Damir Khabirov

Meta Platforms (NASDAQ: NASDAQ:META) has seen its share worth skyrocket from its lows, as buyers turn out to be much less involved about its AR/VR spending. Apple (NASDAQ: AAPL) getting into the business has doubtless been a robust supply of help. The corporate does keep a robust core enterprise, however its advert enterprise continues to see threats.

Our thesis with Meta Platforms is easy. The corporate is at a $760 billion valuation in a rising rate of interest atmosphere. To justify that valuation, you want shareholder returns. The corporate is chasing an AR/VR dream with no signal of revenue, and seeing rising competitors throughout its product traces, making it a poor funding.

Meta Monetary Efficiency

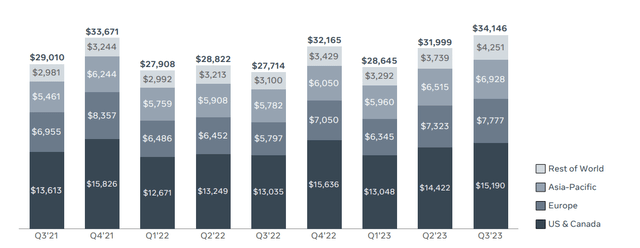

The corporate’s monetary efficiency exhibits improved income supported by developed markets.

Meta Investor Presentation

The corporate took a significant impression from Apple’s privateness modifications, nevertheless, it is labored to enhance focusing on for advertisers. Nonetheless it has achieved what we contemplate “full penetration” within the US & Canada market and there is not any indication of income development right here. Remainder of world income has remained sturdy and supported the corporate’s income and Asia-Pacific income has grown.

YTD the corporate’s inventory has greater than doubled. Most of that has been hype, as clearly evident above, the story across the firm’s monetary image has not modified YTD. Nevertheless, with the emergence of Chat GPT, expertise shares are attention-grabbing once more, and Meta Platforms stays one of the fashionable and well-known firms.

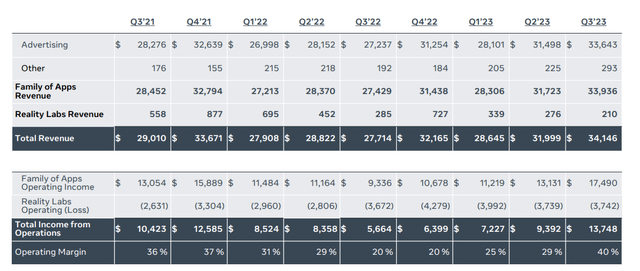

Meta Bills

Nevertheless, the corporate’s margins stay worse than they have been a number of years in the past, by a noticeable quantity.

Meta Investor Presentation

The corporate’s promoting income together with its general income made it one of many firm’s strongest quarters ever from a top-line perspective. Nevertheless, regardless of a modest restoration in its working margin from 25% to 29%, margins nonetheless stay effectively under the 40+% that they have been simply a number of years in the past.

The corporate’s most up-to-date quarter had sturdy margins, as income bounced up, however a decline in Actuality Labs’ income exhibits the corporate has no actual path to producing returns from the division. The corporate had large layoffs and centered to extend margins, however we have now but to see if the corporate’s current margin enhance is sustainable.

The corporate is buying and selling at a P/E of ~20x. That is a 5% shareholder yield, in step with present long-term treasury charges. For an organization to be buying and selling at a comparatively low yield, we count on the energy in development to justify it. The final a number of years don’t point out that that is the case.

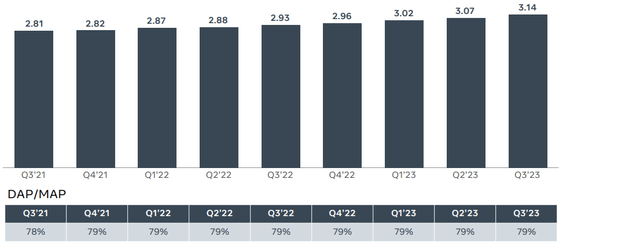

Meta Buyer Exercise

The corporate has seen buyer exercise enhance, however development charges stay pretty mounted.

Meta Investor Presentation

The corporate’s DAP / MAP ratio has remained roughly fixed at 79%. That exhibits it is not growing or bettering the ratio. We do not have the basic knowledge right here, however our guess is that is an intrinsic property of human exercise and social networks, and we do not count on this ratio to extend dramatically.

Any lower could be a big trigger for concern. The corporate’s development price is now within the mid-single digits per 12 months. The corporate’s largest supply of shoppers is much less its penetration into present markets, and extra continued development in international web entry. World web entry is increasing by ~4%. The corporate’s annualized person development is a mere 3% above that.

A scarcity of dramatic development is not “improper”, but it surely’s additionally not one thing you need to see from an organization that is valued as if it is persevering with to develop quickly.

Advert Enterprise Threats

The corporate’s core advert enterprise additionally faces threats.

We advocate an train for readers. Evaluate the valuation of the biggest web firms from 25 years in the past and in the present day. Evaluate the valuation of Yahoo and Myspace at their peak versus Google and Fb in the present day. You may discover some issues that’ll shock you.

- The web is far bigger in the present day. Person counts have elevated dramatically.

