JHVEPhoto

Thesis

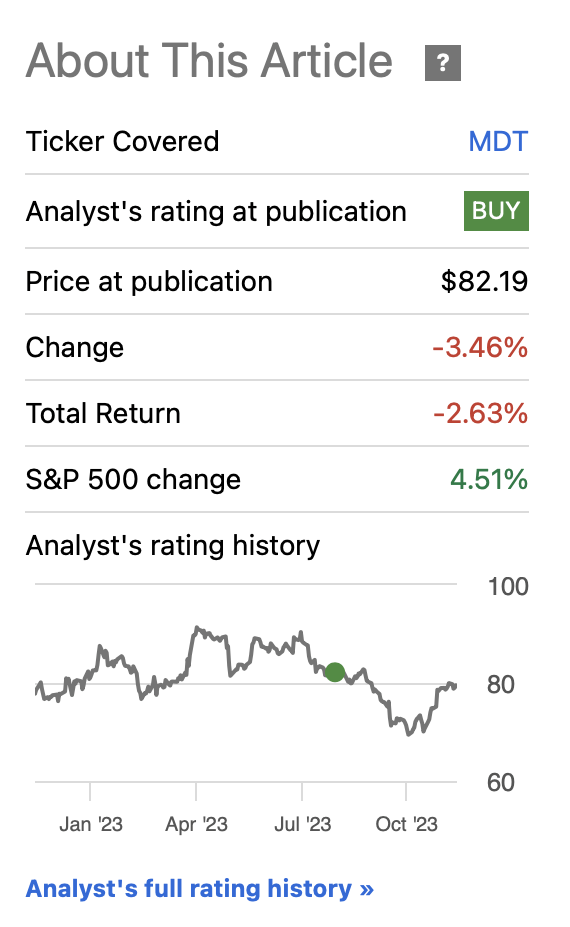

Since my preliminary article on Medtronic plc (NYSE:MDT) the inventory has skilled a decline, propelled by issues surrounding Medtronic’s diabetes enterprise—primarily targeted on insulin pumps and displays. The apprehension stems from the latest approvals of weight reduction medicine by Novo Nordisk A/S (NVO) and Eli Lilly and Firm (LLY), which have forged doubt on the longer term prospects of the aforementioned diabetes phase.

This text goals to elucidate why Medtronic stays resilient and why weight-loss medicine pose no vital menace to the general power of the corporate.

In my earlier evaluation, I established a good inventory worth of $128.79, indicating a possible upside of 58% at the moment. Nonetheless, on this up to date evaluation, I’m upgrading it to a Robust Purchase. Consequently, I’m revising its honest worth upward to $137.6.

Overview

Q2 Earnings Report

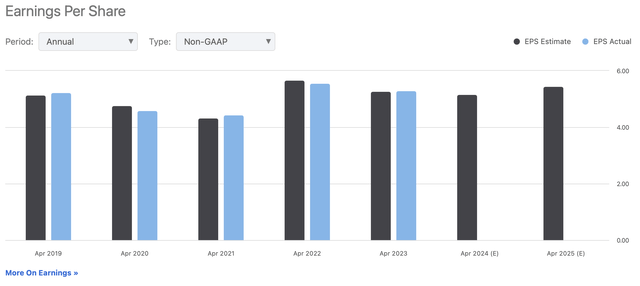

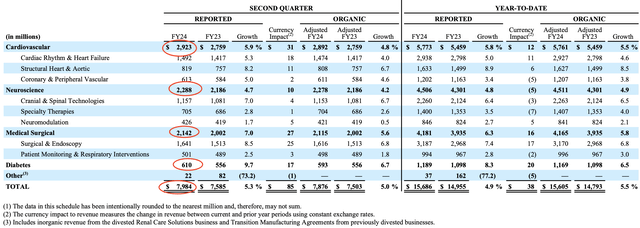

Within the second quarter of 2024, Medtronic surpassed EPS estimates by $0.07 and exceeded income expectations by $80 million. Following this constructive efficiency, Medtronic has revised its non-GAAP EPS steerage, growing it from $5.08-$5.16 to $5.13-$5.19—a distinction of $0.04, comparable to $45.2 million.

Why the inventory was declining after my first article?

