- MicroStrategy intends to purchase extra BTC with a latest convertible notes supply.

- MSTR’s stay an irresistible short-term guess over BTC.

On thirteenth June, MicroStrategy [MSTR] introduced a plan so as to add extra Bitcoin [BTC] from proceeds from its non-public providing of $500 million convertible notes. The senior notes, a kind of debt technique, are due in 2032. A part of the replace read,

“MicroStrategy intends to make use of the online proceeds from the sale of the notes to amass further bitcoin and for basic company functions.’

MicroStrategy has been leveraging debt to ramp up its Bitcoin technique.

In April, the agency scooped an additional 122 BTC cash at $7.8 million, bringing its total holdings to 214,400 BTC value over $14.5 billion based mostly on present market costs.

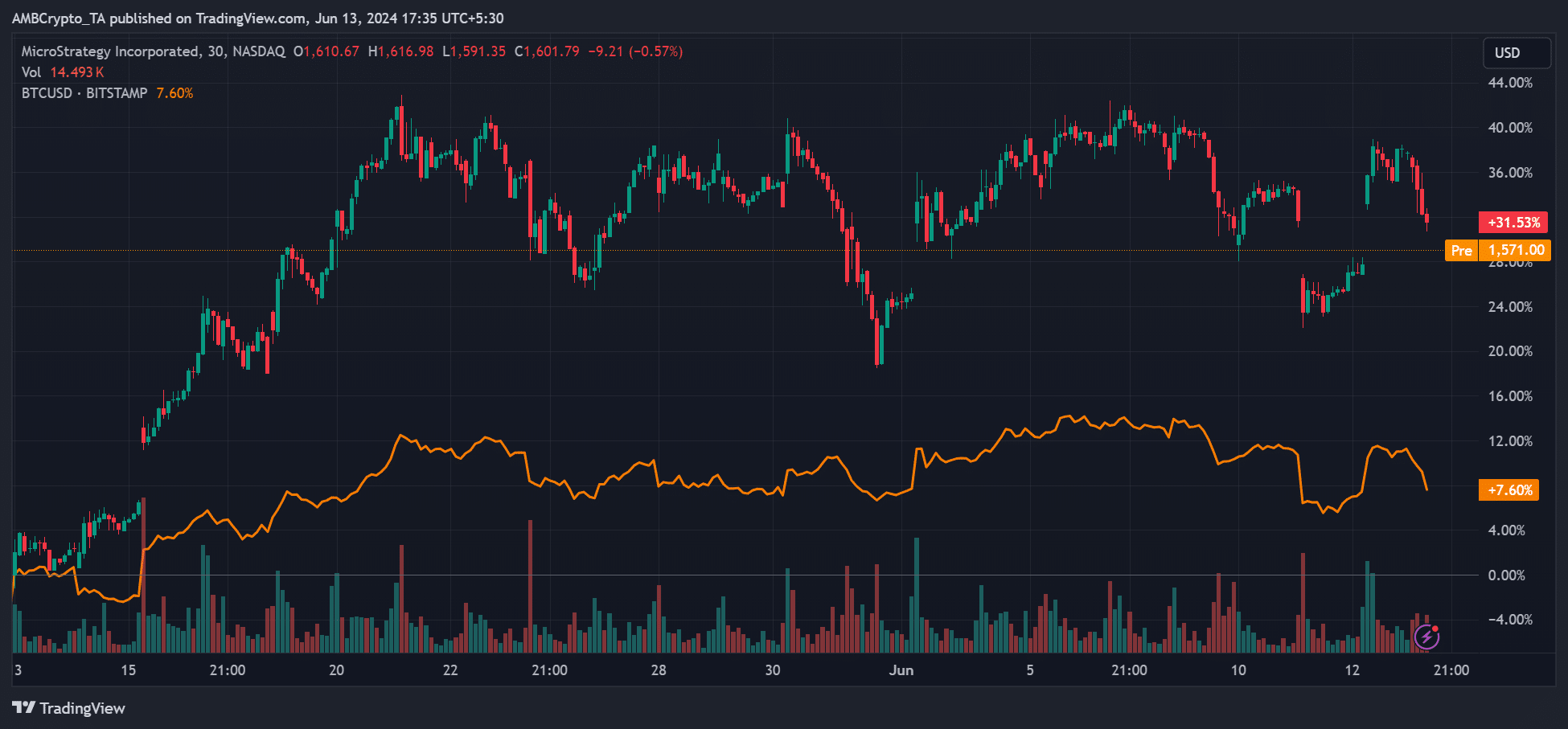

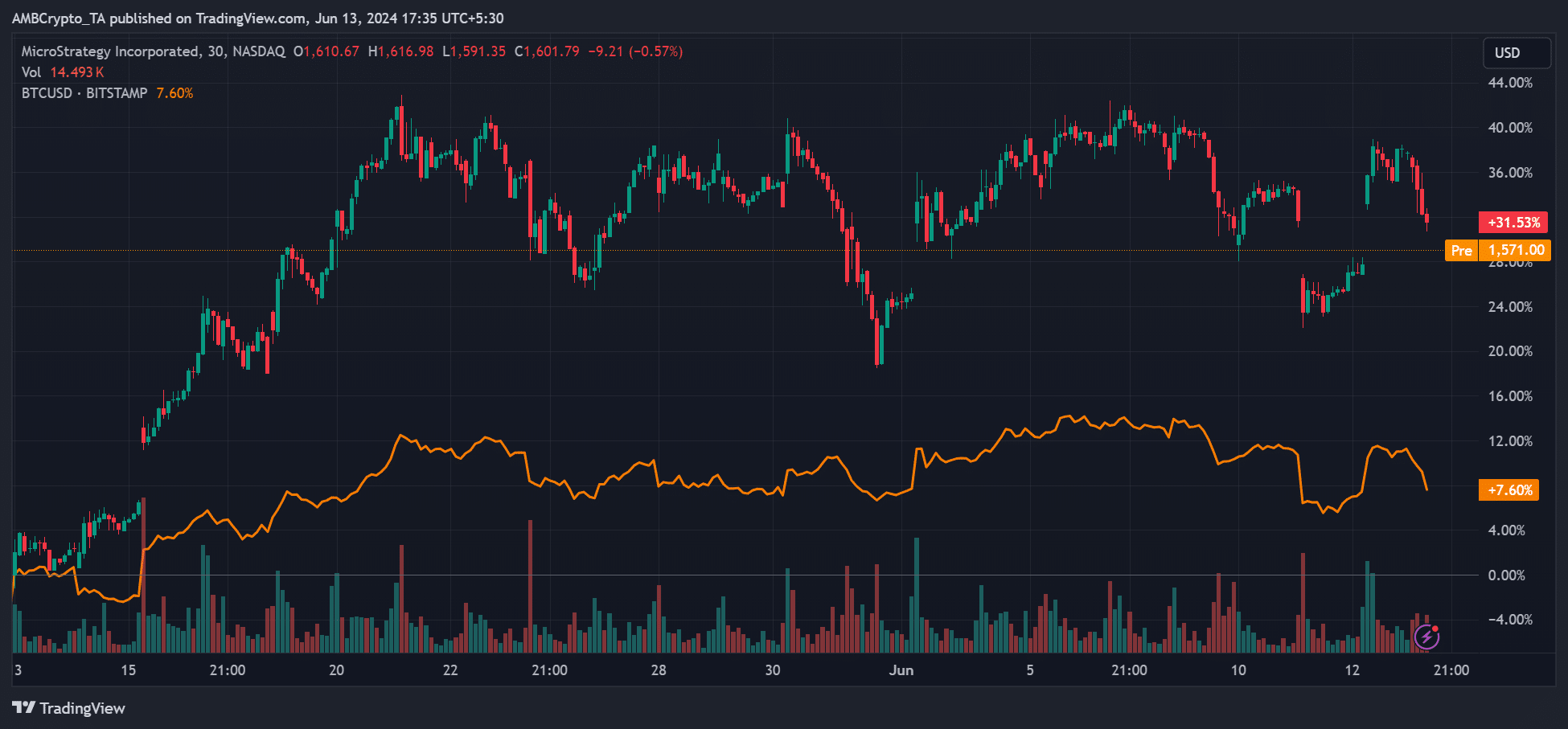

Regardless of different catalysts just like the addition to the MSCI Index and the upcoming inclusion of the Russell 1000 Index on twenty eighth June, MSTR inventory has religiously adopted BTC’s value motion.

Nonetheless, the inventory has emerged as a greater short-term guess than BTC. It has outperformed the king coin on a number of events.

