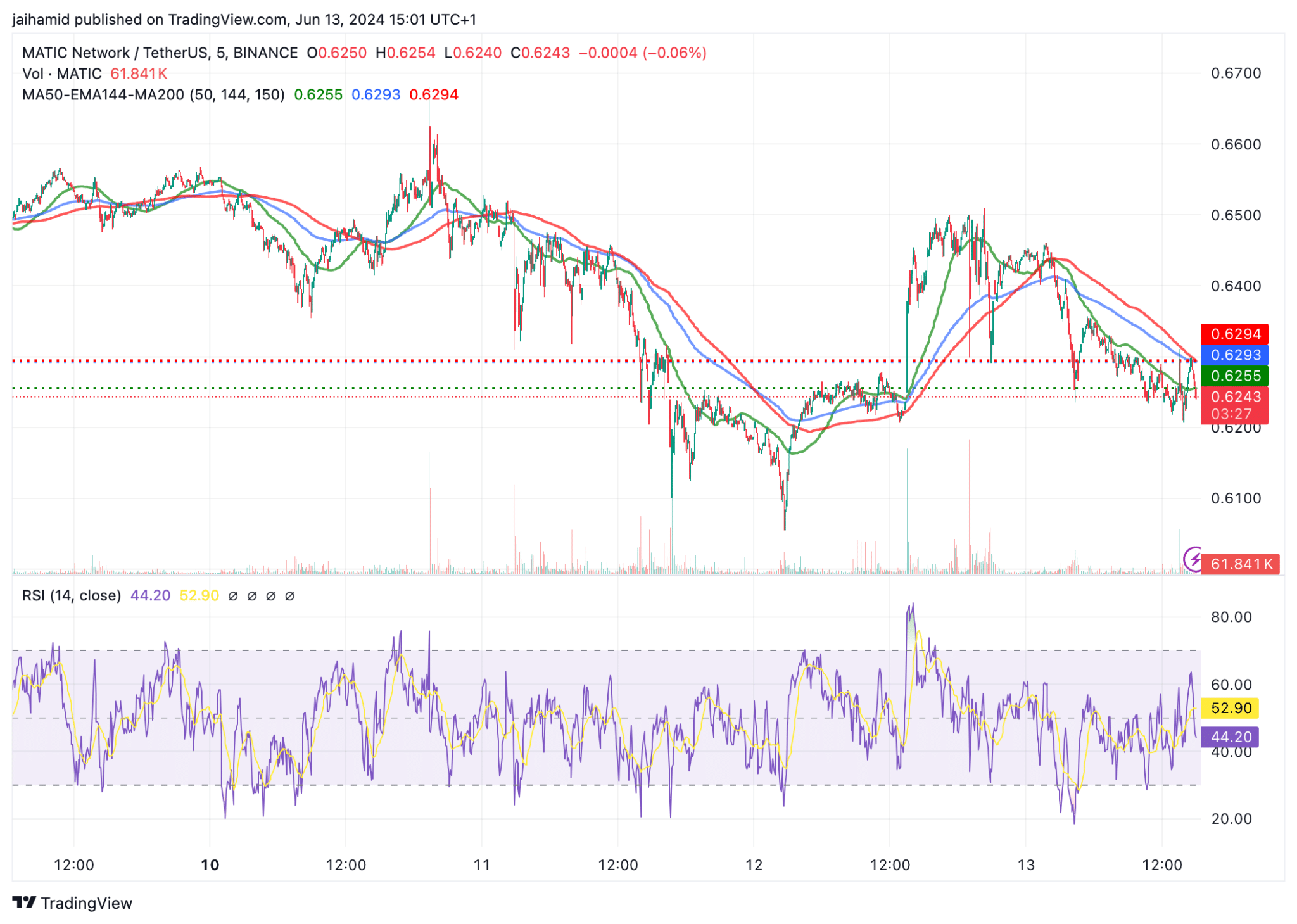

- MATIC stays caught in a bearish development, with its worth constantly beneath all main shifting averages.

