Jean-Luc Ichard

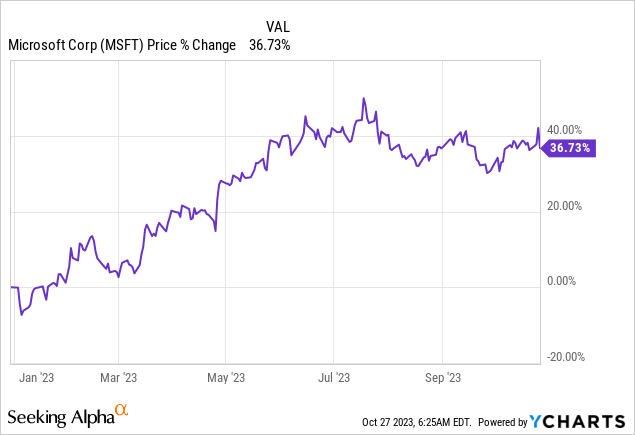

Shares of Microsoft (NASDAQ:MSFT) soared 3% instantly (however later dropped) after the expertise firm introduced better-than-expected outcomes for its first fiscal quarter of FY 2024. Microsoft beat expectations, on each the highest and backside line, attributable to a robust displaying of the Cloud enterprise which continued to generate double-digit prime line progress. Microsoft additionally diverged from Alphabet (GOOG) by way of Cloud efficiency within the final quarter and Microsoft often is the higher wager on Cloud progress going ahead as nicely.

However, Google has a severe valuation benefit in comparison with Microsoft. Whereas Google was upset with a slowdown in Cloud-specific progress, the corporate noticed a robust rebound in digital promoting spending. Microsoft, nevertheless, stays a robust Cloud progress funding… though shares should not low cost!

Earlier score

My score on Microsoft was robust purchase after the expertise firm submitted a sturdy earnings sheet for the second quarter, in July, attributable to a reacceleration of income progress: Microsoft: Purchase The Dip.

Extra causes to contemplate shopping for Microsoft, regardless of an elevated valuation multiplier issue, are that the corporate managed to develop its free money circulation margin to an enormous 36.6% in FQ1 and the corporate is returning a ton of this free money circulation to shareholders by way of buybacks and dividends. Microsoft’s Cloud progress can be diverging from Google’s Cloud progress, indicating that Microsoft’s enterprise Cloud providing is perceived as stronger. The power in Cloud in addition to return to constructive progress within the Private Computing companies will likely be mentioned on this replace.

Extra observe: the third-quarter reference on this article pertains to Microsoft’s fiscal quarter of FY 2024.

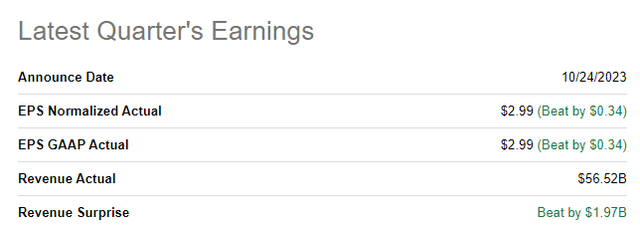

Microsoft beat prime and backside line FQ1 estimates

The driving pressure behind vital earnings and prime line outperformance was the Cloud section which is benefiting from growing buyer adoption, particularly of Microsoft’s AI/Cloud-supported company options. Microsoft’s prime line got here in at $56.5B, beating the common prediction by an enormous $1.97B… whereas adjusted EPS of $2.99 was $0.34 per share higher than the consensus estimate.

