Overview

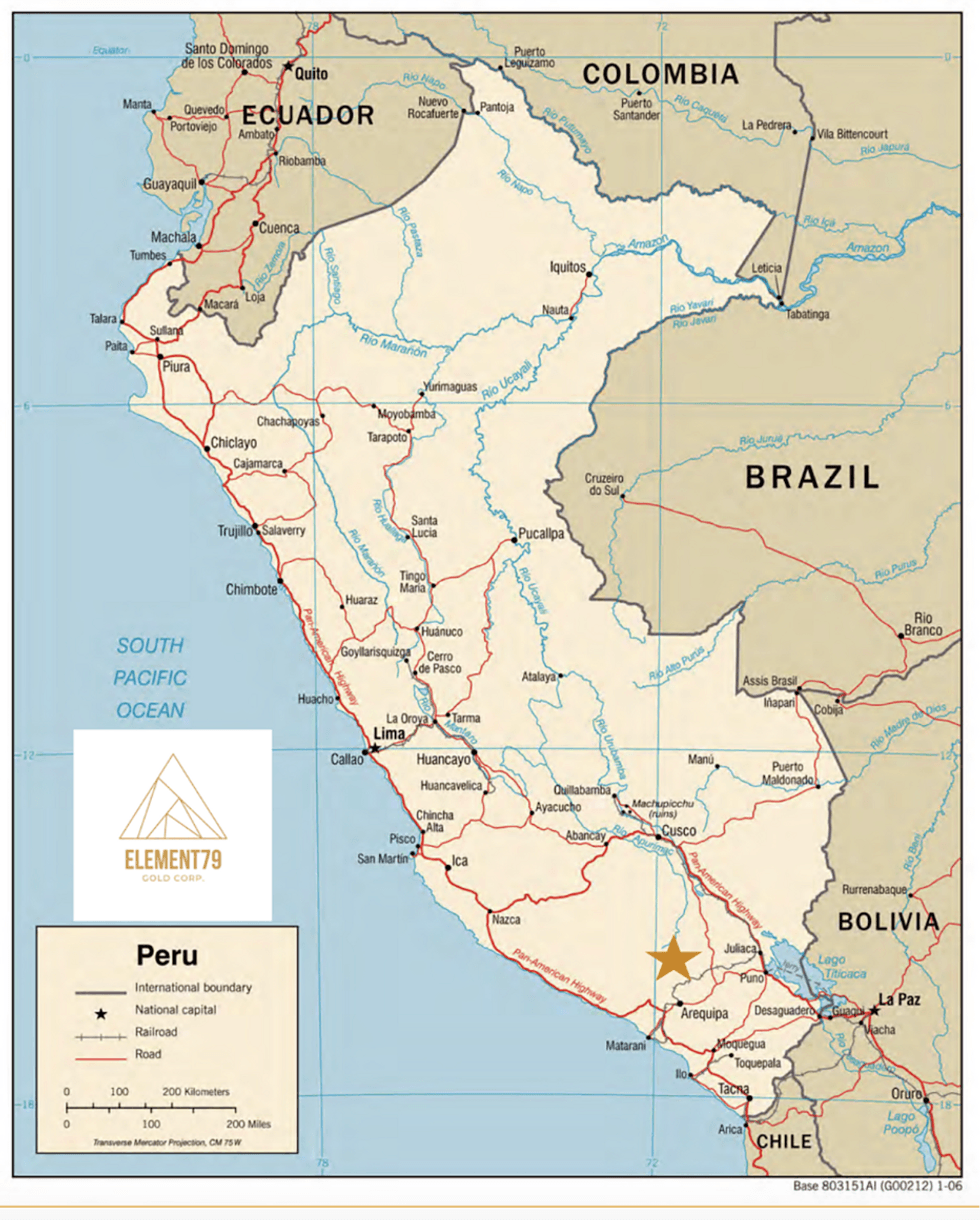

Element79 Gold (CSE:ELEM,OTC:ELMGF) is an exploration and growth mining firm with the potential for near-term manufacturing by means of its Lucero undertaking in Peru. The Lucero mine is likely one of the highest-grade underground mines in Peru’s history and is on the quick monitor for manufacturing. Moreover, the corporate’s two exploration tasks in Nevada, Clover and West Whistler, create additional alternatives for future useful resource growth. A globally-experienced administration crew with a confirmed monitor file of success in growing operational mines leads Element79 towards absolutely realizing the potential of its property.