For the reason that publication of my preliminary article on Medtronic, the inventory initially skilled a decline of 14.62%, regardless of my projection of Medtronic’s honest worth at $128.79, representing a 58% improve over the prevailing inventory worth of $82.19 at the moment.

The first catalyst for this 14.62% downturn was the approval of weight problems medicine by firms resembling Novo Nordisk and Eli Lilly. These medicine goal to expedite weight reduction in overweight people present process a strict weight loss program and train routine. The priority arose from the potential influence on Medtronic’s diabetes phase, provided that people on the highest danger of diabetes are sometimes overweight. If a remedy facilitates weight reduction on this demographic, the chance of diabetes is predicted to lower.

Nonetheless, the inventory has since rebounded, and the preliminary 14.6% decline has now narrowed to a mere 2.63%. For my part, a key issue contributing to this restoration is the belief that present weight problems tablets may induce serious side effects, together with a heightened danger of bowel obstruction and gastrointestinal points. As of now, weight-loss tablets are usually not deemed environment friendly sufficient to jeopardize the marketplace for diabetic gadgets and coverings.

It’s essential to notice that Medtronic’s diabetes segment specializes in selling insulin pumps, such because the MiniMed 630G, and glucose displays. Subsequently, a discount within the diabetic inhabitants would seemingly result in a considerable decline in demand for these merchandise.

Inventory Efficiency after my first article on Medtronic was launched (In search of Alpha)

Which gamers have launched weight-loss remedies?

Probably the most recognized is Novo Nordisk’s Wegovy which was launched within the U.S. in June 2021, however attributable to an preliminary manufacturing outage, all doses turned obtainable in December 2022. The opposite drug created by Novo Nordisk is Ozempic, which is a weekly injection designed to decrease blood sugar by stimulating the pancreas to provide extra insulin. This final one is prescribed for weight reduction regardless of not being accepted for that function.

Eli Lilly gives Zepbound within the type of an injection, which is FDA-approved if mixed with a reduced-calorie weight loss program and elevated bodily exercise for persistent weight administration.

Lastly there’s Pfizer’s danuglipron, which demonstrated vital weight reduction in a scientific trial as members skilled a mean weight reduction starting from 8% to 13% after 32 weeks. This product is just not nonetheless accepted for prescription.

Why will not Medtronic undergo if weight-loss drugs acquire traction?

It is vital to notice that the present downside of weight reduction remedies lies in the truth that patients typically begin regaining weight as quickly as they stop the remedy.

Moreover, it is essential to acknowledge that Medtronic’s diabetes enterprise contributes solely roughly 7.64% to its general revenues. The first income driver for Medtronic is its cardiovascular devices segment, which accounts for a major 36.6% of the overall income. As talked about earlier, the burden loss remedies beneath dialogue have unintended effects associated to coronary heart ailments, and paradoxically, this might be advantageous for Medtronic given its substantial presence within the cardiovascular gadgets market.

In step with its strategic imaginative and prescient, Medtronic is actively pursuing a cost-cutting technique, with a selected emphasis on divesting sure belongings. As articulated by the CEO, this strategy is anticipated to generate financial savings totaling $1 billion by the 12 months 2025.

Market (In tens of millions of USD except states in any other case)

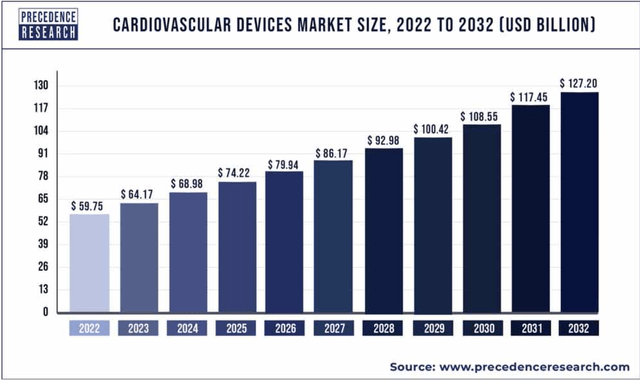

Medtronic’s main income driver, the cardiovascular devices market, is projected to keep up a sturdy progress trajectory with a compound annual progress price [CAGR] of seven.9% till the 12 months 2032. This notable projection underscores the promising progress prospects inside Medtronic’s pivotal sector.