- Occasional bullish reversal indicators have appeared, however weren’t robust sufficient to maintain a worth restoration.

In current weeks, Polygon [MATIC] has struggled to interrupt free from a persistent bearish development, inflicting concern amongst traders and merchants.

Regardless of a broader restoration from the market, MATIC’s worth has been caught in a downward loop, elevating questions on its potential to get well.

MATIC’s worth was beneath all three shifting averages at press time, which is a bearish indicator. The truth that the value is struggling to breach the 50-period MA on a number of events factors to resistance within the brief time period.

Supply: TradingView

MATIC worth chart exhibits…

The RSI suggests that there’s neither robust promoting stress that has exhausted the market neither is there robust shopping for momentum, that means merchants are fairly skeptical about Polygon.

The downward development line (higher dotted line) exhibits constant decrease highs, which confirms the continuing bearish sentiment.

Notably, the value has additionally not dropped considerably beneath the current lows, suggesting some stage of help across the $0.6250 space.

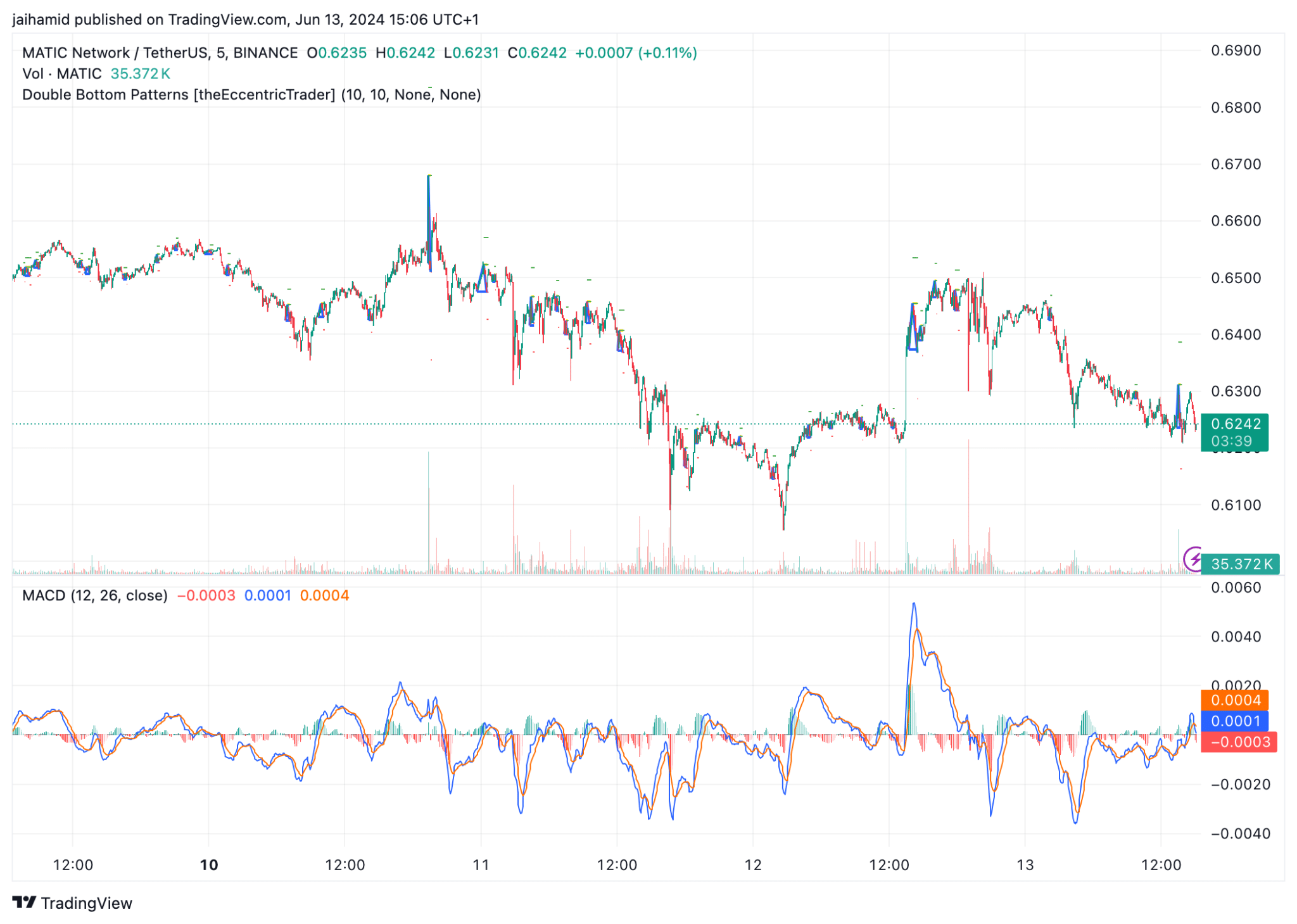

Supply: TradingView

