wildpixel

It has been round one 12 months and a half since I offered a overview of the Franklin U.S. Low Volatility Excessive Dividend Index ETF (NASDAQ:LVHD), so I imagine it’s value offering an replace. Earlier than we delve into the evaluation, you will need to be aware that in June 2022, the fund was renamed; beforehand, it was known as the Legg Mason Low Volatility Excessive Dividend ETF.

To recap, the most important concept of the March 2022 article was that “LVHD is a suboptimal alternative for dividend traders.” Within the stated be aware, I concluded that

Market-beating efficiency is clearly to not be anticipated in the long run, with the low-volatility issue lowering its potential to outpace the S&P 500.

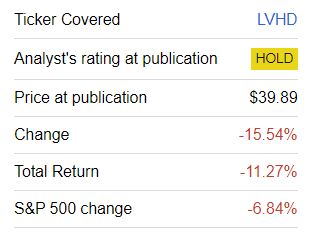

Since then, LVHD has been a gross disappointment because it considerably underperformed the S&P 500.

The screenshot taken on October 18, Japanese Time (In search of Alpha)

One of many key ideas of profitable investing is that horrible efficiency often results in an funding alternative rising. However this case is totally different, and I imagine it’s value avoiding the ETF. The explanations might be reviewed shortly.

Technique fundamentals: aggregating low volatility, worth, dividend, and high quality elements

In line with the fund’s web site, its technique is predicated on the Franklin Low Volatility Excessive Dividend Index. The factsheet describes the index as “composed of fairness securities of U.S. corporations with comparatively excessive yield and low worth and earnings volatility.” The next abstract of the methodology is offered:

The Index begins with the most important 3,000 U.S. shares as decided by the Solactive U.S. Broad Market Index, an index calculated and printed by Solactive AG composed of three,000 U.S. large-cap, mid-cap and small-cap corporations. Primarily based on historic and projected information utilizing Franklin Templeton Funding Options’ proprietary methodology, the index screens for worthwhile corporations which have the potential to pay comparatively excessive sustainable dividend yields. Yields of the remaining securities are then scored increased or decrease based mostly on the attractiveness of their worth and earnings volatility. The portfolio is constructed of the very best scoring securities topic to focus limits: no particular person element of the Index will exceed 2.5%, no particular person sector (as outlined by FTIS) will exceed 25%, and actual property funding belief (“REIT”) elements as an entire is not going to exceed 15%. The variety of element securities within the Index is anticipated to vary from 50 to 100. The Underlying Index’s elements are reconstituted yearly and rebalanced quarterly.

Efficiency: low volatility issue detracts from returns

Wanting on the decline LVHD has skilled for the reason that earlier article, extra meticulous traders would probably riposte that despite the fact that the fund did disappoint, specializing in returns alone is myopic as we’re discussing a car with a low volatility ingredient. And on that entrance, this Franklin ETF had clearly delivered, as its commonplace deviation was a lot decrease in comparison with the iShares Core S&P 500 ETF (IVV) over the April 2022–September 2023 interval. Nonetheless, it was barely extra unstable in comparison with the iShares MSCI USA Min Vol Issue ETF (USMV), which I analyzed in April 2022.

| Portfolio | LVHD | IVV | USMV |

| Preliminary Steadiness | $10,000 | $10,000 | $10,000 |

| Last Steadiness | $8,971 | $9,701 | $9,581 |

| CAGR | -6.99% | -2.00% | -2.81% |

| Stdev | 16.87% | 20.69% | 14.71% |

| Finest 12 months | -1.14% | 13.11% | 1.78% |

| Worst 12 months | -9.26% | -14.24% | -5.86% |

| Max. Drawdown | -13.10% | -20.28% | -14.10% |

| Sharpe Ratio | -0.56 | -0.18 | -0.37 |

| Sortino Ratio | -0.72 | -0.24 | -0.52 |

| Market Correlation | 0.82 | 1 | 0.92 |

Information from Portfolio Visualizer

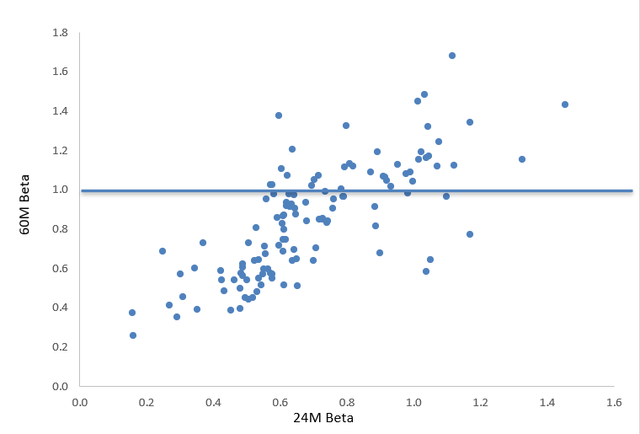

That is hardly shocking. Under is the chart with LVHD’s present holdings’ 24-month and 60-month beta coefficients; the exception is WK Kellogg (KLG), which has been spun off only in the near past.

Created utilizing information from In search of Alpha and the fund. Monetary information as of October 16

As it may be seen, most holdings have that coefficient under 1 (extra particularly, 85.4% have a 24-month beta under 1), with the weighted-average 24-month determine standing at simply 0.65.

