yorkfoto/E+ through Getty Pictures

Magellan Midstream (NYSE:MMP) holders will get up Monday morning now proudly owning shares of ONEOK (NYSE:OKE), after MMP unitholders agreed to approve the deal. The deal was hotly contested as a result of tax penalties it might impose on long-term MMP unitholders, however the deal gained assist from proxy advisory service companies Institutional Shareholder Companies and Glass Lewis, in addition to high holder SS&C ALPS Advisors, which runs the Alerian MLP ETF (AMLP).

Holders of roughly 55% of the excellent models voted in favor of the deal, whereas 76% of the models that voted permitted the deal. MMP administration went into full press mode to persuade holders on the deal. They even reached out to me after my article urging unitholders to reject the deal (though I had journey plans on the time and was unable to talk to them.)

Merger

As a fast reminder, OKE introduced in mid-Could that it might purchase MMP in a deal valued at $18.8 billion, together with debt, on the time. MMP unitholders would get 0.667 OKE shares for each MMP unit they owned, and $25 in money.

The deal represented a 22% premium to MMP’s closing value earlier than the announcement in addition to to its 20-day VWAP. MMP unitholders will personal 23% of the mixed firm.

Mixed Firm

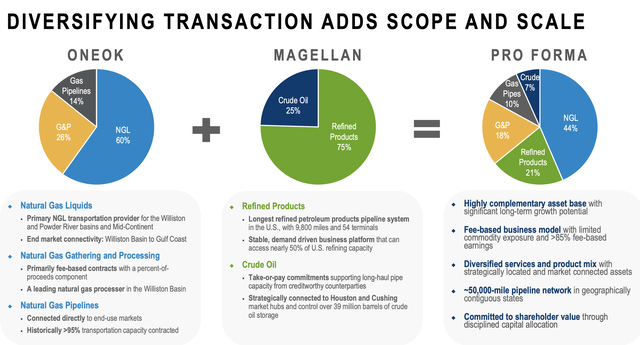

So, what precisely do MMP holders personal now? Initially, they are going to personal a mixed firm that’s way more diversified.

MMP was a grasp restricted partnership (MLP) that was targeted on the transport, storage, and distribution of refined merchandise and crude oil. The corporate had the biggest refined petroleum merchandise pipeline system within the U.S. and refined merchandise made up about 75% of its EBITDA. About 85% of its working earnings had been fee-based.

MMP had been benefiting from an inflationary atmosphere, as its pipeline tariffs had been typically tied PPO or different inflationary components. Its tariffs had been elevated 6% final 12 months, and went up 11.5% July 1st of this 12 months. Nonetheless, the corporate wasn’t discovering a lot in the way in which of intriguing development tasks and was as a substitute specializing in its stability sheet and capital allocation.

Whereas the subsequent 12 months was promising for MMP, given the shortage of development tasks and the sale of the corporate, administration clearly had some longer-term considerations across the enterprise because the U.S. pushed ahead with rising electrical car (EV) utilization.

OKE brings to the desk an organization that can be largely fee-based. Nonetheless, the corporate is within the enterprise of gathering and transporting pure gasoline and pure gasoline liquids (NGL). NGLs is its largest phase, the place it offers gathering, fractionation, transport, and advertising and marketing companies throughout numerous basins. It additionally owns gathering pipelines and processing vegetation primarily within the Bakken, Powder River Basin, and Mid-Continent. As well as, it owns intrastate pure gasoline pipeline and storage property positioned in Oklahoma, Texas and Kansas.

For its half, OKE has been performing effectively as a standalone firm. When reporting its Q2 steerage, the corporate grew its EBITDA 10% to $971 million and likewise elevated its full-year EBITDA steerage.

Whereas tied to NGLs and pure gasoline, the corporate largely offers with related gasoline and NGLs in oil areas. And on that entrance, the corporate has seen robust quantity development, with Q2 NGL volumes up 11%, led by the Rockies and Permian. Pure gasoline volumes had been even stronger, up 16%.

Firm Presentation

Synergies

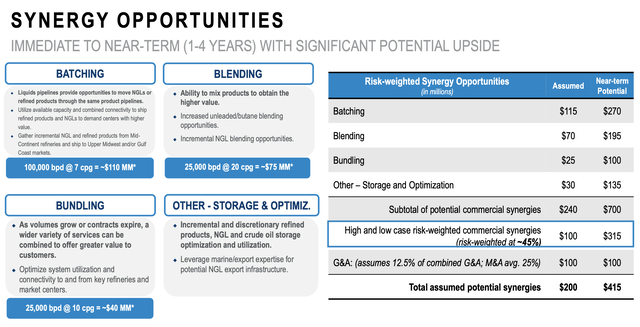

So the large query is with the businesses handing completely different merchandise and MMP not discovering many development alternatives, why did OKE wish to purchase MMP. OKE initially pegged synergies between the 2 firms at $200 million, which isn’t an entire lot for a mixed firm that ought to generate about $6.3 billion in EBITDA this 12 months. That provides solely about 3% to EBITDA.