Lucero is a past-producing, high-grade gold mine prepared to succeed in manufacturing shortly. The mine operated between 1989 to 2005. Historic reviews between 1998 and 2004 point out that the mine produced roughly 18,800 ounces of gold and 435,000 ounces of silver per yr at 19 grams per ton (g/t) gold equal. An NI 43-101 report ready by a 3rd social gathering signifies grades up to 116.8 g/t gold equivalent. Along with producing near-term money circulate, the ten,805-hectare Lucero undertaking additionally has excessive upside potential for additional greenfield exploration.

Peru is taken into account a comparatively secure mining jurisdiction, particularly for smaller-scale operations. As mining is an essential aspect of the country’s GDP, Peru has developed a good regulatory regime for its mining trade. Element79 Gold is poised to learn from the pro-mining jurisdiction because it strikes the Lucero asset towards manufacturing.

Floor work on the Lucero property is presently underway, the place Element79 has engaged Ore Discovery LLC, a technical mining service supplier, to work together with Element79’s operations crew. The work consists of above-ground and underground mapping, sampling, trenching, drill web site concentrating on on each better-known and unexplored vein techniques, for exploration and de-risked useful resource growth on the trail towards ore extraction and near-term money circulate technology.

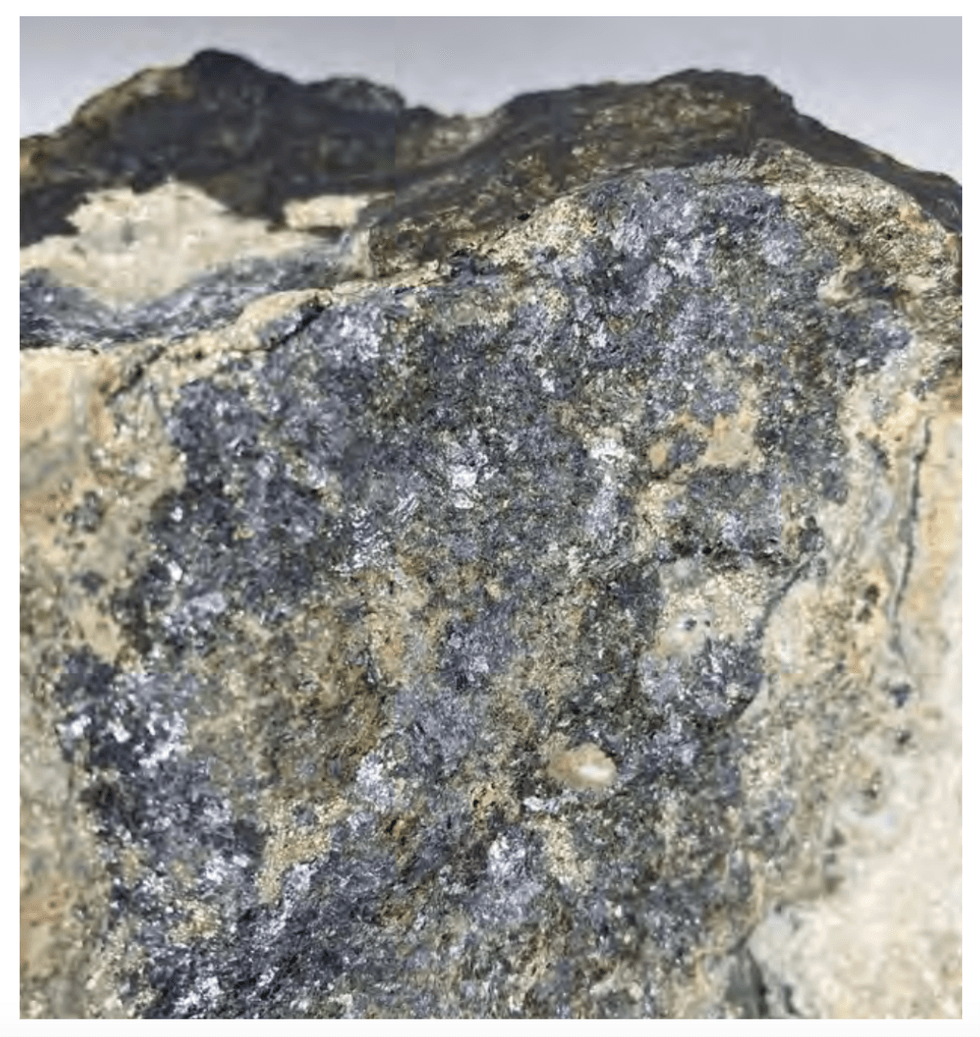

Newest underground mapping and channel sampling efforts on the Lucero property have revealed extra insights, documenting an expansive community spanning 8.9 kilometers of workings, with 85 p.c now meticulously mapped and sampled. A complete of 19 adits have been mapped, with 10 extra adits remaining for underground mapping. Intersected mineralization conforms to the intermediate sulfidation epithermal model, characterised by gold-silver veins with related lead and zinc sulphides.

