Hispanolistic/E+ by way of Getty Photographs

Funding Thesis

LGI Properties (NASDAQ:LGIH) had a robust yr together with remainder of the homebuilders as a result of lack of resale stock driving new housing gross sales. Its positioning inside entry stage house section allows them to capitalize on a rising section which has led to an uptick within the housing closings. We imagine the challenges stay within the close to time period as shoppers proceed to search for smaller sized properties (which now varieties 27% of Q2 2023 closings) and declining ASP of properties. Housing market stays difficult with the Fed’s narrative to carry charges for longer and a persistently increased mortgage charges which has crossed 7% now. Regardless of the 25% decline in its market worth over the previous two months, LGIH inventory nonetheless trades at a premium to its friends and historic averages. We provoke at Impartial.

Firm Background

LGIH is engaged in offering hooked up and indifferent entry-level properties with common house dimension ranging between 1,000 to 4,100 sq. toes throughout 20 states within the US. Its common house gross sales value ranges about $350k and at the moment supply properties on the market in about 100 communities throughout the US.

Historic Monitor File

LGI Properties has reported a robust development traditionally with strong income and earnings momentum which grew 34% and 41% respectively throughout 2014-2021 interval, nonetheless stumbling in 2022 amidst report rise in mortgage charges. House closings has additionally witnessed a robust development leaping over 5x over the same interval together with a constant uptick within the common gross sales value. It has been in a position to keep steady gross margins over the interval together with enhancements in web revenue margins pushed by income development outpacing SG&A prices.

| Particulars | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| House Closings | 2.4k | 3.4k | 4.2k | 5.8k | 6.5k | 7.7k | 9.3k | 10.4k | 6.6k |

| ASP ($ ‘000) | 163 | 185 | 201 | 215 | 231 | 239 | 254 | 292 | 348 |

| Income ($M) | 383 | 630 | 838 | 1,258 | 1,504 | 1,838 | 2,368 | 3,050 | 2,304 |

| Gross Margin | 28% | 28% | 28% | 27% | 27% | 26% | 27% | 28% | 29% |

| Diluted EPS | $1.3 | $2.4 | $3.4 | $4.7 | $6.2 | $7.0 | $12.8 | $17.2 | $13.8 |

Regular Earnings Amidst Weak Macro

LGIH reported a gradual set of earnings for Q2 2023 with house closings down 9% YoY, however up 35% sequentially, pushed by absorption declining by 18% to six.1/month. It reported a 2% decline in common promoting value sequentially as consumers proceed to buy smaller-sized properties lower than 1,500 sq. toes amidst report mortgage charges and rising unaffordability to buy properties.

It reported a 11% decline in revenues pushed by a decline in house closings whereas common promoting value remained flattish. There was a sequential enchancment via the quarter with April closings down 21% YoY, whereas Might fell 9% and June rose 6% and absorption additionally improved from 5.4 in April to six.3 in Might and 6.5 in June.

The corporate reported a gross margin enchancment of 170 bps sequentially and forward of estimates pushed by value will increase throughout majority of communities, normalization in development prices and new neighborhood openings at increased margins. SG&A as % of income declined 300 bps sequentially whereas up 190 bps YoY pushed by a robust income development sequentially outpacing the expansion in fastened prices. It reported an EPS of $2.25 forward of the estimates pegged at $1.76 pushed by robust gross margins and decrease SG&A.

Steadiness sheet place remained steady as the corporate ended with whole liquidity of $385 mn together with $43 mn of money and a web debt/cap ratio of 36.8%

Following YTD closings via July down 7% YoY, the corporate elevated its steerage for 2023 house closings by 2% at mid level to six,850 pushed by continued momentum and gross sales backlog. It reported August closings up 24% YoY implying a 4% decline in YTD closing via August and additional demonstrating the administration’s capacity to fulfill its steerage. It elevated its gross margin steerage by 50 bps pushed by pricing actions and better margin in new neighborhood openings in This fall.

It reiterated its steerage for ASP for the yr to be between $345k – $360k regardless of a soar in smaller sized properties (which fashioned 27% of Q2 2023 closings vs 19% final yr) and ASP down sequentially because it expects increased priced ASPs in new communities will possible offset the decline. We imagine the ASP is more likely to fall beneath the decrease finish of its steerage because the growing unaffordability and rising mortgage prices will proceed to impair purchaser’s capacity to buy larger properties. Whereas the present backlog and demonstrated enchancment in closings spotlight the corporate is more likely to be at or above the mid level of its house closings steerage, a decline in ASP may result in a deterioration in gross margins to the decrease finish of its steerage. Whereas administration expects neighborhood depend to develop 20-30% YoY in 2024 over and above the 16-26% YoY development it expects for the present yr (steerage being 2H weighted), there are growing issues on its capacity to ship robust development amidst present housing turmoil and we await its capacity to drive a rise in neighborhood development for the approaching quarters.

Challenges in Housing Market

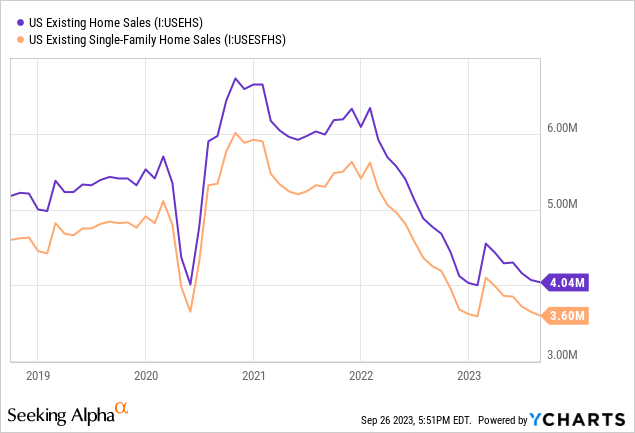

Housing market continues to stay difficult because the Fed’s vow to maintain charges increased for an extended interval continues to dampen demand which has been reeling underneath report mortgage charges. August new house gross sales declined 8.7% MoM to 675k beneath the consensus pegged at 700k whereas whole current house gross sales declined 0.7% sequentially pushed by a 1.4% decline in single-family properties.

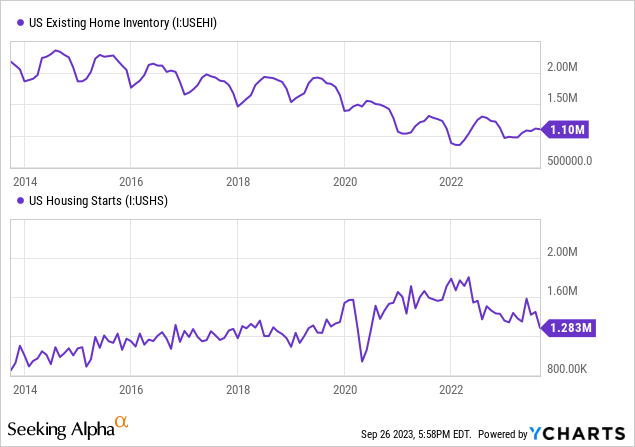

Stock ranges of current properties obtainable on the market remained at report lows, down over 53% from its peak, on account of reluctance of sellers to promote their current properties after locking in at report low charges amidst the pandemic. Whereas the housing begins improved on account of scarcity in stock, it continued to stumble with August housing starts declining 11.3% sequentially and 14.8% YoY on account of continued problem in housing affordability.

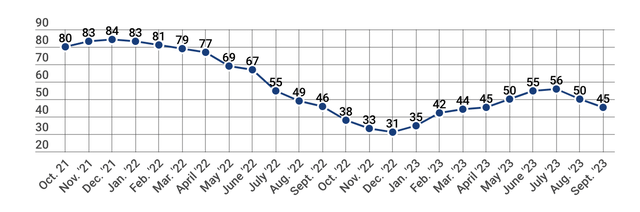

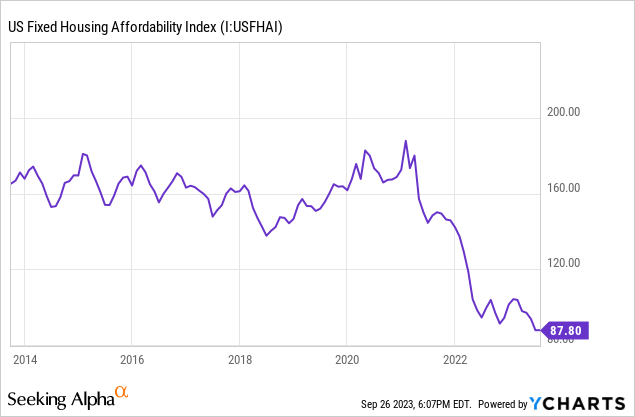

Builder’s confidence continues to weaken which dropped 5 factors in September following a 6 level decline in August on account of mortgage charges persisting above 7% mark eroding buying energy and continued challenges in housing affordability. Housing affordability index continued to be at report lows and took additional jolt put up the feedback from US Federal Reserve which factors to extended ache to the sector.

NAHB

Valuation

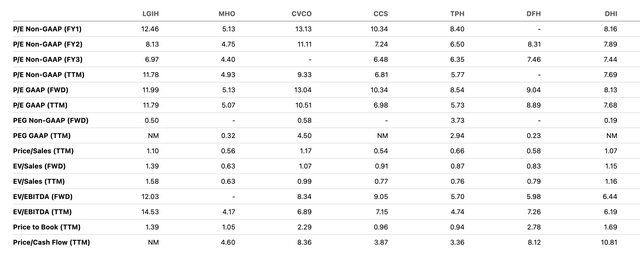

LGIH trades at 12.5x Fwd P/E, a premium to its friends in addition to to its long run historic common (5Y Avg: 9.9x). Submit the 25% decline in its market worth throughout final two months, we imagine there are nonetheless potential draw back dangers as enhance in housing begins is more likely to be offset by a decline in ASP as extra consumers search for smaller sized properties as a consequence of persistent mortgage prices. We provoke at Impartial with goal value of $95 at 8x 2024 EPS.

Looking for Alpha

Dangers to Score

1) Affordability challenges amidst persistent mortgage charges and a looming recession for a chronic time may result in a major deterioration in housing exercise and decline so as e book

2) Rising development prices in addition to increased wages for development employees may result in a decline in working margins

3) Upside dangers embody provide crunch in current housing gross sales stock may drive up order e book and increase gross sales

Conclusion

LGIH has had a robust observe report of development traditionally and it reported a gradual set of earnings amidst a difficult macro atmosphere. Regardless of the corporate elevating its steerage for house closings and reiterating the steerage for common promoting value, we imagine there are vital draw back dangers to their 2H weighted ASP steerage given the present atmosphere. We imagine regardless of the steep decline in its market worth in current instances, there are vital challenges within the close to time period and we await additional readability on the ASP steerage going ahead. Provoke at Impartial.