Bundles of $100 U.S. banknotes.

allanswart/iStock through Getty Pictures

It is typically been mentioned that cash by no means sleeps. This precept can both be your personal worst nightmare or your dream come true. What do I imply?

On one hand, payments and dwelling bills by no means relent. In contrast to us people who may take day without work throughout the vacation season, might take an occasional sick day, and doubtlessly take weekends off, payments and dwelling bills are unrelenting. Dwelling bills do not care in regards to the holidays, any person’s circumstances, or their emotions.

Nonetheless, the flip facet of this coin is what has fascinated me for the higher a part of almost 15 years, starting after I was 12 years outdated. At any given time, the most effective companies on the planet are busy working and being profitable. Since these companies are additionally devoted to rewarding their shareholders, dividends typically issue into the equation of returning worth to shareholders. Thus, proudly owning blue-chip dividend shares is equal to being profitable in a single’s sleep.

Striving to dwell nicely beneath my means, I’ve been routinely placing surplus capital to work for the final six years. Fundamental Road Capital (NYSE:MAIN) accounts for 1.2% of my portfolio worth, which makes it the twenty eighth largest holding in my portfolio.

For the primary time since September, I’ll dive into the corporate’s fundamentals and valuation to clarify why I’m reiterating my purchase ranking.

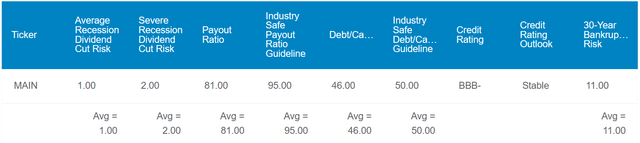

DK Zen Analysis Terminal

Fundamental Road Capital’s 6.7% dividend yield is considerably better than the three.9% yield of the 10-year U.S. treasury. In even higher information, the corporate’s 81% payout ratio is nicely beneath the 95% that ranking businesses wish to see from BDCs. For this reason Fundamental Road Capital paid a considerable quantity of particular dividends in 2023, which raised the yield even additional to eight.6%.

The BDC additionally maintains a strong steadiness sheet, with a 46% debt-to-capital ratio. For context, that’s barely lower than the 50% debt-to-capital ratio that’s thought-about sustainable by ranking businesses for BDCs. Thus, Fundamental Road Capital enjoys a BBB- credit standing from S&P on a secure outlook. This means an 11% chance of chapter via 2053.

On account of its conservative payout ratio and capitalization, Dividend Kings estimates the danger of Fundamental Road Capital reducing its dividend within the subsequent common recession is simply 1%. Even within the subsequent extreme recession, that threat stays manageable for a well-diversified portfolio at 2%.

DK Zen Analysis Terminal

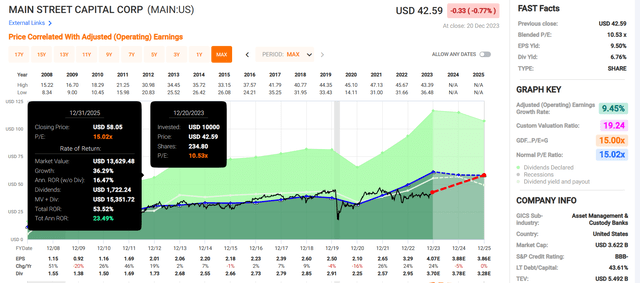

Fundamentals alone make Fundamental Road Capital an intriguing inventory. However that is not all there may be to love in regards to the BDC. Historic valuation metrics akin to dividend yield counsel shares of the inventory are value $58 every per Dividend Kings. Stacked up in opposition to the $43 share value (as of December 21, 2023), this may equate to a 27% low cost to truthful worth.

If Fundamental Road Capital have been to revert to truthful worth and meet the analyst progress consensus, listed below are the whole returns that it may produce via 2033:

- 6.7% yield (excluding particular dividends) + 8% FactSet Analysis annual progress consensus + 3.1% annual valuation a number of upside = 17.8% annual whole return potential or a 415% 10-year cumulative whole return versus the 8.6% annual whole return potential of the S&P 500 (SP500) or a 128% 10-year cumulative whole return

One other Quarter Of Operational Excellence

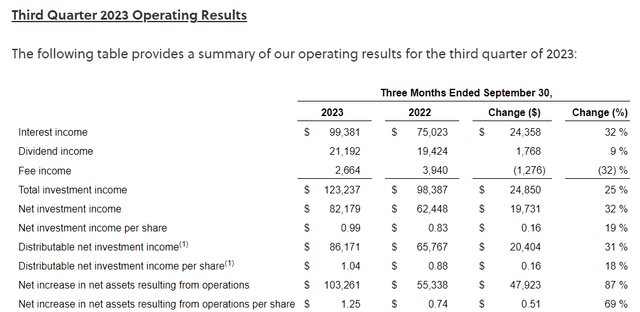

Fundamental Road Capital Q3 2023 Earnings Press Launch

As shareholders have come to anticipate through the years, Fundamental Road Capital as soon as once more got here via with strong leads to the third quarter ended September 30. The corporate’s $123.2 million in whole funding earnings was $0.6 million wanting the consensus, however this nonetheless represented 25.3% year-over-year progress.

