StefaNikolic/E+ through Getty Photos

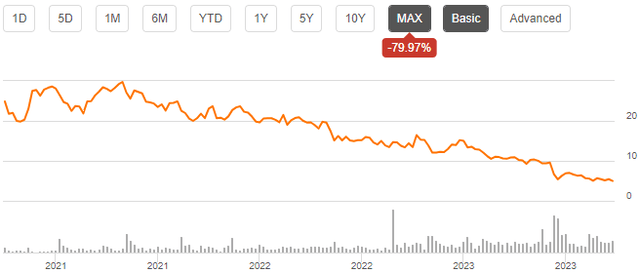

Leslie’s (NASDAQ:LESL) sells pool equipment in america. The corporate had an IPO in 2020, after which the inventory has been on a sluggish and regular decline because the pandemic-boosted financials have become reducing earnings. For my part, traders’ visibility into Leslie’s long-term development is kind of restricted in the meanwhile; I might anticipate a couple of quarters to see the corporate’s development capacity as year-over-year comparability figures normalize.

The Firm & Inventory

Leslie’s sells pool provides digitally and thru small brick-and-mortar shops. The corporate’s bought merchandise embrace a spread of pool chemical compounds, pool covers, pumps, filters, equipment, in addition to scorching tub & spa merchandise. The pool provides market noticed a big increase throughout the Covid pandemic, as people’ use of non-public swimming pools rose due to closedowns. Leslie’s noticed the boosted market as an opportunistic time limit to turn out to be a publicly traded firm.

Leslie’s had an IPO in late 2020. After the inventory started buying and selling in November of 2020, the value has fallen right into a fifth of the shut on the primary day of buying and selling with:

Inventory Chart From IPO (Looking for Alpha)

Financials

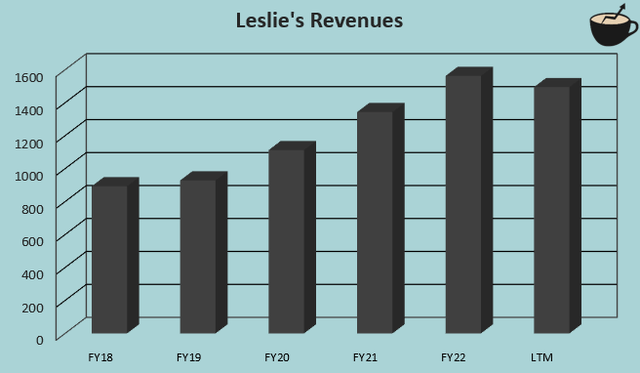

The corporate’s quarterly information begins from FY2018. Buyers have a restricted visibility into Leslie’s pre-pandemic efficiency, clouding visibility into the corporate’s sustainable development stage and margins. Within the firm’s public monetary historical past, the corporate has achieved a very good quantity of development with a compounded annualized development of 11.5% from FY18 to LTM figures as of Q3/FY2023. Among the development has been attributable to money acquisitions made largely in FY2022 with an quantity of $108 million within the yr. Regardless of the acquisitions, Leslie’s revenues have decreased to date in FY2023:

Writer’s Calculation Utilizing Looking for Alpha Information

Because the pandemic-boosted market has subsided, traders have a greater view into Leslie’s sustainable revenues. I nonetheless imagine that the corporate’s long-term development charge is generally unknown. Earlier than the pandemic, Leslie’s achieved a development of 4.0% from FY2018 to FY2019. As Leslie’s will quickly begin having year-over-year comparability numbers which have been achieved in a extra regular market setting, traders ought to see a extra clear long-term development charge within the coming quarters.

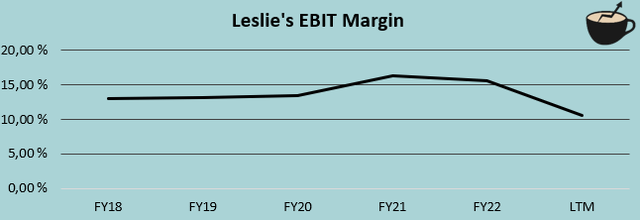

Leslie’s has achieved a steady EBIT margin, though the margin was considerably increased in FY2021 and FY2022 because of the heightened market. From FY2018 to FY2022, the common EBIT margin was 14.3%, when in FY2021 and FY2022 the margin was 16.4% and 15.6% respectively. At the moment, the trailing margin stands at 10.6%. The present margin is partly attributable to a poor climate and an elevated shopper worth sensitivity in accordance with the corporate’s Q3 presentation.

