has been the best-performing S&P inventory since adopting the BTC technique in 2020. This has seen MSTR outperform and will even downplay the agency’s newest Q3 lack of $19.4 million.

On year-to-date (YTD) foundation, MSTR was up +250%, greater than 4x BTC’s 60% positive factors. In Q3, MSTR rallied about 20%, whereas BTC closed the quarter with lower than 1% positive factors.

Supply: MSTR vs BTC, TradingView

In brief, from an investor returns perspective, it was higher to carry MSTR than BTC.

Apparently, the inventory was anticipated to put up an additional 7% rally after the newest earnings report, famous Bitwise’s head of alpha methods, Jeff Park. Citing the MSTR choices information, Park stated,

“As we enter $MSTR earnings, an explosive arrange: Nov 1 Vol is ~115%, implying a 7.2% transfer.”

At press time, MSTR was valued at $247, and it stays to be decided whether or not it’s going to print a contemporary yearly excessive as Park projected amid BTC’s tight consolidation above $72K.