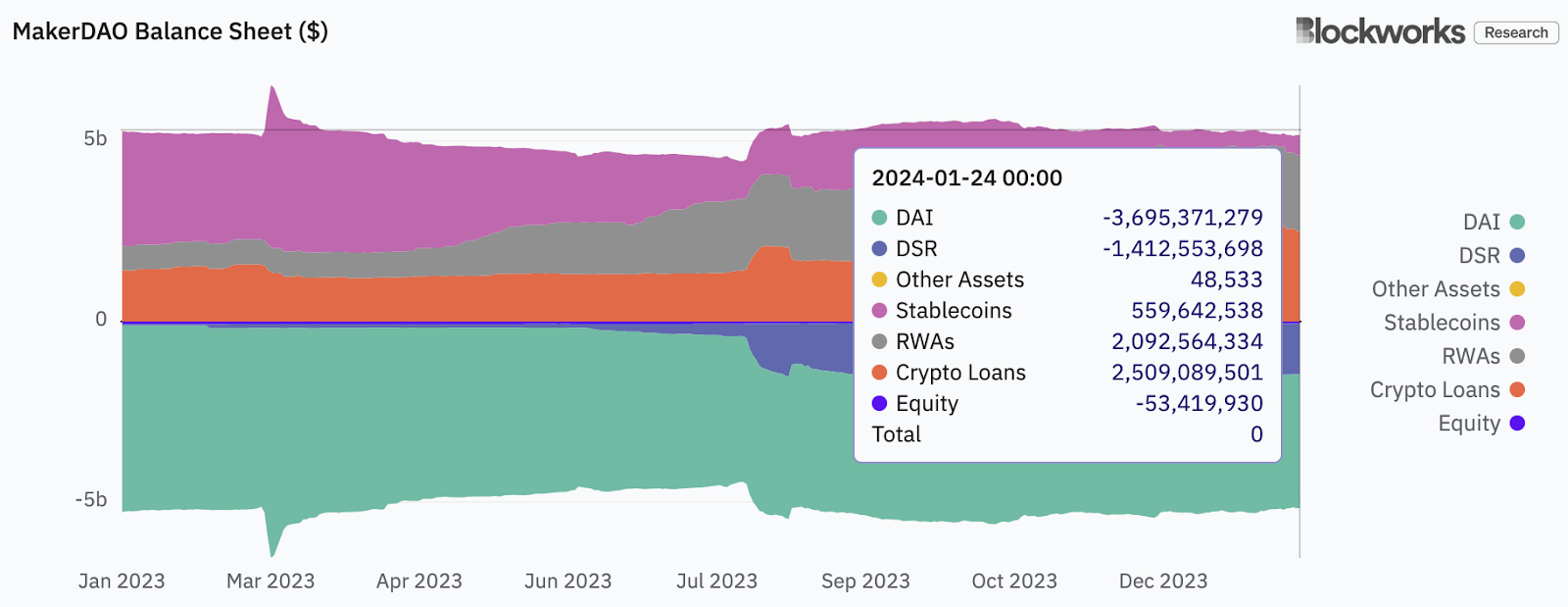

MakerDAO, issuer of the DAI stablecoin, has seen a notable shift within the composition of its steadiness sheet as a result of mixture of macroeconomic occasions and rising crypto markets.

The newest knowledge from the DAO’s Digital Asset-Legal responsibility Committee (ALCO) reveals that cryptocurrency-backed loans – i.e. DAI issued towards crypto collateral corresponding to ether – as soon as once more exceeded 50% of complete belongings for the primary time since Could 2022. symbolize belongings. .

For many of 2023, Maker’s public credit score portfolio — assume U.S. Treasury bonds — dominated the protocol’s earnings, whereas Federal Reserve fee hikes pushed short-term Treasury yields above 5%.

However as yields fell within the fourth quarter of the 12 months and demand for DAI loans elevated, the DAO, by its Particular Function Automobile (SPV) intermediaries, started promoting T-bills, stated Sebastian Derivaux of Steakhouse Monetary, who the financial institution advises. DAO.

“The explanation we’re lowering publicity to authorities bonds is to replenish stock [Peg Stability Module] and the rationale why the PSM has been shrinking currently is as a result of we’re in a bull market,” Derivaux informed Blockworks. “And as you’ll be able to see, crypto financial institution loans are skyrocketing as a result of individuals wish to speculate, and each time somebody takes out a mortgage [from] MakerDAO to realize leverage reduces the PSM roughly by the identical quantity.

Learn extra: MakerDAO can develop non-crypto asset portfolio with BlockTower, Centrifuge

The ALCO highlighted one space of gentle concern concerning the provision of stablecoins in Maker’s PSM within the minutes of its most up-to-date assembly, which was revealed on Wednesday.

“Day by day liquidity has been persistently tight in current months,” the committee wrote. “The Digital ALCO recommends a medium-term precedence to shift liquidity again barely.”

The DAO goals to have no less than 18% to 22% of stablecoins accessible for the PSM, Derivaux stated.

“So typically issues decelerate a bit after which one thing is completed to complement the PSM,” he stated.

In keeping with knowledge from Blockworks Analysis, the ratio of stablecoins to complete belongings has been nearer to 10%-12% currently.

ALCO mentioned the additional diversification of the protocol’s steadiness sheet, particularly wanting on the suitability of Collateralized Mortgage Obligations (CLOs) and different asset courses as potential additions to attain increased returns than authorities bonds.

The committee acknowledged that it might be essential to barely lengthen the length of investments, taking into consideration the chance related to a doable return to a low rate of interest macro surroundings in the long run. CLOs sometimes have variable charges.

Learn extra: MakerDAO strikes $250 million from Coinbase to rebuild DAI collateral

For belongings that pay increased than authorities bonds, the committee thought of senior tranches of Asset Backed Securities (ABS), particularly these backed by present belongings corresponding to bank card receivables and short-term ETF bond funds.

These can put stress on returns whereas holding danger low, however there are trade-offs and potential challenges in integrating these belongings into Maker’s algorithmic Asset-Legal responsibility Administration (ALM) scheme.

The ALCO just lately added conventional monetary heavyweight Moorad Choudhry as an unbiased advisor.

Steakhouse has primarily based parts of its ALM analysis and proposals on Choudhry’s work in academia as a professor on the Division of Economics at London Metropolitan College and creator of textbooks and reference works on finance.

Whereas the ALCO concluded that holding extra kinds of belongings may assist develop the steadiness sheet by rising the Dai Financial savings Charge (DSR) – which at the moment stands at 5% – it emphasised the necessity for cautious consideration of capital adequacy, liquidity, value transparency and danger administration. integration.

Learn extra: The DAI financial savings rate of interest is 8%, simply not for People

A excessive proportion of the DAI minted is just not deployed for the 5% yield. Derivaux stated as a lot as 70% is simply in Externally Owned Accounts (EOAs) on Ethereum or layer 2 chains.

“That is fairly surprising as a result of sDAI – perhaps it isn’t identified to individuals – however it’s utterly risk-free,” he stated, referring to the chance related to holding uncovered DAI, which yields nothing.

The 5% fee ought to be sustainable, Derivaux stated, as a result of the composition of the steadiness sheet is altering. The demand for leverage ought to make collateralized lending extra worthwhile for the protocol.

“It’s clear that we now have fewer stablecoins [on the balance sheet]the extra income MakerDAO generates and the extra revenue it generates,” he famous.