- Based on Ali Martinez, MATIC’s key metric has offered a shopping for alternative.

- Bearish sentiments nonetheless abound within the token’s market.

The Market Worth to Realized Worth (MVRV) ratio of Polygon’s native token MATIC has flashed a purchase sign, crypto analyst Ali Martinez famous in a post on X (previously Twitter).

Based on the analyst, the token’s MVRV ratio assessed over completely different shifting averages returned damaging values. Per Santiment’s knowledge, MATIC’s MVRV ratios on 30-day and 365-day shifting averages had been -10.11% and 11.99%, respectively, on the time of writing.

The MVRV ratio tracks the ratio between an asset’s present market worth and the common worth of each coin or token acquired for that asset.

A optimistic MVRV ratio above one indicators that an asset is overvalued. It means that the present market worth of an asset is considerably increased than the value at which most buyers acquired their holdings.

Conversely, a damaging MVRV worth reveals that the asset in query is undervalued. It means that the market worth of the asset in query is under the common buy worth of all its tokens which are in circulation.

As Martinez famous, MATIC’s damaging MVRV ratios current a “good time to purchase.” It is because, at its present worth, MATIC trades at a reduction relative to its historic price foundation.

Are MATIC bulls making a comeback?

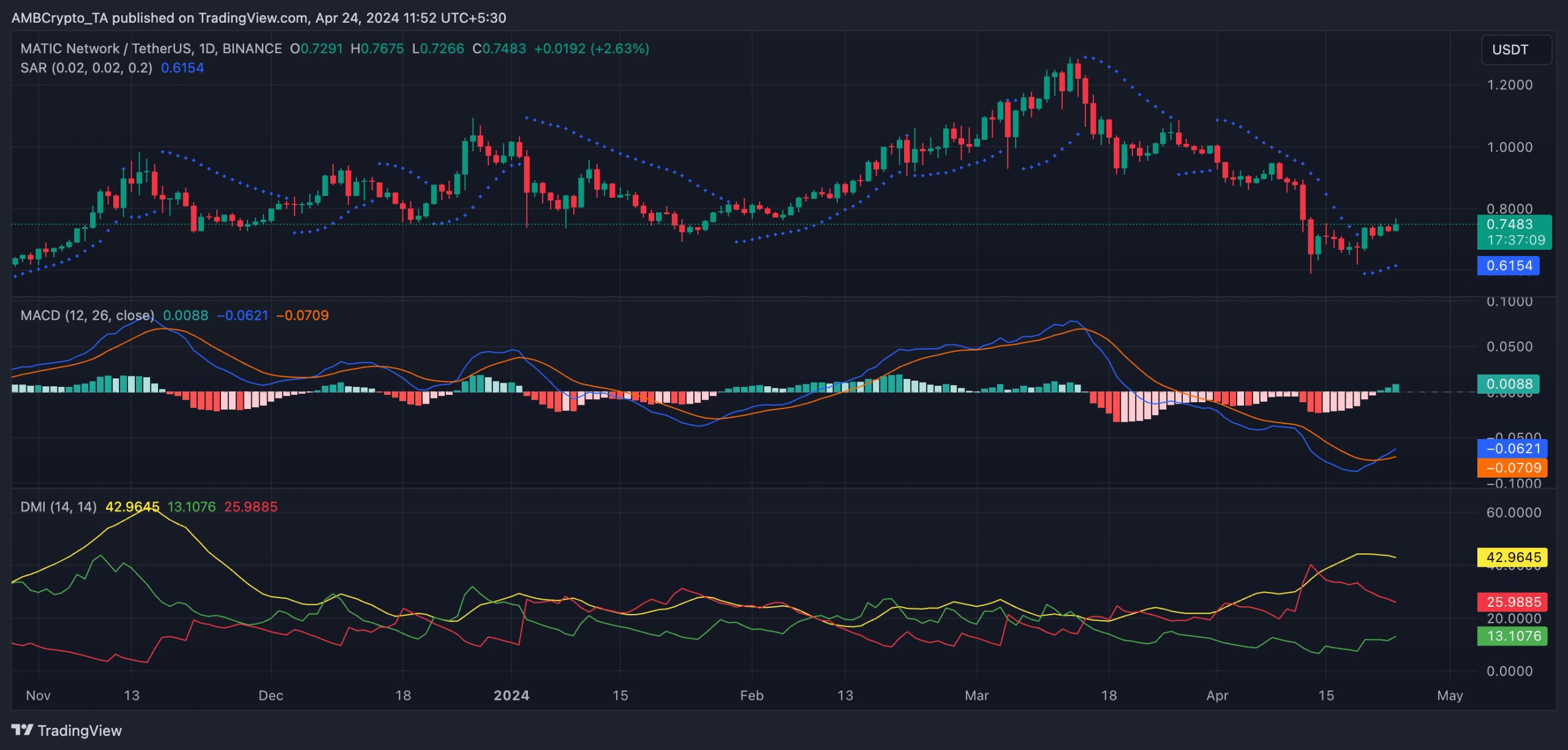

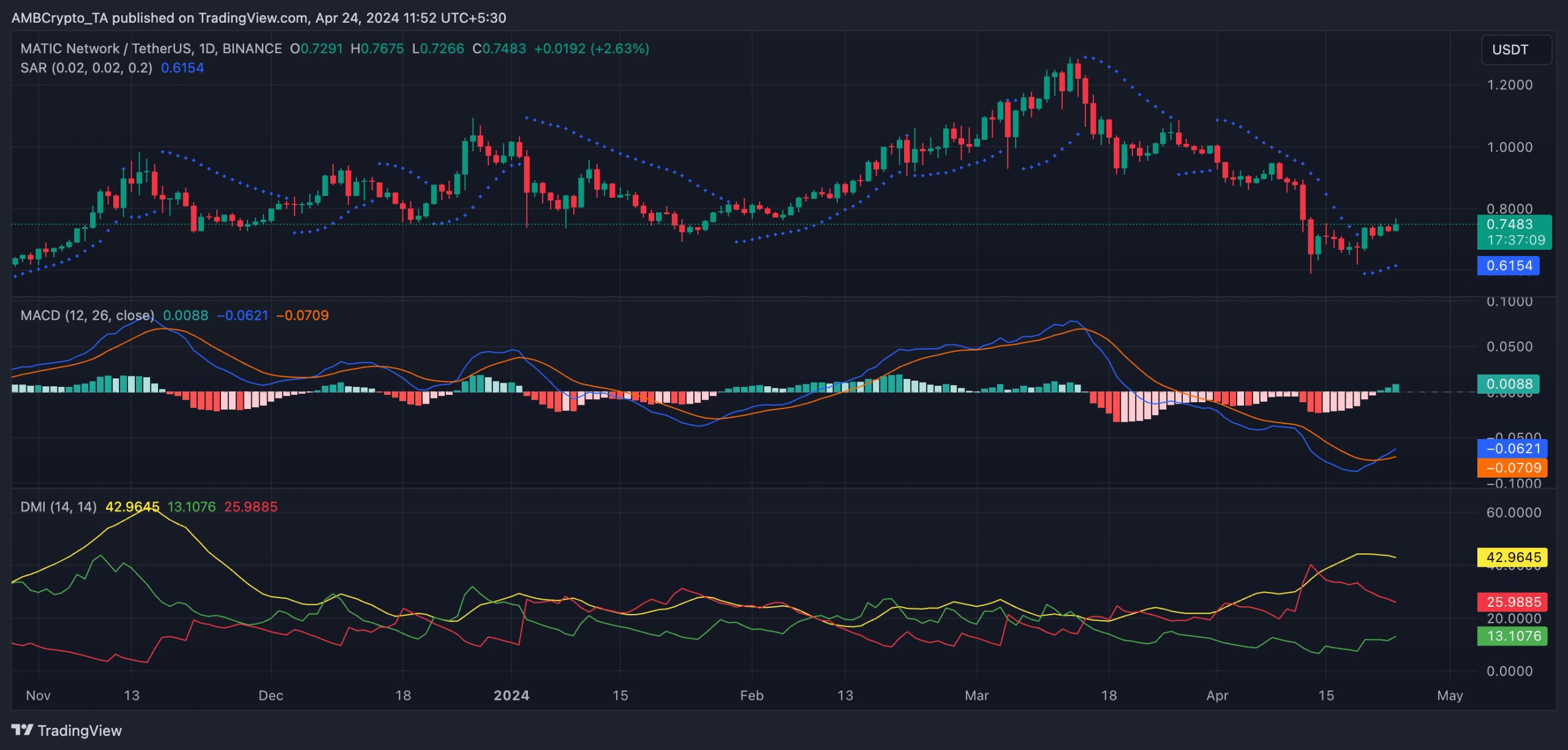

An evaluation of MATIC’s worth actions on a 1-day chart confirmed a gradual shift in market sentiment from bearish to bullish.

First, readings from the token’s Parabolic SAR indicator confirmed its dots resting under the value on the time of writing. This indicator is used to determine potential pattern course and reversals.

When its dotted strains are positioned under an asset’s worth, the market is alleged to be in an uptrend. It signifies that the asset’s worth is rising and will proceed to take action.

Likewise, for the primary time since fifteenth March, MATIC’s MACD line (blue) now sits above its sign line (orange). When these strains are positioned this fashion, an asset’s shorter-term common is above its longer-term common.

It’s a bullish signal, and market contributors take it as an indication to take lengthy positions and exit quick ones.

Learn Polygon’s [MATIC] Value Prediction 2024-2025

Nonetheless, whereas shopping for exercise could have returned to the MATIC market, bearish sentiments stay vital. For instance, its damaging directional index (crimson) nonetheless sits above its optimistic index (inexperienced).

This means that the facility of MATIC bears considerably exceeds that of its bulls, as promoting momentum stays excessive.

Supply: MATIC/USDT on TradingView