The chart can also be marked with a number of double backside patterns, that are thought of bullish reversal patterns. The patterns recommend makes an attempt to reverse the value from a downtrend to an uptrend.

However not all marked double bottoms result in an enormous worth enhance, which means that the shopping for stress was not robust sufficient to maintain a reversal

The MACD line (blue) and its sign line (orange) are hovering across the zero line, indicating a scarcity of robust momentum in both route.

The MACD histogram, which exhibits the distinction between the MACD line and the sign line, can also be very near zero, additional emphasizing the low momentum and indecisiveness out there.

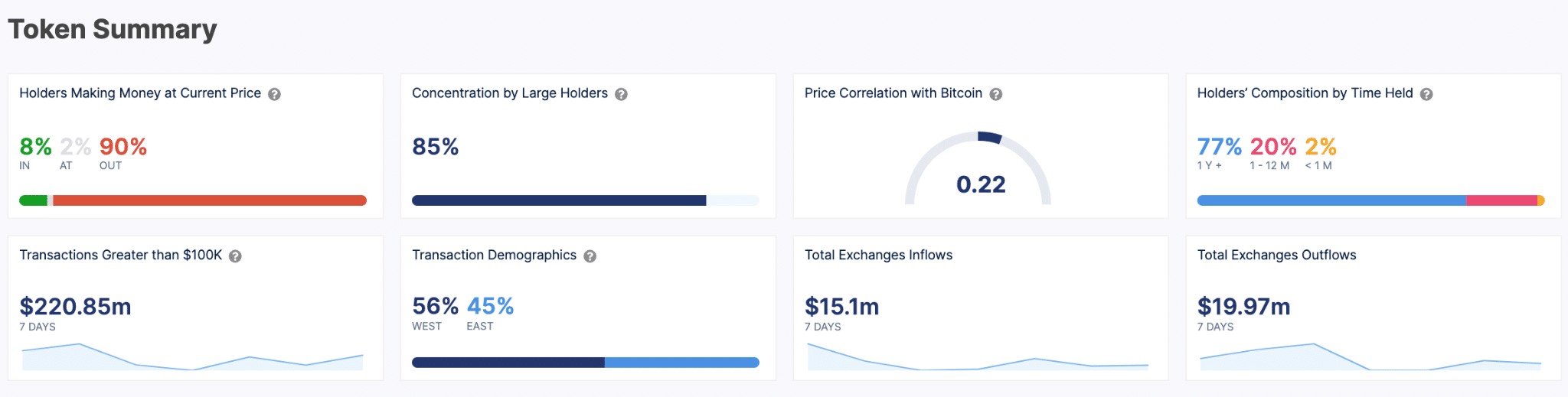

Supply: IntoTheBlock

Solely 8% of MATIC holders are at the moment in revenue, which signifies {that a} important majority (90%) of holders are experiencing a loss on the present worth stage.

Life like or not, right here’s MATIC’s market cap in ETH’s phrases

This might create promoting stress as holders would possibly look to chop losses or exit break-even factors throughout worth recoveries.

A low correlation of 0.22 with Bitcoin signifies that the token’s worth actions are comparatively impartial of the broader market’s sentiment, which may both be actually good, or actually dangerous.