- On the twenty fifth of July, Marathon Digital bought $100M value of Bitcoin.

- The agency turns to a HODL technique, reflecting the long run worth of BTC.

On the twenty fifth of July, Marathon Digital [MARA], the most important Bitcoin [BTC] mining firm, introduced the acquisition of $100M worth of BTC. At press time, the agency held over 20,000 BTC, value $1.3B.

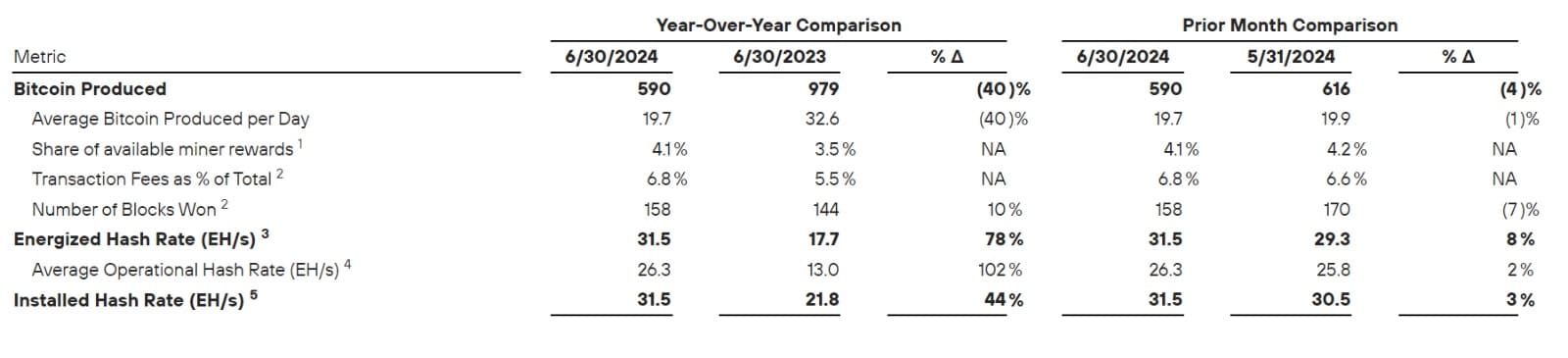

Supply: MARA

Along with continued mining and market purchases, the agency is dedicated to the HODL technique.

The technique implies that the agency frequently accumulates its BTC with out promoting, anticipating future excessive demand and value hikes. Marathon expounded that,

“Adopting a full HODL technique displays our confidence within the long-term worth of Bitcoin. We imagine Bitcoin is the world’s greatest treasury reserve asset and help the concept of sovereign wealth funds holding it. We encourage governments and companies to all maintain Bitcoin as a reserve asset.”

What this technique means for Bitcoin

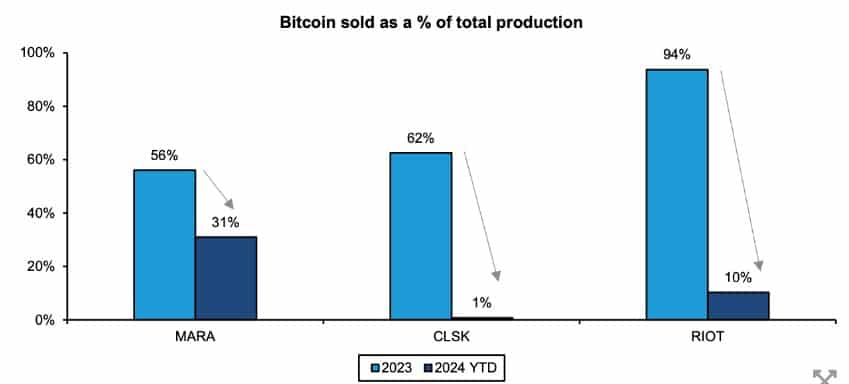

Over the previous months, Mara labored exhausting to scale back its BTC gross sales. In line with Bernstein, the agency has decreased complete gross sales from 56% in 2023 to 31% in 2024.

With the HODL technique in place, MARA can have zero gross sales, because it did previous to 2023.

Supply: Bernstein

Coming to Bitcoin, the king coin is poised to realize 16% of its present worth yearly, pushing its market cap to over $60T.

With such anticipated development, MARA’s inventory will rise exceptionally as nicely, basing its present $1.3B value of BTC on a 208% annual acquire from its present 20k BTC holding.

For the reason that firm will proceed its strategic open market and mining actions, it might double its positive factors by over $500M yearly.

It will instantly replicate its inventory worth development, which has declined by 11.56% YTD due to continued BTC gross sales.

Supply: Google Finance

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If buyers persist with Marathon Digital’s method of merely HODLing, they might see income as nicely, as Bitcoin is understood for having the very best positive factors for long-term buyers.

Nonetheless, don’t take this as funding recommendation, and as with all cryptocurrencies, at all times keep in mind to DYOR.