- Corporations are significantly better at promoting advertisements. Advert spending on-line has elevated dramatically. Fb and Google are significantly better than their predecessors.

- Change comes rapidly. It solely took a number of years for one thing extra attention-grabbing to MySpace to come back alone, and its decline was fast.

Now do not get us improper, Meta Platforms has substantial endurance. Nevertheless, threats exist. TikTok is now past 2 billion users, and the corporate is working to construct up its advert enterprise. Instagram reels shows the company sees the threat. ChatGPT was one thing nobody noticed coming a 12 months in the past, and now it is set data for development.

There’s at all times competitors wanting on the profitable market. Meta Platforms being so reliant on a single enterprise that has already seen cracks with Apple’s privateness modifications, and new opponents, is a significant threat. That is very true with the enterprise’ quickly slowed down development price.

One other main threat right here is that marketplaces are realizing that they’ve large advert potential as effectively. Amazon is likely one of the largest marketplaces on the earth. Amazon is realizing that relatively than placing an advert to your Amazon market on Google, it is far more environment friendly to easily pay Amazon for the advert. That is reflected in Amazon’s ad revenue.

Possibility Brief Alternative

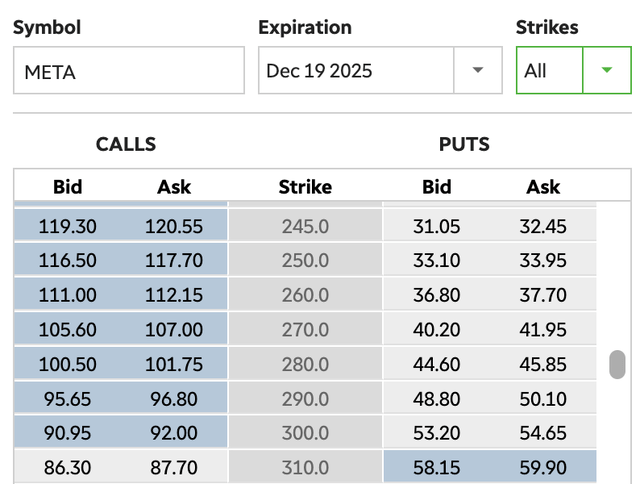

For these seeking to make investments, we advocate looking at choices.

TD Ameritrade

The upside of the technique we advocate is that unlikely a brief, the draw back will not be limitless. The draw back is that the potential losses are increased primarily based on capital invested, because the technique we’re about to debate represents far more of an “all or nothing”.

We advocate a vertical PUT unfold. Buyers purchase a $300 PUT for $54 / share on the midpoint and promote a $250 PUT for $33.5 / share on the midpoint. The expiration is Dec 2025, so simply over 2 years away. The web value from the funding is $20.5 / share in revenue that you simply get immediately. That value represents your most loss.

The perfect situation is that the corporate’s share worth closes under $250 / share. You get the shares offered to you at $250 and promote them at $300 making a $50 / share revenue ($29.5 internet revenue after your value). That is a 1.5x return on funding in 2 years if the corporate’s share worth drops greater than 15% throughout that time-frame.

The draw back is the share worth is above $300. Your PUTs are nugatory and also you lose $20.5. In our view, it is a respectable alternative given the corporate’s draw back.

Our View

Meta is an enormous firm with a $760 billion market cap. The corporate has been one of many high performing tech firms YTD.

Nevertheless, it must justify its valuation. Income are beneath $40 billion / 12 months as the corporate continues to see $15 billion / 12 months of losses from Actuality Lab. The corporate has a robust stability sheet and the power to make the most of all of its money for shareholder returns. Nevertheless, that is solely sufficient to repurchase roughly 6% of its shares yearly.

When long-term bonds are yielding 5%, you want extra returns otherwise you want extra development. To match the S&P 500, the corporate wants to have the ability to generate double-digit returns yearly. That is a troublesome bar to hit. We do not count on the corporate will obtain it.

Thesis Threat

The most important threat to our thesis is two-fold.

The primary threat is that Meta has confirmed endurance, particularly with its advert enterprise within the face of upstart opponents. TikTok has grown quickly but it surely’s struggled to realize the advert earnings energy of Meta. With anti-trust regulation limiting development, the corporate’s core positioning is robust. The corporate can handle to proceed steadily growing its income right here.

The second threat is {that a} substantial a part of the corporate’s valuation draw back is the large quantity of earnings being dumped into Actuality Labs. If the corporate as an alternative chooses to make use of that capital in the direction of shareholder returns, we count on it to get a giant increase from the market. That would assist short-to-mid-term shareholder returns, and allow long-term repurchases.

Conclusion

Meta has seen its share worth carry out extremely effectively this 12 months after a considerable quantity of weak point in prior years. That weak point has come from the corporate’s Actuality Labs division, which even after lay-offs, is one thing that the corporate hasn’t managed to unravel. The corporate is continuous to speculate massively in AR/VR with out a confirmed path to returns.

Tech firms around the globe have an issue. You are producing $10s of billions and share buybacks are boring. It is easy to be incentivized to spend massively on the newest and most attention-grabbing expertise. Shareholders stay enamored by the money move potential of tech firms. The corporate’s valuation is excessive and we count on it will battle to generate future returns.

Tell us your ideas within the feedback under.