Priority Analysis

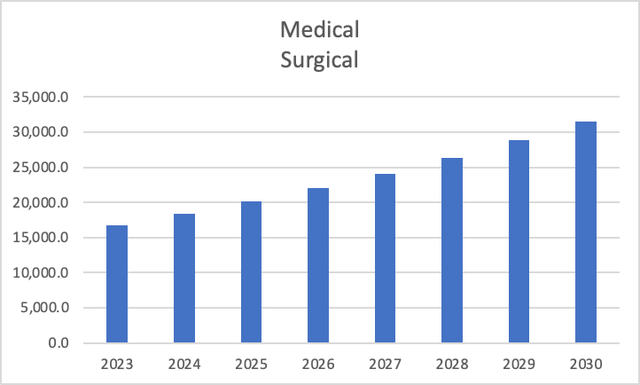

Globally, the medical surgical devices market is anticipated to broaden considerably, demonstrating a CAGR of 9.4%. This progress trajectory is predicted to raise the market from $16.8 billion in 2023 to a considerable $31.58 billion by 2030.

Writer’s Calculations with base on Grand View Analysis

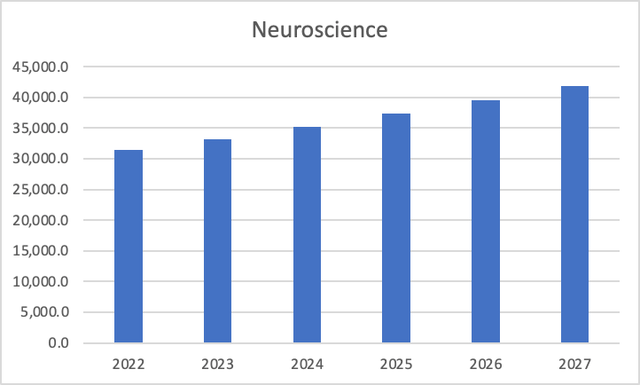

Inside the realm of neuroscience, an upward trajectory is foreseen, transitioning from $31.38 billion in 2022 to an estimated $41.86 billion in 2027. This progress is underpinned by a calculated CAGR of 5.95%.

Writer’s Calculations with base on The Enterprise Analysis Firm

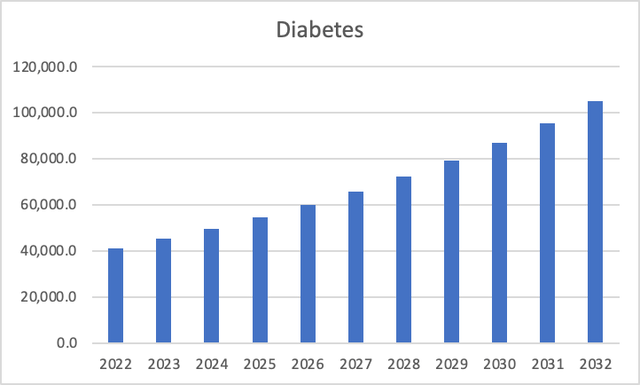

Conversely, the diabetes medical devices phase is poised for exceptional development. Projected to surge at a CAGR of 9.8%, this phase is anticipated to burgeon from $41.2 billion in 2022 to a powerful $107.1 billion by 2032. This trajectory is fueled by escalating diabetes prevalence and escalating investments from each private and non-private entities on this area.

Writer’s Calculations with base on World Market Insights

As you could have guessed, the principle driver of progress right here, is the getting old inhabitants that may improve the demand for medical procedures. Evidently, all segments, apart from neuroscience, are poised for prime single-digit progress. This pattern is promising, indicating that Medtronic possesses the potential to outpace the 4 – 4.5% progress it has maintained over the previous 5 years – a price that aligns with its latest This fall 2023 earnings report. Ought to Medtronic align its progress with the tempo of their respective market segments, an optimum progress price of 8.25% might feasibly be anticipated.

