A large surge in crypto alternate flows suggests establishments may very well be getting ready for the potential approval of spot market Bitcoin (BTC) exchange-traded funds (ETFs), in line with the market intelligence agency Glassnode.

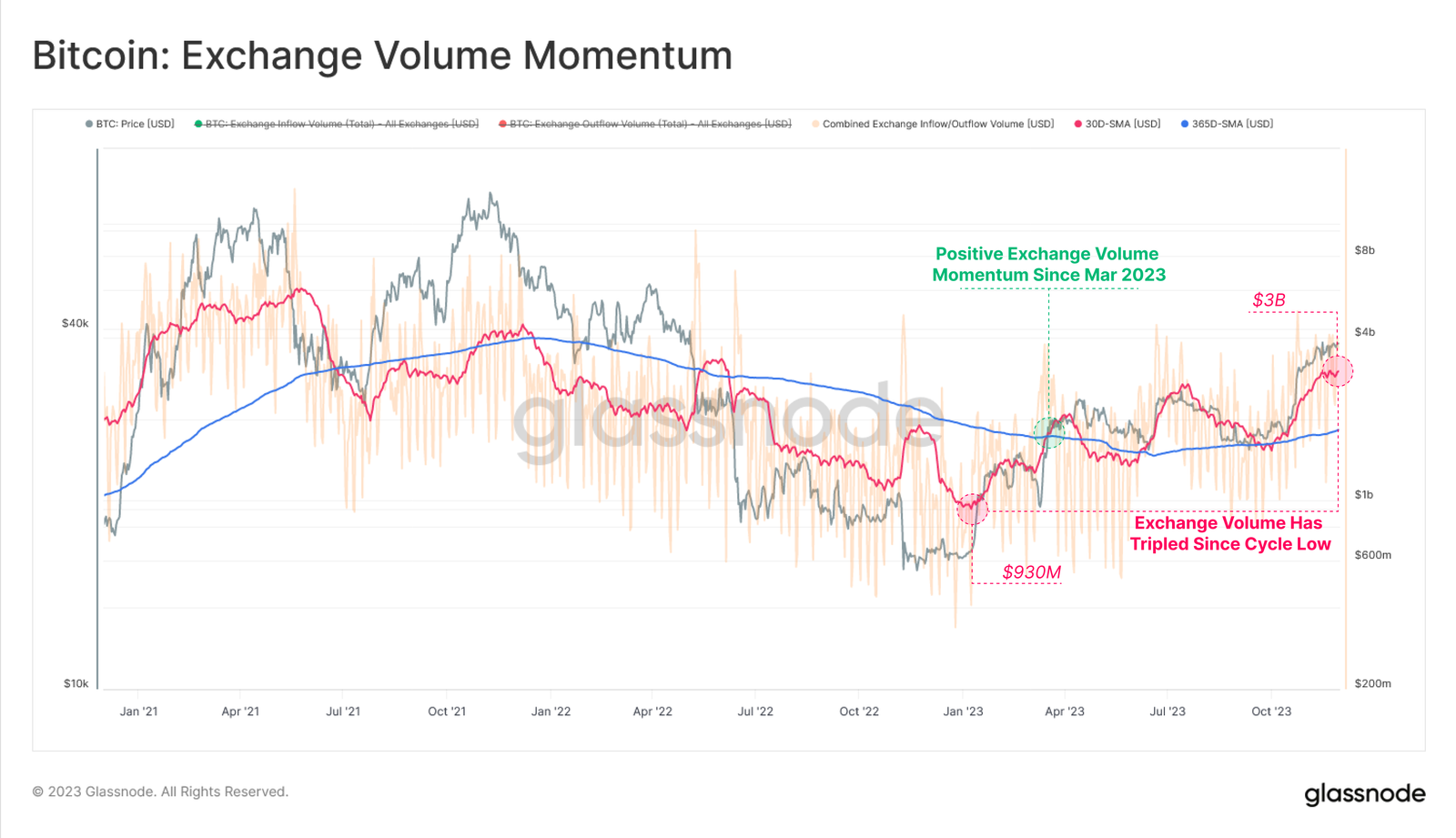

Glassnode notes in a brand new analysis report that the 30-day easy transferring common (SMA) of Bitcoin flows out and in of exchanges grew from $930 million from the beginning of the yr to over $3 billion at time of writing, a 220% improve.

“ this from the on-chain quantity area, we will see that YTD (year-to-date) flows out and in of exchanges have grown significantly from $930 million to over $3 billion (+220%).

This underscores an increasing curiosity from traders to commerce, accumulate, speculate and in any other case make the most of exchanges for his or her companies.”