Subsequent, they’d probably add that LVHD was down by just one.1% in 2022 (almost definitely because of the low beta), so for traders searching for a protected haven amid frenetic worth swings within the fairness universe, it’s an possibility to noticeably think about. However the issue right here is its return in 2023. Within the first 9 months, it declined by 9.26%. Even USMV managed to eke out a acquire of 1.78%.

Moreover, longer-term returns are merely lackluster. To corroborate, the next desk compares the full returns and different related metrics of LVHD, USMV, IVV, and the WisdomTree U.S. Excessive Dividend Fund ETF (DHS) over the January 2016–September 2023 interval.

| Portfolio | LVHD | IVV | USMV | DHS |

| Preliminary Steadiness | $10,000 | $10,000 | $10,000 | $10,000 |

| Last Steadiness | $17,435 | $24,165 | $20,025 | $17,555 |

| CAGR | 7.44% | 12.06% | 9.37% | 7.53% |

| Stdev | 14.19% | 15.96% | 12.94% | 15.24% |

| Finest 12 months | 26.89% | 31.25% | 27.69% | 23.03% |

| Worst 12 months | -9.26% | -18.16% | -9.42% | -7.39% |

| Max. Drawdown | -24.32% | -23.93% | -19.06% | -25.89% |

| Sharpe Ratio | 0.47 | 0.7 | 0.65 | 0.46 |

| Sortino Ratio | 0.68 | 1.07 | 0.97 | 0.67 |

| Market Correlation | 0.85 | 1 | 0.9 | 0.84 |

Information from Portfolio Visualizer

Furthermore, LVHD is without doubt one of the worst-performing dividend ETFs amongst these I cowl, i.e., its 3-year whole return is simply 20.2% vs. the median within the group of 28.3%. The one-year worth return is unfavourable 2.8% vs. the median acquire of 5.88%.

Progress traits are too weak

One other concern with LVHD is its mushy development traits. Definitely, traders searching for a extra defensive combine with a little bit of worth almost definitely pay little consideration to development, if in any respect. Nonetheless, I imagine these parameters should be talked about.

So, in a 126-strong portfolio, the weighted-average ahead EPS development fee is at 1.7%, whereas the income CAGR is at 5.1%, as per my estimates (information as of October 16). Though I’m not a growth-style maximalist, these charges are too small. The important thing causes are that ~33% of the holdings are forecast to expertise an EPS decline, whereas analysts predict a income contraction for round 14.3% of the portfolio.

Unsatisfying dividend development

Did excessive yield-focused LVHD ship on the dividend development entrance? In equity, dividends of its present holdings have been rising, however at a somewhat glacial tempo. I’d not say that the mid-single-digit charges are engaging.

| DY | 3Y Div CAGR | 3Y Div CAGR |

| 4.7% | 5.5% | 5.1% |

Calculated by the creator utilizing information from In search of Alpha and the fund

The WA DY of 4.7% is general tremendous, barely under the 10-year Treasury yield (US10Y), because of the highest contributors from the actual property sector like Workplace Properties Earnings Belief (OPI), Brandywine Realty Belief (BDN), and many others. However the fund itself has a TTM yield of simply 3.8%. And as we now have seen from the full returns evaluation above, the ETF’s yield was unable to compensate for its lackluster worth efficiency.

The silver lining: worth and high quality elements

One of many high tales of the primary week of October was the roles report that turned out hotter-than-expected and triggered the bond market sell-off, which, in flip, was reverberating by way of equities as effectively. Though it was placed on pause later, only in the near past, it has resumed, with the US10Y now teetering only a few bps under 5%. For equities, this implies worth and high quality elements ought to nonetheless be favored over development.

On these fronts, LVHD has largely sufficient traits. My evaluation confirmed that for a portfolio heavy in giant caps, the fund has a somewhat robust EY, principally thanks to a couple monetary corporations like New York Neighborhood Bancorp (NYCB) and Eagle Bancorp (EGBN). On the similar time, roughly a 3rd of holdings have a B- Quant Valuation grade or increased, whereas 86% have not less than a B- Profitability ranking. Different related metrics are compiled under.

| Metric | LVHD |

| Market Cap | $67.54 billion |

| EY | 6.8% |

| ROE | 22.8% |

| ROA | 5.8% |

Calculated by the creator; monetary information as of October 16

Nonetheless, I imagine it’s value being selective; I would like the next ROA and a stronger EY.

Investor takeaway

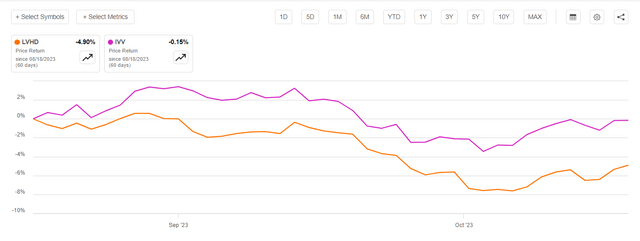

LVHD’s appalling efficiency for the reason that earlier be aware doesn’t imply a shopping for alternative has emerged. The issue is its technique. It does ship in a stormy atmosphere (e.g., the 2022 bear market). Nonetheless, it lags dismally throughout recoveries. Additionally, within the final two months, when the higher-for-longer narrative returned, it underperformed IVV by 4.75%, which once more illustrates the constraints of its low-volatility method.

In search of Alpha

General, the important points are its tepid efficiency, small development issue publicity, unattractive yield, and mediocre dividend development. On the optimistic facet, valuation is sufficient, and there’s something to understand when it comes to publicity to notable profitability and capital effectivity tales. Nonetheless, this isn’t sufficient for a Purchase ranking.