In June 2023, Element79 Gold additional strengthened its portfolio in Peru with the acquisition of the 1,200-hectare Lucero del Sur 28, positioned strategically simply east of the high-grade Lucero gold-silver undertaking. Lucero del Sur 28 is a coveted space protecting the Roxana vein, a vein dominated by white to hyaline quartz and altered rock clasts, with lesser quantities of limonite patinas, hematite, pyrite and jarosite.

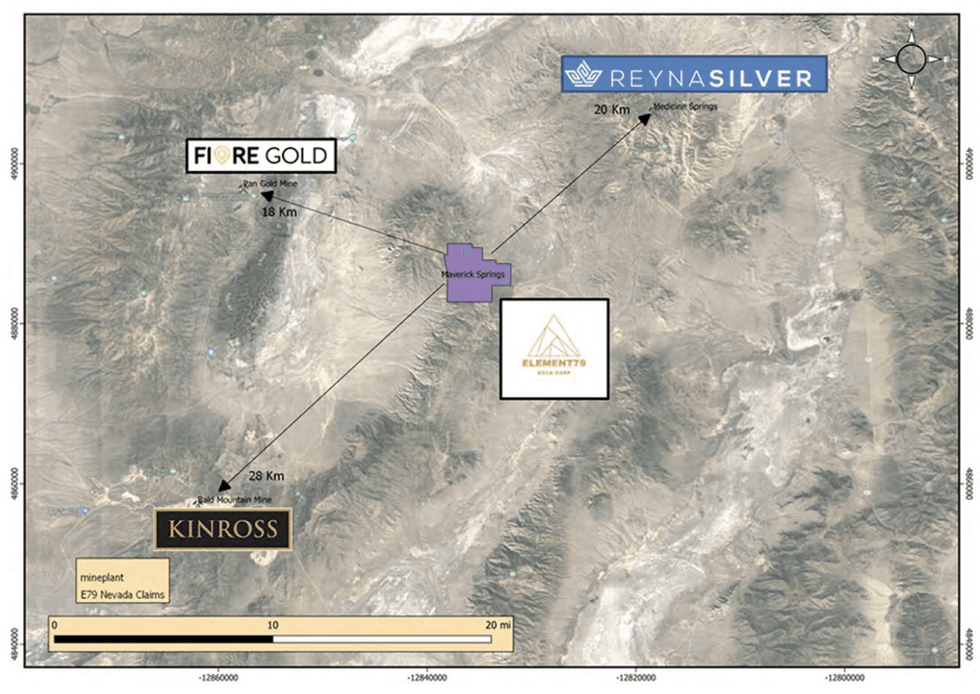

In North America, the corporate holds a portfolio of mining properties in Nevada, one in all which is the Maverick Springs gold and silver undertaking. With an inferred 3.71 million ounces of gold equal, the undertaking is positioned in one of many world’s richest gold mining districts and is positioned solely 30 kilometers away from the Kinross (NYSE:KGC) Bald Mountain Mine. It’s presently beneath an possibility settlement to promote whereby the corporate stands to generate CAD $4.4 million money and AUD $800,000 in shares of Inexperienced Energy Minerals (quickly to be often called Solar Silver Restricted by July 2024.

A powerhouse administration crew leads Element79 Gold with a monitor file of expertise and success. Antonio Maragakis, Former COO and now Director, has held director-level positions at miners with multi-billion greenback portfolios, together with Barrick Gold Company and Koch Industries. As well as, Kim Kirkland, Chief Working Officer, has led engineering roles in a number of the world’s largest mining corporations, akin to Rio Tinto Group and Barrick Gold Company.

Shane Williams, strategic advisor, brings a historical past of serious worth creation in early-stage and working corporations and presently heads West Pink Lake Gold (TSXV:WRLG) as president and CEO. Mixed, Element79 has the proper specialists to completely notice its property’ potential.

Firm Highlights

- Element79 Gold is an exploration and growth mining firm with a high-grade gold and silver flagship undertaking with near-term money circulate potential.

