- Historic knowledge utilizing the MVRV ratio indicated a attainable 31% hike for MATIC within the mid-term

- Previous tokens have kept away from shifting – An indication that one other correction is likely to be unlikely

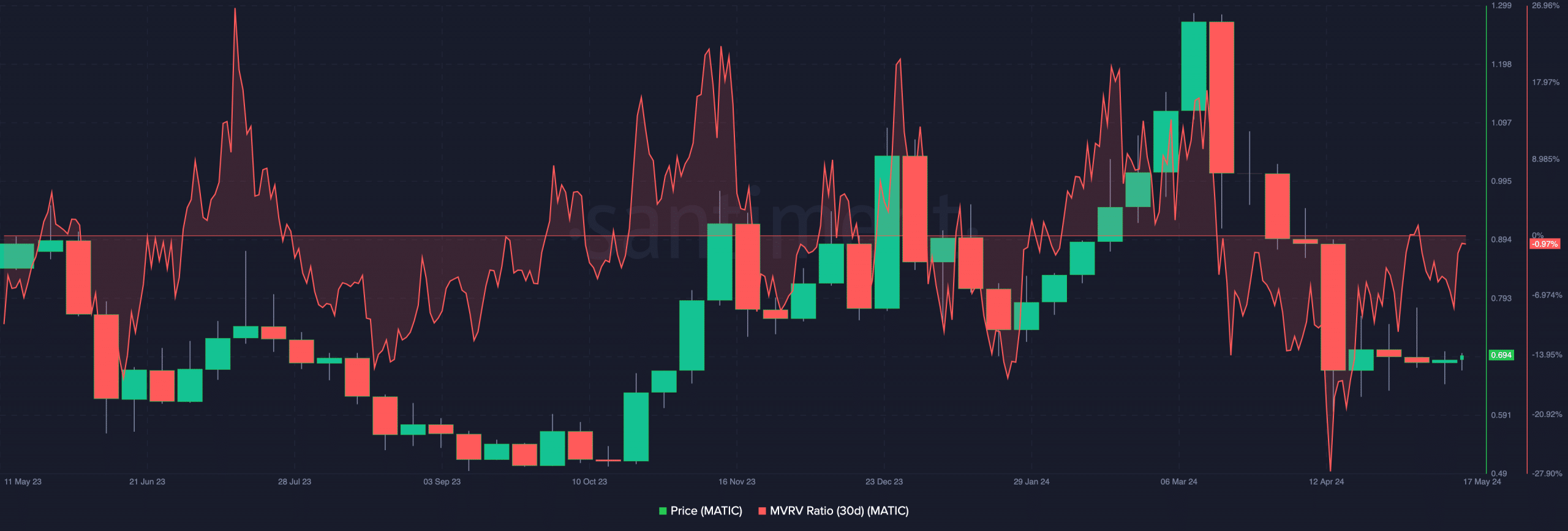

An important MATIC on-chain metric has proven indicators that the token may very well be able to reverse its losses of the previous few months. At press time, MATIC was valued at $0.69 on the charts following a depreciation of 26.38% over the past 90 days.

The metric that flashed the aforementioned signal was the Market Worth to Realized Worth (MVRV) ratio. The MVRV ratio determines if an asset is undervalued or overvalued, relying on investor profitability out there.

At press time, the 30-day MVRV ratio for MATIC had a studying of -0.97%. Traditionally, the worth of MATIC bounces when the metric is between -8% and -16%.

After the lows, come the highs

This, as a result of many holders are holding at a value decrease than the historic value foundation. Thus, as a substitute of realizing losses, market contributors might reap the benefits of the decline and accumulate. Most instances, this ends in a better worth.

On 14 Could, the MVRV ratio was -8.22%. Nevertheless, the worth of MATIC rose from that zone, pushing the metric to a a lot greater degree.

Supply: Santiment

In February, when the same factor occurred, MATIC’s value went on to hit $1.20. On this market, historical past doesn’t precisely repeat itself. Nevertheless, traits are typically related.

Subsequently, if the ratio breaks into the constructive zone, it’s possible that MATIC’s subsequent goal is likely to be $1, contemplating that it’s a key space of curiosity.

