M. Suhail

The McDonald’s Company (NYSE:MCD) has demonstrated a strong historical past of constant earnings progress, solidifying its place as a stalwart within the fast-food trade. This gross sales progress has endured in latest quarters, with robust gross sales progress reported throughout most of McDonald’s main markets. This spectacular efficiency is attributed partly to strategic worth changes made to counter inflation, regardless of related value will increase in key components like cheese and meat. Remarkably, this didn’t deter patrons, because the variety of guests to McDonald’s eating places within the US continued to rise.

In an period more and more outlined by digitalization, McDonald’s has additionally been proactively enhancing its on-line channels to additional drive gross sales progress. In my opinion, robust funding in these digital channels positions McDonald’s properly to learn from altering shopper behaviors, which sees customers more and more eager to order in. Research present that this shift in habits spans throughout all age teams, solidifying meals supply as a everlasting fixture within the restaurant trade. At the moment, digital orders represent a considerable 40% of gross sales in McDonald’s high six markets, positioning the corporate properly to capitalize on this evolving shopper development and keep its sturdy market share.

Gross sales progress and outlook

Within the second quarter of 2023 McDonald’s reported a 17.7% 12 months-over-12 months (YoY) improve in gross sales at firm owned eating places and a rise in gross sales of simply over 11% YoY at franchisee owned eating places. Whole international comparable gross sales elevated by round 11.7% Quarter-over-Quarter (QoQ) which exceeded analysts’ expectations of a rise of round 9.2%.

This robust gross sales progress has been partially attributed to elevated costs to maintain tempo with inflation. The inflation pushed will increase had been additionally coupled with will increase within the prices related to key components similar to cheese and meat and will probably lead to a discount within the variety of patrons. Regardless of this inflation pushed will increase, McDonald’s additionally noticed a rising variety of guests to its eating places within the US. In my opinion, that is indicative of its comparatively good pricing energy, with a capability to extend costs to guard margins with out shedding its patrons.

As a part of its efforts to proceed driving gross sales progress, McDonald’s has additionally actively labored on strengthening its on-line channels. In the UK, McDonald’s has for instance entered right into a long-term partnership with Deliveroo to develop supply choices for McDonald’s meals. When it comes to this settlement, Deliveroo, whose largest buyer base is within the UK, would be part of the McDelivery companions to ship meals. Within the US, McDonald’s largest market, the corporate has additionally actively labored on bettering its app with administration noting that –

Final quarter, we launched an enhanced ordering course of by way of our app within the US with the purpose of delivering a sooner and extra fulfilling expertise for the shopper. Whereas we’re nonetheless studying from this deployment, early outcomes have been extraordinarily optimistic with elevated gross sales initiated by way of the app, elevated buyer satisfaction and improved service instances.

In my opinion, this continued give attention to bettering digital gross sales methods and supply providers shall be essential for McDonald’s long run progress given the elevated shopper choice for meals delivered on to their door. In a examine commissioned by Next Bite it was discovered that round 43% of customers now order meals for supply at the very least as soon as a month whereas 23% of customers order meals for supply at the very least as soon as every week. In line with a examine performed by Subsequent Chew, previous to the pandemic, the 18-34 age group predominantly utilized meals supply providers, as they had been essentially the most adept at utilizing cellular apps and their life prioritized pace and comfort. Nonetheless, the pandemic led to a shift in habits pushed by necessity and security issues, resulting in widespread acceptance of ordering supply throughout all age teams.

The examine notes that whereas millennials stay essentially the most frequent customers (with 71% putting weekly orders), even older demographics have embraced on-line meal supply platforms now contemplating it a traditional a part of their routine. Consequently, meals supply has solidified its place as a everlasting fixture throughout the restaurant trade, necessitating that supply choices cater to a much wider viewers. For McDonald’s itself, digital orders now make up round 40% of gross sales in its high six markets. Subsequently, McDonald’s is for my part properly positioned to proceed capitalizing on this alteration in shopper habits, which must also help it in sustaining its robust market share.

Nonetheless, administration at the moment expects gross sales progress to decelerate within the second half of the 12 months. This decline in gross sales progress is predicted to be pushed by declining inflation and a more difficult macroeconomic setting in a few of its key markets. Administration has noticed on this respect that –

..we actually are seeing inflation begin to step by step come down. I feel that is been the case within the US enterprise most likely beginning the tip of final 12 months. It is clearly nonetheless elevated, however I feel we’re seeing that gradual form of decline. And I feel within the majority of our worldwide markets, we began to see, I feel, as we head into the again half of the 12 months, the gradual decline start there as properly. And so I feel as inflation begins to return down, I would definitely count on our pricing ranges to additionally begin to come down … I feel there are a variety of our high markets the place we all know the macroeconomic situations are difficult. We all know there continues to be numerous strain on customers. We all know shopper sentiment continues to be impacted. And so we do count on the broader sector to form of start to form of decline in these markets as we undergo the again half of the 12 months.