Nonetheless, the corporate has been indicating that quantity is conservative, and pushing it up nearer to $400 million. It mentioned whereas $100 million of the synergies are taking out SG&A, it may be about to take out 25% of the fee, which might be nearer to $200 million.

Firm Presentation

The corporate has additionally began to speak about alternatives in batching, mixing, and bundling. On the mixing facet, the corporate mentioned it may possibly combine merchandise to create a better valued product. It has loads of regular butane on its system, and it thinks that upgrading it provides it a $75 million a 12 months alternative. On the bundling facet, it mentioned it might have the ability to optimize the 2 firms’ programs to enhance utilization and connectivity when contracts come up. It views this as a $40 million a 12 months alternative. In the meantime, it mentioned that NGL and refined product pipelines can transport each via the identical pipeline via a course of known as batching. By discovering higher markets, it thinks it may possibly see $100 million in synergies.

Discussing batching at a Barclays conference, OKE CEO Pierce Norton mentioned:

“We have had extra conversations to grasp precisely what batching is and the way we are going to do it. And we do that as we speak. We transfer refined merchandise on our NGL pipeline as we speak. And so the way you do that’s when you’ve got or instance, purity NGL pipelines, when you’re transferring propane and also you wish to transfer unleaded on that, what you are going to do is you are going to put a buffer of regular butane in there. There’s going to be a few thousand barrels of regular butane. By way of a pipeline, that is miles of pipeline that will likely be underneath regular butane. So we’ll have propane, the buffer of regular butane, after which we’ll put unleaded proper subsequent to it. And the explanation we use the buffer of regular butane is regular butane will be combined into propane, there’s spec for that. And as effectively, know that ordinary butane will be combined into unleaded for mixing. In order that strikes down the pipeline, we now have a system the place we are able to monitor that buffer because it goes down and also you’re speaking about miles of pipeline. So when it is available in, we are going to, what they name, reduce, we’ll reduce the batch. We’ll [add] extra of the conventional butane into the unleaded and that we get an improve on that otherwise you get some mixing on that and the opposite ones will keep within the propylene. That is how we are able to batch down the pipeline. So you concentrate on it that these 2 programs sit on high of one another. To the extent that it turns because the market adjustments otherwise you get spikes available in the market and there is pinch factors alongside Magellan’s system, we are able to transfer on to the NGL system round these pinch factors or if there’s extra long-term constraints on both one of many programs, we are able to transfer forwards and backwards as a result of the pipelines sit on high of one another to get to those places.”

The synergy estimates could show conservative, however operation synergies are typically harder to foretell. Nonetheless, the SG&A estimates may very effectively be any simpler space to get some further prices financial savings out of it. That mentioned, I feel displaying the operational advantages of the deal will likely be extra vital for traders transferring ahead.

Mixed Valuation

The present consensus has OKE 2024 EBITDA falling from 2023 ranges and MMP rising barely, so mixed with $100 million in additional fast synergies, the mixed firm is ready to generate about $6.1 billion in adjusted EBITDA in 2024. That values the mixed firm at roughly 10x 2024 EBITDA.

By comparability, diversified midstream operator Enterprise Merchandise Companions (EPD) trades at 9.1x and Vitality Switch (ET) at 7.5x. I feel each of those friends have a greater asset base and commerce at a decrease valuation.

Conclusion

MMP traders will get hit with a tax invoice, so save up a few of that money portion of the deal for the taxman. What they are going to get is a stronger, extra diversified firm with out having to fret a couple of Okay-1. It would have about 4x leverage, and look to get that down a bit. Total, the mixed firm will likely be stable.

That mentioned, for my part there are higher offers within the midstream area which are cheaper and have higher property, similar to EPD and ET. I’d choose to rotate into both of those two shares, or another midstream names I’ve mentioned prior to now such Plains All America (PAA) (article), Western Midstream (WES) (article), or Antero Midstream (AM) (article).

Total, I fee the brand new OKE-MMP a “Maintain,” and assume the inventory appears appropriately priced, however with out a lot upside outdoors of the dividend.