Financials (In tens of millions of USD except states in any other case)

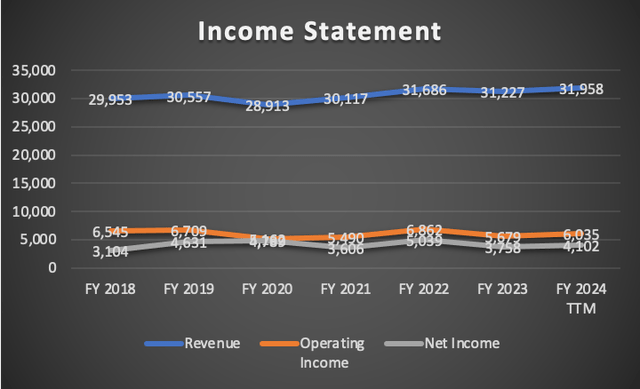

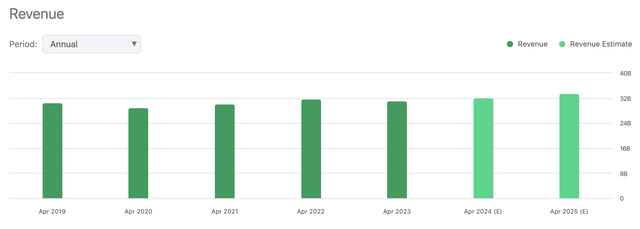

For the reason that launch of my first article on Medtronic in Q1 2024, the 2024 TTM income has proven a modest improve, rising from $31.5 billion to $31.95 billion, reflecting a 1.42% progress. Over a extra prolonged interval, since FY 2018, Medtronic’s income has demonstrated sluggish however constant annual progress, averaging 1.11%.

Working incomes have equally skilled a marginal uptick, registering a rise of 1.29%. Notably, probably the most substantial progress has been noticed in web revenue, surging by roughly 13.3% from the Q1 2024 TTM determine to the Q2 2024 TTM metric.

Writer’s Calculations

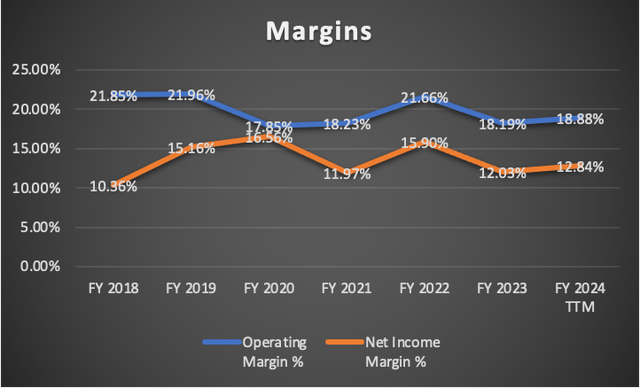

Margin indicators have additionally seen constructive actions. In Q1 2024, each working and web revenue margins on a TTM foundation have been 18.9% and 11.5%, respectively. As of the most recent knowledge, these margins have barely improved, now standing at 18.88% and 12.84%, respectively.

Whereas working margin skilled a slight decline from its Q1 2024 TTM stage of 18.9%, the online revenue margin has witnessed progress, progressing from 11.5% to 12.84% after the Q2 2024 launch.

Writer’s Calculations

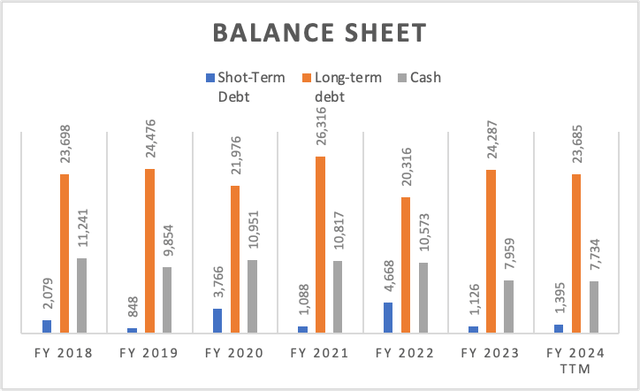

Inspecting the identical interval, it is noteworthy that earlier than Q2, long-term debt was recorded at $24.4 billion and has since lowered to $23.6 billion, indicating a 3.38% discount. This achievement in debt discount has had a minimal influence on money reserves, as money, which beforehand totaled $7.87 billion, now stands at $7.73 billion, reflecting a 1.81% discount.