Writer’s Calculation Utilizing Looking for Alpha Information

To finance the corporate’s acquisitions and total operations, Leslie’s has drawn a considerable amount of long-term debt on its steadiness sheet. At the moment, the long-term debt steadiness provides as much as $814 million, of which $8 million is within the present portion. With trailing twelve months’ figures, Leslie’s curiosity bills cowl round 36% of the corporate’s working earnings – I imagine that the quantity remains to be manageable, though the web debt is nearly as massive as Leslie’s market capitalization of $916 million on the time of writing.

Valuation

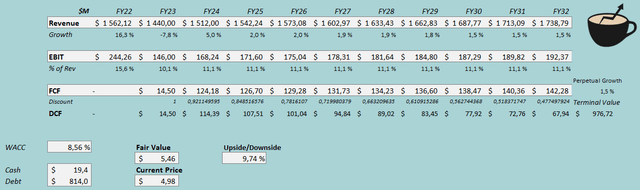

To guage a tough truthful worth for Leslie’s inventory, I constructed a reduced money movement mannequin. Within the mannequin, I estimate Leslie’s to hit its FY2023 income steerage with a income lower of -7.8%. After FY2023, I estimate the market situations to normalize with a 5% rebound in revenues. After the yr, I imagine that Leslie’s natural development catalysts are fairly poor – I estimate a development of two% from FY2025 ahead, that begins to decelerate right into a perpetual development charge of 1.5%.

For Leslie’s EBIT margin, I estimate a determine of 10.1% for FY2023, 5.5 share factors under FY2022 because the market has gone from heightened to a weak one. From FY2024 ahead, I estimate a steady EBIT margin of 11.1%, one share level above the FY2023 estimate. The estimated margin is under Leslie’s achieved common, however I imagine that the corporate must show a greater margin once more earlier than I’d be snug with estimating one. The talked about estimates together with a weighted common value of capital of 8.56% craft the next DCF mannequin with a good worth estimate of $5.46, round 10% above the value on the time of writing:

DCF Mannequin (Writer’s Calculation)

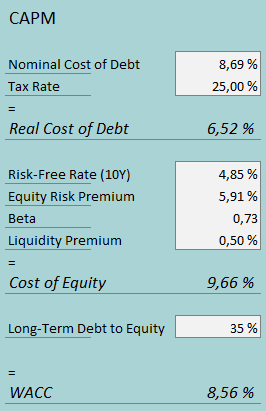

The used weighed common value of capital is derived from a capital asset pricing mannequin:

CAPM (Writer’s Calculation)

In Q2, Leslie’s had $17.7 million in curiosity bills. With the corporate’s present interest-bearing money owed, Leslie’s rate of interest comes as much as an annualized determine of 8.69%. The corporate leverages a excessive quantity of debt in its financing – I estimate a long-term debt-to-equity ratio of 35%.

The chance-free charge of 4.85% on the price of fairness aspect is america’ 10-year bond yield, which is a determine that I see as consultant for the aim. The fairness threat premium of 5.91% is Professor Aswath Damodaran’s latest estimate made in July for the US. Yahoo Finance estimates Leslie’s beta at 0.73. I see pool-related equipment as a largely discretionary product, that would see a bigger fluctuation correlated to the macroeconomy than Yahoo Finance’s low beta estimates. The low beta might be a results of the pandemic – the inventory market as an entire had a adverse correlation to the pandemic, however pool equipment’ demand noticed a optimistic correlation. As Leslie’s IPO’d throughout the pandemic, the exterior pandemic issue might be the explanation for the beta determine. For the second being, I don’t see a greater technique to estimate Leslie’s beta although – within the estimates, I hold the beta of 0.73, though I acknowledge that the beta might be considerably increased sooner or later. Lastly, I add a liquidity premium of 0.5% into the price of fairness, crafting the determine at 9.66% and the WACC at 8.56%.

Takeaway

Within the subsequent few quarters, I imagine that traders could have higher visibility into Leslie’s future development tempo. Wanting on the firm’s monetary historical past, Leslie’s natural efficiency appears to have been fairly poor when excluding the pandemic-boosted market in FY2021 and FY2022. In the intervening time, Leslie’s inventory appears to be priced for fairly low development and a margin that’s pretty under Leslie’s historic margins. In the meanwhile, I imagine that these estimates are a very good start line; in the meanwhile, I imagine {that a} maintain ranking is justified.