At the moment, Hashflow, a number one multichain buying and selling platform within the decentralized finance panorama, introduced that it’ll permit charges, following the neighborhood governance vote in mid-October, which handed with a near-unanimous vote.

The implementation of charges on Hashflow will symbolize the primary income stream adopted by the platform and shall be dynamic in nature relying on the particular asset pair being traded. The charge is “included instantly into the quote and paid robotically when the transaction is accomplished.”

In accordance with Varun Kumar, co-founder and CEO of Hashflow, “We’re completely happy to announce that Hashflow shall be introducing buying and selling charges beginning right this moment, following the approval of the proposal via DAO governance. This is a crucial milestone for the protocol, which we consider will strengthen Hashflow’s place as a number one multi-chain decentralized change. By distributing charge proceeds to the token stakers and the Basis, this proposal creates a sustainable mannequin that can profit all stakeholders within the Hashflow ecosystem.”

Compensation distribution

Not like current charges imposed by rival platform Uniswap, Hashflow’s new levy shall be utilized in no small half to create worth for current stakers of the HFT token.

In accordance with a press launch shared upfront with BSC Information, the distribution of the compensation shall be as follows:

- 50%: Allotted to stakers of the HFT token.

- 30%: allotted to the neighborhood treasury to be used in HFT buyback initiatives.

- 20%: allotted to the Hashflow Basis to cowl working prices.

Hashflow right this moment

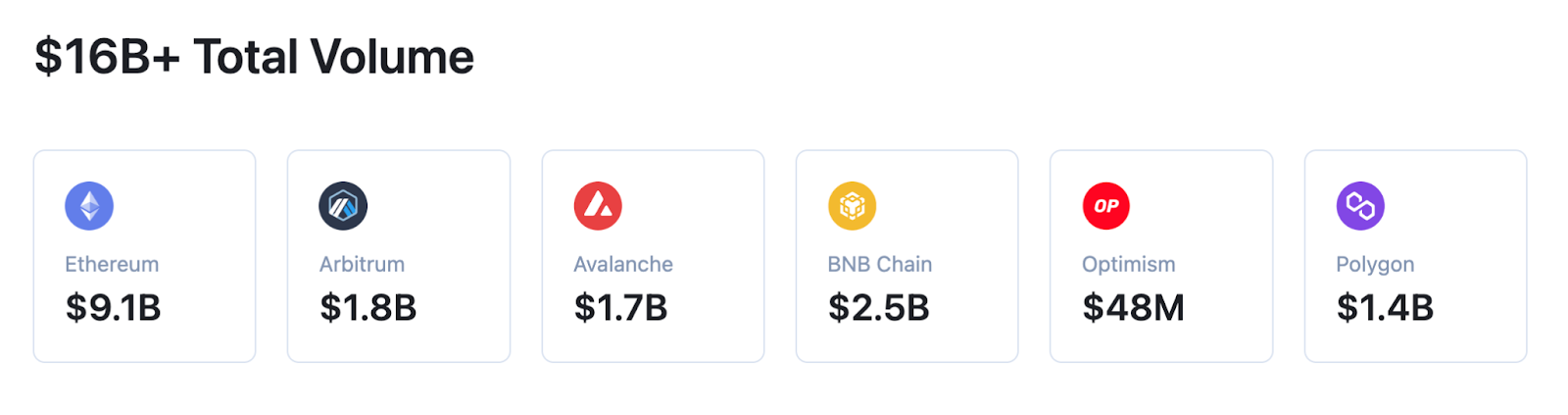

In accordance with a launch, Hashflow is a decentralized multi-chain change (DEX) that enables customers to commerce digital property in seconds on main blockchains together with Ethereum, Arbitrum, Avalanche, BNB Chain, Optimism and Polygon. Not like AMMs, Hashflow makes use of a request for quote (RFQ) mannequin to supply merchants with assured quotes instantly from skilled market makers (PMM), eliminating inefficiencies present in decentralized finance (DeFi), together with slippage and MEV.

In accordance with Hashflow’s web site, the platform has already seen round $16 billion in buying and selling quantity throughout outstanding networks resembling Ethereum, BNB Chain and Arbitrum.