Supply: Looking for Alpha

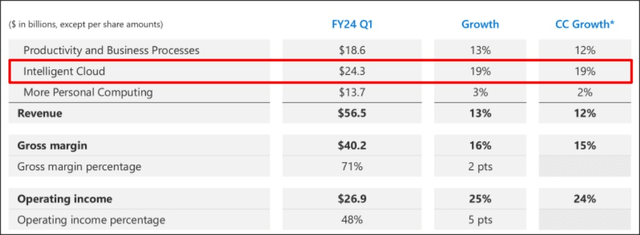

Private Computing again to constructive progress, Clever Cloud drives Microsoft’s efficiency

Microsoft benefited within the third quarter from a robust efficiency within the Cloud enterprise whereas the Private Computing enterprise continued to get well. Whole revenues have been up 13% yr over yr and FQ1 was the third consecutive quarter of a prime line acceleration.

Private Computing, which incorporates Home windows OEM and {hardware} revenues, noticed a 3% prime line improve, after posting a 4% prime line decline within the final quarter. Home windows OEM revenues, which depend upon {hardware} gross sales, have been up 4% yr over yr and it confirmed that the state of affairs within the {hardware} market has improved significantly within the final three quarters.

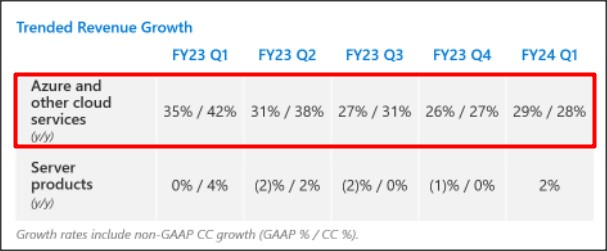

Whereas the Private Computing enterprise stabilized, Azure remained a progress machine for Microsoft and it confirmed stronger progress than Google Cloud. Microsoft’s Clever Cloud section generated 19% year-over-year progress, and Azure, Microsoft’s Cloud platform, noticed 29% year-over-year progress.

Supply: Microsoft

Microsoft’s Azure progress accelerated quarter over quarter from 26% to 29%, displaying 3 PP progress. Google noticed decelerating Cloud section progress which declined from 28% in Q2’23 to 22% in Q3’23, so Microsoft’s Cloud enterprise clearly developed significantly better. The acceleration of progress is because of Microsoft’s AI merchandise which might be built-in into its Cloud providing in addition to robust enterprise buyer adoption of such AI merchandise.

Supply: Microsoft

Microsoft stays a strong free money circulation play

Microsoft just isn’t a cut price and it’s because the expertise firm is a real free money circulation champion with tons of free money circulation obtainable for buybacks and investments, just like the one made into ChatGPT-creator OpenAI.

Microsoft generated $20.7B in free money circulation on revenues of $56.5B which calculates to a formidable free money circulation margin of 36.6%, implying an 8% year-over-year free money circulation margin growth. In different phrases, Microsoft is producing extra free money circulation now per greenback generated in revenues than in final yr’s FQ1.

|

$billions |

FQ1’24 |

FQ4’23 |

FQ3’23 |

FQ2’23 |

FQ1’23 |

Y/Y Progress |

|

Revenues |

$56,517 |

$56,189 |

$52,857 |

$52,747 |

$50,122 |

13% |

|

Money Circulate From Working Actions |

$30,583 |

$28,770 |

$24,441 |

$11,173 |

$23,198 |

32% |

|

Capital Expenditures |

($9,917) |

($8,943) |

($6,607) |

($6,274) |

($6,283) |

58% |

|

Free Money Circulate |

$20,666 |

$19,827 |

$17,834 |

$4,899 |

$16,915 |

22% |

|

Free Money Circulate Margin |

36.6% |

35.3% |

33.7% |

9.3% |

33.7% |

8% |

(Supply: Writer)

Of the $20.7B in free money circulation, Microsoft returned $9.1B to shareholders ($3.6B as inventory buybacks and $5.6B in dividends) within the third quarter which calculates to a free money circulation return share of 44%.

Microsoft vs. Google valuation, progress potential, FV estimate

Microsoft just isn’t buying and selling at a low free money circulation/earnings multiplier issue and the corporate’s robust enterprise positioning in Cloud is the rationale for this.

