- Mara bought BTC value $249 million.

- Current purchases of 4144 BTC introduced Marathon’s whole holding to 25000 BTC.

The crypto market is frequently evolving amidst elevated acceptability and institutional curiosity. With elevated consideration in direction of crypto by the federal government, and politicians, crypto miners are re-energized.

All year long, main corporations coping with crypto and Bitcoin [BTC] have been on a shopping for spree, betting on BTC’s future worth.

Notably, the biggest BTC miner Marathon is popping to its strategic open market buy to bolster its bitcoin reserves.

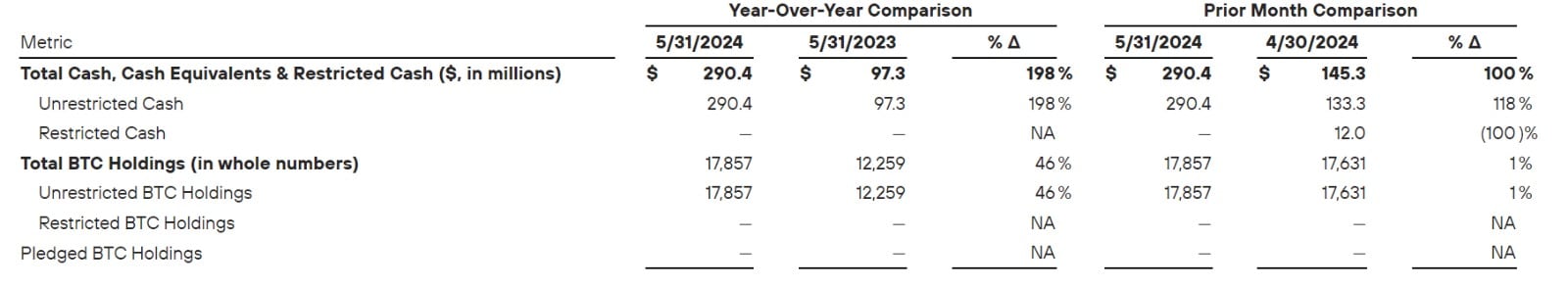

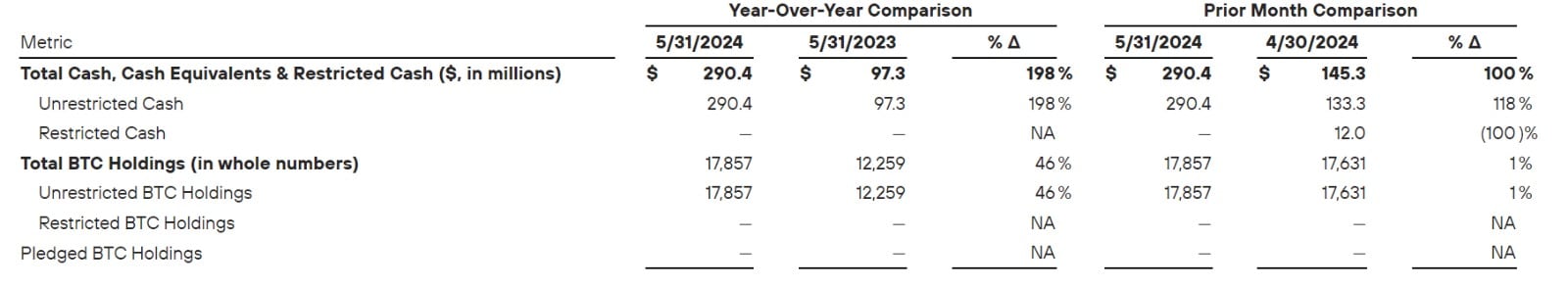

Supply: MARA

Mara buys $249m value of BTC

The mining form introduced the acquisition by its official web page, reporting that,

“MARA secures $300M by an oversubscribed providing of convertible senior notes. With proceeds, we bought 4,144 BTC (valued at approx. $249M), boosting our strategic Bitcoin reserve to over 25,000 BTC. “

The transfer is important because the agency makes an attempt to safe its place as a robust chief in Bitcoin mining.

Within the buy, the corporate bought 4,144 BTC at a $59,000 common worth, rising its whole holding to 25,000 BTC.

The senior observe providing observe for the acquisition gained buyers curiosity, incomes $292.5 million in web revenue. The observe providing is issued with a 2.125% annual rate of interest and is due in September 2031.

These gross sales are important because it affords the corporate monetary flexibility in operations.

Mara’s HODL technique

Undoubtedly, the acquisition certifies Mara’s technique for BTC accumulation.

As reported earlier by AMBCrypto, Mara is dedicated to HODL methods the place it is going to mine and mix with open market purchases to extend its reserve.