Writer’s Calculations

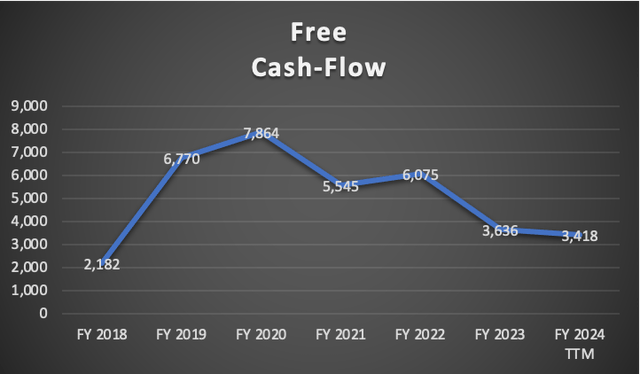

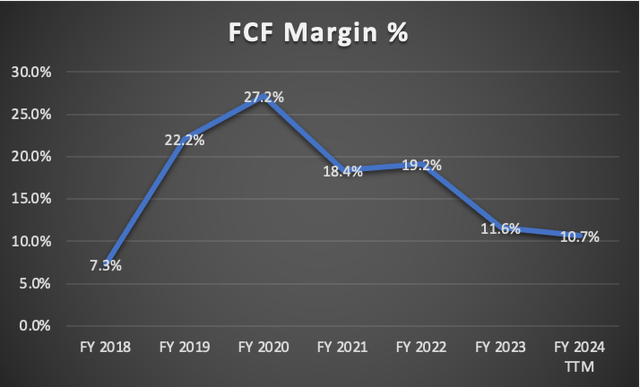

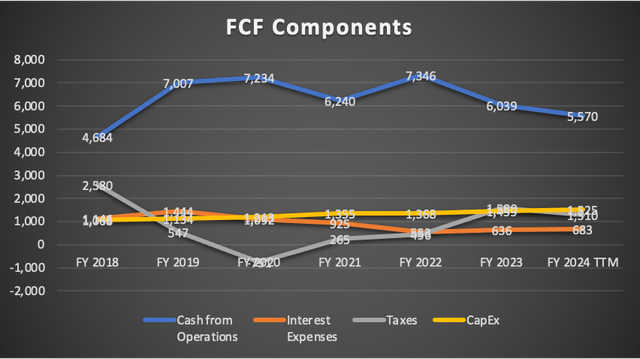

Nonetheless, free money move has not but recovered to its 2019 peak when the money move margin reached 27.2%. A more in-depth take a look at the “Free Money Circulate Parts” desk reveals that that is primarily attributed to a discount in money from operations.

Returning to the efficiency of free money move earlier than and after Q2, there was a constructive pattern with a 6.94% improve, rising from $3.19 billion to $3.41 billion.

