Brandon Bell/Getty Photographs Information

By Brian Nelson, CFA

We like how McDonald’s (NYSE:MCD) is positioned within the present market setting. The corporate’s model title is almost unmatched on the world stage by every other restaurant save for Yum Manufacturers’ (YUM) KFC, and its mostly-franchised enterprise mannequin shields it partially from operational inflationary pressures because it collects franchise charges. Although costs on a few of its value-offerings have elevated because the final time we wrote about McDonald’s on this article, the agency continues to ship menu gadgets that resonate with the cost-conscious client, because it seeks to capitalize on new alternatives with its new beverage-led idea CosMc’s.

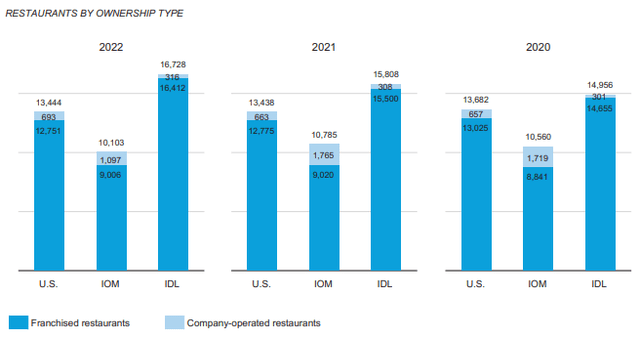

McDonald’s is diversified on the world stage. (McDonald’s)

Extra not too long ago, McDonald’s has famous that the struggle between Israel and Hamas is having an affect on its enterprise within the Center East as a consequence of the actions by some franchisees to offer discounts and free meals to Israeli forces. McDonald’s mostly-franchised enterprise mannequin has been one of many main drivers behind its success permitting homeowners flexibility to satisfy buyer calls for which may be distinctive to the area wherein they function. This has been a boon for shareholders, however extra not too long ago, it has revealed that the technique will not be foolproof. Although the information that McDonald’s is dealing with some stress on gross sales within the Center East will not be nice, the agency is closely diversified geographically throughout its Worldwide Operated Markets [IOM] and Worldwide Developmental Licensed Markets [IDL].

Newest Quarterly Outcomes

When McDonald’s reported third-quarter outcomes October 30, the agency confirmed the resilience of its enterprise mannequin. World systemwide gross sales superior 11% (10% in fixed currencies) within the quarter, whereas it put up 8.8% international comparable retailer gross sales efficiency thanks partially to energy in its digital rollout. World comp gross sales in its IOM and IDL areas superior 8.3% and 10.5%, respectively, within the interval, and the agency leveraged the top-line energy right into a 16% improve in consolidated working revenue (13% in fixed currencies).

This is what CEO Chris Kempczinski needed to say concerning the quarter within the press launch:

With international Systemwide gross sales progress of 11%, our third quarter outcomes replicate our place of energy because the trade chief. The macroeconomic setting is unfolding in step with our expectations for the 12 months, and we continued to ship comfort and worth for our prospects. Due to your entire McDonald’s System’s excellent execution of Accelerating the Arches, we stay assured in our future and the strategic route of our enterprise.

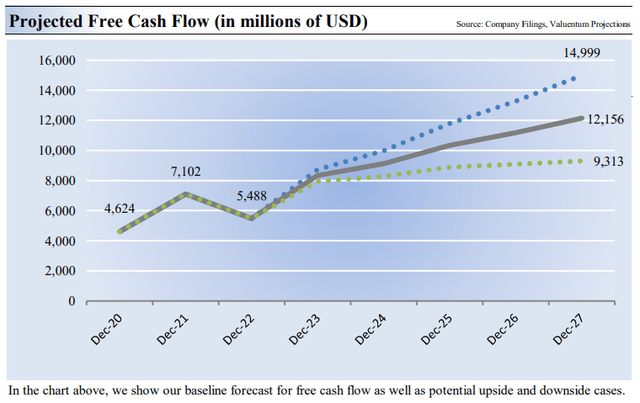

The agency’s diluted earnings per share superior 18% on a year-over-year foundation within the quarter (15% in fixed currencies), and its free money movement era was spectacular. For the nine months ended September 30, money movement from operations elevated to $7.12 billion from $5.19 billion within the year-ago interval whereas capital expenditures superior to $1.6 billion from $1.37 billion in the identical interval final 12 months. The corporate’s free money movement by the primary 9 months of the 12 months of ~$5.52 billion was almost 45% larger than what it achieved throughout the identical interval in 2022. We’re large followers of this strong free money movement era, which we count on to proceed.

We count on continued sturdy free money movement era at McDonald’s. (Valuentum)

New Alternative

Here’s what we wrote on our web site concerning McDonald’s new alternative in CosMc’s:

We predict McDonald’s has discovered one other profitable idea in CosMc’s. The new, small-format, beverage-led idea is drive-thru solely and opened its first location in Bolingbrook, Illinois, and in keeping with studies, “people lined up for hours to strive the brand new McDonald’s restaurant.

The corporate’s menu is stuffed with drinks resembling a Bitter Cherry Power Burst and Berry Hibiscus Bitter-ade, in addition to numerous iced teas, lemonades, slushies and frappes. CosMc’s has quite a few coffee-based choices and some traditional McDonald’s gadgets, too, together with a set of McMuffins.

We’re liking McDonald’s innovation on this space and assume the idea has promise to be aggressive in the long term towards the likes of Dunkin’ and Starbucks (SBUX). Ten places are deliberate initially, with two anticipated within the Dallas-Fort Price and San Antonio metro areas.

