It is a phase of the 0xresearch publication. To learn full editions, subscribe.

Centralized firms are like mini dictatorships.

They don’t seem to be excellent, however their enterprise mannequin has labored nicely on the idea of financial effectivity.

Firms decrease the transaction prices, which is why they exist in any respect, argued the Nobel Prize winner Ronald Coase in 1937.

Are centralized DAOS firms? Sure and no.

Daos is centralized within the sense that there are typical figureheads or a sequence of actors who comprise disproportionate energy to affect modifications. But Daos aren’t totally like centralized conventional firms, as a result of even the founders of Daos can not break with their fingers and penetrate a proposal.

Right here is an ideal instance. Final Thursday, Aave Labs introduced ‘Horizon’, a permitted copy of the AAVE V3 Codebase with which ‘certified’ settings might use tokenized cash market funds to make use of the liquidity of the Stablecoin.

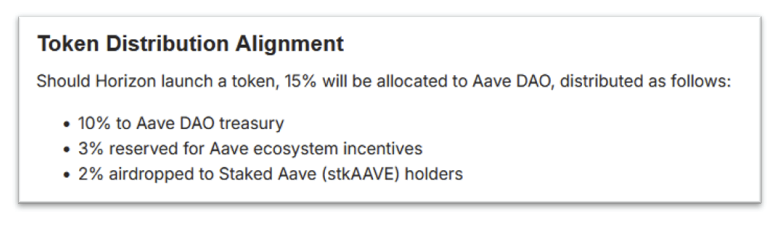

Regardless of the plans of the proposal to share earnings with the DAO (at an annual fee of fifty% within the first yr, 30% within the second and 15% within the third), the point out of a possible horizon token nearly Unanimous Unfavorable Suggestions from DAO members, together with an initiative of the Chan (ACI) founder Marc Zeller.

The criticism in a nutshell: If Aave Labs is planning to make use of a know-how to create new issues, give that worth to a token holders as a substitute of a brand new token of which a laborator will maintain a big bag.

The sturdy recoil has inspired a management of a laboratory to gracefully settle for the consensus of the group. It left the opportunity of a horizon topping, though it continues with the Horizon product.

Aave Labs in all probability anticipated such a response. If a horizon was launched, 15% was even promised to be assigned to the DAO, however that root was unable to forestall the worry of token dilution.

Supply: Aave Governance

There’s a putting parallel between the recoil to the Horizon announcement of Aave and the revealing of Uniswap Labs from his Unichain L2.

Do not forget that when Unichain was introduced final October by the Uniswap Basis, Uniswap Dao was overwhelmed and felt exterior the choice -making course of behind such an integral launch.

Jay Yu, president of Stanford Blockchain Membership and a Uniswap consultant, argued that the announcement left ‘Dao representatives at midnight’.

Though Unichain continued with the launch (in distinction to Horizon), the implications are to catch up.

In response to the poor market efficiency of Reside after a month (Unichain has solely ~ $ 9 million in TVL), Uniswap Basis instructed two weeks in the past to spend $ 45 million on Uni -Tokens from the DAO Treasury to stimulate actions.

But when Unichain is unquestionably a “labs” product, it’s a huge no -no immersing within the dao’s treasury to finance that product.

Uniswap DAO consultant GFX labs additionally factors out that almost all uniswap V4 hooks (akin to Flaunch and Bunni) don’t successfully permit the DAO to earn cash from V4 exercise by way of a reimbursement swap, due to using a “no-op”, hooks the core contracting logic of V4.

“Though this might imply that Uniswap Labs and DAO lose a technique for producing earnings, Uniswap can at all times select to activate the Protocol reimbursement swap on Polish with out hooks,” Rostyslav Bortman, co-founder of Hookrank.io, instructed Blockworks.

“Nonetheless, the preferred Hook groups work in shut collaboration with Uniswap Basis, and we do not see Bunni or Flaunch eliminating the logic of ‘protocol prices’ of their hooks.

Within the case of each Aave and Uniswap, you could have centralized management groups that you just completely need to worn as startups – that’s, and launch shortly to outlive and succeed.

Nonetheless, DAO management is burdened by the decentralized requirements of Dao Governance, which limits the agility and maneuverability that requires a startup.

To get one thing achieved, a DAO should behave in sure methods:

- The DAO should place a request for remark (RFC) to ask group dialogue

- After an inexpensive stage of debate, the DAO begins an early temperature management

- If the DAO has issues with the proposal, the dialogue inevitably flows into the anarchy of Crypto Twitter

- The DAO in the end takes a ultimate vote to finish the proposal

That whole course of brings transaction prices as a substitute of down, so do we actually need Daos? Away the moral advantages of decentralization towards the burden of transaction prices?