From a strategic viewpoint, I choose Microsoft as a segment-specific Cloud progress play which is seeing a robust prime line growth, pushed by Cloud product choices. Whereas Microsoft’s Cloud enterprise is rising quicker than Google’s, Microsoft Cloud’s potential is far more costly than Google’s as nicely.

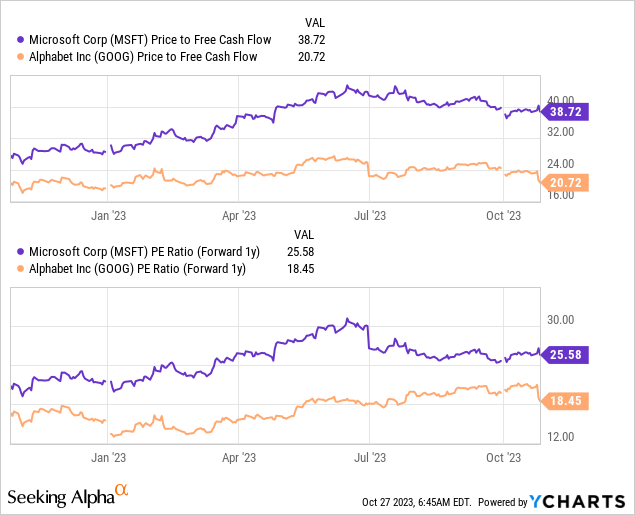

Microsoft is buying and selling at a P/FCF ratio of 38.7X in comparison with a 20.7X P/FCF ratio for Google… and Google has seen a robust rebound in prime line progress (+11% Y/Y in Q3’23) as nicely in Q3’23, attributable to a spending restoration within the digital promoting enterprise. Based mostly off of earnings, Google can be cheaper than Microsoft and I contemplate GOOG to characterize deep worth for traders.

I see a good worth for Microsoft, given its monumental free money circulation power and excessive FCF return share, at about 30X ahead earnings. This isn’t a low earnings multiplier issue, however it might extra precisely mirror the core power of enterprise, in my view. With EPS expectations of $12.84 per share (estimated for FY 2024), shares of Microsoft could be extra pretty valued at $385, resulting in potential upside of 17%.

I justify a 30X earnings multiplier additionally with Microsoft’s AI alternative in Azure. Microsoft has stated that it plans to combine synthetic intelligence options into your entire tech stack with a view to drive enterprise productiveness and Azure AI adoption may increase the agency’s prime line and EPS progress going ahead. Additionally, Analysis firm Gartner stated in October that global PC shipments declined 9% within the third quarter — after declining 17% in Q2’23 — and that machine gross sales may see the start of a restoration in This autumn’23. This is able to indicate favorable tailwinds for Microsoft’s Private Computing enterprise as nicely.

Dangers with Microsoft

Given the excessive valuation issue that Microsoft is buying and selling at, the largest danger is a slowdown in Microsoft’s Cloud enterprise in addition to a downturn in free money circulation progress. From a valuation perspective, I imagine Google has much less danger than Microsoft, due to the a lot decrease FCF valuation multiplier issue. What would change my thoughts about Microsoft is that if the agency noticed deteriorating Cloud progress in addition to decrease free money circulation margins.

Remaining ideas

Microsoft executed very nicely within the third quarter by way of income and free money circulation and all these outcomes have been pushed mainly by Microsoft’s robust place within the Cloud section, which advantages from growing product uptake in addition to AI merchandise. Microsoft’s and Google’s Cloud progress diverged, too: Microsoft’s Azure prime line progress accelerated within the final quarter (+3 PP) whereas Google’s progress slowed 6 PP.

The Private Computing section additionally posted its first constructive prime line progress charge this yr, indicating that the market state of affairs in {hardware}/machine gross sales can be bettering. Whereas shares of Microsoft should not low cost, particularly not relative to Google’s, I imagine Microsoft is executing its Cloud technique very nicely and I verify my robust purchase score following the FQ1’24 earnings report!