- Metaplanet raises 10 billion yen to broaden its Bitcoin holdings, following MicroStrategy’s lead.

- Regardless of a 5.85% inventory drop, Metaplanet boasts 644% year-to-date positive factors.

Japanese agency Metaplanet has just lately gained consideration for considerably rising its Bitcoin [BTC] holdings.

As of the newest replace, Metaplanet, also known as Asia’s MicroStrategy, has raised 10 billion Yen in contemporary capital by way of its current inventory sale beneath the eleventh sequence of Inventory Acquisition Rights.

Metaplanet’s new Bitcoin technique

The truth is, based on the newest knowledge from Bitcoin Treasuries, Metaplanet just lately made two substantial BTC acquisitions on the fifteenth and sixteenth of October, pushing the corporate’s complete Bitcoin stability to 861.4 BTC.

This highlights the corporate’s plans to observe MicroStrategy’s lead through the use of these funds to broaden its Bitcoin holdings.

With 13,774 shareholders taking part, the train of those rights was absolutely backed by EVO FUND, leading to vital proceeds.

In the meantime, Bitcoin noticed over 2% worth dip after going through resistance on the $69,000 mark, reflecting ongoing volatility out there.

As of the newest replace from CoinMarketCap, BTC was buying and selling at $66,942.

Metaplanet’s CEO weighs in

Remarking on the identical, Metaplanet CEO Somin Gerovich famous,

“Metaplanet Inc. has concluded the train interval for its eleventh Inventory Acquisition Rights, attaining a 72.8% train price with participation from 13,774 particular person shareholders.”

He added,

“The Firm has additionally permitted the switch of unexercised rights to EVO FUND, which has dedicated to exercising all transferred rights by October 22, 2024.”

Gerovich defined that when the method of issuing inventory acquisition rights is absolutely accomplished, Metaplanet could have efficiently raised a complete of 10 billion yen.

He additional expressed gratitude to its shareholders for his or her assist and monetary contributions, that are essential for its aim of changing into a serious holder of BTC.

The “last outcomes” discuss with the entire accounting and reporting of the funds raised after EVO FUND (the entity concerned in exercising these inventory acquisition rights) completes its transaction.

All in all, Metaplanet is updating its shareholders on the progress and reaffirming its dedication to utilizing the capital to advance its Bitcoin-focused mission.