These elements actually appear more likely to contribute to a moderation in gross sales progress. Nonetheless, for my part, a decline in costs may properly lead to an additional improve in foot visitors which might offset any decrease costs. Nonetheless, that is actually an space for traders to watch carefully, significantly as analysts count on the broader fast service restaurant trade to face a more difficult working setting within the quarters forward.

Extra time guidelines

In a latest article posted on SeekingAlpha Information, it was famous {that a} proposed change to extra time guidelines by the Division of Labour might pose vital challenges to fast service eating places similar to McDonald’s. When it comes to the proposal, the wage threshold for extra time eligibility beneath the Honest Labor Requirements Act can be elevated to $1,059 per week, equal to $55,068 yearly. In line with the Division of Labor, that is anticipated to develop protection to three.6 million further staff.

Whereas the precise variety of staff at McDonald’s who’re more likely to be affected isn’t recognized, the Division of Labor’s figures point out that simply over 21% of the possibly affected workers are employed within the leisure and hospitality sectors. This exhibits that the short service restaurant sector will definitely be affected by the proposed rule ought to it take impact. Nonetheless, I’m of the view that the exact impression could also be extra restricted, provided that the Division of Labor’s personal report notes that almost all of the possibly affected staff don’t work extra time. In a consultant week, solely round 3.6% of those staff ordinarily work extra time.

Nonetheless, the Division of Labor expects the entire direct value of this proposal to quantity to round $1.2 billion in further wages to be paid within the first 12 months of this proposal taking impact. This contains greater than $400 million in anticipated regulatory familiarization prices. The impact of the rise wouldn’t accordingly be restricted to the precise cost of the elevated wages but additionally by basic regulatory compliance value which might come up even when the enterprise had a comparatively small variety of affected workers. The impact of the foundations should not accordingly insignificant to McDonald’s for my part however appear extra more likely to be handed onto customers than having a considerable impact on profitability. In my opinion, McDonald’s robust pricing energy, as evidenced by its means to lift costs within the present excessive inflation setting with out shedding foot visitors, locations it in a powerful place to cross these prices onto clients with out scaring clients off.

Valuation

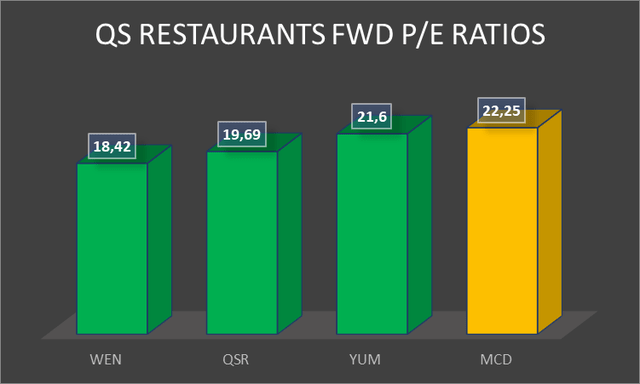

McDonald’s is buying and selling at a ahead P/E ratio of round 22.25 which is the best of the short service restaurant teams thought-about within the peer comp chart beneath. This elevated valuation is perhaps partially justified by robust gross sales progress and is decrease than McDonald’s historic ahead P/E ratio, with its 5-year common ahead P/E ratio of 24.9 and a 10-year common ahead P/E ratio of 24.7.

QS Eating places FWD P/E Ratios (Creator created based mostly on knowledge from EquityRT)

Regardless of its higher-than-peers valuation stage, McDonald’s inventory doesn’t accordingly seem overvalued for my part. Nonetheless, I’m additionally not capable of conclude that the inventory is considerably undervalued. The present low cost to its historic ranges possible come up from issues over slowing gross sales progress and may properly justify a ten% low cost to its historic common ahead P/E ratio. In my opinion, the inventory is at the moment buying and selling round truthful worth and would begin presenting a gorgeous purchase round $260 per share.

Conclusion

McDonald’s robust gross sales progress, attributed partly to strategic pricing changes, displays its means to navigate challenges like inflation and rising ingredient prices whereas sustaining buyer loyalty. It’s this robust pricing means that additionally leads me to be much less involved in regards to the newly proposed wage guidelines. In the end, I imagine that McDonald’s can be properly positioned to cross on the majority of those prices to its clients.

The corporate’s proactive funding in digital channels and supply providers positions it favorably to capitalize on the rising shopper choice for comfort. With digital orders already comprising a good portion of gross sales in key markets, McDonald’s is properly poised to maintain its market dominance. Trying forward, the anticipated slowdown in gross sales progress might current a problem, though the potential improve in foot visitors with a decline in costs might offset this moderation.

The present valuation ranges of the inventory, whereas increased than these of its friends, additionally appear cheap from a historic perspective. Nonetheless, I don’t think about the inventory undervalued in the mean time, given the challenges offered by moderating gross sales progress. In the end, I price McDonald’s a maintain at its present worth stage and would think about initiating a place anyplace from $260 per share.