- The corporate’s Lucero undertaking in Peru has historic high-grade outcomes and supplies alternatives for each near-term income and future greenfield exploration.

- Lucero has traditionally produced 18,800 ounces of gold and 435,000 ounces of silver per yr at 19 grams per ton gold equal.

- Peru is taken into account a secure jurisdiction for mining operations resulting from a pro-mining authorities that acknowledges the trade’s financial contributions.

- Element79 Gold’s Maverick Springs gold and silver undertaking in Nevada creates extra close to time period income technology potential as it’s beneath contract on the market in Might-June 2024.

- A powerhouse administration crew leads the corporate towards absolutely growing its asset portfolio.

Key Tasks

Lucero Gold Challenge

The ten,805-hectare undertaking in southern Peru presents near-term money circulate potential because it strikes towards manufacturing. Lucero operated as a high-grade gold mine between 1989 and 2005 and stays partially unexplored. In consequence, the asset is in a novel place to begin producing income whereas additionally offering future development alternatives with extra exploration.

Challenge Highlights:

- Encouraging Historic Outcomes: Studies from 1998 to 2004 point out manufacturing averaging roughly 18,800 ounces of gold and 435,000 ounces of silver per yr, with grades of 14.0 g/t gold and 373 g/t silver. Moreover, the asset incorporates recoveries on the ore processing facility averaging 94.5 p.c for gold and 85.5 p.c for silver for near-term money circulate.

- Distinctive Geology: Lucero hosts 74 acknowledged epithermal veins, 14 of which have been partially exploited. The undertaking is a low-sulphidation epithermal gold-silver deposit hosted inside tertiary volcanics within the Central Andes Cordillera of southern Peru. The undertaking additionally hosts unexplored high-sulphidation model mineralization, which has returned floor samples as much as 33.6 g/t gold.

- Promising Useful resource Estimate: A 3rd-party NI 43-101 report signifies grades as much as 116.8 g/t gold equal, or 78.7 g/t gold and a pair of,856 g/t silver. Element79 Gold is transferring in direction of manufacturing to capitalize on these sources.

Maverick Springs Gold Challenge

The Nevada-based Maverick Springs gold undertaking covers 4,800 acres on high of a gold belt with deposits roughly 5 miles broad and 40 miles lengthy. The undertaking’s gold belt district has produced more gold than any other mining district in the United States.

Challenge Highlights:

- Prolific Useful resource Estimate: A 2021 constrained mineral useful resource assertion estimates that the asset incorporates 124.4 million tonnes at 68.9 g/t gold equal, which signifies 278 million ounces of gold equal. This estimate demonstrates the excessive upside potential of the undertaking.

- Present Infrastructure: The Maverick Springs gold undertaking is accessible year-round through a gravel street and incorporates a community of drill roads all through its claims. The asset additionally has close by electrical energy that minimizes preliminary growth prices.

Clover Gold Property

The Clover Property is positioned within the historic Midas Mining District in Nevada, which has been producing gold and silver because the early 1900s and is 16 kilometers west of Hecla Mining Firm’s Midas Mine, the most important identified gold-silver epithermal deposit alongside the Northern Nevada Rift. Mineralization on the property is assessed as low-sulphidation, vein-hosted, epithermal gold mineralization much like that discovered on the Midas deposit as it’s discovered inside an identical geologic setting. Gold and silver mineralization on the Midas Mine is hosted in a number of northwest-striking veins. Between 1998 and 2013, the principle veins produced over 2 million ounces of gold.

A $6.7-million program is deliberate for the Clover Property targeted on knowledge compilation, development of geologic and useful resource fashions, and a ten,000-meter drilling program adopted by a mineral useful resource estimate and NI 43-101 compliant preliminary financial evaluation.

Challenge Highlights

- Consists of 169 unpatented claims encompassing 3,063 acres.

- Situated within the historic Midas Mining District, which has been producing gold and silver because the early 1900s, alongside the northeast trending Getchell Pattern that bridges the northwestern ends of the Carlin and Battle Mountain Traits and incorporates Nevada Gold’s energetic Turquoise Ridge Mine, the third largest gold mine within the US with 537,000 ounces of gold manufacturing reported in 2020.

- Drilling by earlier operators intersected mineralized and veined breccias and shear zones with important intercepts together with 9.7 meters grading 25.3 g/t gold, 7.6 meters of seven.9 g/t gold and three meters of 10 g/t gold.