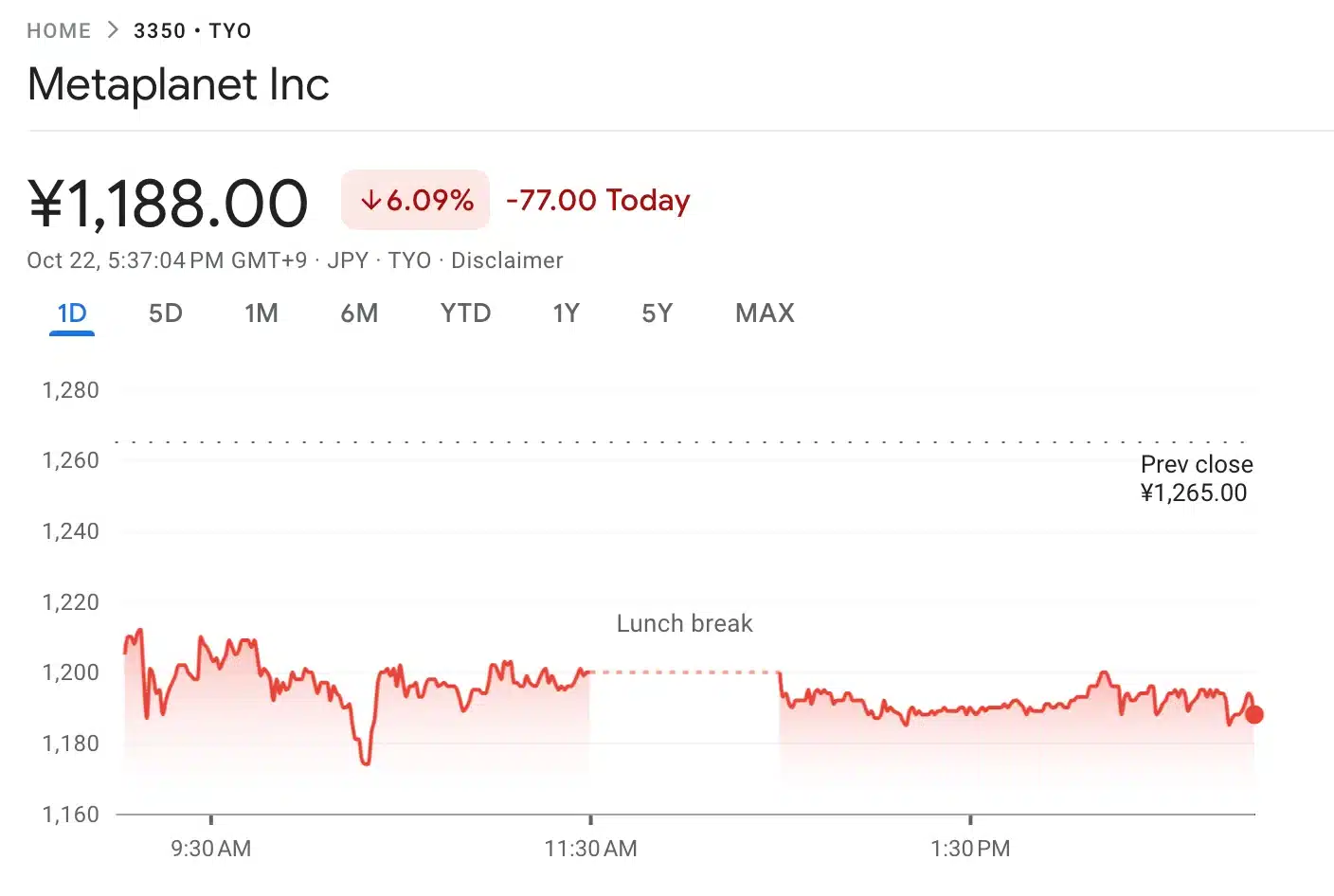

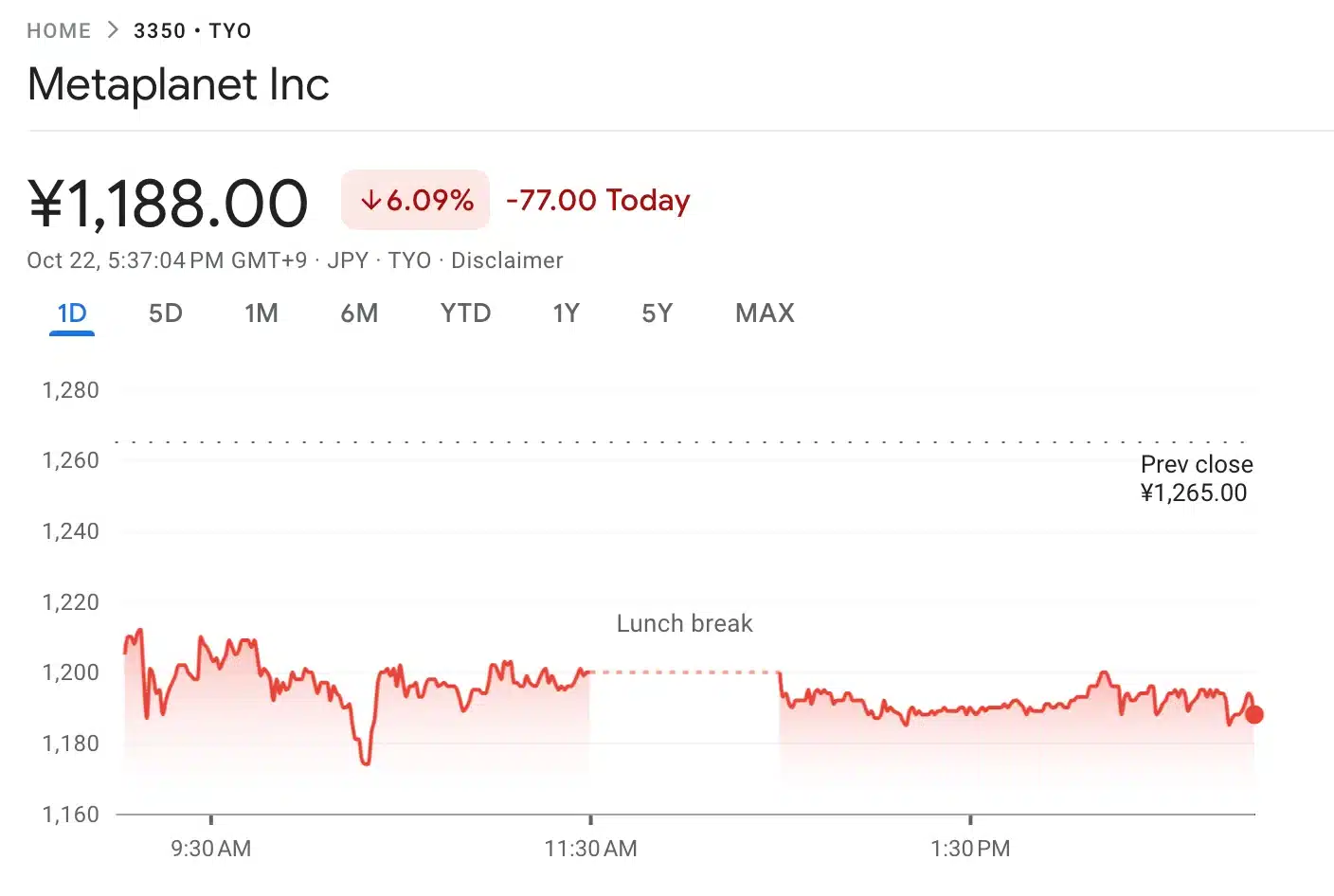

Impression on Metaplanet’s share worth

After as we speak’s inventory sale, Metaplanet’s share worth noticed a big decline, falling by 5.85% to beneath 1,200 JPY.

Regardless of this drop, the corporate stays in robust standing with a exceptional 644% enhance in year-to-date positive factors.

As of the newest replace, Metaplanet’s inventory worth additional dipped by 6.09%, buying and selling at 1,188 JPY.

Supply: Google Finance

This volatility displays the market’s rapid response to the inventory sale, but the corporate’s total efficiency continues to exhibit spectacular progress in the long run.

Therefore, by embracing BTC, Metaplanet seeks to navigate Japan’s difficult financial circumstances marked by destructive rates of interest and quantitative easing.

This daring strategy positions the corporate to hedge towards the nation’s monetary challenges whereas aligning with the worldwide shift in direction of digital belongings.