- TVL hiked by virtually 20% within the final 30 days alone

- Whereas LDO’s value rose, on-line engagement with the undertaking surged

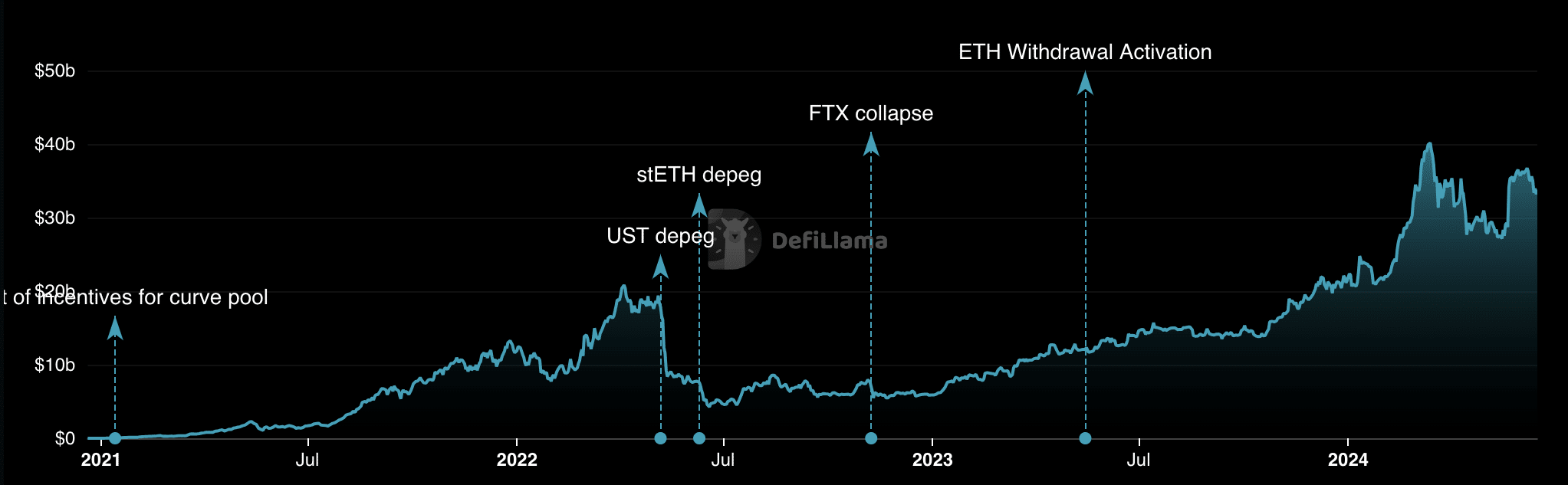

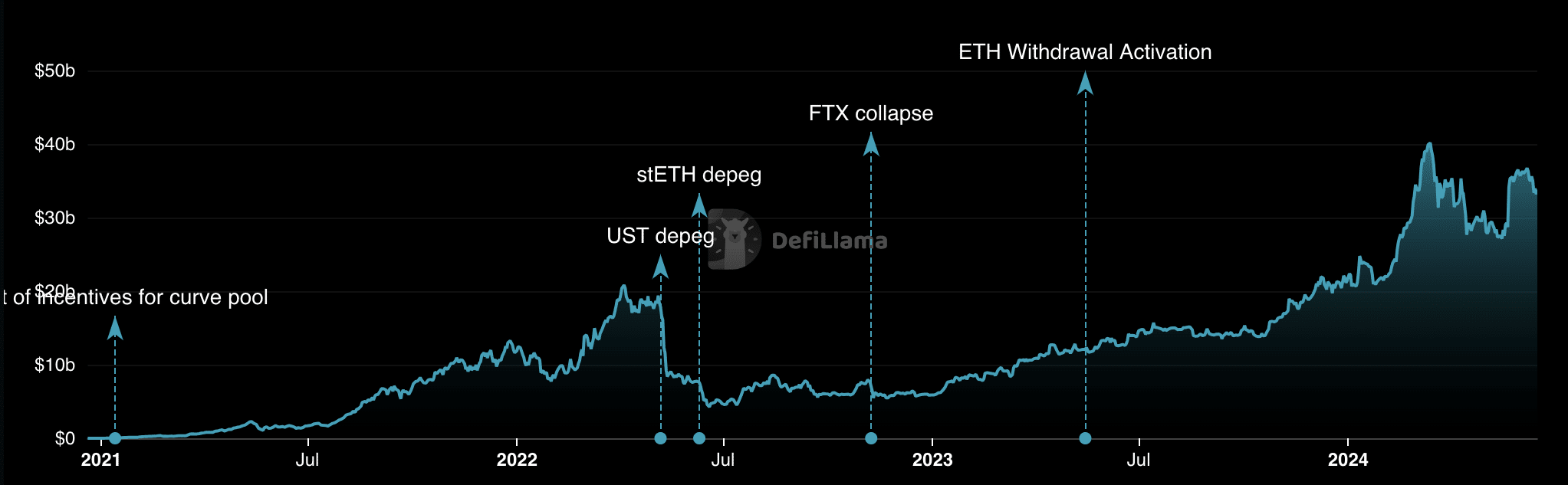

Lido Finance [LDO], the liquid staking platform constructed on the Ethereum [ETH] blockchain, has reclaimed the primary spot per Complete Worth Locked (TVL).

At press time, Lido’s TVL was $33.77 billion. This, after a 19.51% hike within the final 30 days. Right here, TVL measures the whole worth of belongings locked in a protocol. A rise on this metric implies that customers belief the protocol to supply a great yield.

Lido takes the baton from EigenLayer

Alternatively, a decline suggests skepticism in regards to the potential returns a undertaking may provide. Due to this fact, the recent hike implied that market contributors at the moment are again to trusting Lido on this entrance once more.

Supply: DeFiLlama

Just a few weeks in the past, EigenLayer took over the leaderboard. This, after early customers of the undertaking anticipated rewards for his or her participation. In Could, EigenLayer launched the non-transferrable EIGEN token, resulting in an increase in withdrawals from the protocol.

This decline which led Eigen’s TVL to $18.81 billion gave Lido Finance the prospect to high the desk once more. Nevertheless, other than Lido’s TVL, the native token of the undertaking, LDO, additionally recorded a rise on the charts.

In response to CoinMarketCap, LDO was valued at $2.05 at press time, representing a 5.12% hike within the final 24 hours. The value hike made the token one of many market’s greatest performers at a time when remainder of the market bled.

