- Metrics urged that LTC was undervalued on the charts

- Technical indicators have been bearish on Litecoin

Like most cryptocurrencies, Litecoin’s [LTC] value remained below bears’ management final week due to the market circumstances. Nevertheless, if the newest information is to be thought-about, then LTC may quickly showcase a bullish efficiency if it manages to check a sample that has fashioned on its chart.

Litecoin is shedding worth

AMBCrypto reported just a few days in the past how Litecoin’s value surged by practically 10% to guide the altcoin market rally throughout that day’s intraday buying and selling session. Nevertheless, the pattern didn’t final lengthy, because the bears quickly buckled and pushed the coin’s worth down.

In keeping with CoinMarketCap, LTC’s worth plummeted by greater than 5.5% within the final seven days. Nevertheless, the altcoin confirmed some indicators of restoration as its worth moved up marginally within the final 24 hours. On the time of writing, LTC was buying and selling at $98.80 with a market capitalization of over $7.34 billion, making it the twentieth largest crypto on the charts.

In reality, World of Charts, a preferred crypto-analyst, lately shared a tweet highlighting a bull sample that fashioned on LTC’s chart. In keeping with the identical, LTC’s value was transferring in a bullish pennant sample. A breakout above that sample might permit LTC to pump its value by greater than 20% within the coming days.

Is a bull rally inevitable?

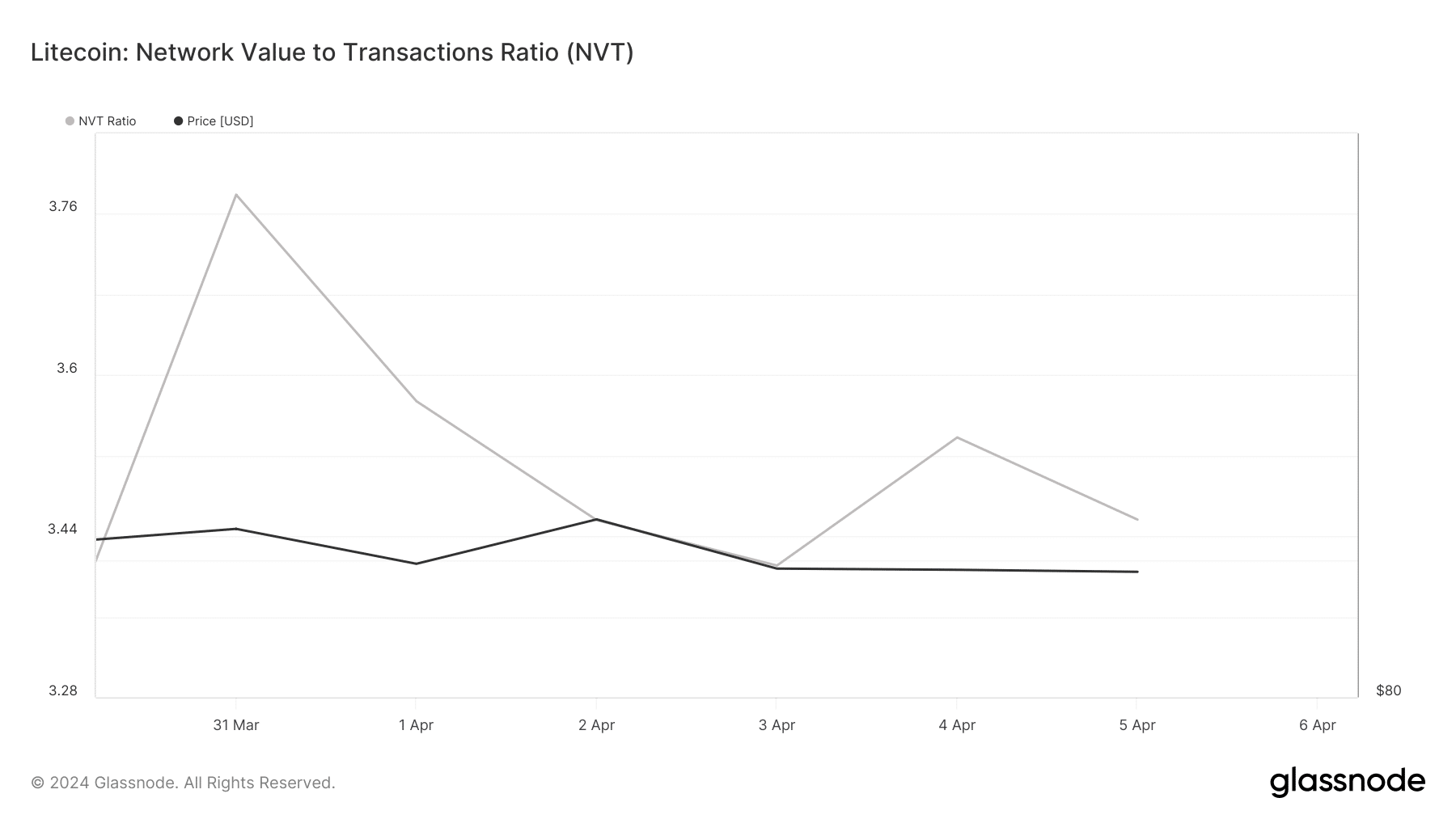

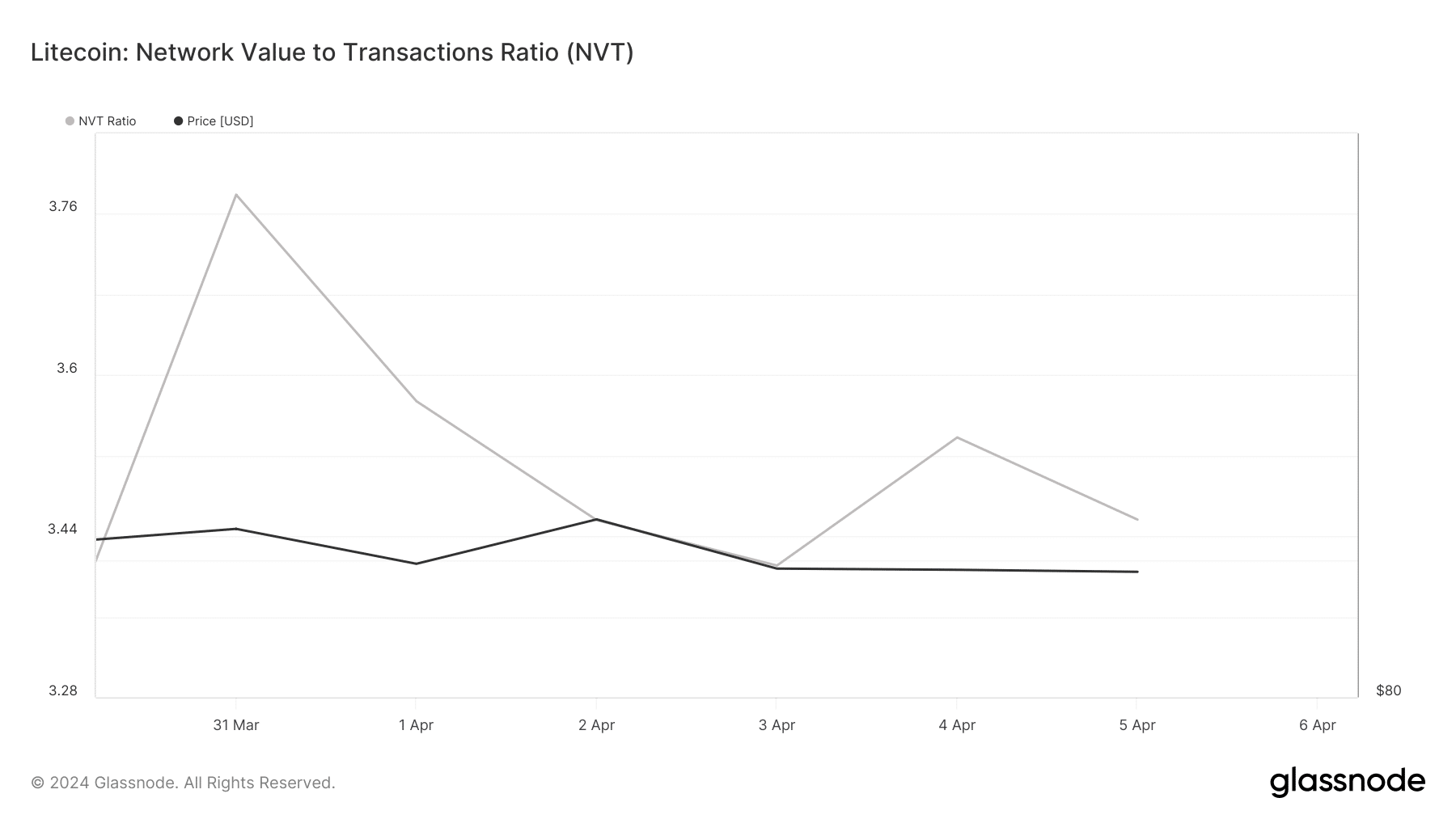

Since LTC’s value was transferring inside a bull sample, AMBCrypto checked the coin’s metrics to search out how probably it’s for LTC to interrupt above that sample. Our evaluation of Glassnode’s information revealed that LTC’s network-to-value (NVT) ratio remained low. A drop on this metric signifies that an asset is undervalued, underlining the excessive chance of a value uptick.