- Work to this point by Element79 discovered that the property has ubiquitous expressions of valuable metals and pathfinder parts in rock chip, soil geochemistry and drill gap intercepts per the Midas, Hollister and different classical epithermal techniques.

West Whistler

The West Whistler Property is positioned within the Eureka Mining District, which hosts mid-Cretaceous, igneous-related, polymetallic carbonate alternative deposits which have subsequently been overprinted by Carlin-type gold-silver mineralization. The property is positioned alongside the southeastern finish of the Battle Mountain Pattern close to a number of gold deposits together with the Cortez Mine, the third largest gold mine in North America with 2021 gold manufacturing of 828,000 ounces.

Since its acquisition, Element79 has accomplished high-level knowledge overview and conceptual plans for goal identification. The corporate has a $ 700,000 program deliberate for the West Whistler Property targeted on area operations, floor sampling and structural evaluation with the intention to develop drill targets

Challenge Highlights

- Consists of 103 unpatented claims encompassing 2,057 acres within the Eureka Mining District.

- Situated throughout the Battle Mountain Pattern in shut proximity to a number of gold deposits together with the Cortez Mine, the third largest gold mine in North America with 2021 gold manufacturing of 828,000 ounces.

- Concentrating on a deposit much like that discovered on the Rain Deposit positioned 113 kilometers to the north the place the Saddle Zone deposit hosts 1.15 million tons grading 0.57 oz/t gold for 782,000 ounces of gold.

- On this mannequin, the gold is deposited above or close to the Devils Gate-Webb Formation contact adjoining to northwest and northeast trending gold-bearing fault zones. On the West Whistler Property a 2-kilometer by 0.65-kilometer window of Devonian Satan’s Gate Limestone and Webb Formation is uncovered within the southern portion of the declare block.

Administration Workforce

James C. Tworek – Chief Govt Officer and Director

James Tworek has held director, senior administration, analytical and operations roles in each private and non-private corporations. A fast research and entrepreneurial to the bone, his 25-year profession began in banking in 1998 and has since garnered a wealth of expertise throughout numerous industries between business banking, mining, undertaking finance, mezzanine debt, oil and fuel, clear water/envirotech and hemp/authorized hashish industries. He has investing expertise in actual property, non-public fairness, non-public mining, startup technology, tech and agricultural ventures. A crew chief pushed by outcomes, Tworek has constructed his profession on efficiently executing growth and company development targets, exceeding gross sales goals, and being conscious of guaranteeing open communication, honesty and integrity with traders and stakeholders.

Tammy Gillis – Chief Monetary Officer

Ms. Gillis is a CPA, CMA with over 20 years of expertise within the public markets bringing complete background in finance, reporting and regulatory necessities for manufacturing, bio-technology, know-how and junior exploration industries. Ms. Gillis has been a part of groups which have accomplished a number of financings, grant functions and acquisition transactions. Ms. Gillis began her profession working at a company and securities legislation agency. Ms. Gillis beforehand served as Company Accountant for a global manufacturing firm that had income in extra of $120 million and as Chief Monetary Officer for a know-how firm with patented cathode supplies utilized in lithium-ion batteries that efficiently constructed a pilot plant with the help of over $4 million in authorities grants. Ms. Gillis has served as an officer for a number of TSX-V and CSE-listed issuers.

Antonios (Tony) Maragakis – Director

Antonios Maragakis accomplished his PhD on the College of Delft, MSc on the College of Tub, his B.Sc and B.A. on the College of Nevada, and govt coaching on the London Enterprise Faculty. He brings with him greater than 15 years of expertise main a number of the largest mining megaprojects within the final decade. Maragakis holds a distinguished resume, together with administration and director-level positions overseeing multibillion-dollar undertaking portfolios internationally at organizations, akin to:

- Barrick Gold (NYSE Listed), the place he led undertaking controls in North America throughout a portfolio of greater than 70 tasks value over $2.3 billion.

- Skeena Assets (TSX Listed), the place he labored intently with govt management to develop the Eskay Creek Challenge and company processes and administration techniques.

- Freeport-McMoRan (NYSE Listed), the place he helped develop the $3-billion Indonesian Copper Smelter Challenge which features a two-million-ton/annum smelter and valuable steel restoration plant.

- Eldorado Gold (TSX, NYSE Listed), the place he was undertaking director for the over $1-billion Skouries Challenge, in addition to led the operational turnaround of the Kassandra Mines.