Proper now, we’re not constructing any contribution from CosMc’s in our valuation mannequin, however McDonald’s does have a observe document of serving to create large hits, with maybe the most effective identified instance being its funding in Chipotle (CMG). It’s miles too early to find out whether or not CosMc’s could have as a lot success as that of Chipotle, however we do assume McDonald’s has one other winner on its arms.

Valuation

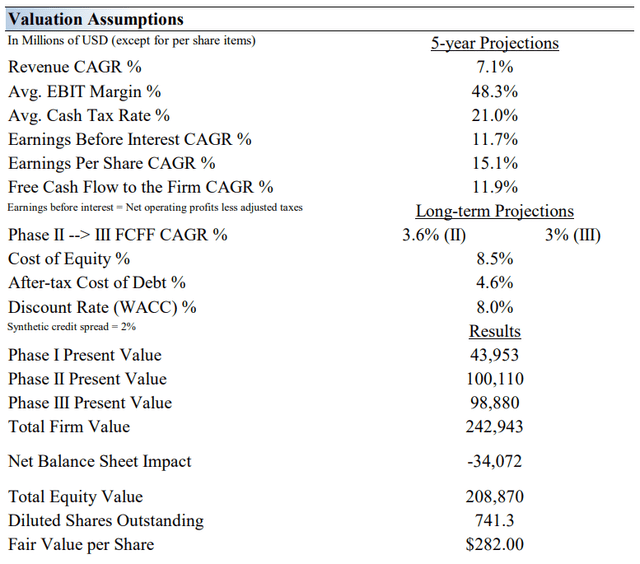

Our abstract valuation assumptions for McDonald’s. (Valuentum)

McDonald’s has quite a lot of tendencies working in its favor. For starters, the corporate is placing up sturdy comparable retailer gross sales numbers, and whereas it’s experiencing some pressures on gross sales within the Center East, we predict it is a non permanent subject, and never one thing that may completely impair its model by any stretch.

Particularly, our $282 per-share honest worth estimate is supported by continued sturdy comparable retailer gross sales within the U.S. and energy throughout its markets within the U.Ok., Germany, and Canada, all three of which have been stand-out performers throughout its most recently-reported third quarter. The corporate’s retailer progress ought to stay sturdy as effectively.

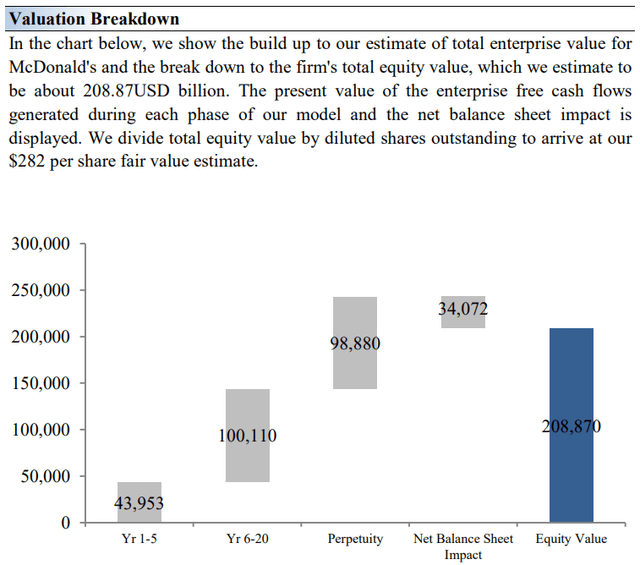

Our near-term working forecasts are roughly in-line with consensus estimates, as our edge is considering how McDonald’s efficiency will look in 12 months 5 and past, not essentially whether or not it’s going to beat or miss subsequent quarter’s or subsequent 12 months’s earnings. A lot of the worth of McDonald’s is pushed within the out years in arriving at our $282 per share honest worth estimate, as proven within the picture under.

Our valuation breakdown of McDonald’s. (Valuentum)

Draw back Dangers and Upside Potential

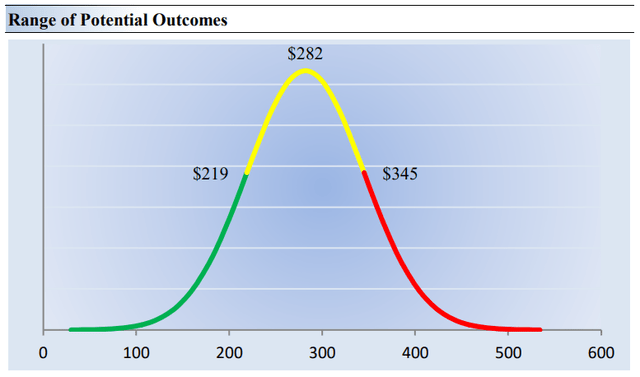

Our honest worth estimate vary for McDonald’s. (Valuentum)

McDonald’s has quite a lot of draw back dangers to its story, however it additionally has upside potential. The unrest within the Center East is one space that would drive variance with respect to our future forecasts, whereas a pattern to more healthy choices given the rollout of weight reduction medication may affect income to the draw back.

To the upside, we are able to look to probably better-than-expected comp progress within the U.S. and the potential monetization of its CosMc’s model within the years forward. As we speak, we’re leaning extra in direction of the excessive finish of our honest worth estimate vary ($345 per share) of McDonald’s as an optimistic valuation for the agency. Shares are buying and selling at ~$290 on the time of this writing.

Concluding Ideas

McDonald’s is a implausible, well-run operation, and as evidenced by its sturdy comparable retailer gross sales efficiency by thick and skinny, the corporate’s worth choices proceed to resonate with cost-conscious customers. We’re large followers of its mostly-franchised enterprise mannequin that partially shields it from inflationary working prices on the franchise stage, and its free money movement era has proven large enchancment in 2023. McDonald’s pays a ~2.3% dividend yield as well. We like shares for the lengthy haul.