According to the technique, MARA bought $100 million value of BTC final month. Subsequently, the miner wager on BTC’s future worth by accumulation with out promoting.

In accordance with the corporate, HODL’s technique displays its confidence within the long-term worth of BTC. Thus, BTC is one of the best treasury reserve asset which is able to frequently achieve worth, thus in flip profiting Marathon and buyers.

What it means for Marathon Digital and BTC

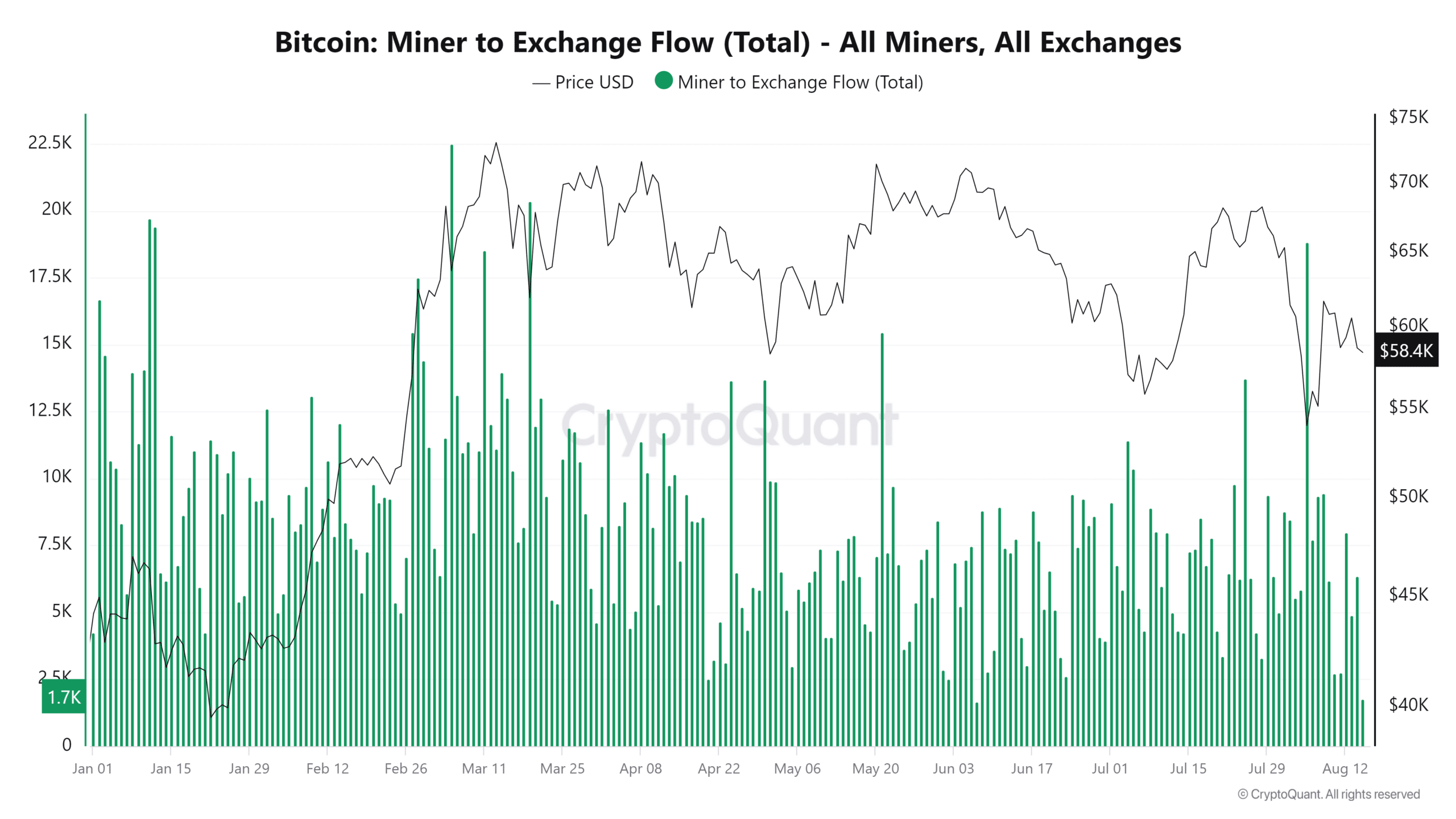

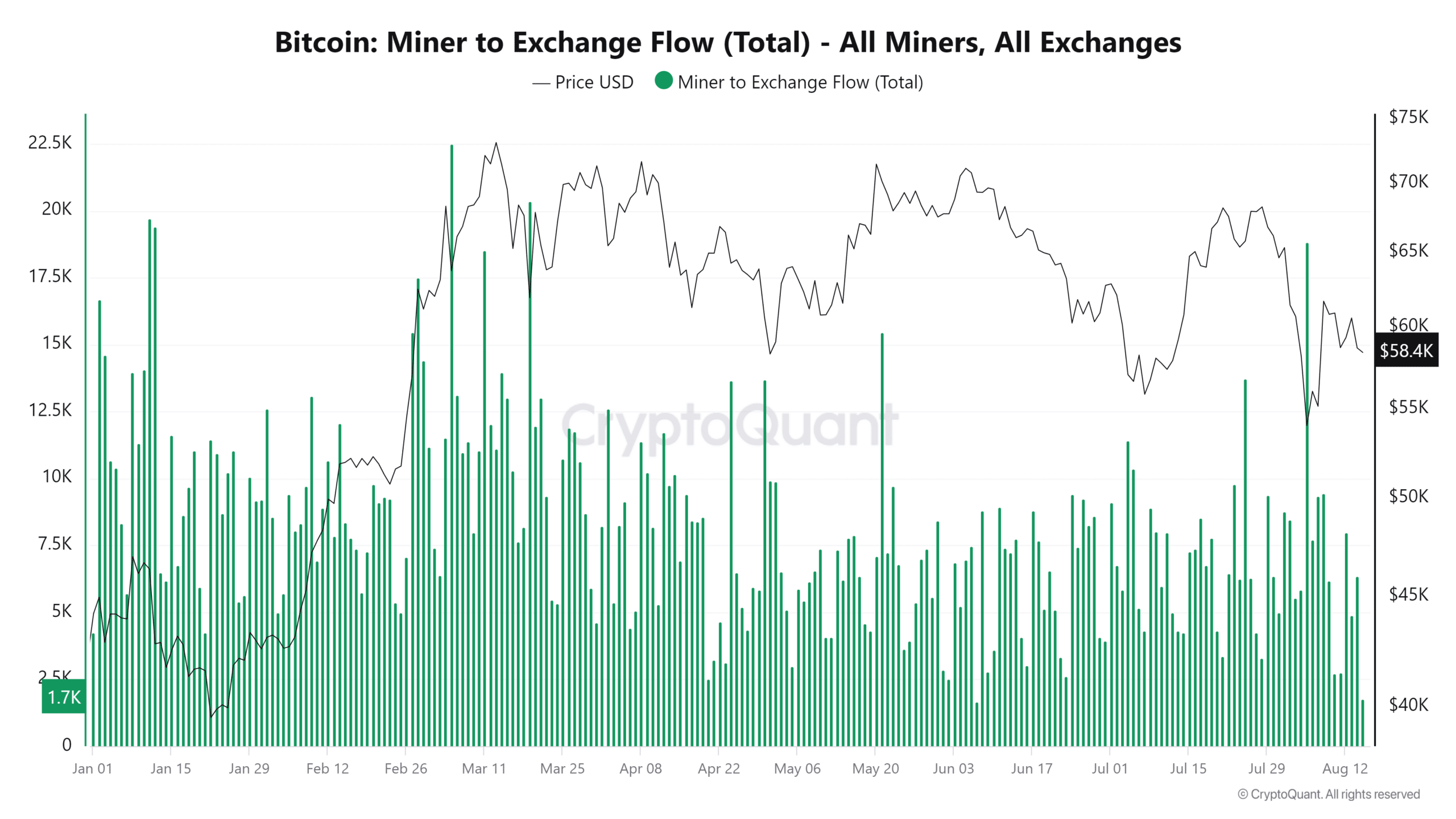

Supply: CryptoQuant

Earlier than returning to the HODL technique, MARA has bought a big quantity of BTC since October 2023. Between June and July, the miners bought 1400 BTC has different miners elevated gross sales.

Equally, in Could, the corporate bought 390 BTC.

Regardless of the gross sales, the corporate lowered its outflows to 31% in 2024 in comparison with 56% in 2023. Nevertheless, these gross sales have harmed Marathon Digital.

In accordance with Google Finance, the corporate inventory has declined by 33.97 Yr-to-date (YTD). The decline arises from elevated BTC volatility whereas its reserve declines.

Supply: Google Finance

Subsequently, the continued BTC accumulation after the latest buy goals to spice up the corporate’s worth.

Since BTC is anticipated to extend in worth over time, continued accumulation will enhance Mara’s inventory, income, and profitability.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Equally, elevated institutional adoption is a win for the King coin because it’s positioned to extend demand, thus driving shopping for stress.

Usually, larger demand means larger costs, thus with institutional funding, the demand will skyrocket additional driving its worth larger.