Unsurprisingly, this surge in whole funding earnings coincided with skyrocketing rates of interest and wholesome enterprise situations. It is because the overwhelming majority of Fundamental Road Capital’s debt investments (70%) bear curiosity at floating charges. Quite the opposite, 75% of the corporate’s excellent debt obligations are locked in at mounted rates of interest. Together with its investment-grade credit standing, that is how Fundamental Road Capital’s typical efficient curiosity margin is round 500 foundation factors on its $1.5 billion personal mortgage funding portfolio. Additionally, the efficient curiosity margin is 425 foundation factors on its center market funding portfolio (particulars sourced from Main Street Capital’s Q3 2023 Investor Presentation).

Because of this, Fundamental Road Capital’s distributable web funding earnings per share surged 18.2% greater over the year-ago interval to $1.04 for the third quarter. This surpassed the analyst consensus by $0.04.

Due to its sound funding method and savvy investments, Fundamental Road Capital’s web asset worth grew by 5.5% versus December 31, 2022, to $28.33 as of September 30, 2023. Cumulatively, meaning the corporate’s NAV has soared 120% because the finish of 2007. That works out to a 5.1% compound annual progress fee, which undoubtedly makes Fundamental Road Capital a confirmed wealth compounder.

Shifting ahead, the corporate ought to have loads of room to develop. That is as a result of its investments in 195 companies all through a wide range of industries symbolize simply 0.1% of the general home whole addressable market of 200,000-plus companies. Merely put, Fundamental Road Capital can stay steadfast in its investing method and nonetheless have loads of alternatives for future funding.

Gradual And Regular Dividend Progress Might Lie Forward

For a BDC, Fundamental Road Capital has been a outstanding dividend grower for some time now. The corporate’s common month-to-month dividend per share has soared 118.2% from $0.33 paid in This autumn 2007 to $0.72 declared for Q1 2024.

Extra particularly, Fundamental Road Capital has generated $3.23 in distributable web funding earnings per share via the primary 9 months of 2023. Towards the $2.715 in whole dividends per share paid over that point, that is an 84.1% payout ratio. That ought to depart the corporate with an sufficient buffer to continue to grow the payout over time.

Dangers To Take into account

Fundamental Road Capital’s observe report and fundamentals earn it a blue-chip 10/13 high quality ranking from Dividend Kings. Nonetheless, the corporate has a threat profile that will not make it proper for everybody.

Not too long ago, the Federal Reserve signaled that it may reduce rates of interest no less than 3 times in 2024. If this have been to happen, Fundamental Road Capital’s monetary outcomes could be adversely impacted. Per slide 44 of 49 of its Q3 2023 Investor Presentation, the corporate estimates each 100 foundation level lower in rates of interest would decrease web funding earnings per share by $0.19.

If rates of interest find yourself being reduce any additional or quicker than what the Fed is presently conveying, that might in all probability imply the financial system is in hassle. This might result in elevated write-offs of investments. Nonetheless, the excellent news is that 83.9% of Fundamental Road Capital’s debt is first lien (per web page 88 of 157 of Main Street Capital’s recent 10-Q filing). This lowers the credit score threat of such investments.

Lastly, Fundamental Road Capital’s continued success is dependent upon the attraction and retention of key personnel. If the corporate loses any of those personnel, it might be unfavorably impacted.

Abstract: Excessive Beginning Revenue And Progress For A Low cost Valuation

FAST Graphs, FactSet

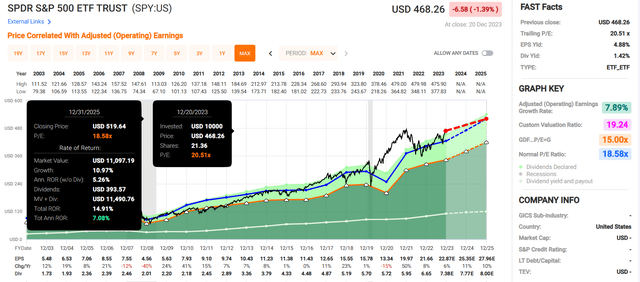

FAST Graphs, FactSet

Fundamental Road Capital’s outsized beginning yield, secure working fundamentals, and investment-grade credit standing are all pluses in my opinion. And the valuation seals the deal on my purchase ranking.

Shares of Fundamental Road Capital are buying and selling at a blended valuation a number of of simply 10.5, which is drastically decrease than the traditional valuation a number of of 15 per FAST Graphs. Assuming the BDC returns to truthful worth and grows as anticipated, it may generate 54% cumulative whole returns via 2025. This would depart the 15% cumulative whole returns of the SPDR S&P 500 ETF Belief (SPY) within the mud, making Fundamental Road Capital a compelling decide for earnings and a few capital appreciation as well.