Writer’s Calculations

Writer’s Calculations

Writer’s Calculations

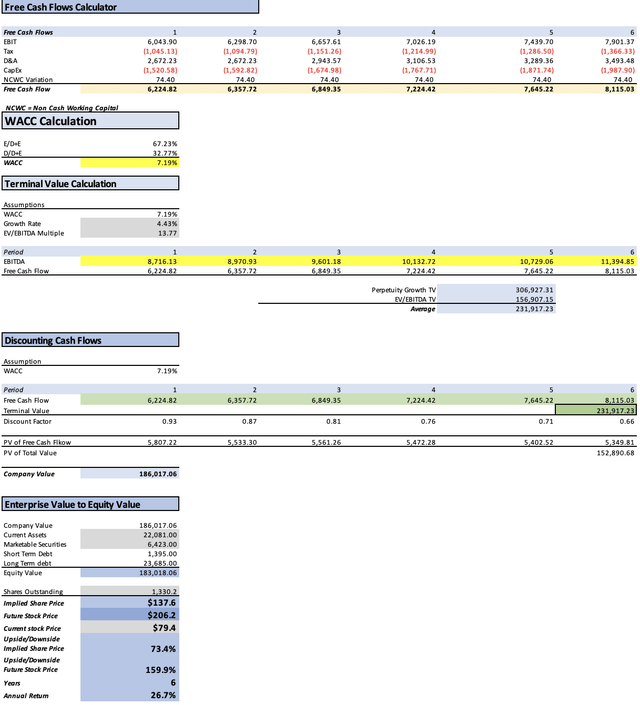

Valuation

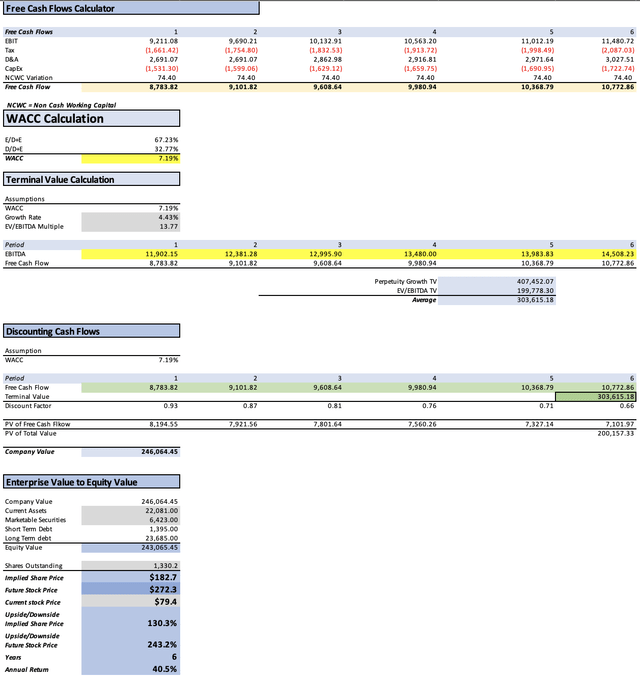

On this valuation, I’ll conduct two DCF fashions to evaluate Medtronic’s intrinsic worth. The primary mannequin incorporates Analysts’ estimates for income and EPS in FY2024 and FY2025, together with ahead income progress and the three to 5-year long-term EPS progress price.

The second DCF mannequin is grounded within the anticipated market income projections for every of Medtronic’s working segments.

The desk supplied comprises all the present knowledge related to Medtronic. Using this knowledge, I’ll compute the WACC by contemplating Fairness worth, Debt worth, and Price of debt. Moreover, Depreciation and Amortization (D&A), Curiosity, and CapEx can be derived utilizing margins tied to income progress. This strategy ensures that as Medtronic’s income expands, these bills may also improve, providing a extra real looking and logical projection.

| TABLE OF ASSUMPTIONS | |

| (Present knowledge) | |

| Assumptions Half 1 | |

| Fairness Worth | 51,460.00 |

| Debt Worth | 25,080.00 |

| Price of Debt | 2.72% |

| Tax Fee | 24.21% |

| 10y Treasury | 4.17% |

| Beta | 0.83 |

| Market Return | 10.50% |

| Price of Fairness | 9.42% |

| Assumptions Half 2 | |

| CapEx | 1,525.00 |

| Capex Margin | 4.77% |

| Web Revenue | 4,102.00 |

| Curiosity | 683.00 |

| Tax | 1,310.00 |

| D&A | 2,680.00 |

| Ebitda | 8,775.00 |

| D&A Margin | 8.39% |

| Curiosity Expense Margin | 2.14% |

| Income | 31,958.0 |

Analysts’ Estimates

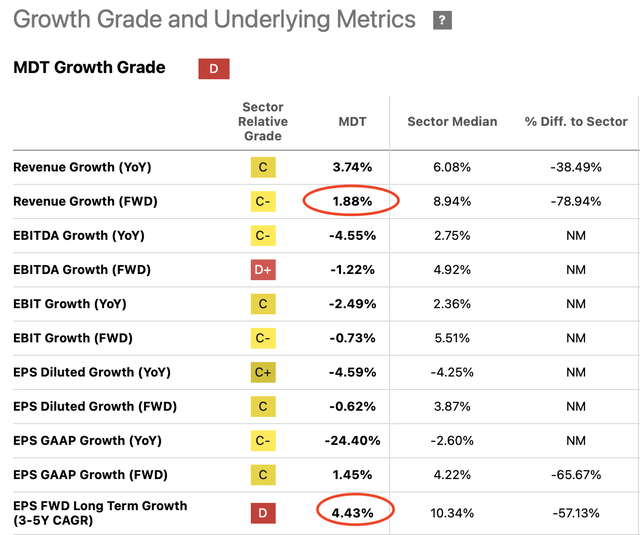

On this preliminary valuation mannequin, I’m assessing Medtronic primarily based on present analysts’ estimates for income, EPS, ahead income progress, and the 3-5 12 months long-term EPS progress price.