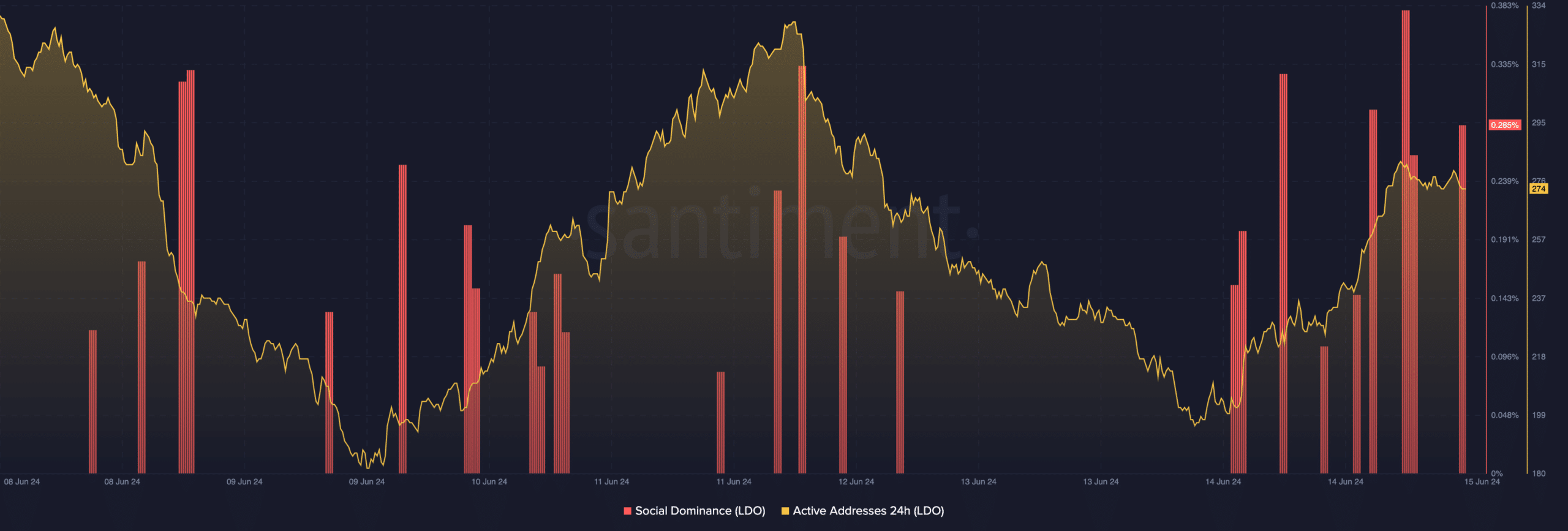

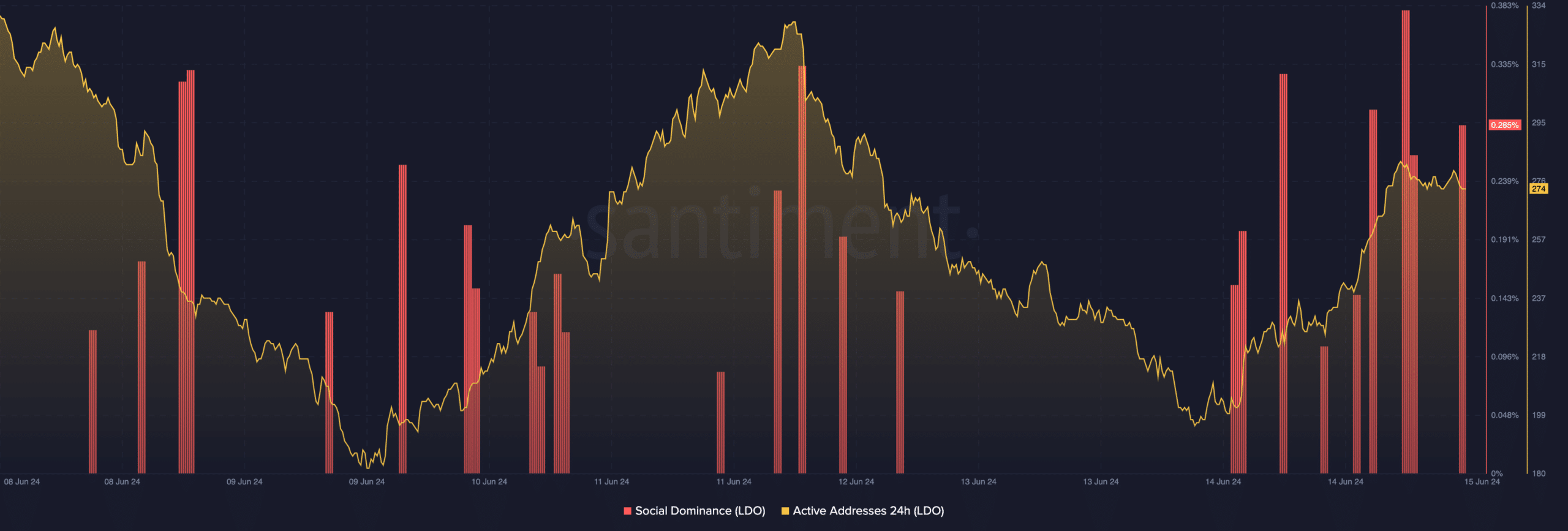

From an on-chain perspective, there appear to be a great stage of exercise occurring behind the scenes with Lido too.

Consideration shifts, however will LDO maintain $2?

On the time of writing, social dominance had risen to 0.285%. This metric measures neighborhood interplay with a undertaking on-line. Due to this fact, a hike in social dominance implies that curiosity in LDO has risen.

As such, it’s not shocking that the rising interest led to demand. Nevertheless, if the dialogue about LDO will get overheated, it may spur a retracement within the token’s value.

If that is so, the worth of Lido’s native token may slide under $2. Ergo, it’s price making observe of the truth that 24-hour energetic addresses on Lido’s community have been growing since 14 June.

Supply: Santiment

Lively addresses check with the variety of distinctive addresses taking part in a switch of a cryptocurrency. When the metric decreases, it implies a fall in interplay with a community.

Nevertheless, a hike means that extra customers are visiting the blockchain. It was the latter case for Lido at press time, reinforcing the notion of larger curiosity within the undertaking and token as nicely.

Whereas LDO’s value may later fall under $2, its mid-term potential may lie with ETH. Traditionally, LDO has proven a powerful correlation with ETH.

Sensible or not, right here’s LDO’s market cap in ETH phrases

With hypothesis spreading that Ethereum ETFs would begin buying and selling in July, ETH may rally. Ought to this be the case, LDO may also take part.

Due to this fact, a attainable hike above $3 could possibly be attainable by then.