- The Federal Reserve not too long ago introduced June’s CPI stories.

- Nonetheless, most crypto property, led by Bitcoin, didn’t reply to the current report.

The current Client Worth Index (CPI) report launched by the Federal Reserve didn’t set off the anticipated optimistic response in Bitcoin’s [BTC] worth.

This consequence was significantly stunning, as market observers anticipated the Fed fee cuts later within the yr, which usually might increase funding in riskier property like cryptocurrencies.

Doable causes for the non-reaction

As market observers anticipated the affect of anticipated Fed fee cuts, the consequences could have already been priced into present market costs.

Since the latter half of 2022, expectations of fee cuts have considerably influenced sentiment throughout the markets. This contributed to Bitcoin’s rise to report highs above $73,000 in 2024.

When fee cuts are applied, they could provoke solely a lukewarm market response. Furthermore, BTC is experiencing substantial promoting strain from a number of quarters.

Notably, miners have been promoting off their holdings following the halving occasion and a subsequent drop in BTC’s worth. This has compelled them to liquidate a few of their reserves.

Moreover, the German authorities has been actively promoting giant portions of BTC because the begin of the month.

Market contributors have been additionally intently monitoring the potential sell-off from Mt.Gox; though these gross sales are prone to happen over-the-counter because of the giant quantity, they continue to be a focus of consideration.

These mixed elements may very well be influencing Bitcoin’s lack of response to the fed fee cuts.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