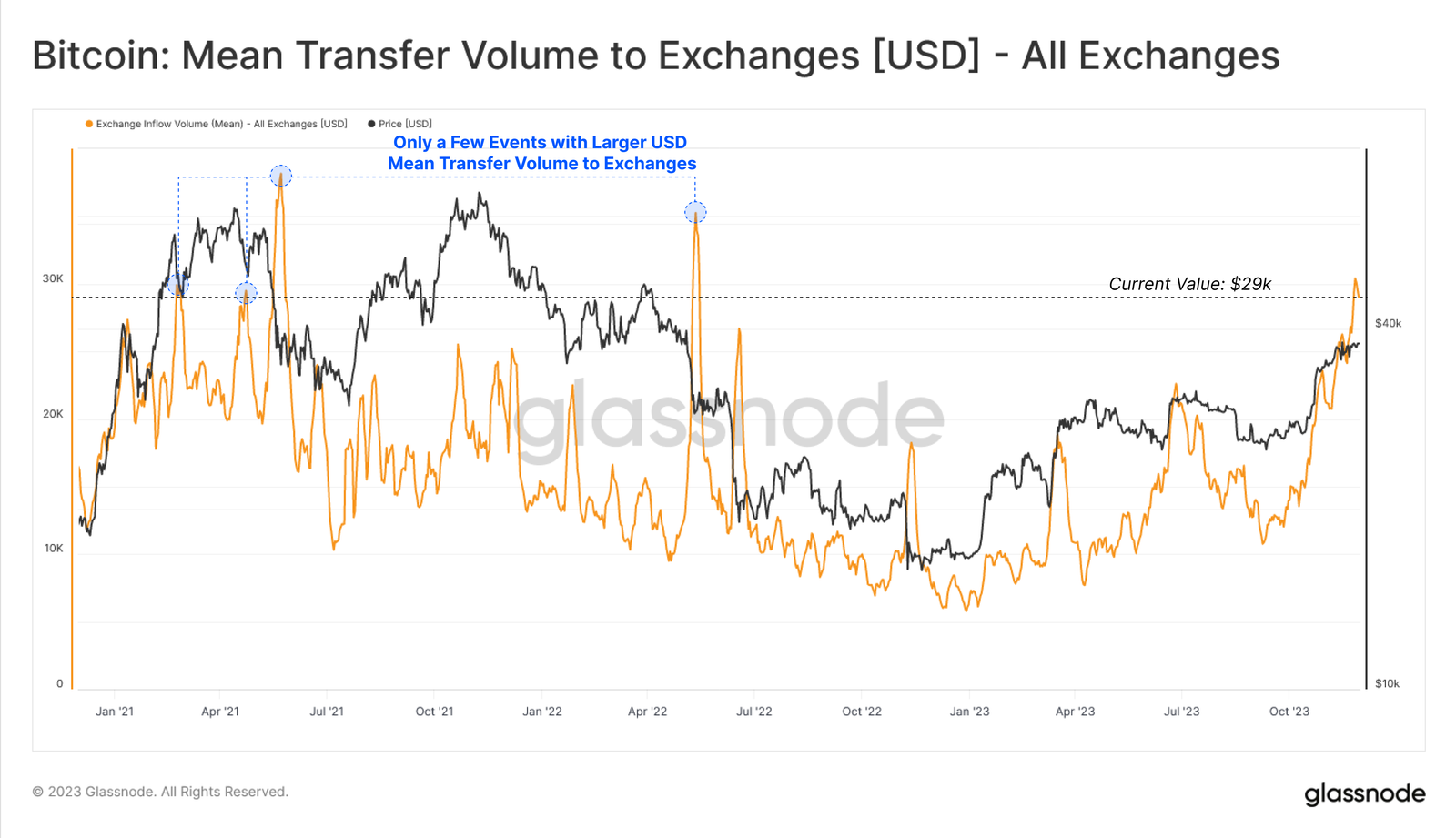

The analytics agency additionally notes that the typical measurement of Bitcoin deposits to exchanges has grown considerably this yr.

“With such a big uptick in alternate volumes, an fascinating remark emerges from evaluation of the typical measurement of deposits to exchanges. This metric has skilled a non-trivial rally, climbing simply shy of the earlier all-time excessive of $30,000 per deposit.

From this, it seems that alternate deposits are at the moment dominated by traders transferring more and more giant sums of cash. That is probably an indication of rising institutional curiosity as key ETF determination dates strategy in January 2024.”

Bloomberg ETF analyst James Seyffart lately speculated that the U.S. Securities and Alternate Fee (SEC) may very well be gearing as much as approve a slew of bids for a spot BTC exchange-traded fund in early January.

Bitcoin is buying and selling at $43,974 at time of writing, up by greater than 16% up to now seven days.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney