Authored by Simon White, Bloomberg macro strategist,

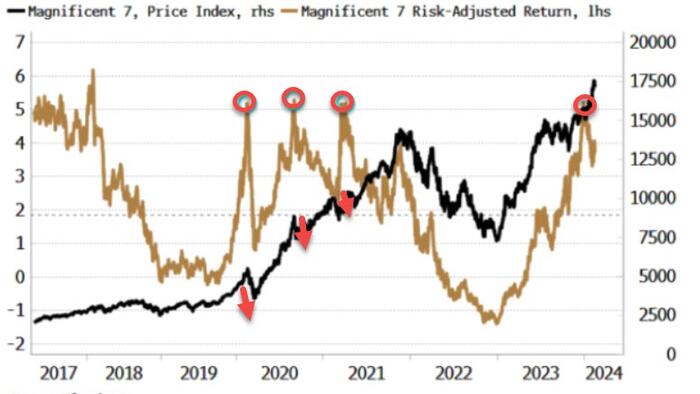

The fabled Magnificent 7’s return adjusted for volatility is greater than different important belongings, and is closing in on ranges which have beforehand been related to pullbacks.

The mix of excessive returns and low volatility is catnip for buyers.

Creating wealth is nice, but when you are able to do so in a monotonically rising manner, then even higher.

The Magnificent 7 at present is blowing the competitors out of the water not simply in straight returns, however in risk-adjusted phrases too.

Its vol-adjusted return is greater than the Nasdaq, the S&P, the Nikkei, US 60/40 and Bitcoin (whose adjusted return is so excessive not a lot attributable to low volatility, however attributable to a stratospheric 130% return during the last 12 months).

Excessive risk-adjusted returns may be self-fulfilling for a time. Engaging metrics pull extra money in, boosting returns, and doing so in a gentle manner, juicing the adjusted return additional.

However when returns turn into stretched, they’re usually related to pullbacks.

Earlier excessive risk-adjusted returns for the Magnificent 7 have occurred at worth reversals.

Apparently, at present the risk-adjusted return is excessive, however not at historic extremes.

This implies that, from this angle, a notable pullback won’t be imminent, but one might be within the offing if the adjusted return retains rising.

Danger-adjusted returns are sometimes nothing greater than a deep tide concealing the dignity of swimmers who’ve been remiss in donning their trunks.

They’re boosted by falling volatility, however repressed vol usually explodes greater sooner or later. Excessive risk-adjusted returns thus immediately turn into very low ones.

They’re thus a warning signal moderately than a inexperienced gentle.

Loading…