BTC’s response to potential Fed fee cuts

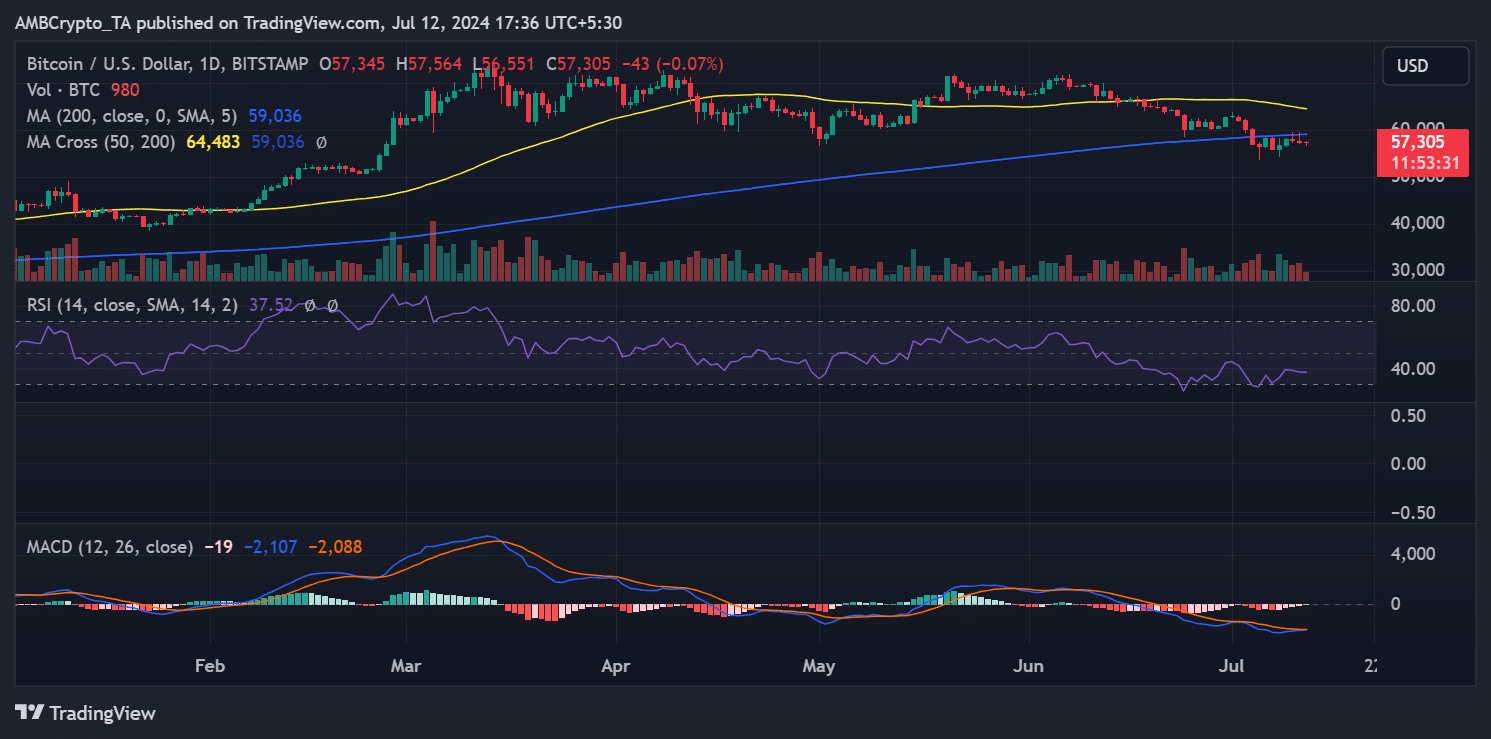

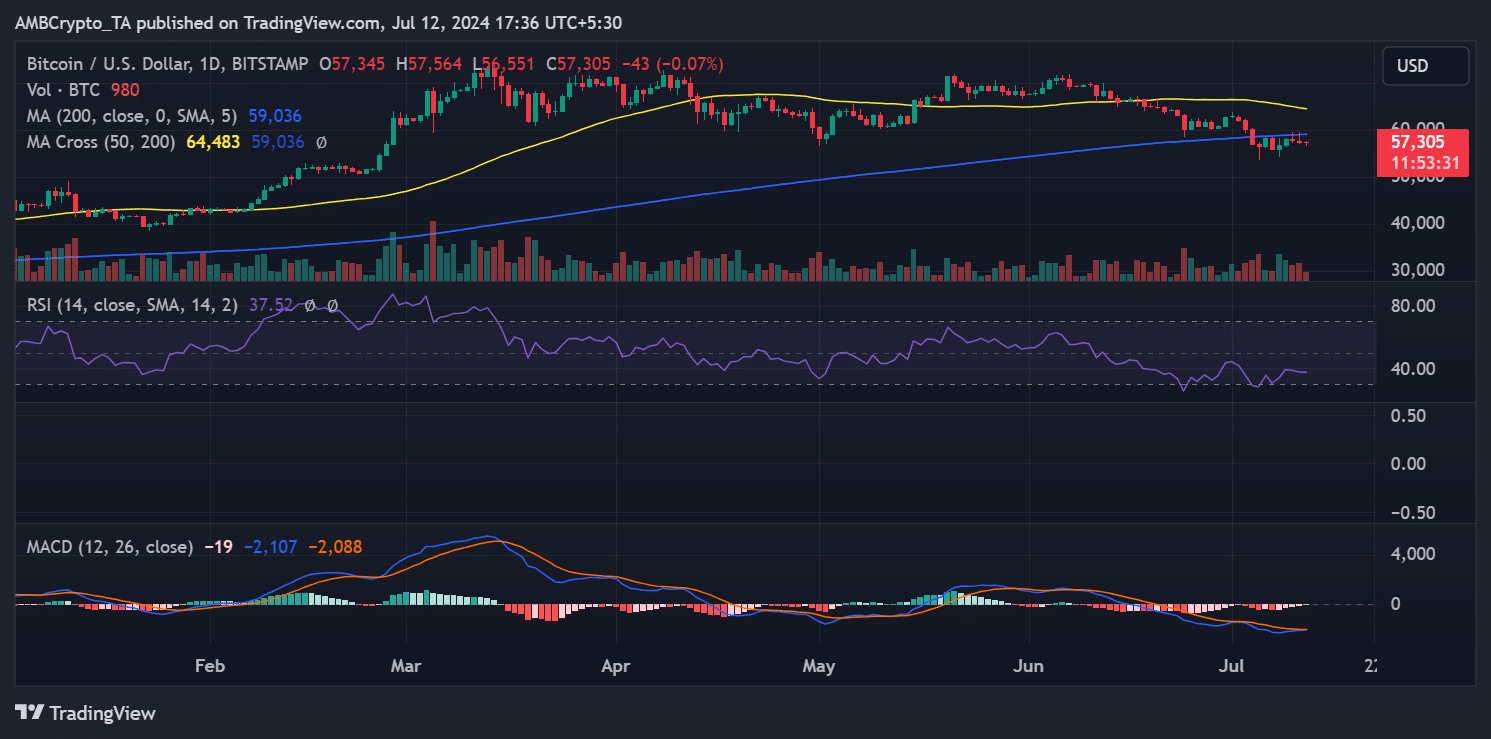

The evaluation of Bitcoin’s worth pattern on a day by day time-frame indicated that it closed on the eleventh of June with a 0.67% decline. It traded round $57,348 following the announcement of the CPI report.

Supply: TradingView

As of this writing, BTC was buying and selling at roughly $57,304, exhibiting a slight additional decline. The present worth motion was bearish. This contrasted the anticipated optimistic response to the anticipated Fed fee cuts.