Beginning with income, analysts anticipate Medtronic to realize $32.09 billion for FY2024 and $33.51 billion for FY2025, translating to an annual income improve of 4.42%.

In search of Alpha

Transferring on to EPS, analysts mission an annual EPS of $5.16 for FY2024 and $5.45 for FY2025, equal to earnings of $6.86 billion and $7.24 billion, respectively.

In search of Alpha

By referencing the “Progress” tab on In search of Alpha for Medtronic’s inventory ticker, analysts foresee a ahead income progress of 1.88%. This estimate is utilized to foretell revenues from FY2026 to FY2029. Moreover, analysts mission a 3-5 12 months long-term EPS progress price of 4.43%, which is utilized to forecast web incomes for the talked about years.

In search of Alpha

| (Analysts’ Estimates) | Income | Web Revenue | Plus Taxes | Plus D&A | Plus Curiosity |

| 2023 | $32,090.0 | $6,863.83 | $8,525.25 | $11,216.32 | $11,902.15 |

| 2024 | $33,510.0 | $7,249.59 | $9,004.39 | $11,695.46 | $12,381.28 |

| 2025 | $34,140.0 | $7,570.75 | $9,403.28 | $12,266.26 | $12,995.90 |

| 2026 | $34,781.8 | $7,906.13 | $9,819.85 | $12,736.65 | $13,480.00 |

| 2027 | $35,435.7 | $8,256.37 | $10,254.87 | $13,226.51 | $13,983.83 |

| 2028 | $36,101.9 | $8,622.13 | $10,709.16 | $13,736.67 | $14,508.23 |

| ^Last EBITA^ |

Writer’s Calculations

Upon finishing the mannequin, the consequence signifies a valuation of $182.70, reflecting a major 130.3% upside from the present inventory worth of $79.40. Moreover, the DCF evaluation means that by 2028 (FY2029), the inventory is predicted to achieve a worth of $272.3, indicating a powerful upside of 243.2%. In different phrases, this suggests an annual return of 40.5% over a six-year interval.

My Estimates

On this second mannequin, my goal is to foretell revenues for every phase by leveraging the expansion charges of the respective markets by which these segments function.

Beginning with the segmentation breakdown, Cardiovascular emerges as probably the most substantial phase, constituting 36.6% of whole revenues. Following intently is Medical Surgical, contributing 28.65%, succeeded by Neuroscience at 26.82%, and Diabetes, which, among the many main segments, gives the least at 7.64%. The “different” phase, being comparatively small, is omitted from consideration.

Segments (Medtronic FQ2 2024)

Referring to the expansion charges specified within the “Market” subsection of the “Overview” part, the cardiovascular gadgets market is anticipated to develop at a price of seven.9%, Medical Surgical at 9.4%, Neuroscience at 5.9%, and Diabetes Units at a price of 9.8%, all projected by way of 2028.

| Cardiovascular | Medical Surgical | Neuroscience | Diabetes | |

| FY 2018 | 11,696.6 | 9,156.0 | 8,571.1 | 2,441.6 |

| FY 2019 | 12,620.7 | 10,016.6 | 8,061.2 | 2,680.9 |

| FY 2020 | 13,617.7 | 10,958.2 | 7,581.5 | 2,943.6 |

| FY 2021 | 14,693.5 | 11,988.3 | 7,130.4 | 3,232.1 |

| FY 2022 | 15,854.3 | 13,115.2 | 6,706.2 | 3,548.8 |

| FY 2023 | 17,106.8 | 14,348.0 | 6,307.1 | 3,896.6 |

| FY 2024 TTM | 36.60% | 28.65% | 26.82% | 7.64% |

To finalize the mannequin, a web revenue margin for the projection is established, using the common web revenue margin recorded from FY2018 to FY2024, which stands at 13.55%.