Supply: Glassnode

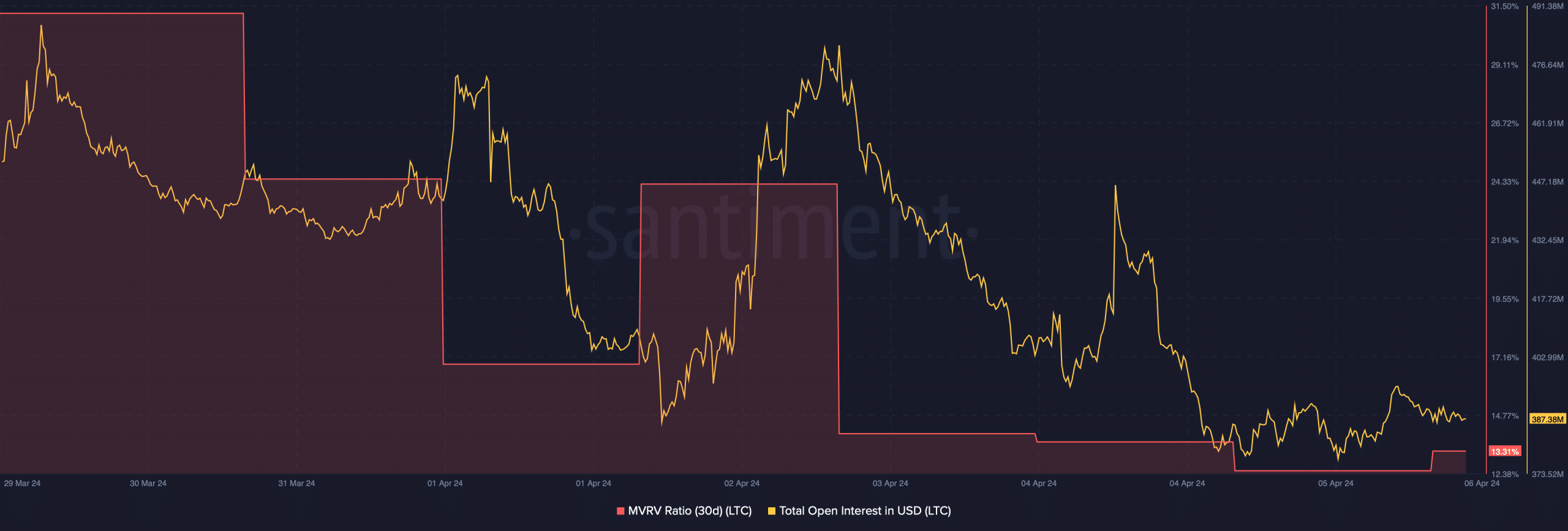

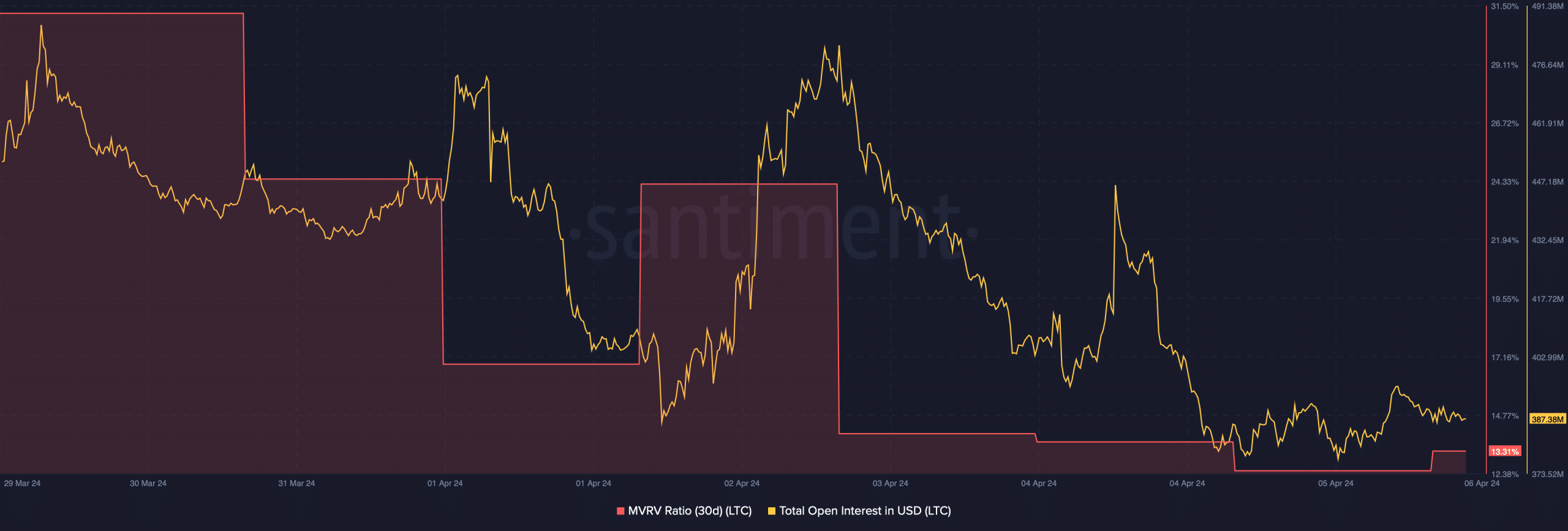

Moreover, the altcoin’s open curiosity additionally dropped alongside its value. That is additionally a bullish sign as a decline in open curiosity is an indication that probabilities of the continued value pattern altering are excessive. Nonetheless, Litecoin’s MVRV ratio was down sharply. At press time, it had a price of 13.3%, which indicated that LTC may not be capable to provoke a bull rally.

