Blockchain protocol MakerDAO (MKR) continues to publish vital positive factors and stays robust rising all year long. MKR has seen vital development of over 358%, accompanied by constructive numbers reflecting elevated adoption and utilization of the protocol.

Furthermore, the upcoming voting initiatives goal to additional improve the advantages of the platform for its stakeholders.

MakerDAO declares plans for pricing system adjustments

In a latest one announcementMakerDAO acknowledged that it’s intently monitoring developments within the cryptocurrency market and has gained a greater understanding of the affect of latest proposals.

In consequence, the protocol recommends the subsequent set of adjustments to its tariff system. MakerDAO emphasised that additional changes are prone to be applied quickly, relying on the state of affairs market dynamicsresembling costs, demand for leverage and the exterior rate of interest surroundings that features the financing charges for centralized finance (CeFi) and decentralized (DeFi) efficient rates of interest.

Associated Studying: US Spot Bitcoin ETFs Expertise File Outflows, Dropping $740 Million in Three Days

The protocol additional famous that the Maker tariff system will probably be adjusted accordingly if the exterior tariff surroundings continues to point out indicators of degradation.

Efforts are underway to replace the speed system language inside the Stability Scope, together with the event of a brand new model of the Publicity Mannequin. These updates ought to make sure that the system can regulate charges extra step by step and successfully sooner or later.

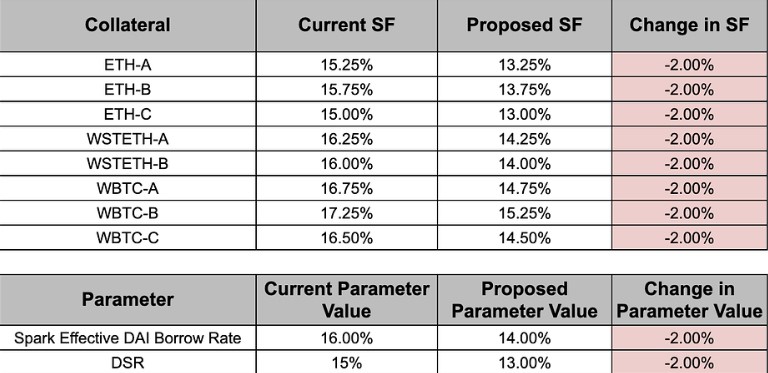

Based mostly on suggestions from BA Labs, a blockchain infrastructure supplier, the Stability Facilitator suggests a number of parameter adjustments to the Maker Price system, which will probably be topic to an upcoming vote by the Government.

As proven within the desk above, the proposed adjustments embrace a 2 share level discount within the stability charge for various kinds of collateral, resembling ETH-A, ETH-B, ETH-C, WSTETH-A, WSTETH-B, WBTC-A, WBTC-B, WBTC-C. As well as, the Dai Financial savings Price (DSR) and the Efficient DAI Borrowing Price for Spark can even be lowered by 2 share factors.

Nonetheless, one energetic protocol person provided another view, suggesting that he would exploit the opportunity of a requirement shock to extend the web curiosity margin. Whereas he agrees with the proposed 2% rate of interest fee discount for debtors, the person is asking for a bigger 4% DSR discount, which he believes will additional profit MakerDAO’s web curiosity margin.

Finally, the result of the voting course of will decide whether or not these proposed adjustments are applied and profit MakerDAO stakeholders. Additional choices on charges and reimbursements will probably be made primarily based on the outcomes.

Market capitalization skyrockets

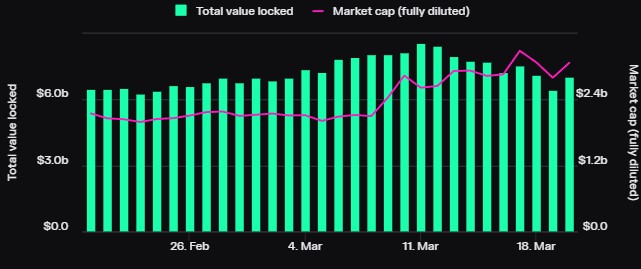

Based on info from Token Terminal, MakerDAO has proven vital development and constructive efficiency throughout a number of key metrics over the previous 30 days.

When it comes to market cap, MakerDAO’s absolutely diluted market cap has reached roughly $3.07 billion, reflecting a notable improve of 40.9% over the previous 30 days. The circulating market capitalization is roughly $2.82 billion, displaying an analogous development fee of 41.1%.

Then again, the overall worth (TVL) in MakerDAO has elevated by 10.1% over the previous 30 days to roughly $7.05 billion.

The signal buying and selling quantity for MakerDAO is up 126.6% over the previous month to roughly $4.35 billion. This improve in buying and selling quantity signifies elevated market exercise and curiosity within the protocol.

When it comes to person exercise, MakerDAO has seen a rise within the variety of every day energetic customers, up 32.2% to 193 customers. Then again, the variety of weekly energetic customers dropped by 22.6% to 783 customers. Nonetheless, month-to-month energetic customers have proven a constructive development fee of 10.0%, reaching 2,88,000 customers.

Brief-term outlook for MKR

When it comes to value motion, MKR is presently buying and selling at $3,158, reflecting a development of 4.8% within the final 24 hours, 10% within the final seven days, and a formidable 49% improve within the final fourteen and thirty days.

The token has hit a short-term assist wall at $3,048. This degree of assist is important for the token’s development prospects. One other key assist degree lies at $2,884, additional contributing to the short-term stability and potential development of the token.

Associated studying: Crypto professional reveals risk of Bitcoin reaching $500,000

On the draw back, the closest resistance degree is noticed on the 28-month excessive of $3,321. This degree represents the very best level the token has reached since November 2021.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is for instructional functions solely. It doesn’t signify NewsBTC’s views on shopping for, promoting or holding investments and naturally investing entails dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use the data on this web site completely at your personal threat.