- Saylor owns 17,732 Bitcoin, representing 10% of MicroStrategy’s whole holdings.

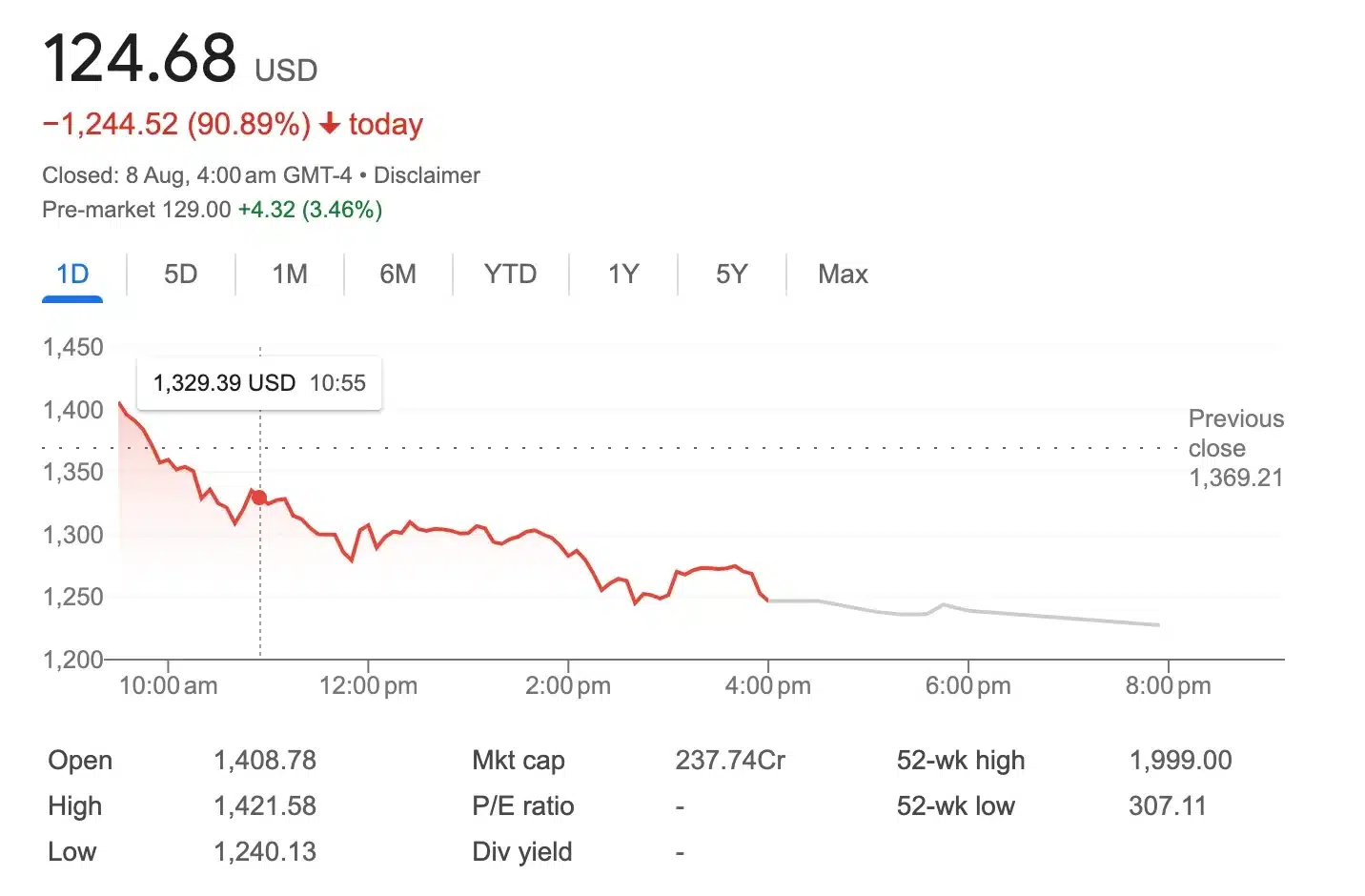

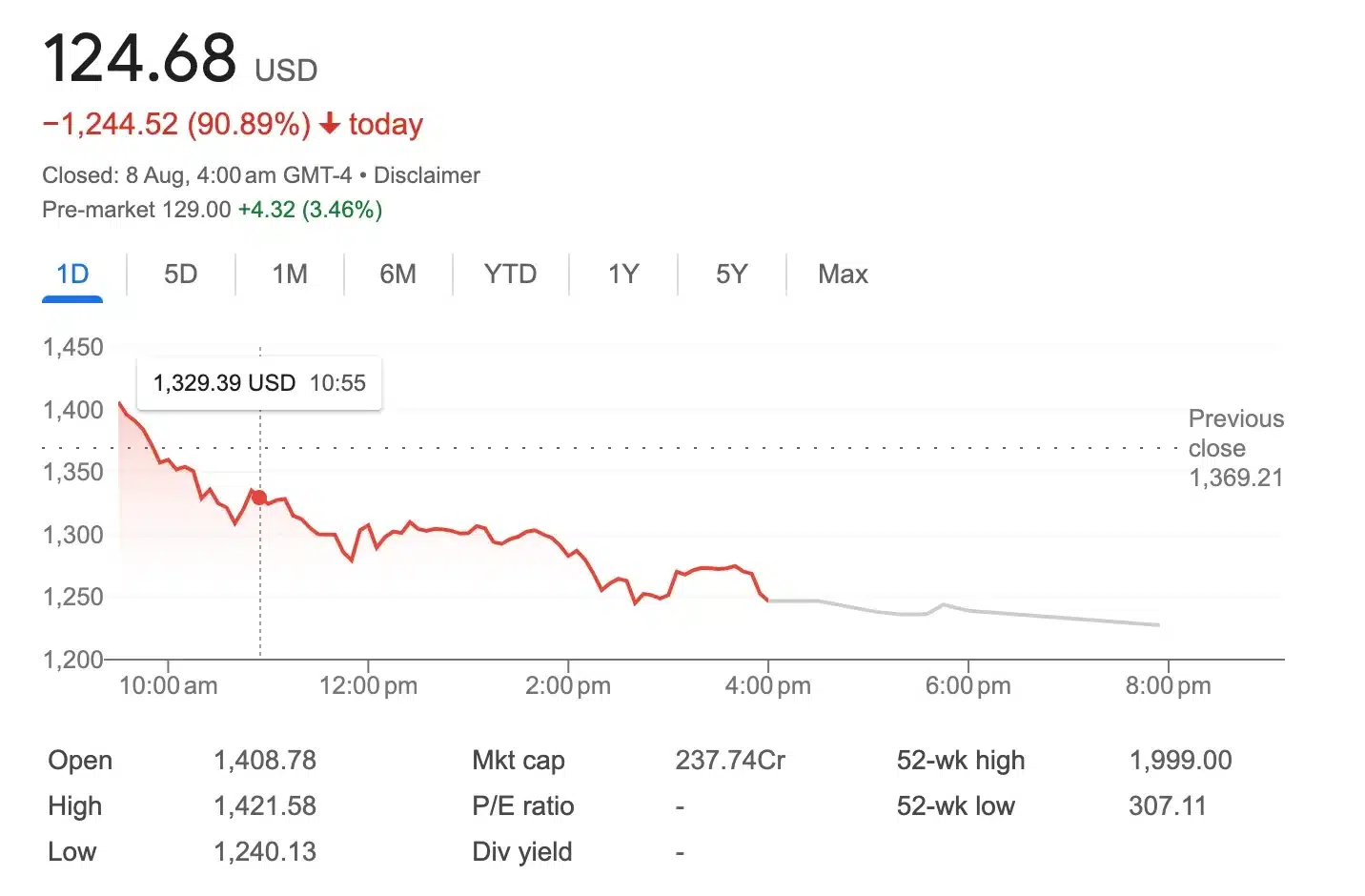

- MicroStrategy’s inventory surged 1,000% since adopting Bitcoin, however a latest dip of over 90% was famous.

Michael Saylor, the co-founder and chairman of MicroStrategy, recognized for his unwavering assist of Bitcoin [BTC], not too long ago disclosed that he has made a big private funding within the cryptocurrency.

Saylor’s Bitcoin holdings revealed

In a latest interview with Bloomberg, Saylor revealed that he owns 17,732 BTC and emphasised that he has not bought a single certainly one of these digital property.

“I proceed to accumulate extra. I feel it’s an awesome capital funding asset for a person, household, institutional company or nation. I can’t see a greater place to place my cash.”

This announcement garnered vital consideration as a result of it’s the primary time in 4 years that Saylor has publicly disclosed particulars about his private Bitcoin holdings.

Although Saylor didn’t specify the precise quantity of his present BTC holdings, he did verify that he hasn’t parted with any of his tokens since his preliminary disclosure.

MicroStrategy’s current Bitcoin holdings

Along with Saylor’s private investments, his firm, MicroStrategy, has emerged as the biggest public company holder of Bitcoin, amassing 226,500 tokens by the top of July.

With the present market worth, this intensive reserve is price roughly $12.7 billion.