Whether or not MATIC would be capable of maintain on to the worth will depend on the holders. If some determine to ebook income on the projected value, MATIC would possibly retrace on the charts.

Nevertheless, sustained demand at that degree might set off an extra uptrend, one that would ship the worth to $1.30. Nevertheless, this conclusion would possibly sound too hasty with out checking different indicators.

MATIC diamond arms aren’t quitting

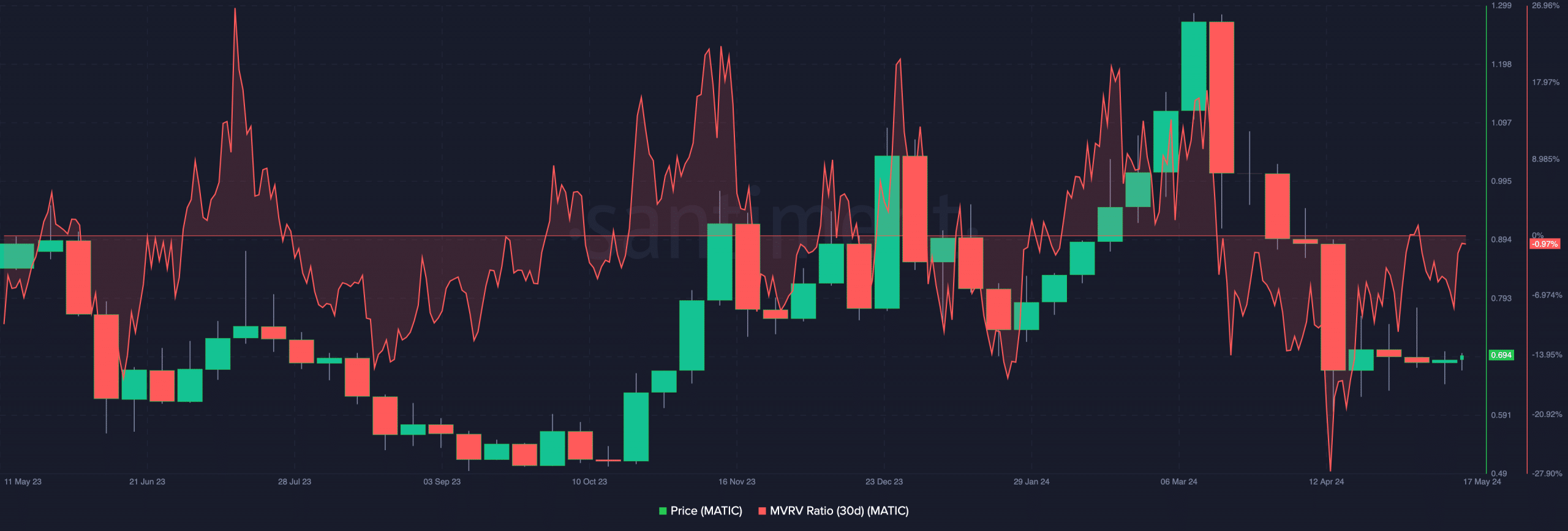

One other metric AMBCrypto analyzed was dormant circulation. If the dormant circulation spikes, it implies that tokens which have moved in an extended whereas are being transacted. On this case, the token would possibly face promoting strain.

Nevertheless, a low studying of the metric appeared to indiate that long-term buyers are sticking to HODLing, as a substitute of liquidating. That was the case with MATIC.

If sustained, the worth of MATIC won’t fall. As an alternative, it would consolidate for a while earlier than a breakout finally involves cross.

Supply: Santiment

Within the meantime, the ratio of on-chain volume in profit to loss fell to 0.42. Readings like this suggest that the majority transactions involving the token ended up in crimson, fairly than in inexperienced.

Learn Polygon [MATIC] Value Prediction 2024-2025

From all indications, this on-chain quantity in revenue would possibly start to enhance if MATIC validates the prediction above. Nevertheless, ought to a change from the bullish bias seem, transactions in loss would possibly proceed to dominate.