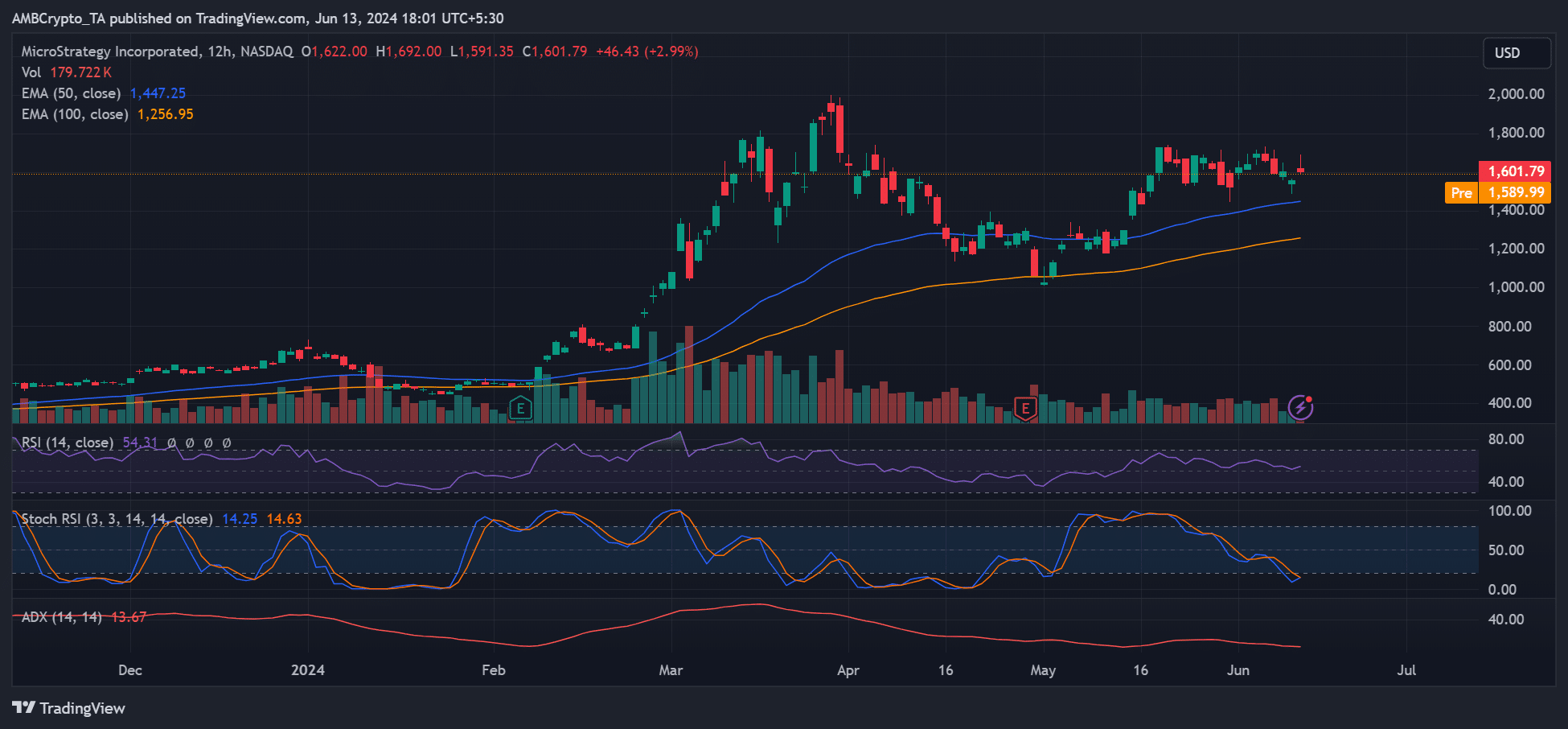

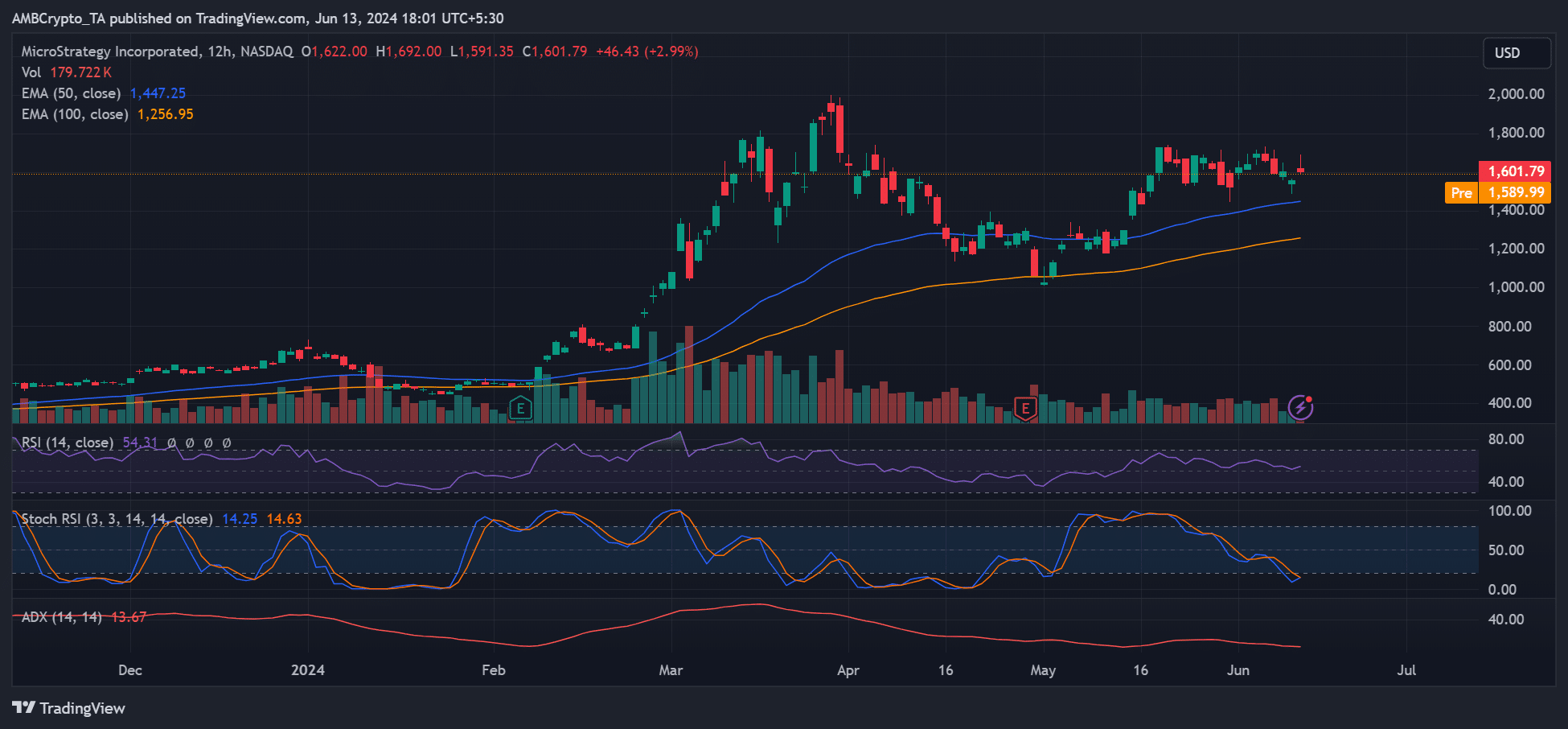

MicroStrategy inventory value chart place

The MSTR’s market construction was nonetheless in a greater place regardless of the present market drawdown after the ‘hawkish’ Fed charge resolution.

Supply: MSTR inventory, TradingView

Notably, value motion was above the 100-day and 50-day EMAs (Exponential Shifting Averages). This demonstrated that MSTR’s short-term and long-term value tendencies hadn’t weakened but.

Moreover, the RSI (Relative Energy Index) hovered above the mid-range, reinforcing muted however above-average shopping for strain. However bulls may very well be tempted by the stochastic RSI, which flirted with oversold territory and will counsel a possible bullish reversal was probably.

In that case, MSTR may quickly bounce off the 50-EMA and goal $1800 or $2000.

Nonetheless, if BTC data extra losses, the inventory may very well be dragged to the 100-EMA ($1256). The ADX (Common Directional Index) studying beneath 20 indicated an absence of pattern and referred to as for dealer warning.

Regardless of the market rout and total value consolidation over the previous three months, MSTR nonetheless introduced higher returns than BTC.

As of press time, on a month-to-month adjusted foundation, MSTR supplied +30% positive factors in opposition to BTC’s +7% over the identical interval. This meant that MSTR supplied almost 4X extra returns than BTC.

Supply: MSTR vs. BTC efficiency