That being mentioned, Saylor’s particular person BTC holdings are notably vital, representing round 10% of MicroStrategy’s complete Bitcoin portfolio.

Remarking on the identical, an X user- Yakuza mentioned,

“Actually not shocked. He’s been a real advocate for #bitcoin so long as I can bear in mind.”

Saylor’s comment on Senator Lummis’s BTC invoice

This disclosure coincides with Saylor’s latest interview with CNBC, the place he referred to Senator Lummis’s strategic BTC reserve invoice as a ‘Louisiana Buy’ second for the digital asset.

In utilizing this time period to explain Lummis’ Bitcoin reserve bill, Saylor implies it may have a transformative influence on U.S. BTC adoption, probably positioning the nation as a frontrunner within the cryptocurrency house.

This underscores not solely Saylor’s private funding in Bitcoin but additionally his advocacy for each his firm and the nation to embrace and admire its worth.

Market developments

As anticipated, MicroStrategy’s inventory has skyrocketed practically 1,000% for the reason that firm initiated its Bitcoin acquisition technique.

Over the identical timeframe, BTC itself has seen a considerable enhance of over 500%.

Nevertheless, regardless of Michael Saylor’s daring Bitcoin funding and MicroStrategy’s exceptional inventory surge, the present market exhibits a stark distinction.

Supply: Google Finance

As of the most recent replace, MicroStrategy’s inventory has plummeted by over 90%, whereas Bitcoin, trading at $57,000, has skilled solely a modest enhance of 0.53%.