Upon examination of the desk, it is evident that this strategy is extra conservative than analysts’ expectations. For simpler comparability, the earlier desk is included under.

| (My Estimates) | Income | Web Revenue | Plus Taxes | Plus D&A | Plus Curiosity |

| FY 2024 | $31,865.3 | $4,317.75 | $5,362.88 | $8,035.11 | $8,716.13 |

| FY 2025 | $33,379.3 | $4,522.90 | $5,617.68 | $8,289.91 | $8,970.93 |

| FY 2026 | $35,101.0 | $4,756.18 | $5,907.44 | $8,851.01 | $9,601.18 |

| FY 2027 | $37,044.2 | $5,019.49 | $6,234.49 | $9,341.02 | $10,132.72 |

| FY 2028 | $39,224.4 | $5,314.91 | $6,601.40 | $9,890.76 | $10,729.06 |

| FY 2029 | $41,658.5 | $5,644.72 | $7,011.06 | $10,504.54 | $11,394.85 |

| ^Last EBITA^ |

| (Analysts’ Estimates) | Income | Web Revenue | Plus Taxes | Plus D&A | Plus Curiosity |

| 2023 | $32,090.0 | $6,863.83 | $8,525.25 | $11,216.32 | $11,902.15 |

| 2024 | $33,510.0 | $7,249.59 | $9,004.39 | $11,695.46 | $12,381.28 |

| 2025 | $34,140.0 | $7,570.75 | $9,403.28 | $12,266.26 | $12,995.90 |

| 2026 | $34,781.8 | $7,906.13 | $9,819.85 | $12,736.65 | $13,480.00 |

| 2027 | $35,435.7 | $8,256.37 | $10,254.87 | $13,226.51 | $13,983.83 |

| 2028 | $36,101.9 | $8,622.13 | $10,709.16 | $13,736.67 | $14,508.23 |

| ^Last EBITA^ |

Writer’s Calculations

In the end, this conservative situation interprets right into a inventory worth goal of $137.6, accompanied by a future worth projection of $206.2, indicating a compelling annual return of 26.7%.

Riks to Thesis

The first danger to my optimistic (however nonetheless extra conservative than analysts’) outlook lies within the inherent nature of medical machine firms, together with Medtronic, which closely depend upon innovation and the approval of latest merchandise. This approval course of can range from as little as every week to so long as eight months. Falling behind opponents and failing to catch up on this dynamic setting might probably seal Medtronic’s destiny.

Furthermore, a broader problem throughout the healthcare system, spanning from medicine to gadgets, introduces an extra layer of danger. President Biden’s latest announcement expressing a willingness to exercise executive power to seize drug patents, with the goal of decreasing medicine prices, raises issues. An analogous situation might unfold for medical gadgets, initiating an inevitable worth struggle. Nonetheless, the draw back of this strategy may embrace hindering the innovation of latest medicine and gadgets. In such a hypothetical scenario, solely giant companies may survive, probably catalyzing mega-mergers throughout the healthcare sector, harking back to historic occasions in different regulated industries, resembling railway firms dealing with heavy taxes and laws.

Lastly, Medtronic’s energetic pursuit of a cost-cutting technique, with a particular emphasis on divesting sure belongings, introduces one other dimension of danger. As articulated by the CEO, this strategy is projected to yield financial savings amounting to $1 billion by the 12 months 2025. The importance of reaching this purpose is underscored by the truth that, given Medtronic’s unlikely prospect of providing 20%+ income progress within the close to future, creating worth by way of improved free money move turns into very important.

Conclusion

In conclusion, my complete evaluation of Medtronic, considering numerous monetary fashions and potential dangers, underscores a sturdy funding case. Using analysts’ estimates and a market-based segmentation strategy, the primary mannequin predicts a considerable 130.3% upside from the present inventory worth of $79.40, with a future worth projection reaching $272.3 by 2028, implying an distinctive annual return of 40.5% over six years. The second mannequin (that are my estimates and subsequently the ultimate inventory goal worth), adopting a conservative stance and predicting phase revenues primarily based on market progress charges, yields a extra reasonable inventory worth goal of $137.6, accompanied by a future worth projection of $206.2, translating to a compelling annual return of 26.7%. Each eventualities, regardless of their variations, converge on a “Robust Purchase” suggestion for Medtronic, aligning with the corporate’s proactive cost-cutting technique and resilient monetary efficiency.