HAKINMHAN/iStock by way of Getty Photos

Introduction

The subsequent FOMC assembly will decide which approach the market will go for the following few weeks, in my view. If the FED chair pushes again on potential price cuts and decides to shock buyers with a hike, then I anticipate the market to react negatively. If charges are held and the upper for longer atmosphere is reiterated, this might additionally result in the inventory market volatility. There is a much less doubtless probability that we’ll get some nice information throughout this month’s assembly. Sure, the recent jobs report got here out higher than anticipated with greater than 190,000 added jobs, however inflation is predicted to remain flat and stay elevated above the two% goal.

A number of dividend buyers like shares with excessive, enticing yields equivalent to Enterprise Improvement Corporations (BDCs) or these with fast-growing dividends from tech shares, or different well-established dividend paying corporations. My motto is at all times: Why have or deal with one when you’ll be able to have each? On this article, I checklist two shares from totally different sectors that give buyers’ portfolios each a excessive, sustainable yield, and a rising month-to-month dividend to assist construct stability their portfolio with not solely yield, however some progress as effectively.

#1 Ares Capital

I final talked about Ares Capital (ARCC) again in October, the place I rated the inventory a powerful purchase as a result of their earnings beat and valuation on the time. Since then, the inventory’s worth has appreciated to over $20 a share as buyers seek for protected, higher-yielding alternate options to bonds and CDs. With these nonetheless providing enticing yields presently, this has induced a number of BDCs to maneuver to honest or overvalued territory. ARCC, on the time of writing, gives a protected yield close to 10%, so you’ll be able to see why the worth has appreciated within the final couple of months.

I’ve held ARCC for fairly a while however haven’t added to it or any of my BDC positions lately due to their valuations. If you happen to’re an investor on the lookout for a excessive yield, BDCs or shares like Altria (MO) are normally the primary selections. When contemplating holding a inventory in my portfolio, one factor I at all times attempt to preserve is stability. I’m not a day or swing dealer, as that takes an excessive amount of time and makes one emotionally tied to their holdings. I typically consider quotes from Warren Buffett when issues begin to get robust available in the market.

I am going to admit I will be barely emotional and ask myself questions in regard to the market typically. Having stability and conserving these in test permits me to navigate these feelings with a portfolio that’s well-balanced. I am not a yield chaser, however I do have shares which have yields within the higher single to double-digits like ARCC. However a very powerful query with high-yielders I usually ask is: Is the dividend protected and sustainable for the long-term? I do not plan on promoting my shares except the basics change, however doing all your due diligence and choosing high quality ones that supply a excessive yield is essential.

With a yield of 9.71% presently, one might imagine a yield nearing double-digits is routinely unsustainable. However throughout ARCC’s third quarter, they continued to carry out conservatively like they at all times do. Web funding revenue fell from the earlier quarter, however nonetheless continued to out-earn its dividend by practically 23%! So, not solely did they do that impressively within the final quarter, additionally they decreased their leverage to 1.03x and had ample liquidity to cowl the $1.3 billion in debt due subsequent yr.

One of many issues I like about ARCC is that the BDC likes to hold over additional revenue from the earlier yr. So, as an alternative of paying out their additional revenue within the type of specials and supplementals, administration prefers to maintain it. This permits them to make use of the additional revenue to cowl the dividend in the event that they ever get right into a monetary bind or face sudden headwinds for a sustained interval. As you’ll be able to see from the chart under, ARCC carried over $643 million in spillover revenue into 2023 and in This fall I anticipate administration to announce their spillover for 2024.

ARCC investor presentation

#2 Agree Realty

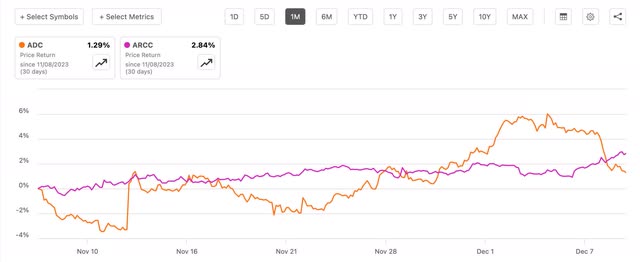

Agree Realty (ADC) is one among my absolute favourite REITs and I final coated them again in November. The sector skilled some headwinds a few months again, however now appears to be leveling off. One motive is as a result of Mr. Market is probably going anticipating a possible price minimize someday in 2024. As you’ll be able to see under, ADC is up 3.53% within the final month. Greater than every week in the past the worth moved above $60 which it hadn’t seen since September.

