MakerDAO, Ethereum’s first defi lending protocol, has captured a 52% share of the ETH lending market.

The milestone was highlighted in Steakhouse Monetary’s MakerDAO Protocol Economics Report for January 2024, which confirmed a 22% improve in ETH lending via crypto vaults on Spark.

A lot of MakerDAO’s market dominance over the previous 12 months may be attributed to Spark, which has offered excessive liquidity and aggressive rates of interest for DAI – the most important decentralized stablecoin. Spark is now the third largest defi lending protocol by whole worth locked (TVL).

SparkLend retains the momentum going, listed here are the previous week’s efficiency:

Mainnet

• Property delivered are up practically $1 billion from final week, presently at ~$5.65 billion.

• Loans quantity to ~$1.69 billion.

• Accessible liquidity is sort of $4 billion, presently… pic.twitter.com/kOc5KgXBgI

— Spark (@sparkdotfi) March 4, 2024

You may additionally like: Biden-related meme cash surge 4,700% amid Tremendous Tuesday outcomes

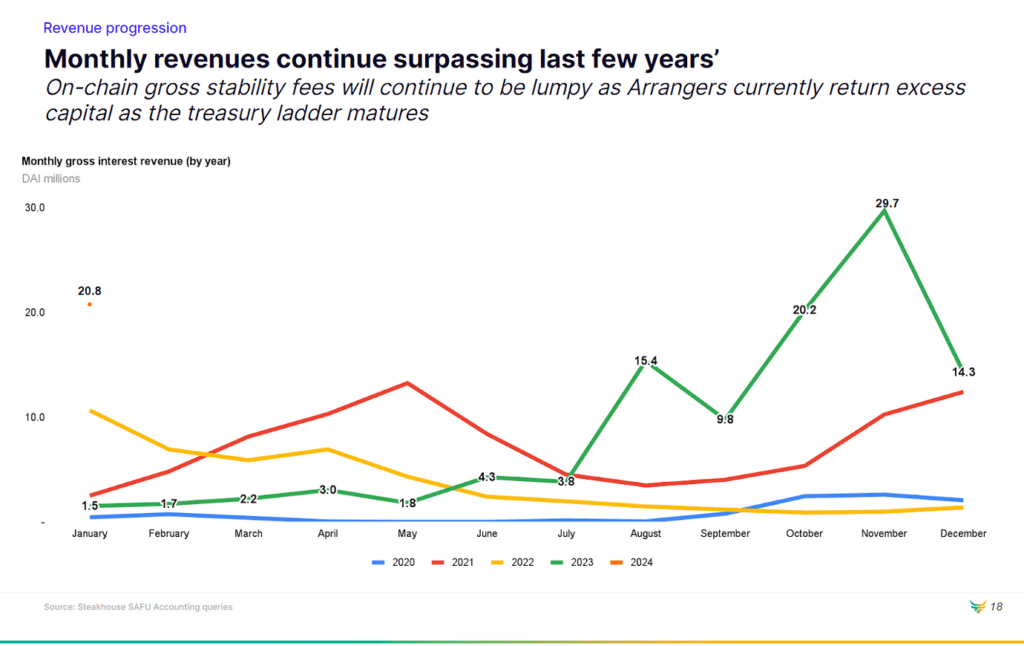

The report particulars MakerDAO’s monetary efficiency, with gross month-to-month income of 20.8 million DAI as of January 2024. Crypto vaults have been a serious income, contributing 10.3 million DAI.

Actual-World Property (RWA) income additionally performed a vital function, including 10.5 million DAI to the overall, regardless of a 14% decline in RWA publicity in comparison with December 2023.

The shift in the direction of crypto-backed lending from authorities bonds has been key to capitalizing in the marketplace rally.

MakerDAO continues to evolve its governance construction via the Endgame Plan, aiming to additional decentralize decision-making by introducing SubDAOs. Every SubDAO may have its personal governance token, course of and workforce, marking an vital step in the direction of a extra decentralized and environment friendly ecosystem.

Learn extra: Spain blocks Sam Altman’s Worldcoin over knowledge privateness considerations