Supply: Santiment

Learn Litecoin’s [LTC] Value Prediction 2024-25

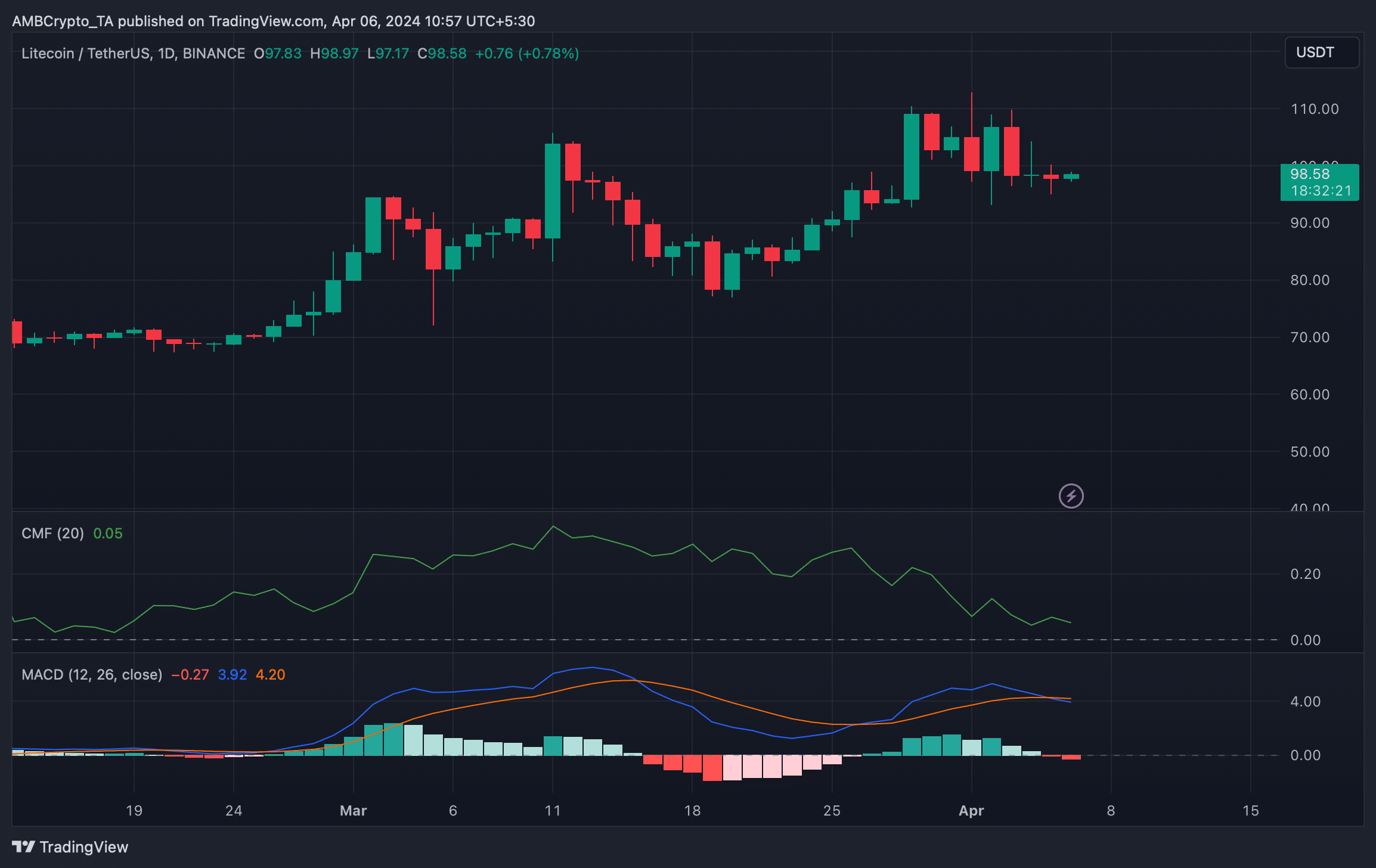

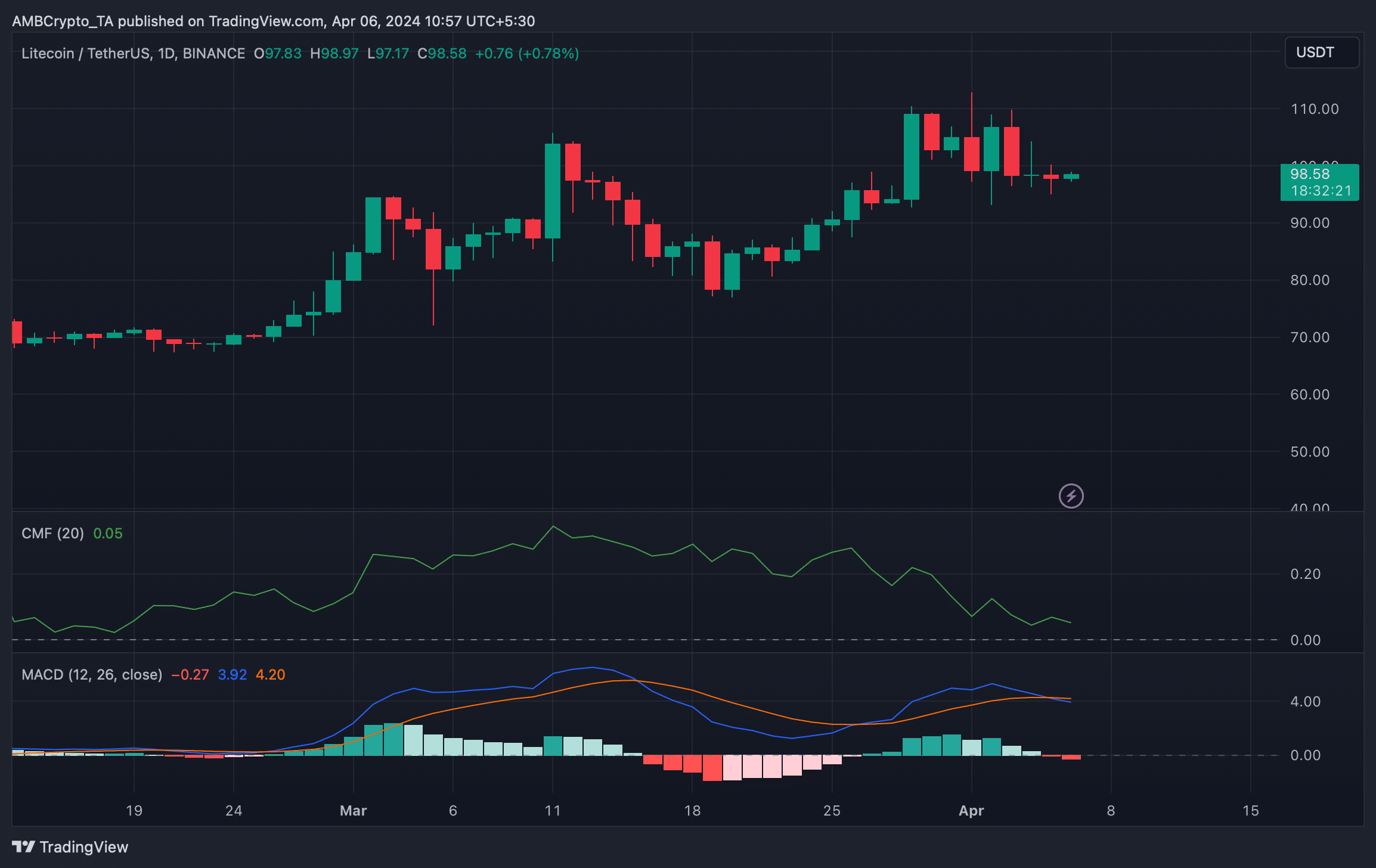

To higher perceive whether or not LTC would contact $100 within the close to time period, AMBCrypto then analyzed its day by day chart. We discovered that the technical indicator MACD flashed a bearish crossover. Its Chaikin Cash Stream (CMF) additionally registered a downtick, signaling sustained value decline.

As many of the market indicators have been bearish recently, will probably be attention-grabbing to see whether or not the bullish metrics translate right into a value uptick and permit LTC to climb within the coming days.

Supply: TradingView