I have been including closely to my place to decrease my value foundation because the inventory has dropped to the low $50’s lately, hitting a brand new 52-week low earlier than bouncing again above $60 earlier this month. Some might not take into account REITs to be progress investments, however I disagree. In fact, they do not provide the identical excessive double-digit progress as say a Starbucks (SBUX), however what they do usually provide is regular single-digit progress. On high of that, with Agree Realty, you get a rising month-to-month dividend that’s well-covered by a 76% payout ratio, well-below the REIT common of 90%.

ADC December presentation

Throughout their newest earnings, ADC beat FFO estimates by a penny. Moreover, additionally they managed to lift their steering regardless of the volatility and secular headwinds. Their portfolio can be effectively occupied at 99.7%, one of many highest amongst their friends. So, some buyers could also be asking the query, with REITs being thought of low-growth revenue automobiles, how can one anticipate progress with their typical decrease yields? Nicely, ADC’s CEO said throughout Q3 earnings that the REIT expects to ship 3% progress over the following yr with no acquisitions or any new capital deployed. And with a dividend yield of practically 5%, you get practically 8% while you embody the three% anticipated progress price.

Danger Components For Each

Though each shares are in two utterly totally different sectors, they nonetheless face related dangers from the present macro atmosphere. One is elevated rates of interest, or the potential for one other price hike. I am not under no circumstances saying I do know what is going on to occur through the December 12-13 assembly subsequent week, however I do anticipate the FED chair to push again on the evolving sentiment of a price minimize. If charges stay elevated all through 2024, or they resolve to lift, this may place an incredible quantity of stress on each companies’ portfolio tenants. This might doubtlessly result in a decline in income for each as the danger for hire/loans defaults rise.

Whereas I do nonetheless anticipate one within the coming yr, investor and market sentiment may take a blow subsequent week in the event that they do resolve to carry or increase charges additional. The current job report added extra jobs than anticipated final month, which I imagine shifted the general market sentiment lately, as seen by the rise in inventory costs.

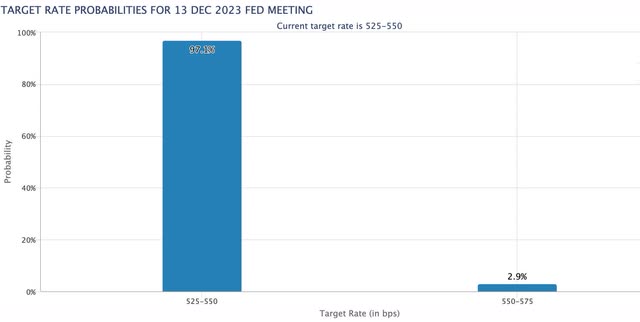

However, I anticipate Jerome Powell to proceed to go away the door open for extra potential hikes down the road as information continues to come back within the coming months. With the market anticipating greater than a 97% probability charges keep right here, I feel the market response (good or unhealthy) will rely extra on what Powell says on the upcoming assembly greater than something. And whereas many analysts are leaning towards a tender touchdown, others predict a gentle recession in 2024 or 2025.

CME FedWatch Instrument

Valuation

As you’ll be able to see, each are within the inexperienced barely over the past month. That is compared to the S&P, up roughly 5% over the identical interval. In my final articles on each, I rated each shares a powerful purchase as a result of their low valuations. Whereas Wall Road analysts presently price ARCC a purchase and ADC a powerful purchase, I price each a maintain as a result of ARCC’s share worth practically 6% above its NAV, giving buyers barely any upside to their worth goal. Concerning ADC, they nonetheless provide some upside to their worth goal of roughly $66. However these on the lookout for a larger margin of security ought to look ahead to a possible pullback in worth if wanting so as to add. I ideally like the worth beneath $55 and relying on the following assembly, buyers may see the inventory worth fall close to or under this worth.

Looking for Alpha

Investor Takeaway

Buyers on the lookout for stability of their dividend portfolios ought to take into account including these two shares on a pullback in worth or any indicators of share worth weak point. Though sentiment appears to have shifted positively within the final month, the following FOMC assembly may trigger some volatility available in the market as I anticipate the FED chair to offer some pushback on potential price cuts subsequent yr. In that case, that might doubtlessly be a good time so as to add if each corporations expertise decline. Even with the present macro atmosphere persevering with to position downward pressures on a number of companies, each ARCC and ADC are amongst the very best of high quality on the subject of their sectors and their friends.