Tanarch

What has occurred to the worth of the U.S. greenback for the reason that Federal Reserve started to execute its quantitative tightening financial coverage in March 2022?

Right here is the reply.

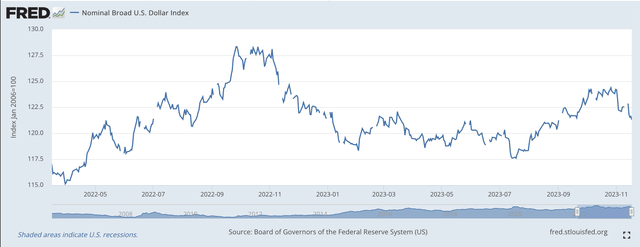

Nationwide Broad Greenback Index (Federal Reserve)

In March 2022, the index was proper round 116.0.

As one can see from the chart, the energy of the U.S. greenback elevated proper after the Fed’s change in coverage path.

The greenback continued to strengthen in worth into very early November 2022 when it reached a near-term excessive of about 128.0.

Then, as I’ve written about many occasions, different central banks started to maneuver their financial insurance policies right into a tighter place and the U.S. greenback dropped off from its near-term excessive.

The worth of the U.S. greenback fell via the winter of 2023 and was round 122.0 transferring into early March 2023.

As increasingly knowledge was launched, it appeared as if the Federal Reserve shifted the way in which it was managing its coverage of quantitative tightening. I’ve written about this in a really latest publish.

Across the first of March 2023, the Federal Reserve was confronted with the difficulty that a number of industrial banks had been having issues and the Fed must transfer in on them and oversee their default.

A number of banks had been closed with little or no disruption to the exercise of the industrial banking system.

Coverage sensible, the Federal Reserve continued on with its coverage of quantitative tightening, persevering with, as much as the present time interval, to supervise common reductions within the Fed’s securities portfolio.

Issues did change after the primary of March.

As much as that time, the Fed had been making use of the “reverse repo” market so as to clean out the monetary markets because the Fed tightened up on cash and stored elevating the Fed’s coverage charge of curiosity.

After the primary of March, the Fed allowed the “extra reserves” of economic banks to rise and assist the monetary markets via the time some banks had been having solvency issues. The Federal Reserve has continued this place up till the current time.

The worth of the greenback index targeted upon above neared 125.0 for a time earlier than backing off slightly in the previous couple of market days.

Extra reserves within the banking system rose modestly, and the industrial financial institution use of reverse repurchase agreements dropped considerably.

The information on this shift are so clear, that since early March 2023, the Federal Reserve has been working with a distinct market focus.

And, what occurred within the overseas trade market?

Nicely, I feel one can argue that individuals working in overseas trade markets acknowledged the shift that had taken place.

Since early March the worth of the U.S. greenback has risen modestly and I imagine that the overseas trade merchants would truly prefer to see the worth of the U.S. greenback rise additional, however are ready to see what occurs via the top of this 12 months.

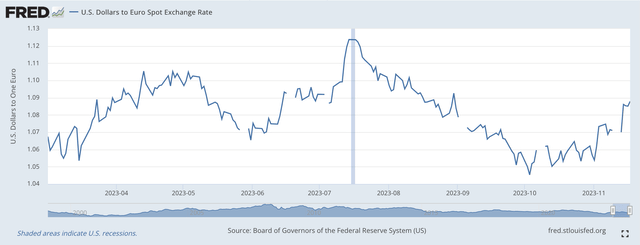

Towards The Euro

Taking slightly nearer have a look at a selected relationship, let’s take a look at the U.S. greenback/Euro trade charge.

U.S. Greenback to Euro (Federal Reserve)

On March 1, 2023, it took $1.0664 to amass one Euro.

On November 9, 2023, it took $1.0699 to buy on Euro, and though its worth has gone up slightly bit since then, it appears to be like as if…in the interim…that the “market” desires the worth to be round $1.07 to $1.08.

As I’ve written earlier, it’s my opinion that the worth of 1 Euro will transfer right down to $1.05 or so for the primary six months of 2024.

It’s my perception that some policymakers wish to see the greenback at this “stronger” worth within the close to time period.

I imagine that this may be achieved if the Fed’s coverage of quantitative tightening just isn’t ended quickly.

I do not suppose Fed Chairman Jerome Powell desires to cease the quantitative tightening too quickly. I feel Mr. Powell wish to see quantitative tightening undergo not less than half of 2024.

That might imply that the quantitative tightening program would have existed for twenty-seven months. I feel the sign that will ship the monetary markets can be ample to assist Mr. Powell’s rivalry that he has stored with this system of combating and that he has proven how he has lived as much as his duty to be an inflation fighter being the Chairman of the Board of Governors of the Federal Reserve System.

I imagine if Mr. Powell does this, he’ll justify the overseas trade market conserving the worth of the U.S. close to the place it’s…or slightly bit decrease.