- Koch Industries (the most important privately held firm within the US), at its subsidiary, Koch Ag. & Power Options, the place he helped execute the Enid Growth Megaproject, on the time the most important capital undertaking ever undertaken by the complete Koch Industries conglomerate.

- Mochica Assets and Calipuy Assets (non-public Peruvian gold mines) the place he oversaw the event of assorted undertaking portfolios.

Kim Kirkland – Chief Working Officer

Kim Kirkland’s monitor file spans senior govt and lead engineering roles at a number of the world’s largest mining corporations. Key highlights of Kirkland’s work historical past embody:

- Barrick Gold Company – Concerned throughout the early development and innovation years on the Goldstrike Complicated, together with the event and upkeep of the open-pit mineral reserve mannequin for the Betze-Submit Mine

- Rio Tinto Group – La Granja Copper Challenge in northern Peru, held a senior administration place on the Benga Mine

- MMG Ltd. – regional supervisor on the Las Bambas Copper Mine in Peru

- Amec Foster Wheeler Plc – Marcobre SAC’s Mina Justa Mine Challenge

- McEwen Mining – Liable for the restructuring of the El Gallo Silver Challenge (later renamed to Fenix) in Sinaloa, Mexico, because the director of undertaking growth.

Neil Pettigrew – Director

Neil Pettigrew is an expert geologist in good standing, registered in Ontario, with over 20 years of expertise within the mineral exploration trade. He obtained his Honors B.Sc. from the College of New Brunswick and his M.Sc. from the College of Ottawa. Pettigrew has been employed as a senior precambrian geoscientist with the Ontario Geological Survey and has labored for a number of junior and main corporations in gold and Cu-Ni-PGE exploration. He has held officer and director positions at a number of TSX and TSXV listed junior corporations and presently sits as vice-president of exploration and director of Palladium One Mining Inc.

George Tumur – Director

GeorgeTumur brings a wealth of expertise and a profound understanding of mining, funding funding and authorities relations. As former ambassador to Singapore, Tumur’s outstanding profession has been characterised by visionary management, strategic acumen and an distinctive potential to navigate complicated challenges.

Tumur has held a number of executive-level positions at minerals exploration and mining organizations, together with Hunnu Coal (ASX:HUN), Power Assets (later, MMC, HKEX: 0975) and different private and non-private entities. Most notably, in these roles, Tumur has had a transformative influence on management, unlocking important coal sources, estimated at 1 billion tons of measured and indicated coal throughout three tasks at Hunnu Coal, and elevating the corporate’s valuation nine-fold in simply 18 months following IPO; in addition to commencing a big manufacturing of a personal undertaking inside six months from a head begin, introducing a global contract mining expertise into native mining trade, resulting in a profitable IPO.

Previous to his latest function as a senior advisor at Gateway Companions, a personal fairness funding fund in Singapore, Tumur was appointed as ambassador of Mongolia to Singapore, Philippines and Brunei Darussalam, and utilized his diplomatic abilities to strengthen bilateral and multilateral relations, boasting commerce and tourism between host nations and Mongolia.

Tumur’s tutorial background features a grasp of science in mining and earth techniques engineering from the Colorado Faculty of Mines and a bachelor of science in metallurgy and supplies engineering from the identical establishment.

Zara Kanji – Director

Zara Kanji is a founding father of Zara Kanji & Associates (established in 2004). Kanji is skilled in monetary reporting compliance for junior listed useful resource corporations, private and company taxation, common accounting, monetary reporting and value-added operational consulting companies for people, and personal and public corporations. Previous to beginning her accounting follow, Kanji served as a controller for a advertising and marketing firm, as an accountant in public follow for a CA agency, a CGA agency and as an analyst for a pension fund. Along with offering accounting and monetary compliance companies to non-public and public entities, Kanji has served as director and officer for a number of listed issuers.

Shane Williams – Strategic Advisor

Shane Williams carries a historical past of serious worth creation in each early-stage and working corporations, which incorporates senior govt and administration roles overseeing and delivering world-class, multibillion-dollar tasks at extremely distinguished corporations, together with: chief operation officer at Skeena Assets (NYSE Listed), Eskay Creek Challenge; former senior vice-president at Eldorado Gold (NYSE Listed), $2-billion international undertaking portfolio; former common supervisor of growth tasks at Rio Tinto (NYSE Listed), $2.5-billion CAPEX; and former vice-president of tasks at Kaunis Iron AB, $800-million flagship Kaunisvarra Iron Ore Challenge.