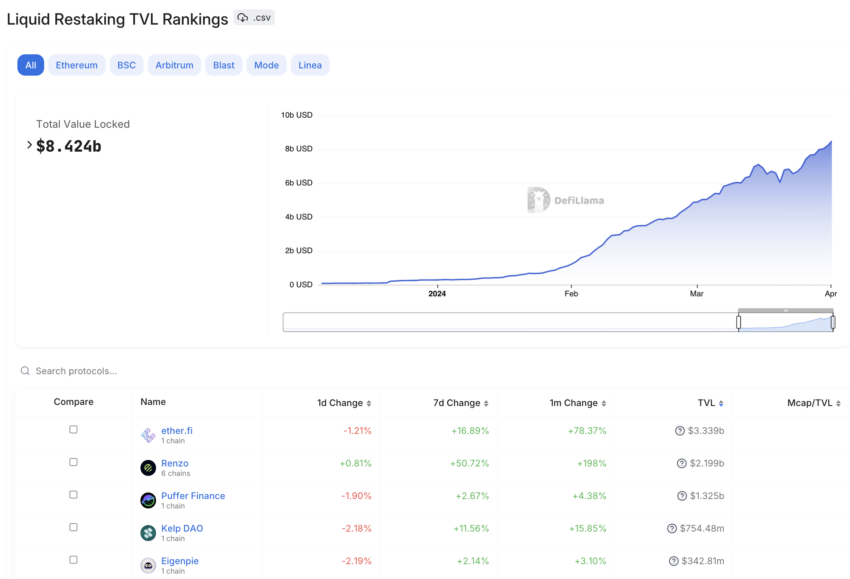

The decentralized finance (DeFi) trade is witnessing a transformative development, with liquid redraw tokens (LRTs) reaching a staggering whole worth (TVL) of practically $8.5 billion.

This enhance highlights a broader story throughout the DeFi ecosystem, signaling a shift in funding dynamics.

What fluid withdrawal protocols contribute to TVL development?

Main this assault is EtherFi, which alone controls a TVL of greater than $3.3 billion. Consequently, protocols like Renzo, Kelp and Puffer are additionally experiencing unprecedented development.

The dominance of Etherfi, adopted intently by Renzo with $2.2 billion and Puffer with $1.3 billion, signifies a sturdy market urge for food for liquid property. As well as, Kelp and EigenPie contribute considerably, with a TVL of over $750 million and $342 million, respectively.

“Liquid withdrawal protocols now management practically 5% of invested Ethereum, most of which was staked in 2024,” mentioned pseudonymous DeFi researcher Hildobby.

Learn extra: Ethereum re-withdrawal: what’s it and the way does it work?

Liquid restoration of TVL rankings. Supply: DefiLlama

Importantly, the adoption of EigenLayer is central to this development. It facilitates retrieval, permitting customers to keep up entry to their funds, which will increase TVL in these protocols.

Moreover, EigenLayer has grow to be a important factor on this ecosystem, with TVL now exceeding $12.4 billion. The protocol’s technique to leverage these funds to enhance community safety is noteworthy.

Particularly, EigenLayer and different resuming platforms began attracting the group’s consideration since February 2024. A report from BeInCrypto highlighted a exceptional 171% enhance in EigenLayer’s TVL in only one week in February, underscoring the market’s enthusiasm for resuming liquidity.

Regardless of a short lived halt to deposit re-withdrawals on EigenLayer, curiosity in LRTs stays excessive. Protocols resembling EtherFi, Renzo and Kelp proceed to draw ether deposits for withdrawal, promising extra rewards by Eigen. This transfer has maintained momentum and strengthened money withdrawal development.

The attraction of an EigenLayer airdrop has additional strengthened the DeFi group. Many are pouring Ethereum into EigenLayer to enhance their airdrop prospects. This technique is indicative of the evolving ways throughout the DeFi sector geared toward maximizing returns.

Learn extra: What’s EigenLayer?

Certainly, the constant enhance in TVL and strategic recapture practices highlights the rising potential of liquid recaptures as a pivotal story within the DeFi house.

“Liquid withdrawals are the largest story for the following decade,” mentioned DeFi analyst Chrome.