On this evaluation, we delve into the latest market habits of LTC, inspecting key technical indicators and on-chain metrics.

We’ll discover the importance of Litecoin’s interplay with the Ichimoku cloud, the implications of its Spent Output Revenue Ratio (SOPR) and Adjusted SOPR (aSOPR) values, and handle potential resistance and help ranges.

Litecoin’s Bullish Sign: Testing the Day by day Ichimoku Cloud

Litecoin (LTC) has lately examined the decrease boundary of the each day Ichimoku cloud, which is a optimistic bullish sign. This growth suggests potential upward momentum, particularly if Bitcoin continues its rise to $73,000. A profitable cloud penetration might propel LTC in the direction of the essential resistance degree at $93.

Key Assist Ranges (4H):

The Ichimoku cloud offers extra help across the $85.70 degree. Staying above this cloud is necessary for sustaining the bullish development. A break beneath the cloud might result in elevated promoting stress and a possible reversal of the latest beneficial properties.

$85.09 (38.2% Fibonacci Degree): This degree serves as the primary line of protection for LTC. A break beneath this help might sign a weakening of the bullish development and would possibly result in additional downward stress.

Learn Extra: How To Purchase Litecoin (LTC) and Every part You Want To Know

$83.74 (50% Fibonacci Degree): The 50% retracement degree is a essential help zone. Holding above this degree is essential for sustaining a bullish outlook. A dip beneath this level might point out a possible development reversal.

$82.40 (61.8% Fibonacci Degree): Sometimes called the “golden ratio,” this degree is important in technical evaluation. If LTC fails to maintain above 82.40, it might invalidate the present bullish momentum and shift the market sentiment

Potential Worth Projections

If LTC breaks by means of the Ichimoku cloud, the following vital resistance to look at is $93. This degree might see substantial promoting stress. Conversely, a break beneath the Tenkan plateau of $81 might sign a possible development reversal, necessitating warning.

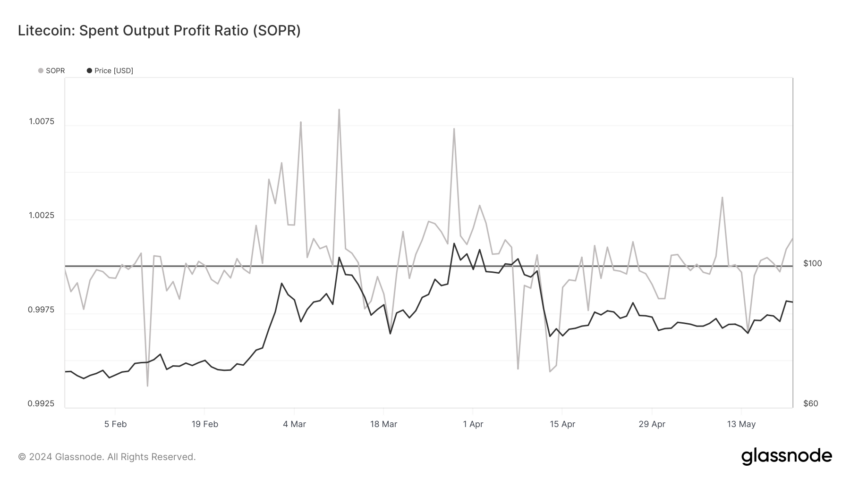

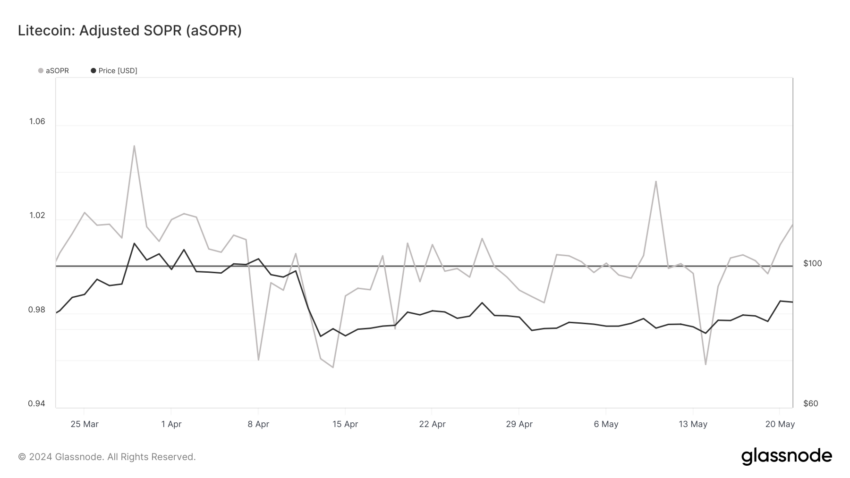

SOPR and aSOPR Point out Optimistic Fundamentals

The Spent Output Profit Ratio (SOPR) and Adjusted Spent Output Revenue Ratio (aSOPR) for Litecoin are above 1, indicating that extra LTC transactions are occurring at a revenue. This can be a sturdy bullish indicator because it displays optimistic market sentiment and elementary energy.

SOPR Evaluation: Litecoin’s SOPR has constantly stayed above the 1.0 threshold, exhibiting that holders are promoting at a revenue. This aligns with latest value actions and suggests persevering with bullish developments.

aSOPR Evaluation: Equally, the aSOPR confirms the identical bullish sentiment. The aSOPR has additionally remained above 1, indicating worthwhile spending and reinforcing the bullish outlook.

Learn Extra: Litecoin (LTC) Worth Prediction 2024/2025/2030

Strategic Suggestions: Bullish to Impartial Outlook

Litecoin exhibits promising bullish alerts by testing the Ichimoku cloud and sustaining optimistic SOPR and aSOPR values.

Merchants ought to look ahead to a cloud breakthrough for potential beneficial properties whereas being cautious of a break beneath the 4H Tenkan plateau, which might point out a development reversal.

Moreover, the expansion price of addresses holding ADA is a metric to watch for future value implications.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.